Because the cryptocurrency market continues to conform, Bitcoin stays on the forefront of investor passion. Here’s supported by its latest ticket performance, surpassing $60,000.

In a detailed prognosis, trading historic Peter Brandt has supplied a compelling forecast for Bitcoin’s ticket trajectory. He linked its doable to the cryptocurrency’s halving occasions. Here’s a mechanism that cuts the reward for mining new blocks in half of. As a end result, it reduces the supply of latest BTC and continually triggering a ticket surge.

Bitcoin Imprint Prediction: Is $400,000 Next?

Brandt’s methodical examination of Bitcoin’s previous bull cycles in the case of its halving dates uncovers a pattern of serious growth phases that align with these occasions. Via an prognosis that spans over a decade, Brandt highlighted the predictive vitality of these cycles. These counsel an optimistic future for Bitcoin’s ticket.

The trading skilled pointed to the historical symmetry within the length of bull trends sooner than and after every halving. With the following halving scheduled for April 2024, Brandt’s projections counsel a bullish outlook for Bitcoin.

Essentially based on his prognosis, if the post-halving ticket increases replicate the pattern of previous cycles, Bitcoin would possibly perchance presumably advise its ticket climb to outstanding ranges. Indeed, he projected targets of $150,000, $275,000, and even $400,000.

“If the tempo of the bull pattern after Apr 2024 is at similar tempo to the bull pattern since the Nov 2022 low, then the excessive in Oct 2025 will seemingly be round $150,000. Alternatively, the post-halving advances for the length of old bull cycles beget been mighty steeper than the pre-halving advances,” Brandt said.

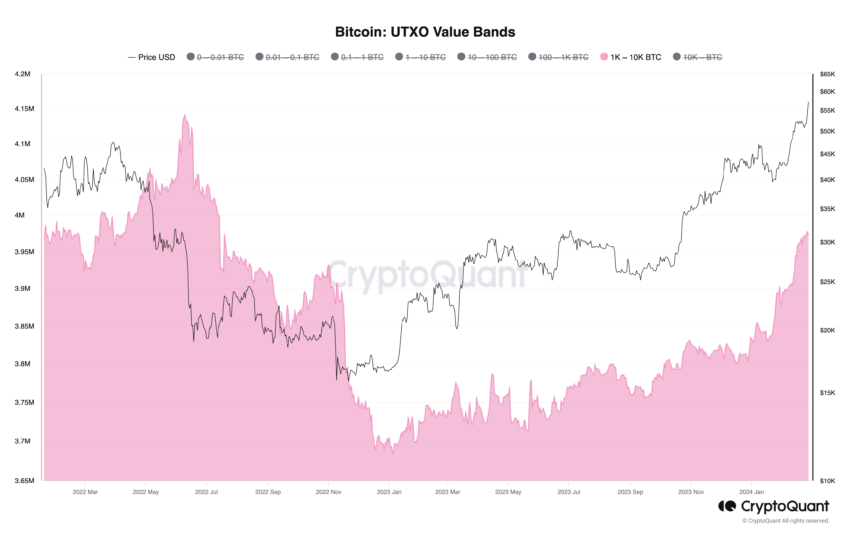

Extra bolstering the bullish sentiment, analysts at CryptoQuant supplied BeInCrypto with a snapshot of the brand new market dynamics driving Bitcoin’s ticket. A latest surge to $64,300, the absolute most practical since November 2021, underscores the loads of quiz of from gargantuan US investors.

This quiz of is mirrored within the rising holdings of gargantuan Bitcoin entities and an inflow of latest capital into the market, as indicated by the rising short-time frame holder realized capitalization.

“The Bitcoin holdings of gargantuan entities has grown to the absolute most practical level since July 2022, totaling 3.975 million Bitcoin. The holdings beget gradually increased from lows of 3.694 million Bitcoin in December 2022. Noteworthy entities (1,000 to 10,000 Bitcoin) rising their holdings is correlated to better costs because it denotes rising Bitcoin quiz of for funding functions,” analysts at CryptoQuant told BeInCrypto.

CryptoQuant’s prognosis moreover shed light on the sustainability of the brand new ticket ranges from a miner revenue standpoint. The analysts urged that Bitcoin’s valuation stays life like, despite the most fresh rally.

Tranquil, they cautioned against doable market corrections, citing indicators corresponding to nearing low ranges of unrealized revenue margin among merchants and the elevated ticket of opening new long positions within the futures market.

Despite these cautionary indicators, the overarching sentiment among experts stays bullish. The confluence of historical facts, new market trends, and the anticipated impact of the following halving match paints a image of serious growth doable for Bitcoin.

This optimism has a solid foundation, as Bitcoin has demonstrated resilience and a fixed capacity to reach new highs following previous halvings.

Disclaimer

The total facts contained on our internet situation is printed in correct religion and for general facts functions simplest. Any hurry the reader takes upon the sure wager discovered on our internet situation is precisely at their occupy threat.