Solana stamp has been choppy over the previous three months, returning a modest 7.9% procure. On a monthly scale, stamp has moved right 2.3%, barely justifying any bullish conviction. Nonetheless hidden inside this flat trajectory had been spicy and unexpected rallies; instant-lived, yet great spikes that saved SOL on vendor radars.

Now, after a pointy 5.29% plunge in the previous 24 hours, Solana has slipped to $180, again following the broader crypto market correction. Nonetheless while sentiment weakens, the on-chain setup is starting up to resemble previous prerequisites that ended in instant reversals. Two foremost metrics are quietly building that identical spike-basically based setup.

Abundant Holders Are Sitting Out the Dip Dump

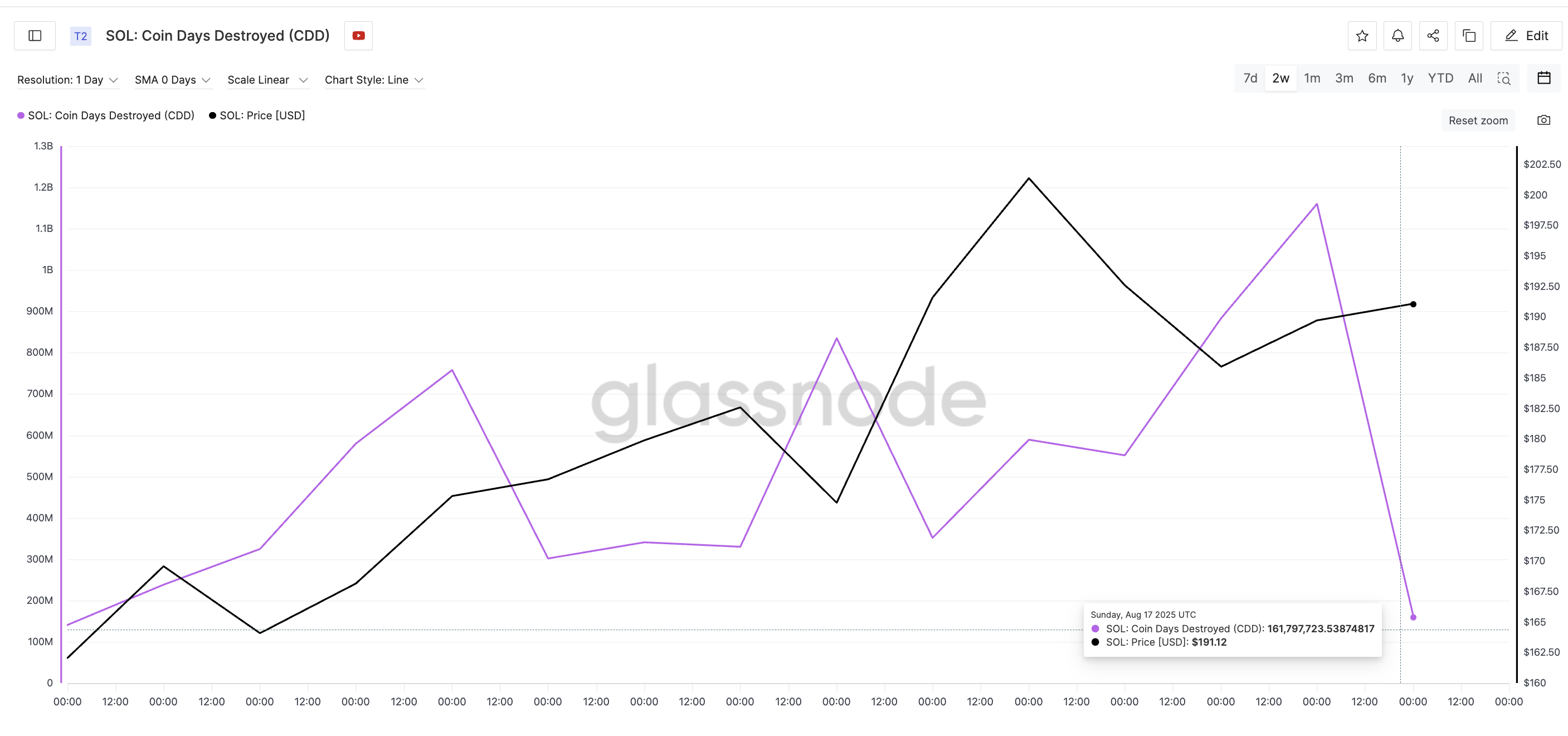

On August 17, Solana’s Coin Days Destroyed (CDD) metric dropped to 161.seventy 9 million, the 2d-lowest every single day worth this month. Moral a day earlier, on August 16, CDD had peaked at 1.16 billion. That’s an 86% single-day crumple in coin day destruction.

This roughly lumber normally happens when lengthy-held coins ought to no longer being purchased. If holders who’ve saved SOL sluggish for weeks or months were all instantly dumping, this quantity would upward push sharply. Something that came about between August 12 and August 16.

The plunge in CDD from August 16 to August 17 indicates most coins being moved are both instant-held or contemporary buys, and the large majority of dormant provide remains untouched. On the opposite hand, the metric’s bullishness could well maybe be confirmed better if the CDD remains low or doesn’t spike at as soon as. That will maybe maybe mean that lengthy-term holders are accomplished with profit booking or selling.

Having a watch lend a hand at early August, identical dips in CDD coincided with Solana stamp consolidation phases that preceded rapid recoveries.

Coin Days Destroyed (CDD) measures how great coin age is misplaced when tokens are spent. The longer a coin is held, the more “coin days” it accumulates. When it’s in the kill moved, those coin days are “destroyed.” Elevated values indicate outmoded coins are on the lumber; lower values counsel contemporary or no meaningful spending.

Provide Continues To Switch Out

Pair that with trade balances, and the setup turns into even clearer. Between August 14 and August 16, the overall SOL all over all exchanges dropped from 32.35 million to 31.23 million. That’s over 1.12 million SOL pulled out — roughly a 3.46% decline in only Forty eight hours, all over a duration when the worth fell from $192 to $185.

Right here’s foremost. In a traditional correction, one would demand rising balances as merchants whisk to exit. Nonetheless the choice is occurring here. Provide is leaving exchanges, no longer coming into, which implies accumulation (dip shopping) or at the least, a lack of apprehension selling.

Collectively, both metrics describe a memoir of provide tightening quietly while Solana prices upright. Halt describe that the steadiness on exchanges has moved up a tiny of at the time of writing. Yet, it’s some distance quiet around the contemporary lows.

For token TA and market updates: Prefer more token insights be pleased this? Take a look at in for Editor Harsh Notariya’s Each day Crypto E-newsletter here.

Solana Notice: Improve Ranges Withhold as Constructing Stays Intact

On the technical aspect, the Solana stamp has dipped to a local low of $180.89 (August 18), rejecting the $189.95 transient resistance. Below that, it’s for the time being sitting between two zones — $178.24 and $173.46, both of which acted as solid response stages in early August.

If these stages preserve, Solana could well maybe revisit the $189–$199 cluster. That zone has been examined about a instances over the previous month and is quiet acting as a mid-term resistance band. An very good fracture above $199.27 would doubtless push SOL lend a hand into the $209+ place of living.

On the opposite hand, this transient bullish hypothesis will lose flooring if the Solana stamp breaks the $173.46 stage.

The put up Solana Notice Dip Nearing Cease? 2 Metrics Hint at a Quick Rebound regarded first on BeInCrypto.