Bitcoin came below distinguished promoting stress following heightened geopolitical concerns stemming from the escalating conflict between Russia and the USA over nuclear threats.

Despite the bearish momentum, the cryptocurrency has now reached a key toughen zone, expected to care for in the quick time duration.

Technical Diagnosis

By ShayanMarkets

The Day-to-day Chart

After a prolonged consolidation within the $116K–$123K vary, BTC encountered heavy promoting stress, driven by escalating concerns over the Russia–US nuclear conflict. This resulted in a breakdown below the indispensable $114K toughen, sparking worry and uncertainty available in the market.

On the opposite hand, BTC has now approached a critical toughen zone between $111K and $112K, an self-discipline defined by the lower boundary of a multi-month ascending channel and a key earlier swing high.

This confluence of technical toughen is at likelihood of appeal to affected person merchants, doubtlessly initiating a bullish consolidation section. Peaceable, if the designate fails to care for above this plan, a quick decline toward the psychological $100K diploma could maybe maybe shriek.

The 4-Hour Chart

On the lower timeframe, Bitcoin’s breakdown from the bullish flag pattern marks a bearish technical signal, confirming the pattern’s failure. The horny rejection from the flag’s higher boundary triggered a steep decline, bringing the designate to a indispensable toughen shut to the $112K zone, which also aligns with the 0.618 Fibonacci retracement diploma. This specific one in overall acts as a magnet for non eternal bullish reactions.

As lengthy because the designate holds above this vary, a corrective soar is probably going. On the opposite hand, if bearish momentum persists, one other promote-off concentrated on a sweep below $111K–$112K could maybe maybe occur. Till then, non eternal consolidation stays basically the most attainable break result.

On-chain Diagnosis

By ShayanMarkets

The Replace Netflow indicator reveals that 16,417 BTC flowed into exchanges the day prior to this, the very best day to day catch influx since mid-July. This suggests a critical assortment of holders are appealing their Bitcoin to exchanges, usually a precursor to promoting process.

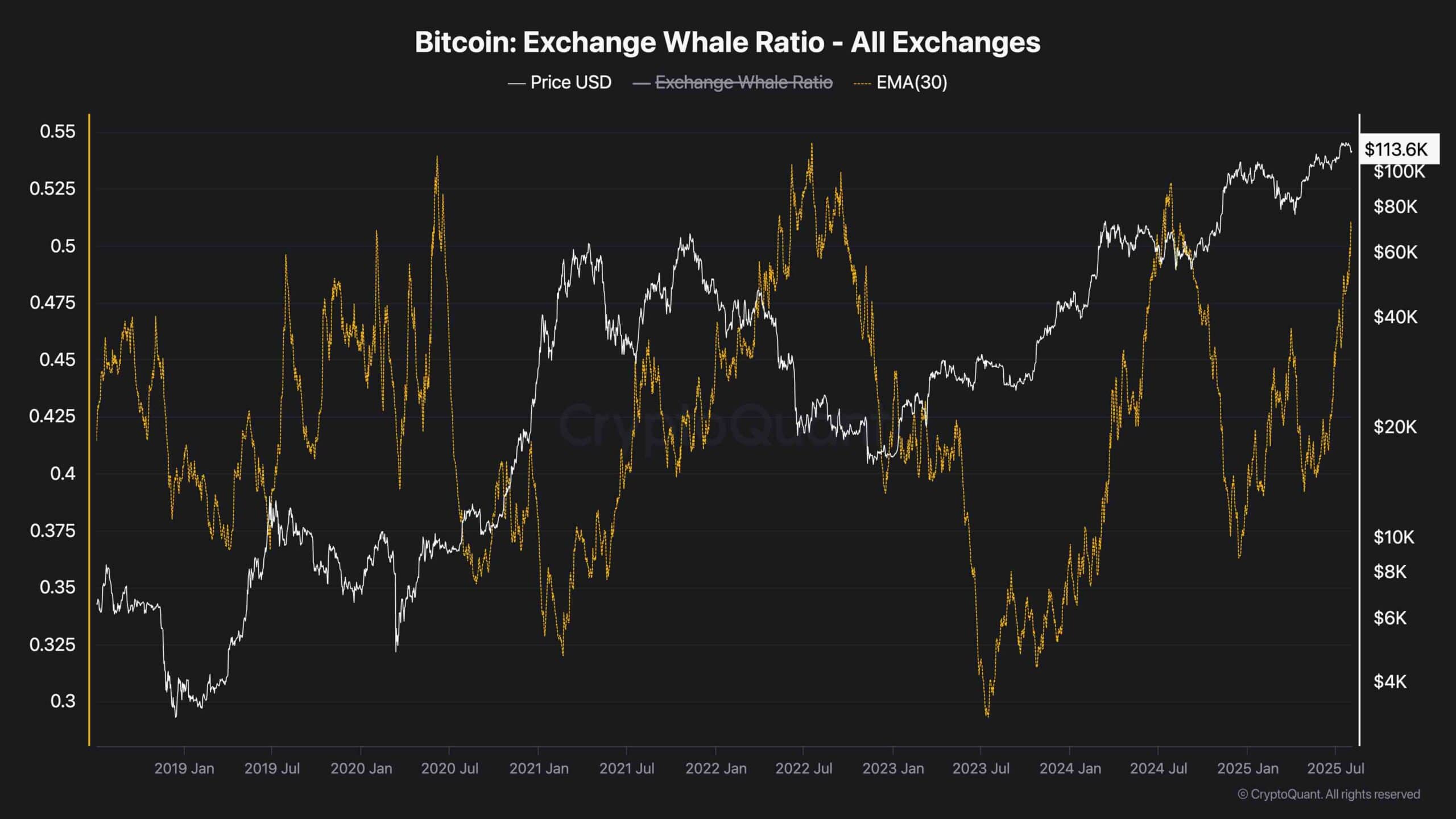

At the identical time, the Replace Whale Ratio surged above 0.70, indicating that just about all of these deposits came from spacious holders (whales). Historically, when whale-dominated inflows coincide with elevated change process, the market in overall faces elevated promoting stress and payment declines.

If this vogue continues and whales persist in depositing BTC at this tempo, further design back likelihood could maybe maybe shriek. Such process could maybe maybe contemplate income-taking, preparation for a correction, or strategic reallocation in anticipation of shut to-time duration volatility.