On Monday, July 14th, Bitcoin, the first and biggest cryptocurrency by market cap, recorded a recent historical stage. Per market data, Bitcoin surged to contemporary establish ranges that saw its market cap grow, toppling established corporations and precious metals. Nonetheless, as of tiring, corporations devour Amazon maintain regained their flooring, reclaiming the Fifth rotten the establish Bitcoin had settled for over 24 hours. In the same expose, Satoshi Nakamoto, the mysterious figure, increased his wealth rankings to a recent establish, pushing Michael Dell one bar below by taking the 11th richest particular person on the earth.

Bitcoin’s Creator Enters Billionaire High 15 After Tag Rally

Satoshi Nakamoto, the nameless creator of Bitcoin, has joined the realm’s prime fifteen richest folk. The entry follows Bitcoin’s surge to a recent ATH, elevating Nakamoto’s estimated rep price to over $131 billion. Per the blockchain analytics platform Arkham, Nakamoto controls roughly 1.096 million BTC, which is dispensed across a few wallets. Per recent market data, this ranks him above several alternate leaders by whole wealth.

https://x.com/arkham/establish/1943725204955340818

Nakamoto’s rep price now exceeds that of Michael Dell, founder of Dell Applied sciences, whose wealth stands at $125.1 billion. This establish locations Nakamoto at quantity eleven globally. Nonetheless, Forbes has but to element in crypto wallet balances in its calculations officially. The valuation depends exclusively on recent Bitcoin market prices.

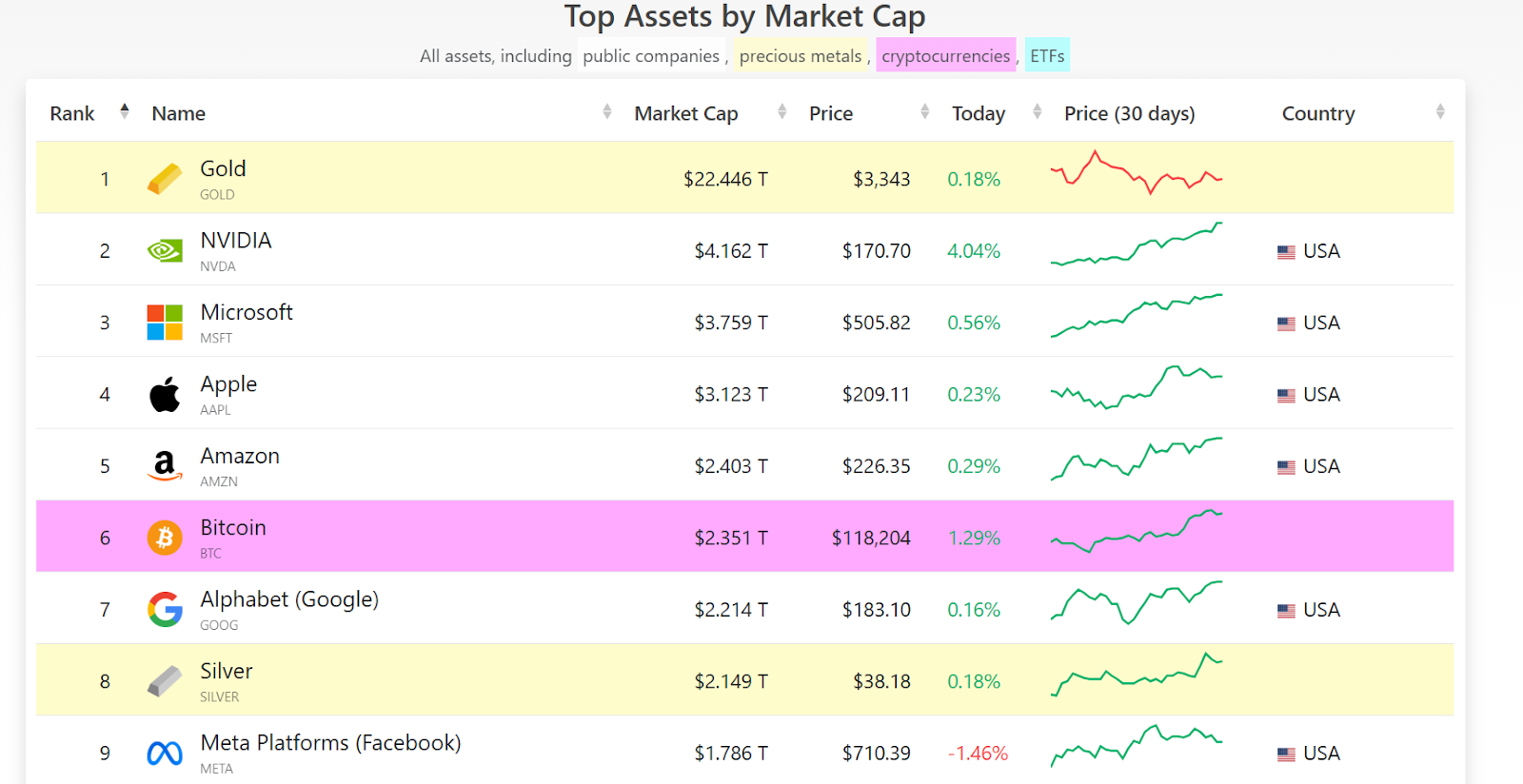

Unique High Assets by Market Cap

Monitoring the recent market pattern in terms of the leading property, Bitcoin stays ahead of Google and Silver, which earlier ranked above BTC. Market data on the time of press indicates that Bitcoin ranks sixth with a market capitalization of $2.351 trillion. Its recent establish is in the differ of $114,000 – $118,000. The asset features as the 30-day establish movement indicates a solid upward pattern. Nonetheless, Gold ranks first with a market capitalization of $22.446 trillion and a recent establish of $3,343. Its 30-day pattern presentations average downward movement.

Source: Companies MarketCap

Bitcoin Desires a Predominant Climb to Reach High Situation

Despite the execute better, Nakamoto would require a valuable establish surge to recount the amount 1 billionaire rotten. Per recent standings, Bitcoin must reach $370,000 per token for Nakamoto’s wealth to surpass Elon Musk’s. Musk, CEO of Tesla and SpaceX, at the moment holds an estimated rep price of $404 billion.

Various excessive-rating folk encompass Larry Ellison and Mark Zuckerberg, every price around $274 billion. Data from Nansen confirms Bitcoin reached $120,000 over the weekend, marking a recent all-time excessive. Bloomberg ETF analyst Eric Balchunas projected Nakamoto could reach 2d establish by tiring 2026. This assumes Bitcoin continues to average 50% in annual enhance.

https://x.com/EricBalchunas/establish/1929513206176752029

In another forecast, Markus Thielen of 10x Review estimated a 60% probability of Bitcoin reaching $133,000 by September. Various projections encompass Bitwise CIO Matt Hougan attempting ahead to $200,000 by 2025. Arthur Hayes predicted $250,000 by year-discontinue. Currently, all corporate and custodial holdings combine for around 847,000 BTC. Person holders encompass the Winklevoss twins, Tim Draper, and Michael Saylor.

What is Fuelling Bitcoin Divulge?

Bitcoin is experiencing renewed establish momentum, supported by solid capital inflows into establish Bitcoin ETFs and rising regulatory clarity. The combo of institutional investments and proposed guidelines is contributing to a shift in market dynamics. These dispositions are adding each liquidity and confidence across procuring and selling platforms. As a result, Bitcoin’s establish continues to toughen in the recent cycle.

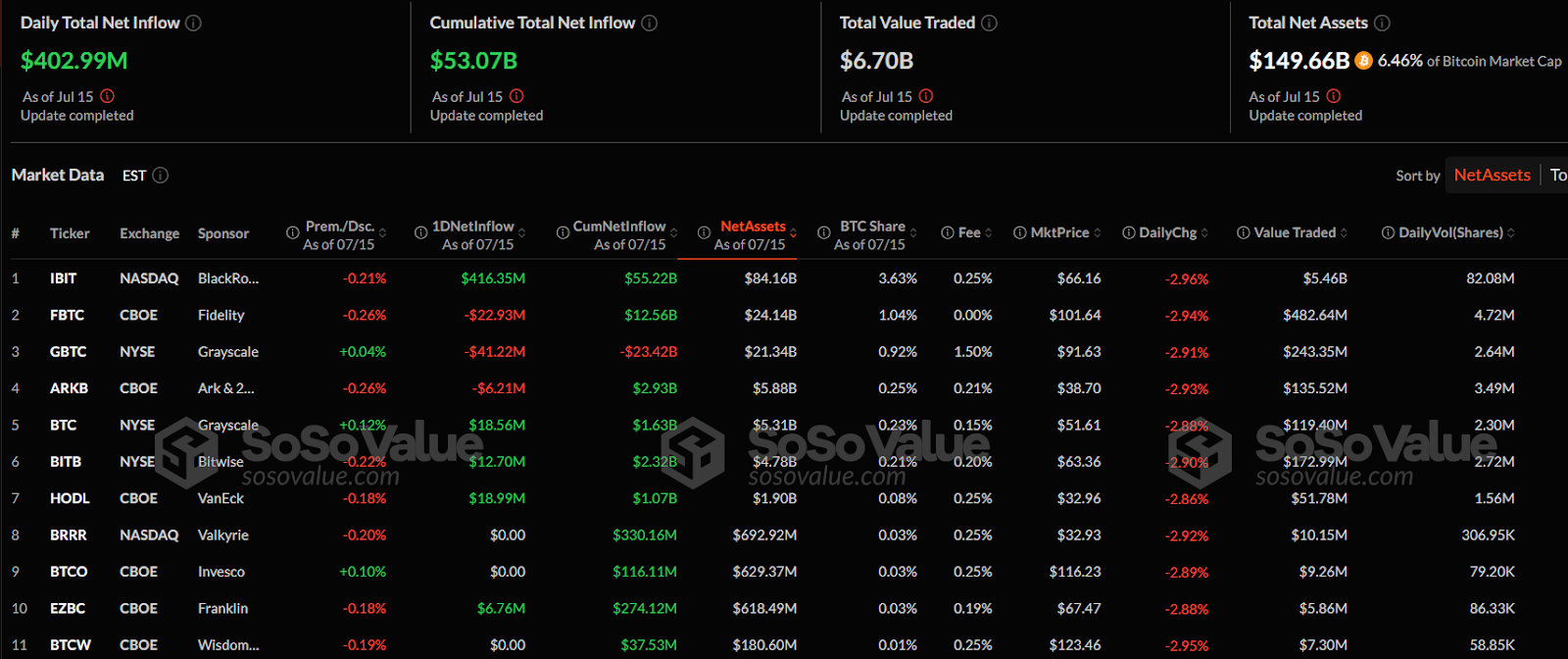

Monitoring the recent ETF performance, on July 15, U.S. establish Bitcoin ETFs registered a day to day rep inflow of $402.ninety 9 million. This marked the seventh straight day of certain inflows, pointing to sustained institutional seek data from of. The total cumulative rep inflow has now reached $Fifty three.07 billion across all ETF issuers. The total establish traded for the day got here in at $6.70 billion, exhibiting increased activity and investor engagement.

Source: SoSoValue (Bitcoin ETFs)

Bitcoin ETFs now preserve $149.66 billion in rep property, which equals 6.46% of Bitcoin’s market capitalization. BlackRock’s IBIT led with $416.35 million in inflows and $84.16 billion in whole property. IBIT also posted the very very most animated volume with $5.46 billion traded across 82 million shares. In the intervening time, some ETFs devour Grayscale’s GBTC and Fidelity’s FBTC recorded outflows of $41.22 million and $22.93 million, respectively.

Fresh dispositions in Washington are also influencing Bitcoin’s upward movement. U.S. lawmakers are reviewing three valuable funds geared in opposition to shaping national crypto policy. These encompass the GENIUS Act, the CLARITY Act, and the Anti-CBDC Surveillance Tell Act. The continuing legislative activity, usually known as “Crypto Week,” is being monitored carefully by market participants. In February 2024, establish ETFs accounted for 75% of Bitcoin inflows over two weeks. That pattern, blended with renewed upright level of curiosity, is utilizing Bitcoin’s persevered momentum and institutional acceptance across markets.