The Ethereum designate on the present time is consolidating at $4,270, down 4.5% from its latest high near $4,480. The transfer comes after a ambitious July-August rally that pushed ETH from $3,000 proper into a brand unusual yearly high. Sellers are in point of truth attempting out whether bulls can protect above $4,200, a stage that aligns with each and every transient liquidity zones and EMA beef up clusters.

Ethereum Trace Forecast Desk: August 19, 2025

| Indicator/Zone | Level / Signal |

| Ethereum designate on the present time | $4,270 |

| Resistance 1 | $4,350 (VWAP / EMA20 zone) |

| Resistance 2 | $4,480 (latest high) |

| Enhance 1 | $4,200 (liquidity cluster) |

| Enhance 2 | $3,950–$3,800 (are expecting zone) |

| RSI (30-min) | 22.7 (oversold) |

| MACD (30-min) | Bearish expansion |

| Bollinger Bands (4H) | Trace at decrease band |

| EMA Cluster (20/50/100) | $4,387 / $4,190 / $3,869 |

| Supertrend (4H) | Bearish below $4,590 |

| DMI / ADX | -DI leads, ADX > 30 (bearish) |

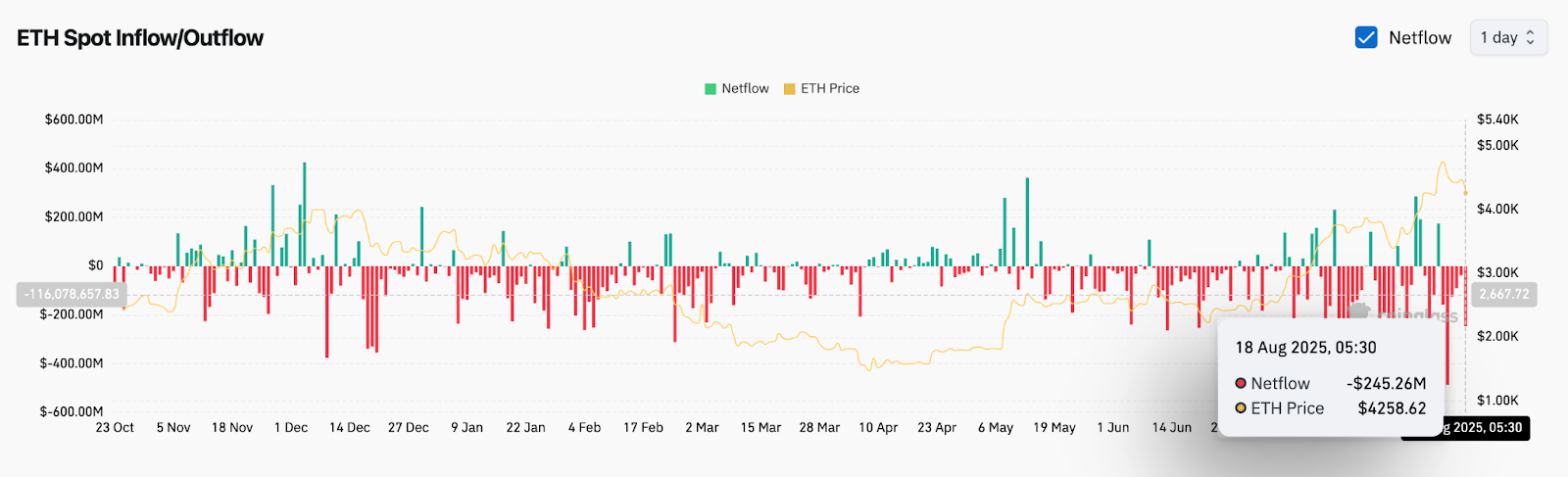

| Netflow (Aug 18) | -$245M outflow |

What’s Going on With Ethereum’s Trace?

On the day-to-day chart, ETH no longer too lengthy ago tapped a musty high near $4,480 sooner than retracing toward $4,270. The cost construction remains bullish on greater timeframes, but transient charts expose a quit. Dapper Money Ideas highlight a replace of character appropriate below $4,500, suggesting sellers are seeking to power a shift in market construction.

The 4-hour timeframe shows ETH breaking down from an ascending triangle, with beef up zones identified between $4,150 and $4,200. Whereas the broader uptrend remains intact, the breakdown indicators that momentum is fading on the ruin.

The RSI sits around 51 on the 4-hour chart, reflecting neutrality after closing week’s overbought stretch. This means ETH is consolidating rather then entering a confirmed reversal, but merchants must step in quickly to protect away from deeper losses.

Why Is The Ethereum Trace Going Down Nowadays?

The decline in the Ethereum designate on the present time is attributable to each and every technical rejection and broader outflows. On the 30-minute chart, ETH has slipped below VWAP ranges at $4,349, confirming bearish intraday alter. The RSI has dropped as little as 22, showing heavy oversold stipulations, while MACD continues to do bigger negatively.

The Supertrend indicator on the 4-hour chart has flipped bearish below $4,590, suggesting a vogue quit. DMI data confirms this, with the -DI line overtaking +DI while ADX rises above 30, signaling downside momentum.

On-chain flows also underline the weak point. Space alternate data shows $245M in gain outflows on August 18, on the total a bullish signal longer term, but on this case coinciding with designate rejection near $4,480. The imbalance between transient inflows and macro promoting tension has saved ETH below tension.

Indicators Signal Key Retest At $4,200

Ethereum finds itself at a pivotal technical juncture. The 20 EMA on the 4H chart sits near $4,387, while the 50 EMA has slipped to $4,190—creating a tight confluence zone where merchants could well additionally protect beef up. Bollinger Bands expose ETH hugging the decrease band near $4,260, with volatility restful elevated following the rejection spike.

Momentum indicators verify mixed sentiment. The 30-minute RSI shows oversold, pointing to a doable bounce, but the MACD slope remains bearish. Liquidity sweeps around $4,200 are also viewed, which system this stage could well additionally act as each and every a springboard or breakdown trigger looking on quantity in the next sessions.

Ethereum Trace Prediction: Short-Term Outlook (24H)

For the next 24 hours, the Ethereum designate is anticipated to live volatile through the $4,200–$4,350 fluctuate. If bulls protect $4,200 and reclaim $4,350, a rebound toward $4,480 and in the ruin $4,600 is doable. On the opposite hand, if $4,200 fails, ETH could well additionally dash toward $3,950 and even the $3,800 are expecting zone highlighted on the day-to-day chart.

Given oversold intraday indicators and heavy outflows, Ethereum’s transient bias leans cautiously bearish. On the opposite hand, the lengthy-term vogue remains bullish above $3,800, suggesting right here’s more doubtless a consolidation than a plump reversal.

Disclaimer: The info offered on this article is for informational and academic capabilities most productive. The article does no longer inform financial advice or advice of any kind. Coin Edition is no longer guilty for any losses incurred as a outcomes of the utilization of direct, products, or companies mentioned. Readers are told to impart warning sooner than taking any motion connected to the company.