- Ethereum trace rebounds after making an are trying out its every day stage of $3,730 on Tuesday, following a brand original year-to-date excessive of $3,941 the day prior to this.

- Institutional inquire for ETH continues to toughen, with ETH ETFs adding a extra 1.6 million ETH up to now six weeks.

- Market participants desires to be cautious as the upcoming tariff deadline and macroeconomic records releases imply a doubtlessly hazardous week for ETH.

Ethereum (ETH) trace is rebounding above $3,800 on the time of writing on Tuesday after surroundings a brand original year-to-date excessive at $3,941 the day prior to this. Institutional inquire for ETH remained well-known, with the ETH Alternate Traded Funds (ETFs) adding a extra 1.6 million ETH up to now six weeks. Nonetheless, merchants may likely likely gentle withhold a search on doubtless volatility, with the upcoming US tariff deadline and the Federal Reserve’s (Fed) passion charge choice expected to pressure volatility across crypto sources, including ETH.

Ethereum hits a brand original yearly excessive of $3,941

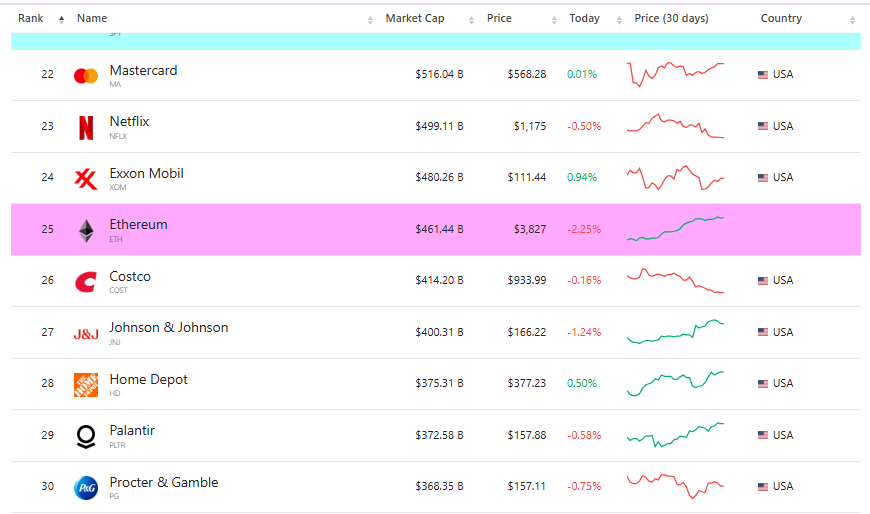

Ethereum trace started the week on a certain present, hovering to a brand original year-to-date (YTD) excessive of $3,941 on Monday, however ended the day with a exiguous correction. So some distance in July, ETH has rallied by over 54%, and its market capitalization now exceeds $460 billion, inserting it amongst the quit 25 sources in the sphere, surpassing corporations such as Costco and Johnson & Johnson.

Institutional inquire rises, ETH outperforms BTC

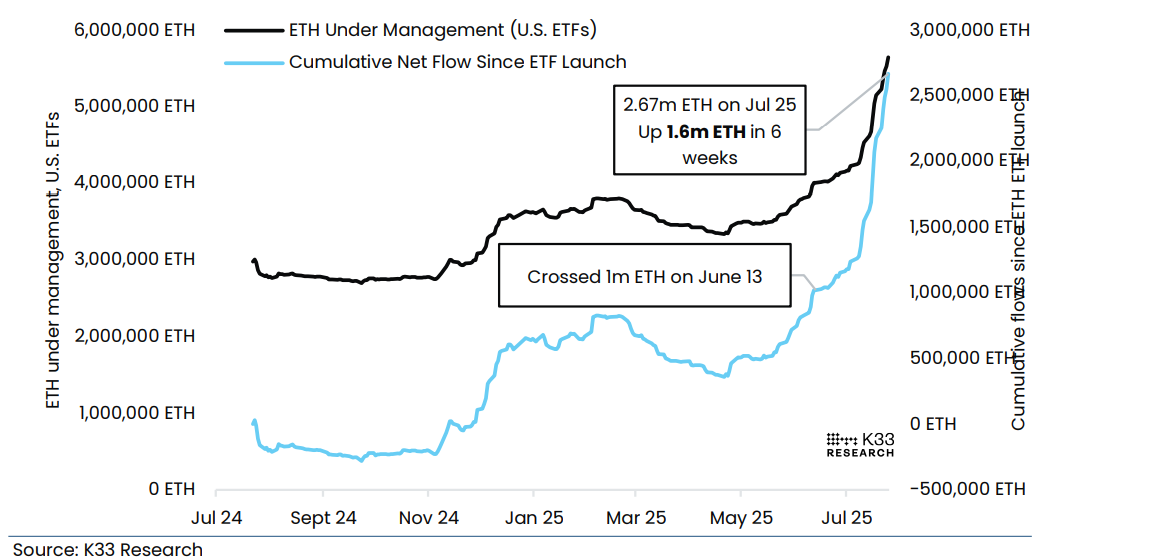

The rising inquire from institutional buyers is supporting the surge in Ethereum’s trace. A K33 Analysis portray printed on Tuesday states that Ethereum’s win Alternate Traded Fund (ETF) inflows crossed 1 million ETH on June 13. Since then, the inflows bear in mind accelerated aggressively, with ETH ETFs adding a extra 1.6 million ETH up to now six weeks.

Alongside large ETF flows, ETH has outperformed BTC closely in July, with the ETH/BTC pair rallying from 0.023 to 0.032, pulling ETH/BTC to its very most life like designate since January 31.

ETF Notional AUM vs. cumulative notional waft chart. Offer: K33 Analysis

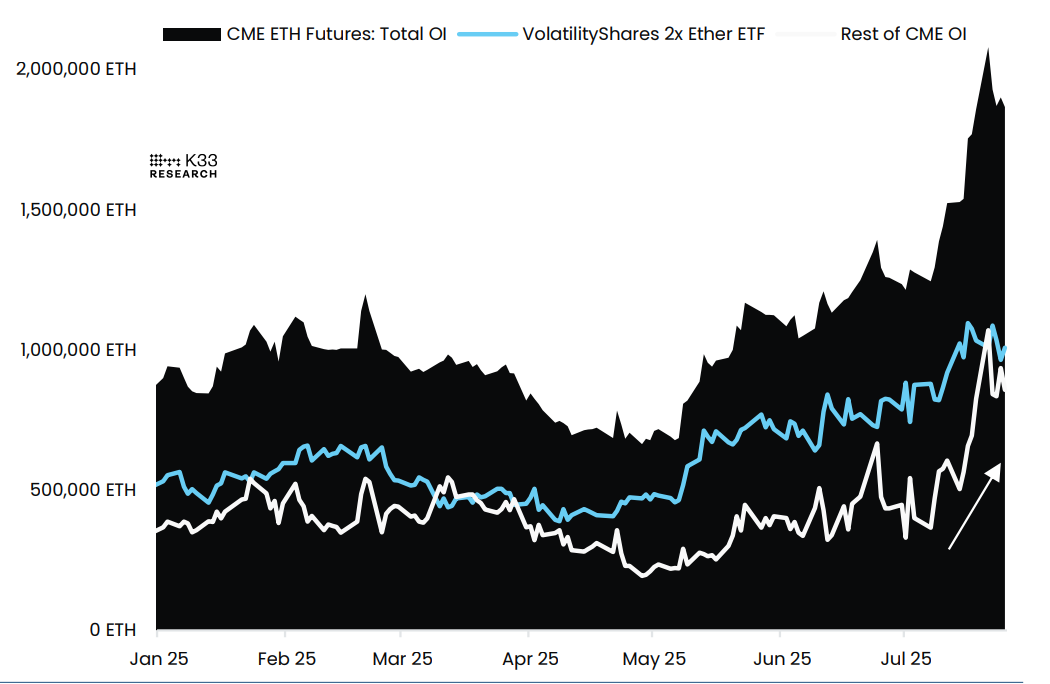

The portray additionally highlights that the evolving consuming gamers in the Chicago Mercantile Alternate (CME) ETH futures bear in mind lengthy been dominated by VolatilityShares. This 2x leveraged ETF issuer has represented bigger than 50% of CME’s ETH Launch Hobby (OI) since unhurried March.

The graph below reveals that the leveraged ETH ETF faces a 250,000 ETH prolong in CME publicity in July, and consuming market participants bright at as soon as on CME sees the most huge rise in CME OI. Moving market participants elevated their publicity from 331,224 ETH to 858,850 ETH in July, representing a in actual fact in depth 527,000 ETH prolong in publicity from this cohort. Alongside a relative futures basis top charge when compared to BTC and large design ETF flows, this means that institutional gamers are turning into extra willing to plot directional lengthy publicity in ETH.

CME ETH Futures: VolatilityShares publicity vs. the the rest of the CME chart Offer: K33 Analysis

Volatile week for ETH

Traders desires to be cautious of a doubtlessly hazardous marketplace for Ethereum this week, with a few bulletins expected to be released.

The US employment records unlock on Tuesday, adopted by the Fed’s passion charge choice and a doubtless White Dwelling Crypto Document on Wednesday, and the drawing near US President Donald Trump’s tariff deadline on Friday. These news and macroeconomic prerequisites may likely likely teach in racy volatility in both course, which may likely likely trigger large liquidation in leveraged merchants across Ethereum.

Ethereum Model Forecast: ETH bulls aiming for phases above $4,000

Ethereum trace retested and chanced on enhance around its every day stage at $3,500 on Thursday, recovering almost about 8% and shutting above the every day resistance at $3,730 on Sunday. On the origin of this week on Monday, ETH reached a brand original year-to-date excessive of $3,940, however confronted a exiguous decline and retested its every day enhance at $3,730. On the time of writing on Tuesday, ETH rebounds, trading elevated above $3,800.

If ETH continues its upward momentum, it will most likely well likely likely prolong the rally in the direction of the psychological $4,000 stage.

The Relative Strength Index (RSI) on the every day chart reads 77, above its overbought stage of 70, and functions upward, indicating bulls gentle bear in mind room for a leg elevated. Nonetheless, the Spirited Moderate Convergence Divergence (MACD) indicator reveals that the MACD line and the signal line are converging, indicating indecisiveness amongst merchants. Moreover, the golf green histogram bars are additionally falling, suggesting a fading of bullish momentum.

ETH/USDT every day chart

On the quite quite a bit of hand, if ETH faces a pullback, it will most likely well likely likely prolong the decline to search out enhance around its every day stage of $3,730.