Harvard economist Kenneth Rogoff, who as soon as predicted Bitcoin would sooner break to $100 sooner than it hits $100,000, has admitted plenty has changed since his comments seven years within the past — despite the reality that he reputedly aloof hasn’t come round to Bitcoin.

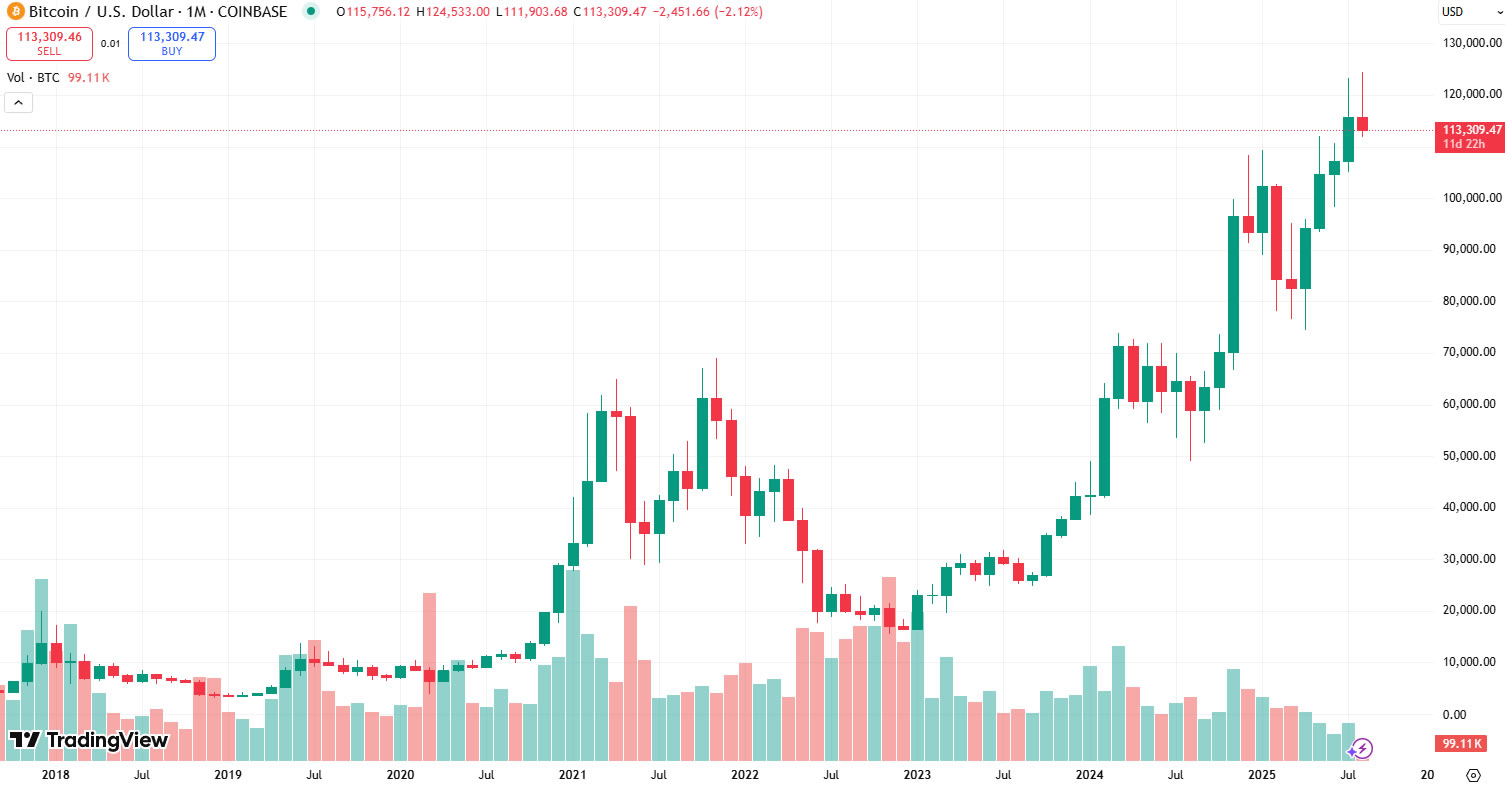

“Virtually a decade within the past, I used to be the Harvard economist that mentioned Bitcoin used to be likely to be price $100 than 100K. What did I miss?” he wrote on X on Wednesday, referring to a section on CNBC’s “Shriek Field” in March 2018.

Rogoff is a outdated chief economist of the World Monetary Fund (IMF) and additionally creator of ‘Our Dollar, Your Narrate’, which used to be published in Might per chance presumably well presumably.

In 2018, Rogoff mentioned that authorities legislation would characteristic off a drop in Bitcoin prices.

Nonetheless, for the reason that Trump administration obtained the November election, it broke $100,000 in December 2024 and has surged bigger than 80% to a brand fresh all-time excessive.

“I used to be some distance too optimistic in regards to the US coming to its senses about appealing cryptocurrency legislation,” he mentioned, indicating his stance on crypto hasn’t changed.

Bitcoin competes with fiat forex

“2nd, I did no longer love how Bitcoin would compete with fiat currencies to motivate as the transactions medium of desire within the twenty-trillion dollar worldwide underground economy,” he continued on X.

Nonetheless, Bitcoin has grow to be an inflation hedge in many nations where native currencies were hugely devalued by governments.

Illicit activity tied to cryptocurrencies used to be round $50 billion in 2024, in line with Chainalysis, but it’s miles a drop within the ocean and no longer up to 1% of what’s laundered the utilization of money.

“Third, I did no longer look forward to a anxiety where regulators, and especially the regulator in chief, would be in a region to overtly withhold hundreds of hundreds of thousands (if no longer billions) of greenbacks in cryptocurrencies reputedly without consequence given the blatant battle of hobby.”

Connected: Trump-linked American Bitcoin seeks Asia acquisitions to steal BTC holdings: Describe

Crypto X decides to steal it as a fetch anyway

Bitwise’s chief funding officer, Matt Hougan, replied, declaring that Rogoff “Failed to bear in mind that a decentralized challenge, which drew vitality from people and no longer centralized establishments, would perhaps presumably be triumphant at scale.”

Meanwhile, a researcher at digital sources brokerage FalconX, David Lawant, mentioned he used to be “very grateful” to Rogoff, as his book ‘The Curse of Cash’ used to be “so gruesome” that it used to be “one in all the things that pushed me to BTC.”

Head of digital sources be taught and VanEck, Matthew Sigel, posted his listing of Bitcoin’s loudest critics on Tuesday, rating Rogoff in ninth space. He “wrote Bitcoin’s obituary too early from within his maintain echo chamber,” mentioned Sigel.

“Perchance you uncared for it attributable to you reside in an echo chamber, same as within the event you lock replies,” he added, referring to Rogoff fighting people from replying to his posts on X.

“Fundamentals matter: fiat debasement, demographic wealth shifts, and worldwide demand for a honest reserve asset.”

Satirically, the Harvard Administration Company, which is to blame for managing the college’s $fifty three billion endowment fund, reported a $116 million funding in BlackRock’s put Bitcoin ETF earlier this month.

⚡ FLASHBACK: In 2018, a Harvard economist mentioned $BTC is probably going to hit $100 than $100K.

Now they invested $116M. pic.twitter.com/YDdZylmzdk

— Cointelegraph (@Cointelegraph) August 10, 2025

Magazine: Solana Seeker review: Is the $500 crypto phone price it?