After hitting a brand fresh all-time excessive (ATH) of $124,474 on Binance on August 13, Bitcoin (BTC) has tumbled toward $113,000, with the next valuable give a lift to zone round $110,000. Analysts warn that extra downside could possibly perhaps soundless be forward for the tip cryptocurrency.

Bitcoin To Plunge More? Crowded Prolonged Commerce Affords Hint

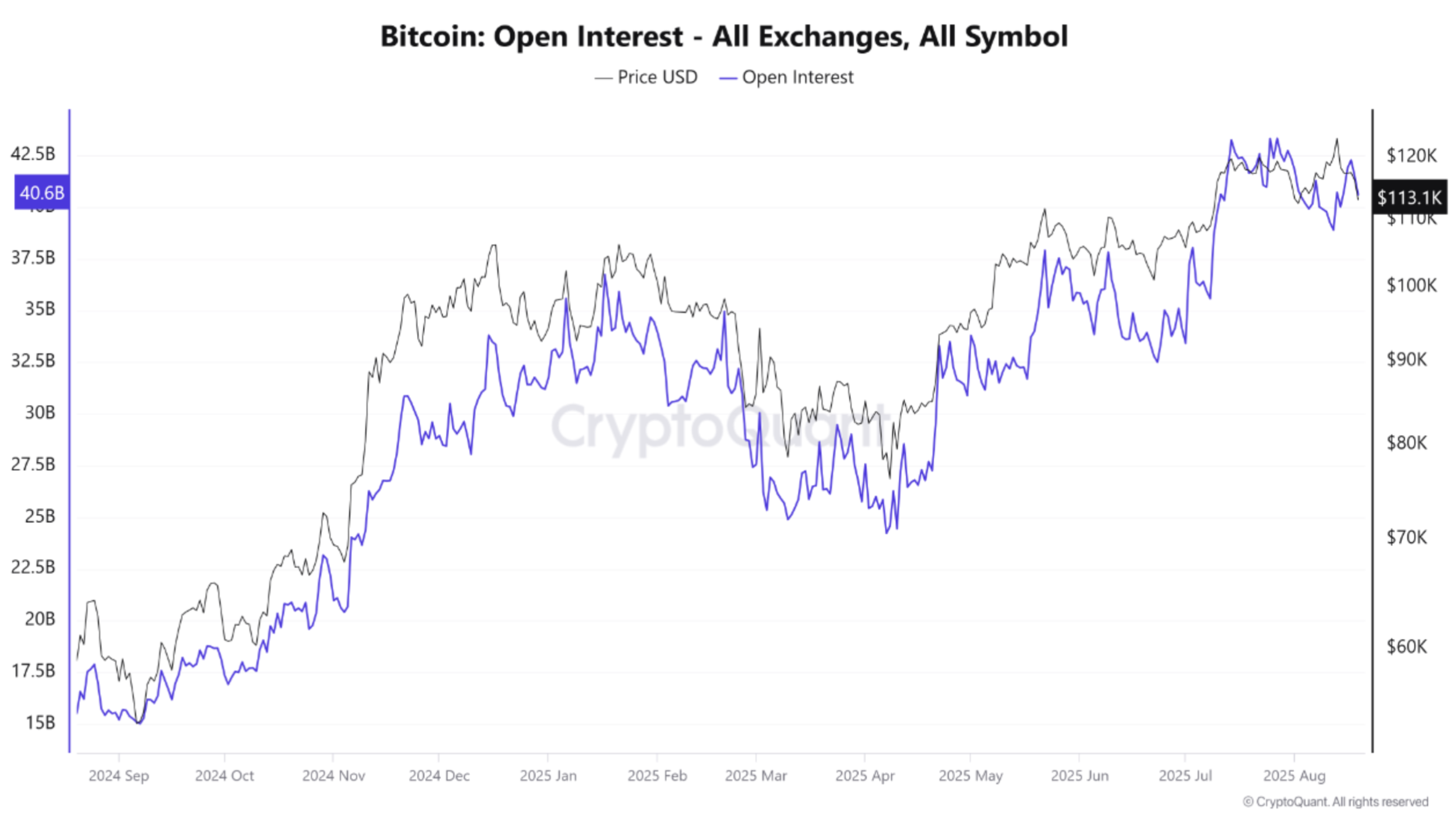

Primarily essentially based on a CryptoQuant Quicktake post by contributor XWIN Look at Japan, Bitcoin birth passion at some point of all exchanges has surged previous $40 billion, nearing ATH territory. This upward thrust reveals both whales and momentary merchants are piling into leveraged positions.

The chart under highlights the most recent spike in BTC birth passion, now hovering at $40.6 billion. Compared with August 2024 stages of $15 billion, birth passion has grown by bigger than 150%.

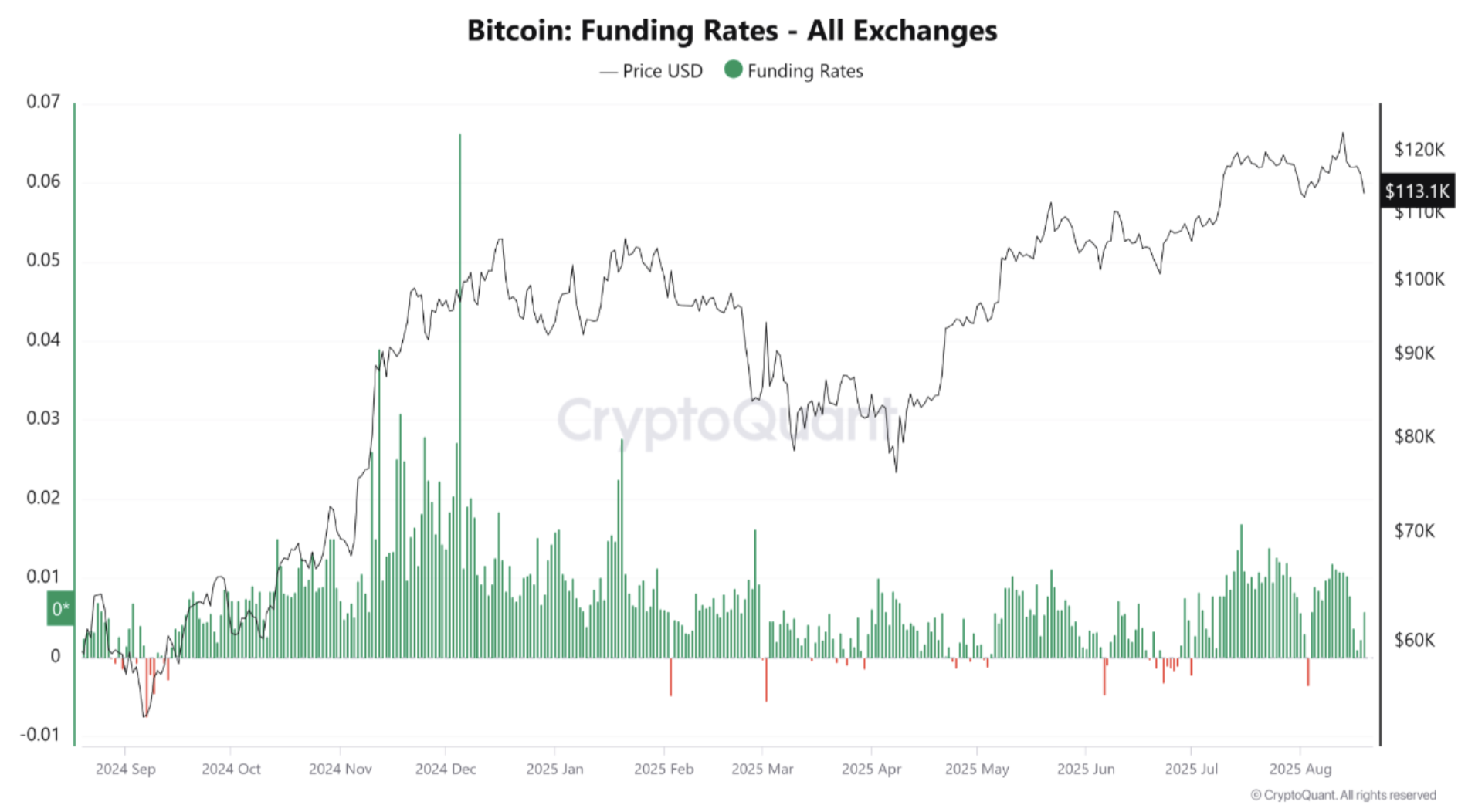

The CryptoQuant contributor added that despite this surge, the funding fee has remained clear, showing a critical long bias. Whereas this reflects market optimism, it also alerts a crowded switch, with most members making a bet on extra BTC appreciation.

In consequence, the menace of a long squeeze – compelled liquidations of long positions because of aggressive leverage – has risen. XWIN Look at Japan defined in their diagnosis:

A sudden mark descend can trigger a cascade of compelled selling, amplifying volatility. In assorted words, Bitcoin’s momentary strikes continue to exist the mercy of speculative flows.

BTC Fund Retaining By Establishments Rises

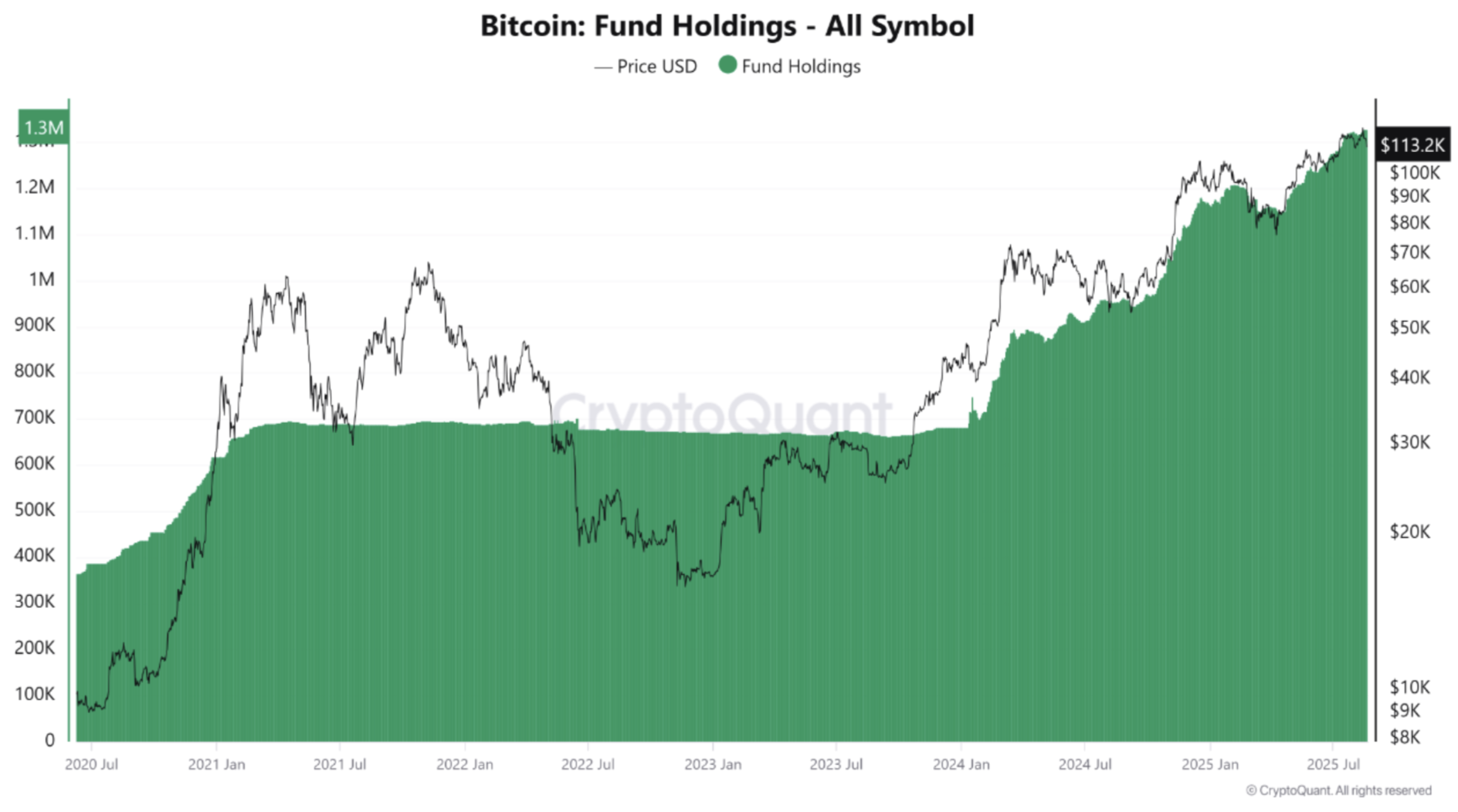

Despite speculative froth from low leverage within the market, BTC fund holdings by Bitcoin alternate-traded funds (ETFs) and institutional merchants continue to surge, exceeding 1.3 million in accordance to newest records.

Speak ETFs and company treasuries appealing BTC offers the digital asset a structural announce that gradually reduces its on hand provide. Primarily essentially based on records from SoSoValue, US-based totally totally self-discipline Bitcoin ETFs for the time being take care of $146 billion in bag assets – representing 6.47% of BTC’s market cap.

That acknowledged, this week by myself has considered bigger than $645 million in outflows from self-discipline Bitcoin ETFs, following two consecutive weeks of inflows totaling nearly $800 million. Among the many ETFs, BlackRock’s IBIT leads with $84.78 billion in bag assets as of August 19.

Nonetheless, no longer all alerts are bearish. As an illustration, while BTC slipped under $115,000, its self-discipline trading quantity surged previous $6 billion, giving bulls hope for a possible rebound.

In an identical plot, technical analyst AO no longer too long within the past urged that BTC can be mirroring gold’s trajectory, with an daring goal of $600,000 by early 2026. At press time, BTC trades at $113,845, down 1.5% within the previous 24 hours.