On the present time, the tag of Dogecoin is $0.2352. The tag is getting tighter in a pattern made by rising lows and a cap that goes assist to the height in November 2024. At $0.2150, investors leaned on the 0.236 Fib set apart and compelled a pleasant rebound that has now stopped beneath $0.2455 to $0.2460. Clear that pocket, and the pass parts to $0.2668 on the Fib grid.

Dogecoin Label Forecast Table: August 12, 2025

| Indicator/Zone | Stage / Signal |

| Unique tag | $0.2352 |

| Resistance 1 | $0.2397 (triangle top) |

| Resistance 2 | $0.2455 (Bollinger upper) |

| Stretch target | $0.2668 (Fib 0.382) |

| Enhance 1 | $0.2233 (EMA50) |

| Enhance 2 | $0.2150 (Fib 0.236) |

| EMA20 / EMA50 / EMA100 / EMA200 (4H) | $0.2314 / $0.2233 / $0.2206 / $0.2151 |

| Bollinger Bands (4H) | Higher $0.2455 / Mid $0.2336 / Decrease $0.2217 |

| VWAP (30 min) | $0.2353 |

| Supertrend (4H) | Bullish above $0.2252 |

| DMI (+DI / -DI / ADX) | 23.15 / 12.05 / 42.24 |

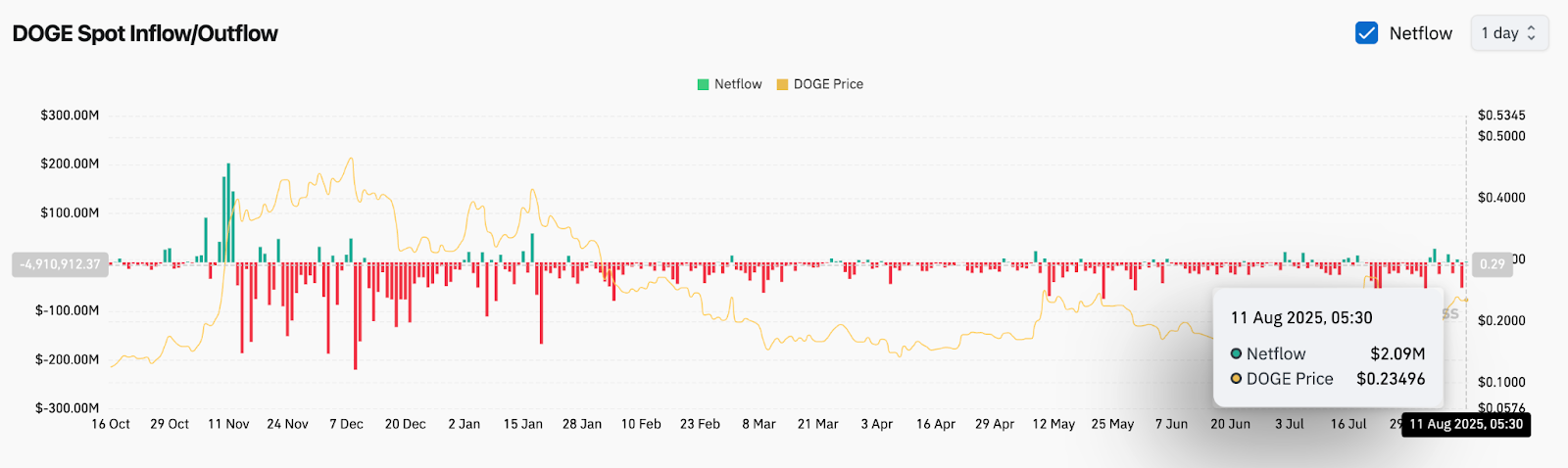

| Space netflow (Aug 11) | +$2.09M |

| Key inquire of zone | $0.16 to $0.15 |

| Liquidity targets | $0.2668 / $0.2865 |

What’s Taking place With Dogecoin’s Label?

DOGE trades between the 0.236 stage at $0.2150 and the 0.382 set apart at $0.2668 on the daily take a look at out. Here’s internal an extended-term triangle. If the tag closes above the downtrend line drawn from $0.4861 on daily basis, the bias for the greater time physique will shift assist to continuation.

The 4-hour setup is correct. DOGE is shopping and selling above the EMA20 at $0.2314, the EMA50 at $0.2233, the EMA100 at $0.2206, and the EMA200 at $0.2151. The Bollinger Bands in the imply time are closer collectively. The upper band at $0.2455 is a short-term resistance stage, and the lower band at $0.2217 is the first give a take hang of to stage.

Tumble to the 30 minute take a look at out and likewise you see tag coiling between VWAP at $0.2353 and an intraday channel lid at $0.2397. RSI sits at 54.05 after easing from overbought, which retains momentum constructive with out stretch.

Dogecoin Label Analysis: Relate Float and Liquidity

Every single day Dapper Money Ideas work showed a Damage of Structure over $0.22 in early August. Then the tag moved toward $0.30 nonetheless used to be grew to turn into away internal a offer pocket between $0.29 and $0.30. After a triangle fracture, that band is silent the first huge purpose. For downside menace, less assailable inquire of is between $0.16 and $0.15, with a stronger unfriendly discontinuance to the $0.10 trusty low.

Inform tools silent lean bullish. The 4 hour Supertrend stays optimistic above $0.2252, which makes $0.2233 to $0.2250 a key protection. DMI displays +DI at 23.15 over -DI at 12.05, whereas ADX at 42.24 alerts a sturdy underlying trend.

Space netflow on August 11 printed a modest +$2.09M, which hints at silent accumulation whereas tag coils.

Dogecoin Label Prediction: Momentary Outlook (24h)

If a 4 hour discontinuance lands above $0.2397, the intraday triangle breaks to the topside. That course targets $0.2455 first, then $0.2668 on the 0.382 marker. If momentum persists, tag can probe $0.2865 discontinuance to the 0.5 stage, which might perhaps per chance perhaps well furthermore succor as firm confirmation of a increased breakout. This take a look at out is invalidated on a discontinuance beneath $0.2233 because that might perhaps per chance well blueprint discontinuance out the 50 duration moderate and weaken construction.

If investors lose $0.2233, the focal level shifts assist to $0.2150, where the 0.236 set apart and basically the most most original swing lows meet. If there might perhaps be a breach, it might perhaps per chance per chance well result in $0.20 and, if there might perhaps be strain, the $0.16 to $0.15 inquire of block.

Self belief: Between Medium and High. Momentum appears to be like to be correct on all time frames, nonetheless it silent wants a gorgeous push thru $0.2455 to $0.2460 with quantity to protect going.

Disclaimer: The facts presented listed right here is for informational and academic functions only. The article doesn’t constitute monetary advice or advice of any sort. Coin Model is no longer accountable for any losses incurred since the utilization of yelp material, merchandise, or products and companies talked about. Readers are suggested to exercise warning outdated to taking any action linked to the firm.