Ethereum has maintained its bullish momentum, decisively breaking through key resistance zones and reclaiming the psychological $4K stage.

While some cooling-off is seemingly, the broader model aloof favors extra upside.

ETH Be aware Evaluation: Technicals

By Shayan

The On daily foundation Chart

After sweeping liquidity below the $3.5K role, ETH attracted come by buying curiosity, igniting a titillating rally. The upward circulation propelled the worth above the $4K threshold, a stage which is significant each psychologically and as a outdated swing high on the day-after-day chart.

This breakout underscores sustained market quiz, but with ticket now buying and selling firmly above $4K, a non permanent pullback to retest this problem stays a likelihood. Such a retracement could possibly encourage as a healthy reset earlier than continuation in the direction of the next key resistance at $4.5K.

The 4-Hour Chart

Zooming in, ETH’s ticket has lower through a pair of resistance ranges with come by bullish conviction, reflecting elevated buying momentum.

Nonetheless, the fresh self-discipline suggests the market could possibly very wisely be ready for a corrective section to absorb fresh quiz earlier than resuming its climb.

The 0.5–0.618 Fibonacci retracement zone, aligned with Ethereum’s established multi-month uptrend, represents a seemingly toughen problem if a pullback unfolds. Maintaining this role would toughen the case for but another leg bigger, seemingly riding the worth into uncharted territory in the direction of a original all-time high.

Onchain Evaluation

By Shayan

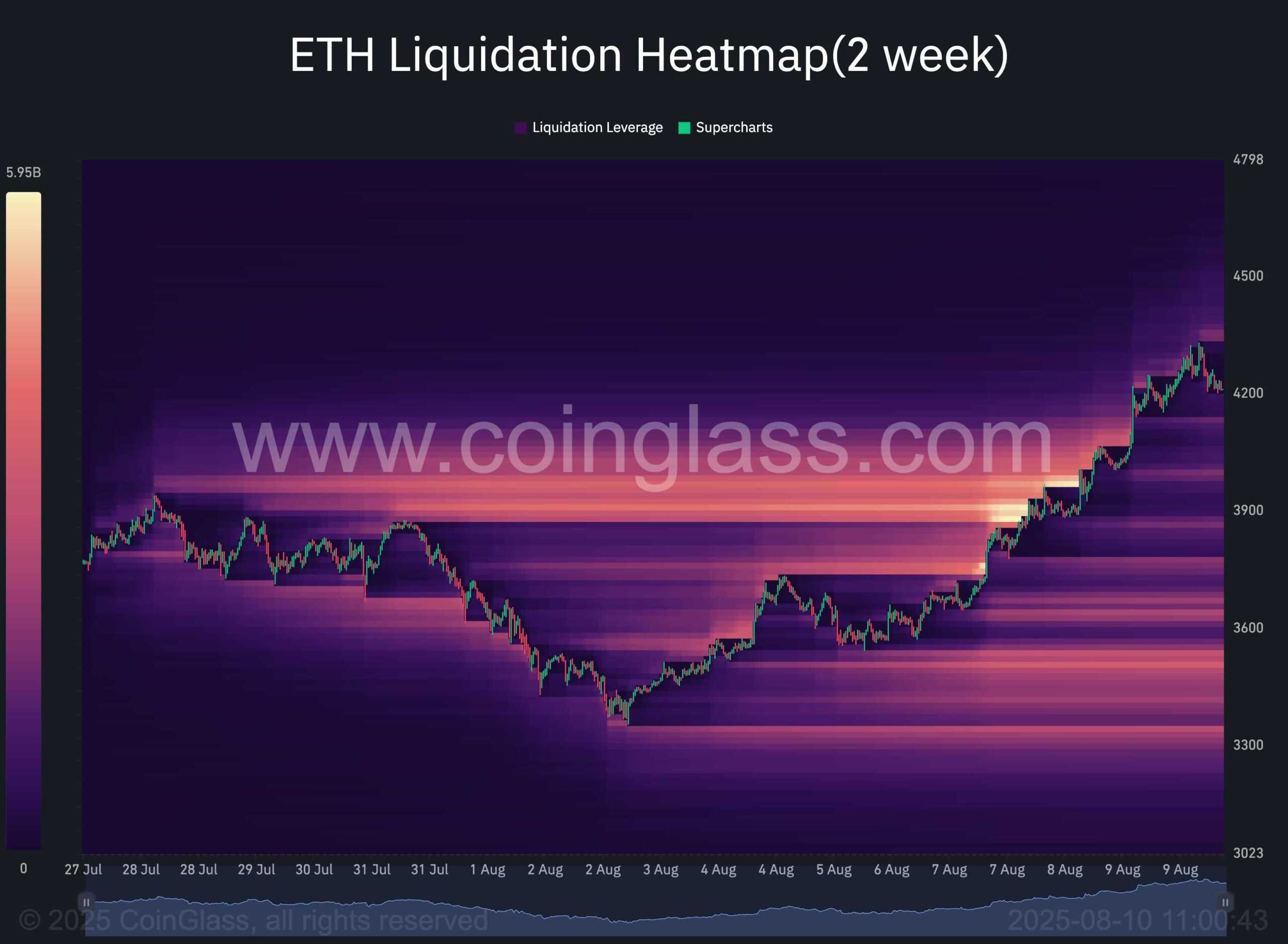

The ETH Liquidation Heatmap suggests a fairly particular direction in the direction of Ethereum’s all-time high, without a predominant liquidity clusters obstructing the attain.

Nonetheless, a vital pocket of liquidity is positioned near the $3.6K stage, seemingly reflecting the liquidation factors of long positions collected for the interval of the fresh rally. This problem marks a dense concentration of leveraged futures exposure, making it a gorgeous goal for market makers and gargantuan avid gamers seeking to trigger liquidity occasions.

Given this setup, a retracement in the direction of the $3.6K zone stays a believable self-discipline, seemingly flushing out these positions earlier than the market resumes its upward push. Merchants ought to aloof video display this stage closely, as liquidity hunts in such areas veritably end result in titillating, like a flash ticket movements and heightened volatility once the zone is engaged.