Bitcoin’s bull cycle is impending its closing stage after 997 days since the cycle bottom on November 21, 2022.

This implies the peak would possibly well presumably presumably additionally happen inside 70 days, doubtless between October 15 and November 15, 2025.

Bitcoin Cycle Height in October–November 2025

In a recent observation of Bitcoin’s historic cycles, analyst CryptoBirb shared some basic insights.

Historical files presented by this analyst outlines the dimension of past bull cycles: 2010–2011 (~350 days); 2011–2013 (~746 days); 2015–2017 (~1,068 days); 2018–2021 (~1,061 days). If history repeats, the recent cycle is projected to final round 1,060–1,100 days.

As of now, counting from the old cycle bottom on November 21, 2022, Bitcoin’s bull flee has lasted 997 days and is nearing its closing section. The height would possibly well presumably presumably additionally appear contained in the next 70 days if history follows the identical pattern.

“Height odds also perfect in subsequent 3 months, with the sweet position between Oct 15 & Nov 15, 2025,” CryptoBirb famed.

Timing the cycle height in step with Bitcoin halving occasions yields a identical projection. The 2012 halving to the 2013 height took about 300 and sixty six days; from 2016 to 2017, about 526 days; and from 2020 to 2021, about 548 days. Basically based on this, the duration from the 2024 halving to the next height would possibly well presumably presumably additionally be round 518–580 days.

“This one puts subsequent height between Oct 19 & Nov 20, 2025 (518–580 days),” CryptoBirb added.

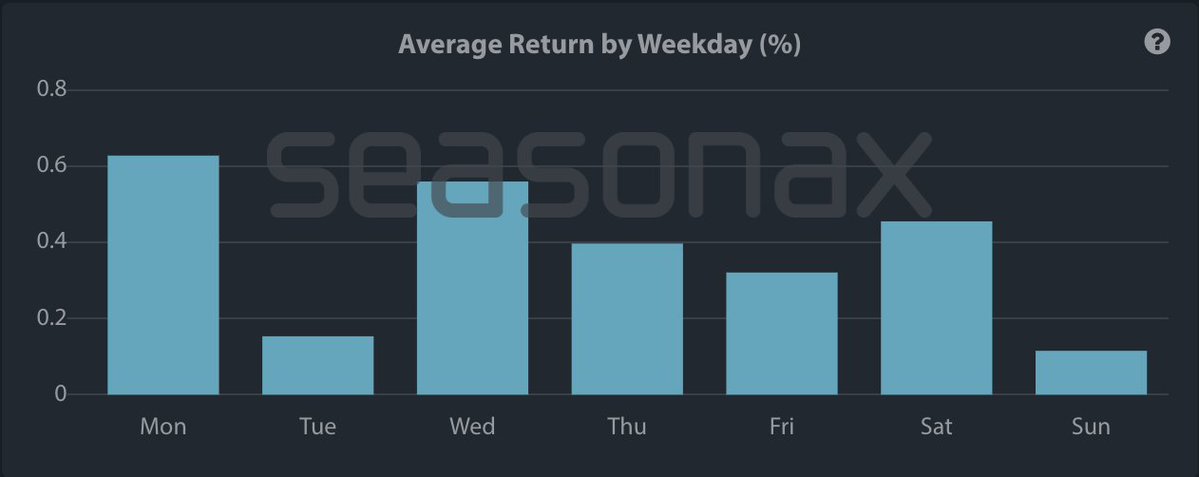

To extra enhance this look, CryptoBirb pointed out that in past cycles, October and November bask in typically been Bitcoin’s strongest enhance months, in particular on key dates indulge in Monday (October 20, October 27) and Wednesday (October 22, October 29). Among these, October 22 is largely the most definitely window for a label breakout.

The overlap between the four-yr cycle of the U.S. presidential election and Bitcoin’s provide halving extra strengthens the hypothesis that the cycle height will tumble between mid-October and mid-November 2025. This pattern has over and over been noticed when political elements, blended with provide scarcity, gas sturdy bull runs.

“Subsequent ATH odds strongly cluster Oct 15–Nov 15, 2025 — where history, math, and market momentum align. My bet is we won’t be too far off 4th week of October,” CryptoBirb said.

This aligns with the look of Alphractal’s CEO, who believes that the Bitcoin cycle remains intact and is extremely inclined to height in October, but cautions investors to brace for heightened volatility ahead of the tip is reached.

Indulge in Market in 2026

From a market psychology standpoint, the pre-height section typically sees low euphoria, surging shopping and selling volumes, and height search interest for Bitcoin-connected key phrases. This section would possibly well presumably presumably additionally additionally perform engaging short-term corrections to “shake out” ragged palms ahead of costs amplify.

Bitcoin has already been experiencing sturdy upward momentum alongside recent corrective pullbacks.

Following the peak, historic trends expose that undergo markets typically final between 370 and 410 days, with a mean decline of about –66%. If this scenario repeats, a downtrend would possibly well presumably presumably additionally start in 2026, ushering in a deep correction section ahead of the next accumulation duration begins.

As a result of this many analysts counsel an exit approach ahead of the market reverses. Some investors bask in already deliberate to money out of crypto ahead of December to entirely stable their earnings.

However, as BeInCrypto previously reported, some experts think the Bitcoin cycle is “silly.” Forecasting menace is harder now, as a doable institutional fright would possibly well presumably presumably additionally redefine future undergo markets.

The submit Analyst Finds When the Most modern Bitcoin Cycle Will Height regarded first on BeInCrypto.