Bitcoin’s mempool is a maintaining put for transactions broadcast to the community nonetheless no longer yet integrated in a block. Analyzing the mempool offers insight into community congestion, transaction query, and charge trends, offering a unfamiliar vantage point on the narrate of the Bitcoin ecosystem.

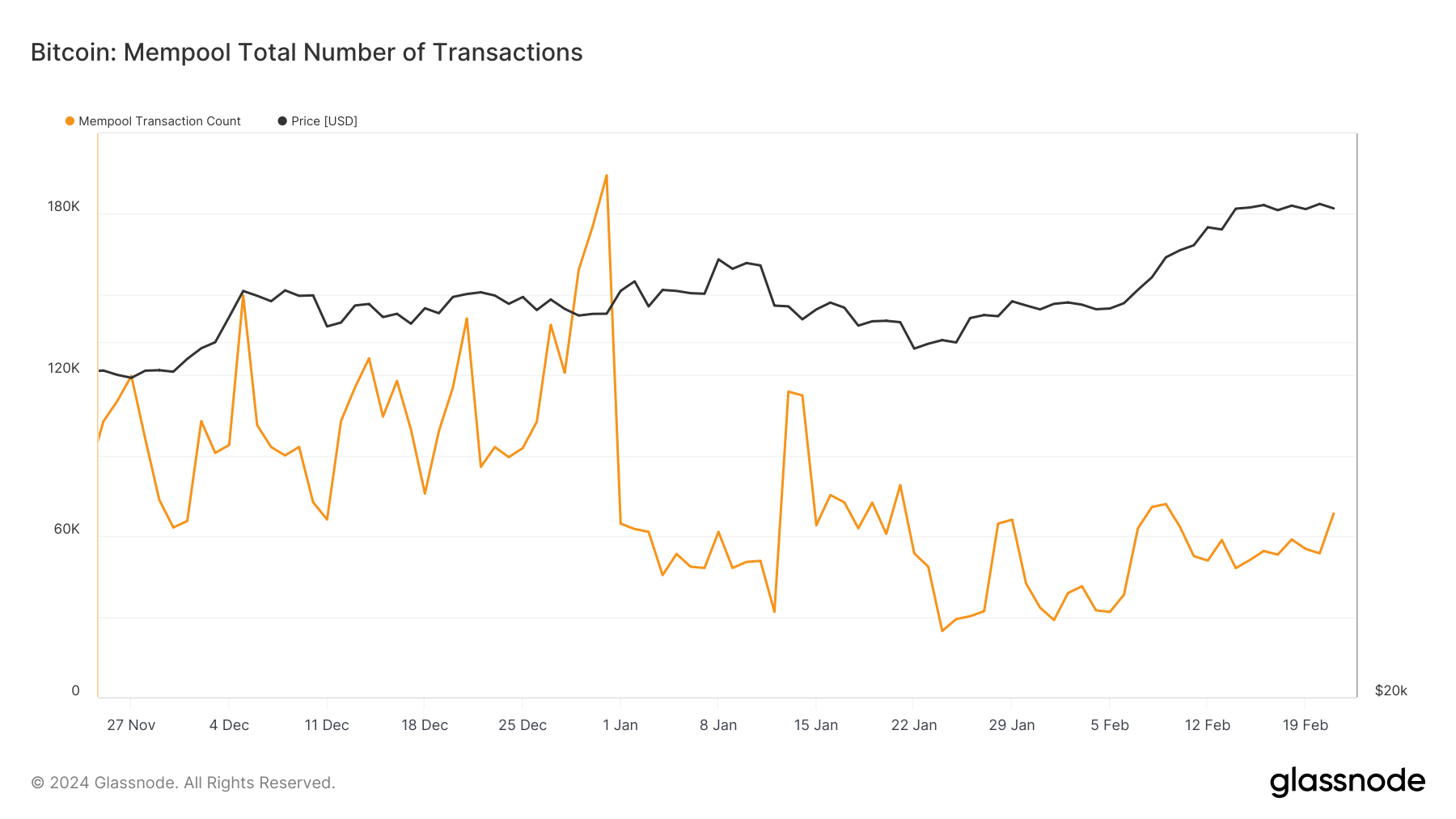

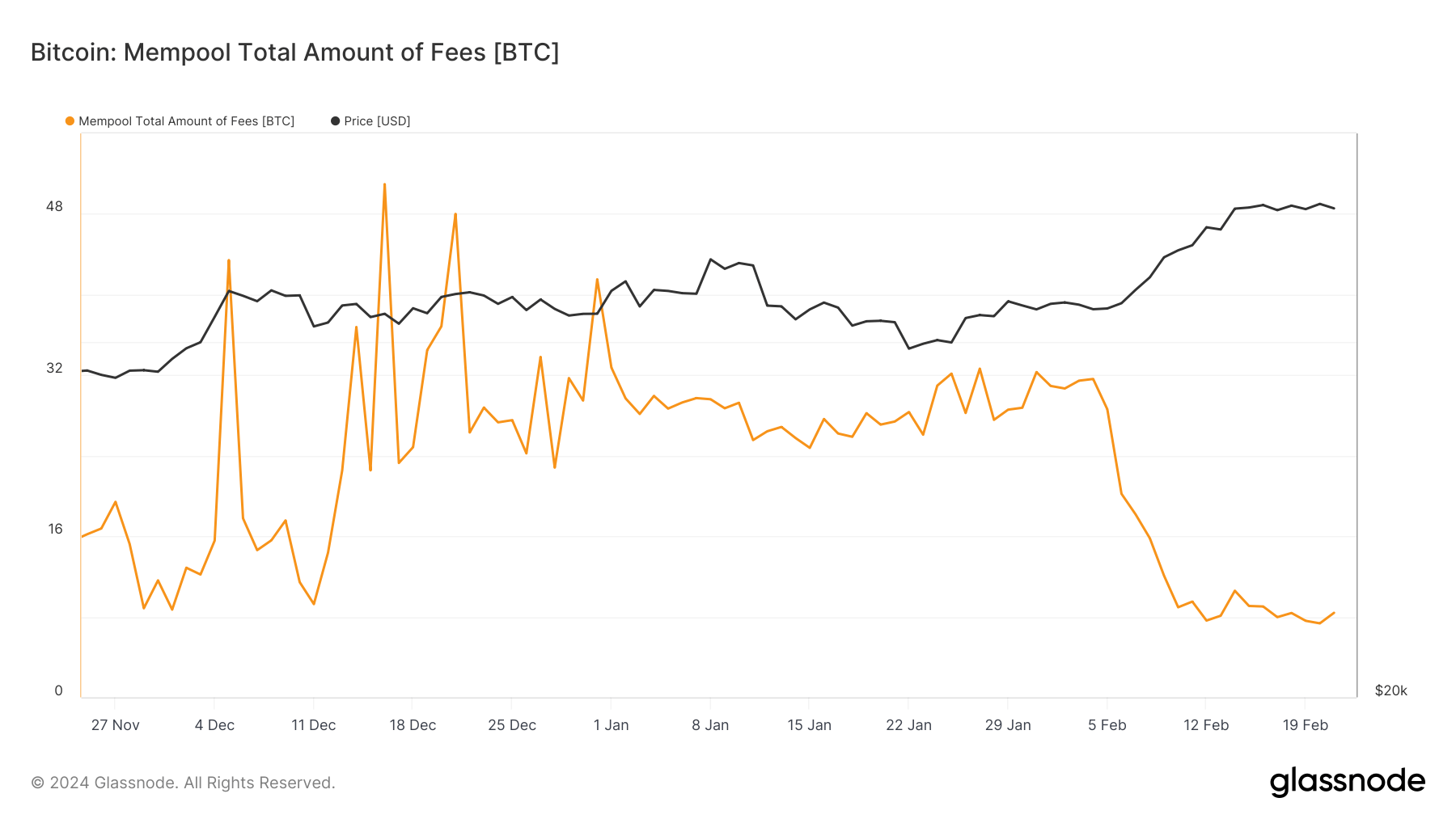

In some unspecified time in the future of the final months of 2023 and the early weeks of 2024, the Bitcoin community experienced significant congestion, as evidenced by the swelling size of the mempool. In mid-December, the mempool contained 117,813 transactions ready to be processed, and transaction expenses totaling 50.9 BTC.

This congestion signaled a high query for block put and highlighted the community’s challenges in accommodating surging transaction volumes. By the waste of December, the subject intensified, with the mempool size escalating to 194,374 transactions, indicating a height in community exercise and individual engagement.

This congestion had little affect on Bitcoin’s stamp, which traded at round $42,000 for the better phase of December. The persistence of high transaction counts and expenses into early January, with the mempool harboring 64,664 transactions and 32.7 BTC in expenses on the key day of the year, underscored the community’s stress below the weight of unprocessed transactions.

The total size of transactions awaiting confirmation within the mempool extra ballooned to 106.369 million bytes, peaking at 139.457 million by gradual January, reflecting a backlog of transactions and an enlarge within the complexity or size of the transactions.

The turning point for the prolonged duration of congestion came in February. By Feb. 21, the mempool cleared vastly, with the total transaction expenses shedding to eight.3 BTC and the assortment of ready transactions lowered to 68,433. The total size of transactions within the mempool moreover lowered to 90.439 million bytes, indicating a significant alleviation of community congestion.

This duration of lowered congestion followed Bitcoin’s bullish rally, which saw it climb over $52,000 after which obtain stability at the $51,800 level.

The clearing of the mempool congestion in February, despite Bitcoin’s rising stamp, signifies an increase within the community’s ability to route of transactions, presumably thru miners prioritizing transactions with elevated expenses or the adoption of efficiency-enhancing measures by customers, honest like transaction batching or the utilization of off-chain solutions.

2nd, the good deal in congestion and expenses seemingly contributed to a particular shift in investor sentiment, viewing the enhanced community performance as a bullish indicator of Bitcoin’s usability and scalability.