The US Treasury’s Field of job of International Property Control (OFAC) presented original sanctions against A7A5, a Russian ruble-pegged stablecoin, and its affiliates.

Per an announcement on August 14, 2025, OFAC furthermore added the stablecoin‘s creator, A7 LLC, to its Specially Designated Nationals list.

Ruble-Backed Stablecoin A7A5 Plummets; Will Tether Be Affected?

This gallop against A7A5 followed the same sanctions from the UK in Might well perchance perchance and the EU in July. It highlights a original entrance in the US effort to discontinuance Russia from using cryptocurrencies to bypass monetary sanctions.

After the announcement, the worth of the A7A5 dropped by roughly 13%, from about $0.0124 to $0.0105.

Regardless of an uncommon fall in the worth of a Russian ruble-backed stablecoin, self perception in varied stablecoins has remained unshaken.

Even as transaction recordsdata linked to the unique incident confirmed huge utilize of Tether (USDT), the stablecoin giant has no longer confronted significant backlash.

The A7A5 Stablecoin: Origins and Operations

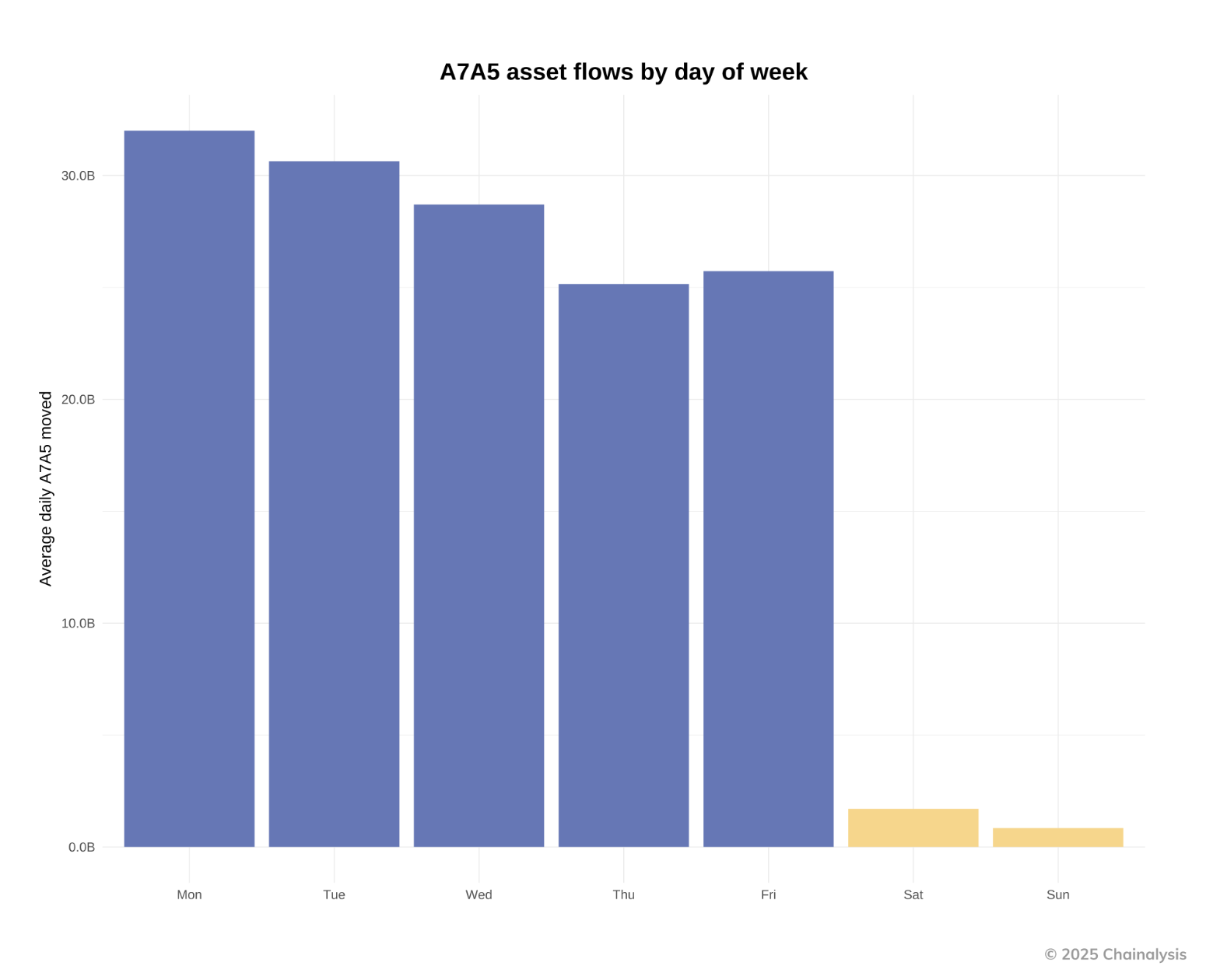

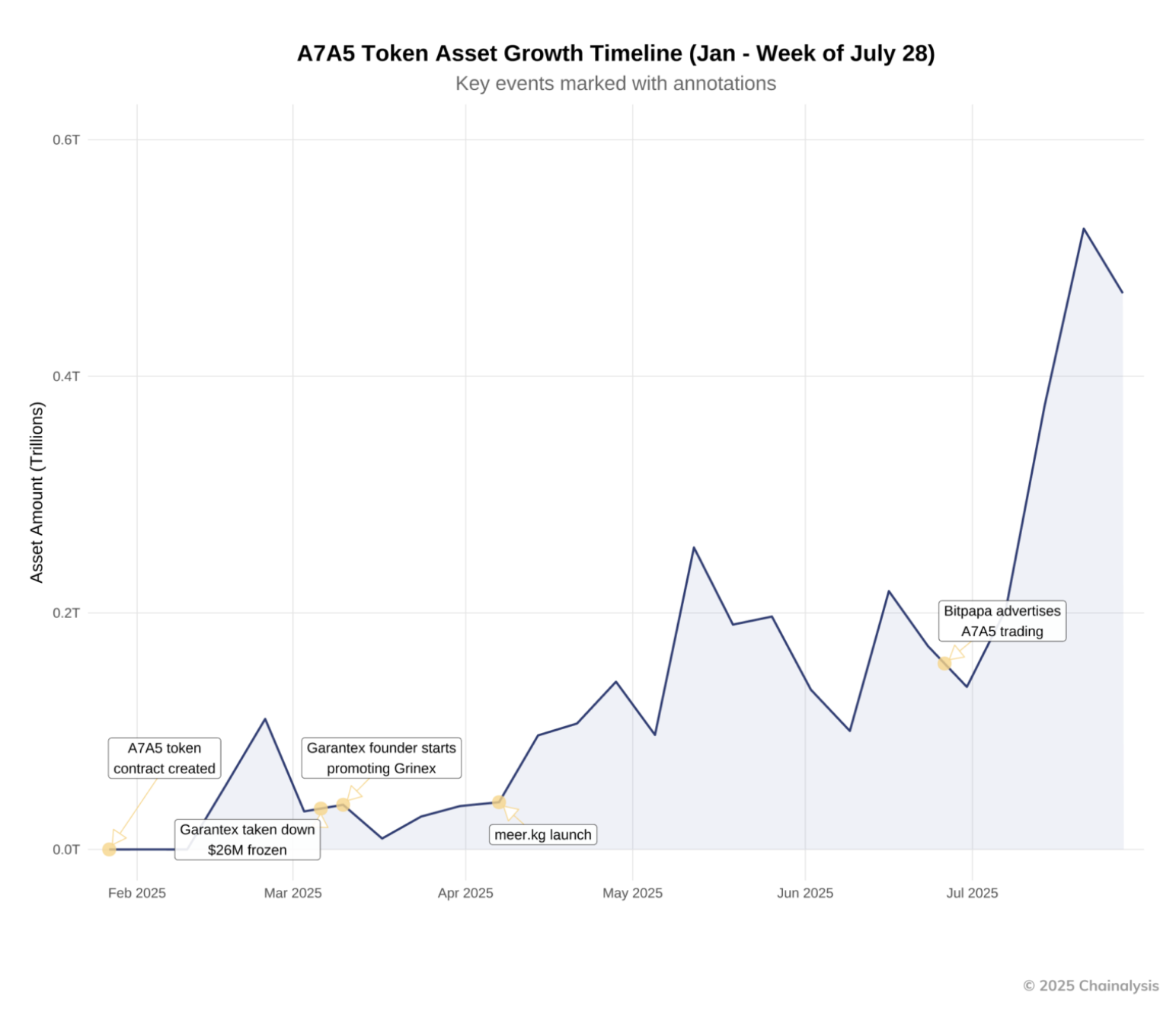

A7A5 launched in Kyrgyzstan in 2025 and rapid modified into the tip ruble-backed stablecoin. On-chain analytics firm Elliptic reports that the token has handled as a lot as $41.2 billion in transfers since its launch. Its every day buying and selling quantity exceeds $1 billion, and its market cap reached $521 million.

A7 LLC, the creator, co-owns the firm with Russia’s enlighten-owned monetary institution, Promsvyazbank (PSB). Curiously, PSB modified into once already on the OFAC sanctions list. The token’s issuer, Feeble Vector LLC, is furthermore primarily primarily primarily based in Kyrgyzstan and is now facing sanctions.

A7 LLC co-owns the firm with Russia’s enlighten-owned Promsvyazbank (PSB), which already seems on OFAC’s sanctions list. Feeble Vector LLC, the token’s issuer in Kyrgyzstan, furthermore faces sanctions.

A7 LLC has connections to Moldovan businessman Ilan Shor, who confronted fraud and election interference charges. Exchanges linked to Russia, in conjunction with Meer and Grinex, provide most of the token’s liquidity. A7A5 furthermore trades on TRON and Ethereum blockchains.

The Rise of A7A5 After Garantex Takedown

In March 2025, the US authorities and world legislation enforcement disrupted Garantex, a crypto alternate already on the OFAC list for facilitating illicit transactions.

Authorities seized the alternate’s net enlighten and froze $26 million in Tether (USDT). The Garantex takedown spurred the growth of A7A5. Many Russian users sought a extra accurate probability than without complications frozen USDT. Grinex, a crypto alternate believed to devour replaced Garantex, modified into a key hub for A7A5 buying and selling.

OFAC has furthermore added Garantex co-founder Sergey Mendeleev to its sanctions list. Entities connected to Mendeleev furthermore purchased sanctions. These include Exved, a low-border price platform for Russian importers and exporters.

Exved makes utilize of USDT to veil its ties to Russian users. One more sanctioned entity is Indefi Smartbank, a crypto service provider for Exved and Grinex.