HBAR has viewed major volatility in newest days, because the altcoin grapples with broader market traits. After briefly sorting out its month-lengthy improve at $0.230, HBAR has confronted downward stress.

If the present bearish pattern continues, the altcoin also can tumble below this key stage, signaling extra weak point.

HBAR Faces Turbulence

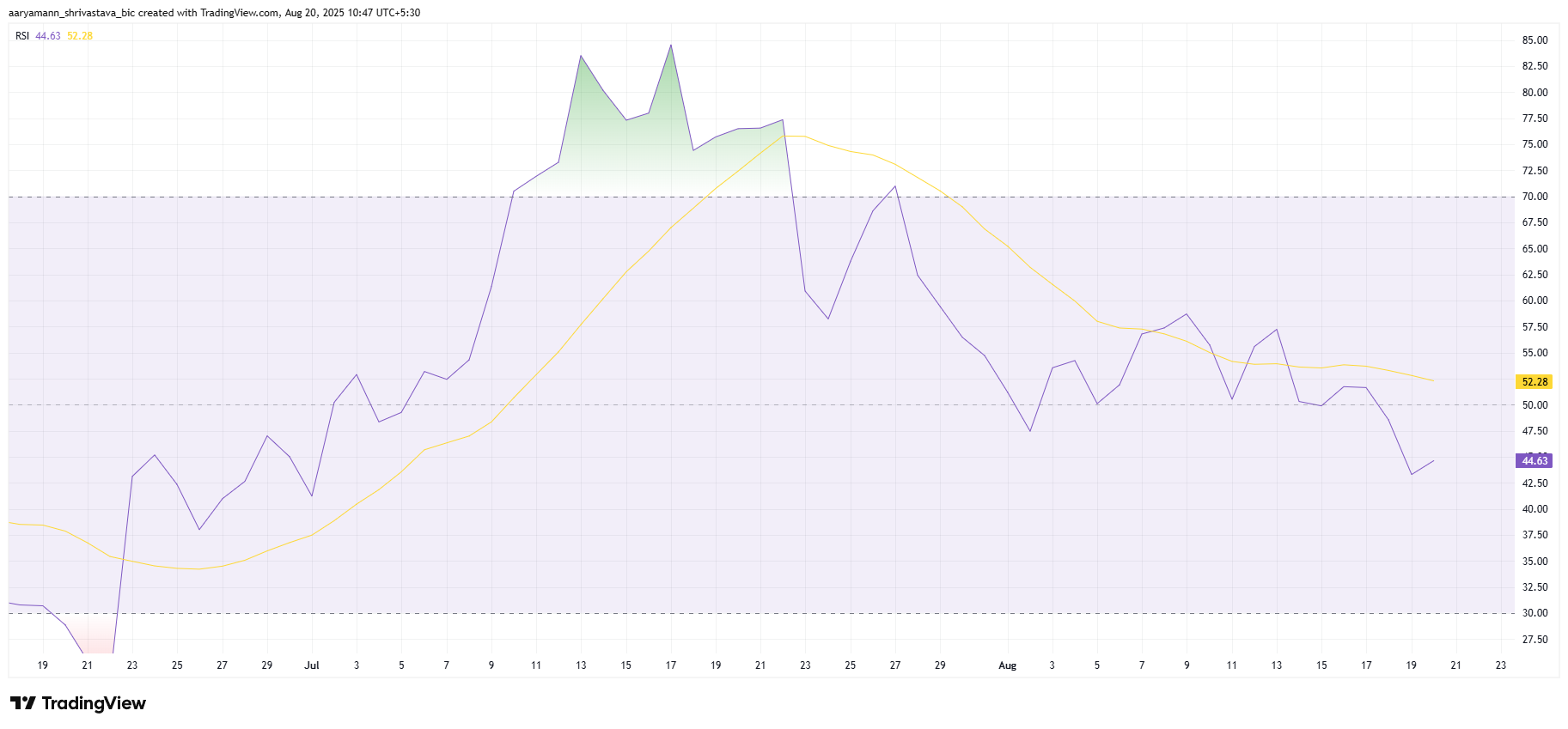

The Relative Strength Index (RSI) for HBAR is signaling rising bearish momentum. Within the intervening time below the neutral 50.0 stage, the RSI marks a detailed to-monthly low, suggesting that selling stress is rising. This shift indicates that the momentum for HBAR has grew to change into unfavorable, which also can intensify the altcoin’s fee decline.

With the RSI’s newest pass, HBAR faces heightened stress. The lower reading suggests that traders also can remain cautious, in particular because the broader market struggles. If the RSI continues to note below the neutral line, HBAR also can journey even more scheme back, doubtlessly breaching the month-lengthy improve.

Desire more token insights like this? Register for Editor Harsh Notariya’s Day-to-day Crypto Newsletter here.

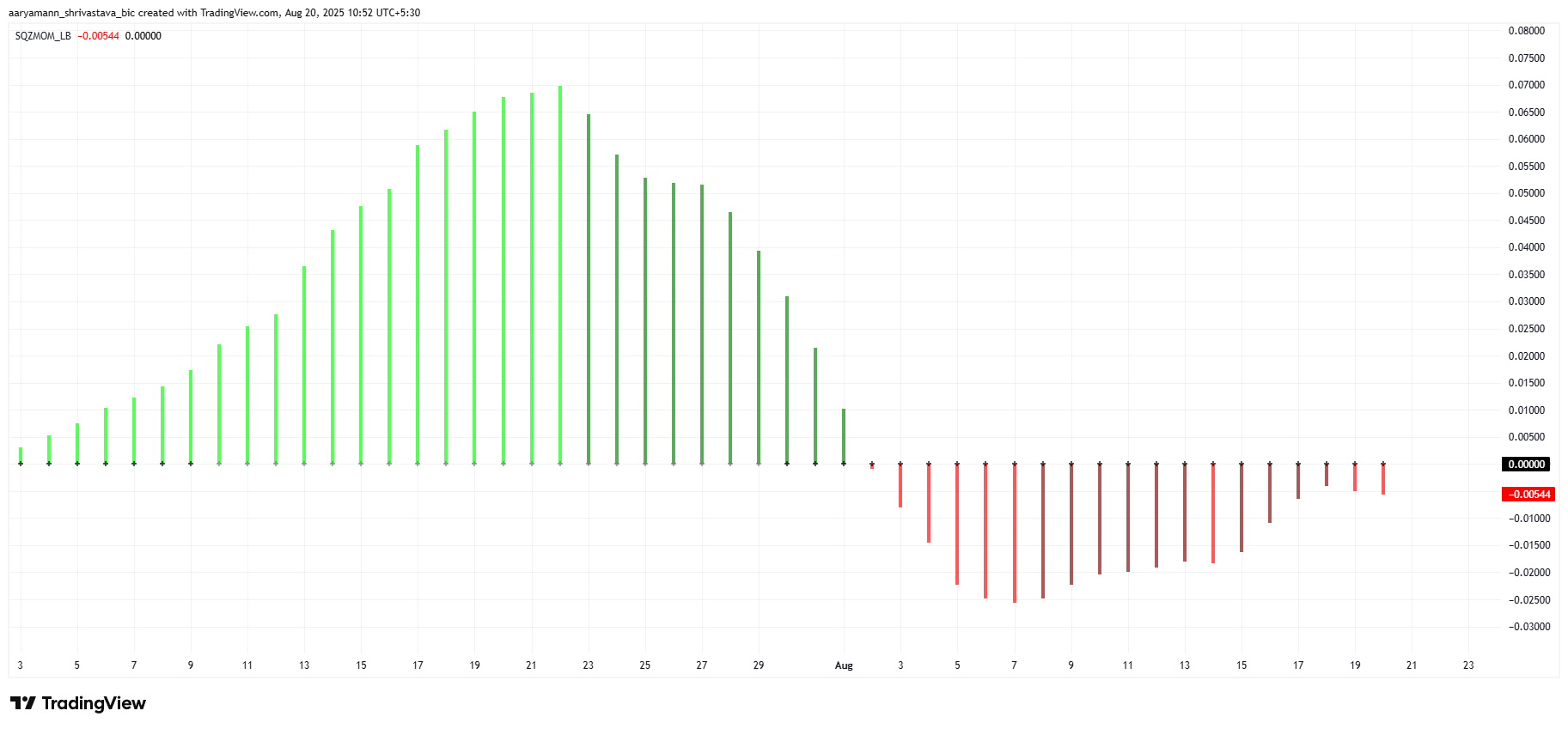

The Squeeze Momentum Indicator (SMI) is at the moment forming a squeeze, with bearish momentum gaining strength. The indicator’s shaded dots verify the continuing bearish pattern, signaling that the fee also can journey elevated volatility as soon as the squeeze is released. If the selling stress persists, HBAR is at possibility of going by method of deeper losses.

The current squeeze suggests that the market also can journey a appealing pass in either direction as soon as the volatility is unleashed. Given the rising bearish momentum, it’s likely that HBAR also can face an additional decline, reinforcing the unfavorable outlook for the cryptocurrency.

HBAR Label May Repeat History

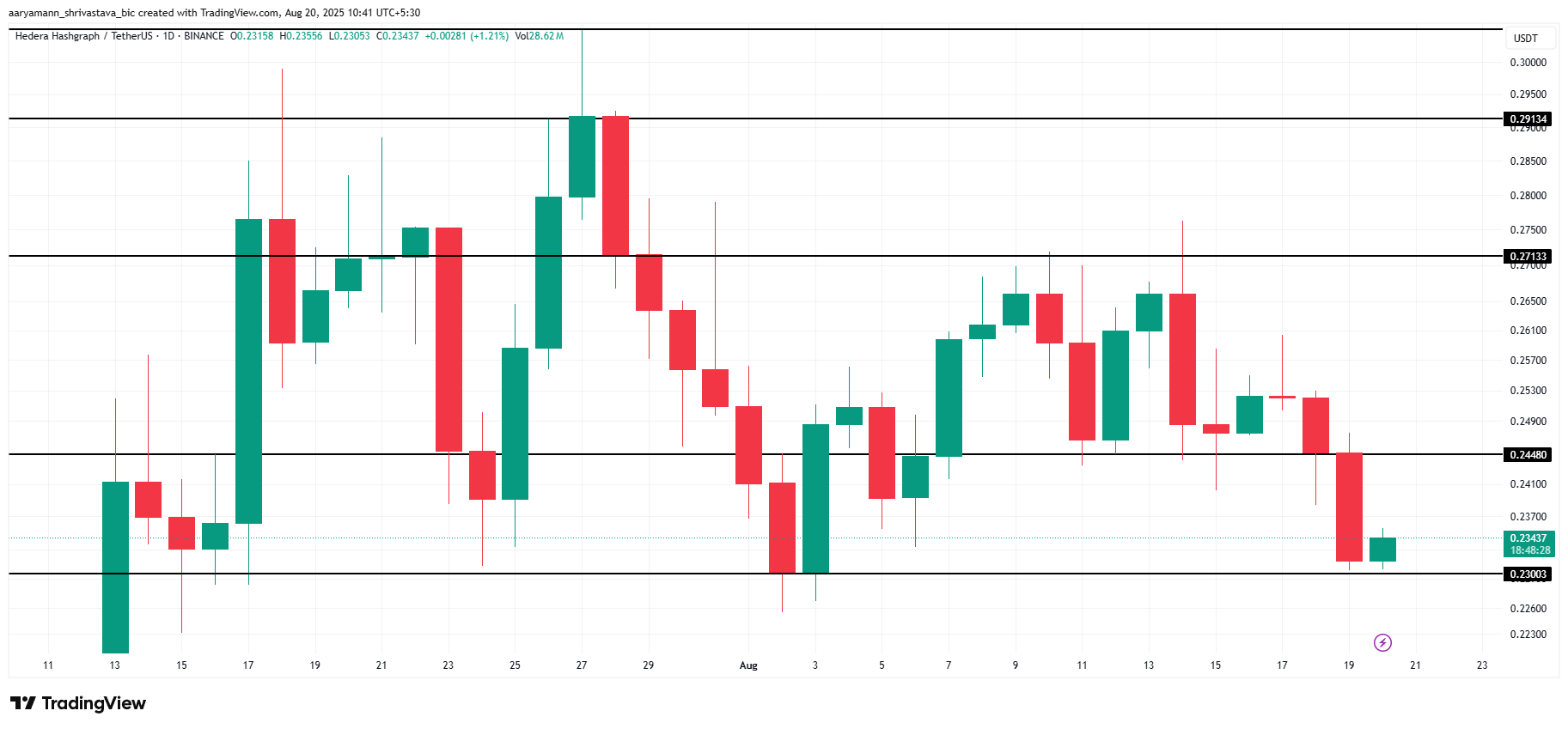

HBAR is at the moment buying and selling at $0.234, sorting out its monthly improve stage of $0.230. This marks the third time the altcoin has dropped to this improve, however this time also shall be diversified. With the rise in bearish momentum, HBAR’s ability to attach the $0.230 stage also can resolve whether the fee continues to say no.

The mix of issues alerts that the unfavorable momentum is gaining strength, making it more likely for HBAR to fall below $0.230. A smash of this improve also can consequence in extra losses, with $0.210 because the next seemingly improve stage. If the market prerequisites aggravate, HBAR also can decline even extra.

Alternatively, if historic past repeats itself and HBAR bounces off the $0.230 improve stage, the fee also can win larger to $0.244. If it manages to flip this resistance into improve, it would invalidate the bearish thesis and open the door for a seemingly upward push toward $0.271, signaling a shift in momentum.

The put up HBAR Label May Repeat History As Bearish Squeeze Strengthens regarded first on BeInCrypto.