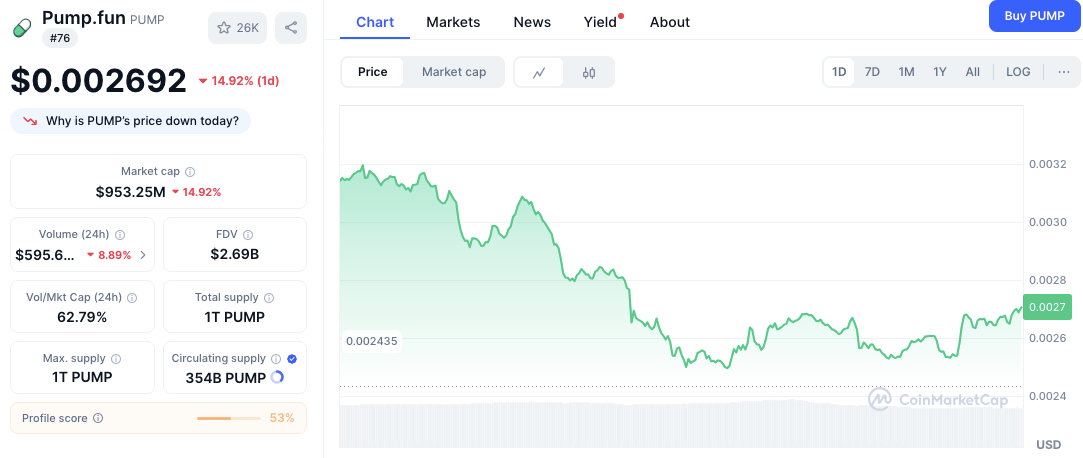

The Pump.stress-free (PUMP) token witnessed a interesting 15% downturn correct by the last 24 hours as intensifying selling stress and millions in liquidations pushed the asset to a first-rate technical juncture.

After falling to a day-to-day low of $0.002435, the token is making an are attempting a gradual recovery, hovering around $0.002690 at press time.

Long Liquidations Gasoline the Downturn

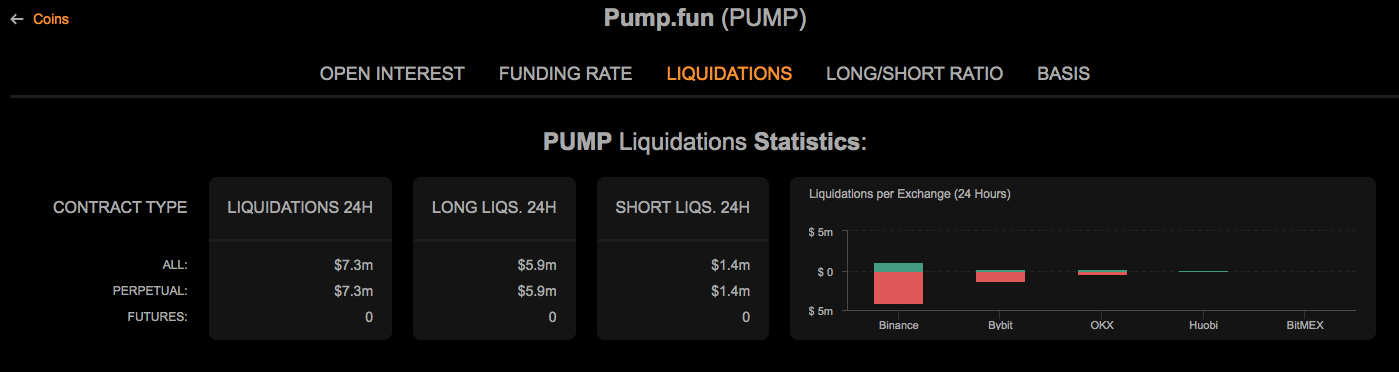

The interesting tag fall used to be amplified by a famous volume of liquidations within the perpetual contracts market. Over the last 24 hours, PUMP saw $7.3 million in total liquidations, in step with records from Coinanalyze.

Particularly, the mountainous majority of these, $5.9 million, occupy been from lengthy positions, indicating that traders making a bet on a tag enlarge occupy been caught off-guard and forcefully sold off.

Vastly, Binance led all exchanges in liquidation volume, followed by Bybit, OKX, Huobi, and BitMEX. This concentration of assignment reflects how speculative hobby is driving non everlasting volatility.

Key PUMP Worth Ranges to Phrase

From a technical standpoint, PUMP is now testing a famous reinforce zone. Irrespective of the fall, technical phases cloak doable stabilization.

The speedy reinforce lies approach $0.002435, which used to be additionally the day’s low. A 2nd layer of reinforce sits at $0.002500, a stage that beforehand attracted dip-buying assignment. These tag floor would possibly presumably presumably also support accumulation if sentiment improves.

On the flip facet, the token is coping with overhead resistance approach $0.002800, where it impartial now not too lengthy within the past did now not withhold beneficial properties. A breakout previous $0.002800 would possibly presumably presumably also trigger momentum buying.

Linked: Pump.stress-free (PUMP) Worth Prediction for August 2025

Nevertheless, a elevated hurdle looms at $0.003200, a stage beforehand rejected by sellers correct by a tag rally. Any circulation in direction of this stage would require renewed bullish hobby.

Momentum Indicators Keep Warning and Opportunity

From a pattern point of view, the one-day chart reveals a predominantly downward pattern. A minor bounce later within the day hints at doable bottoming. The Relative Strength Index (RSI) now reads 28.51 firmly in oversold territory. This stage on the final reflects overextended selling and would possibly presumably perhaps precede a technical rebound.

Linked: Pump.stress-free’s Day-to-day Income Plunges Below $300k, Lowest Since September 2024

Nevertheless, the Transferring Real looking Convergence Divergence (MACD) remains bearish. The MACD line sits beneath the zero line, while the histogram continues to cloak destructive momentum. Investors would possibly presumably presumably want beyond regular time sooner than a convincing reversal forms.

Disclaimer: The records presented on this text is for informational and instructional purposes simplest. The article doesn’t constitute monetary advice or advice of any sort. Coin Version is now not accountable for any losses incurred as a outcomes of the utilization of suppose material, products, or services talked about. Readers are told to command warning sooner than taking any action linked to the firm.