Solana tag not too prolonged ago surged previous the $200 ticket nonetheless has since corrected. It now trades around $185, down over 6% day-on-day. Worthy be pleased Solana-based mostly fully meme money, Solana’s core token also looks to be to be in a brief lived cooldown part.

But is that this correct a healthy dip sooner than a leap? Or are deeper losses brewing? On-chain activity and key technical zones screech a checklist of a substantial make stronger cluster correct beneath, hinting that a reversal is per chance not some distance off.

Original Wallets Are Quiet Showing Up

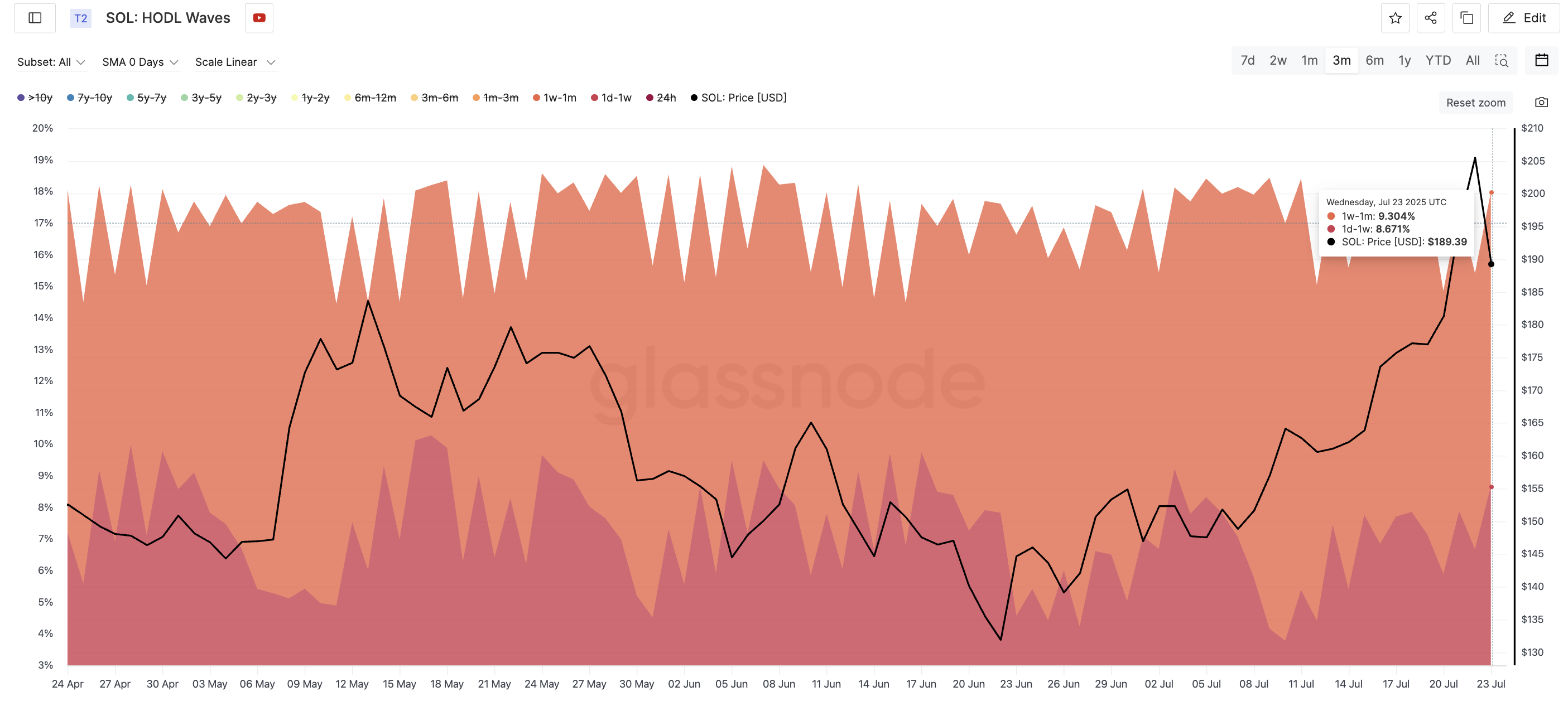

No matter the dip, temporary holders are not bailing; they’re coming into. The 3-month HODL Waves chart shows a spike within the “1 day to 1 week” pockets band, suggesting that new patrons are amassing Solana.

Both key temporary HODL bands non-public elevated all the plot via essentially the latest dip:

- 1-day to 1-week wallets jumped from 6.67% to eight.67%, a 30% develop better

- 1-week to 1-month wallets rose from 8.73% to 9.3%, a pair of 6.5% develop better

For token TA and market updates: Need more token insights be pleased this? Be part of Editor Harsh Notariya’s Day-to-day Crypto E-newsletter here.

This spike is very well-known because of it mirrors a outdated fashion from May perchance simply, when Solana seen a tag dip adopted by an develop better in this identical temporary pockets band. Again then, the dip by hook or by crook reversed. A same rise now hints at rising purchaser conviction, even as tag cools.

In brief, wallets holding Solana for decrease than per week are rising, not exiting. That’s on the total a bullish signal all the plot via corrections.

HODL Waves measure the distribution of cash by age of holding. A rise in younger bands capacity new patrons are coming into the market.

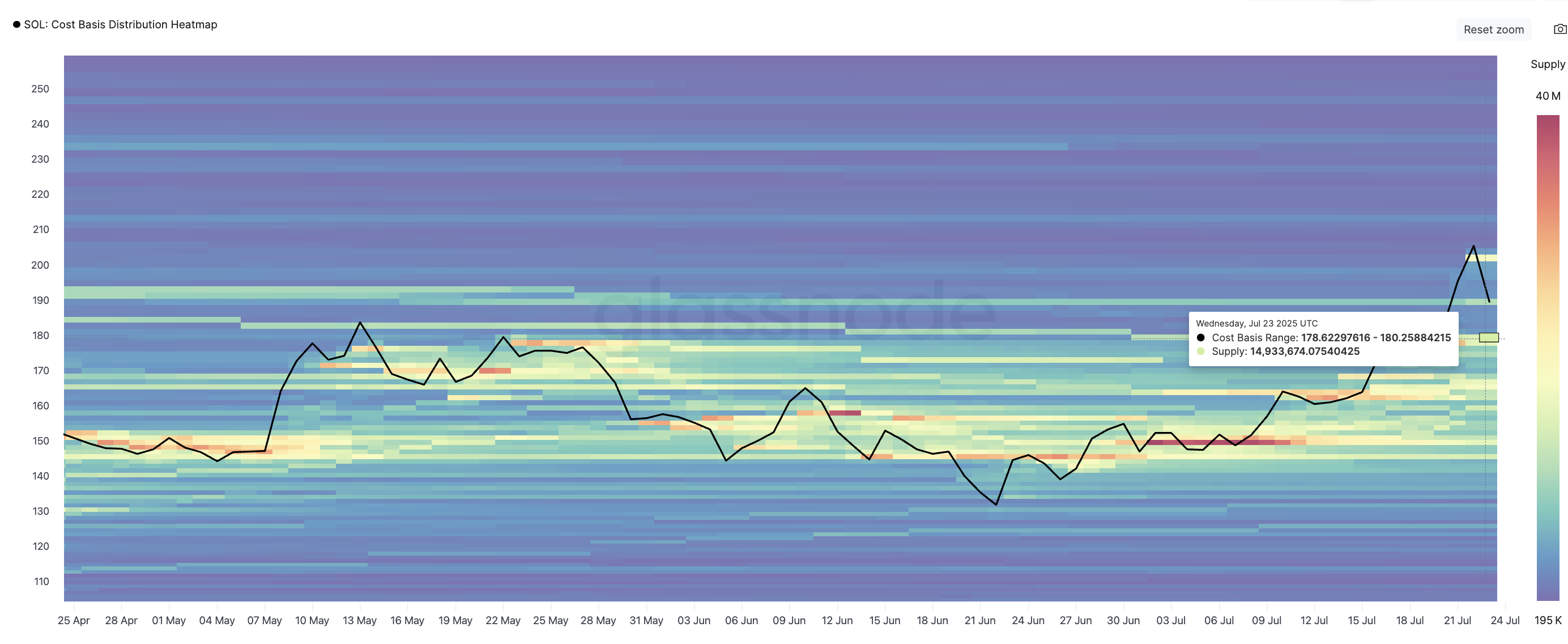

Enhance Cluster: $175 to $180 Zone Remains Intact

The next thing to witness is whether Solana holds its recent make stronger ranges. The Payment Foundation Heatmap shows a dense cluster of pockets accumulation between $175 and $180, undoubtedly one of the vital strongest zones since April. That is where many traders bought in and tend to defend their positions. The total present inner this zone adds up to 38,964,258 SOL.

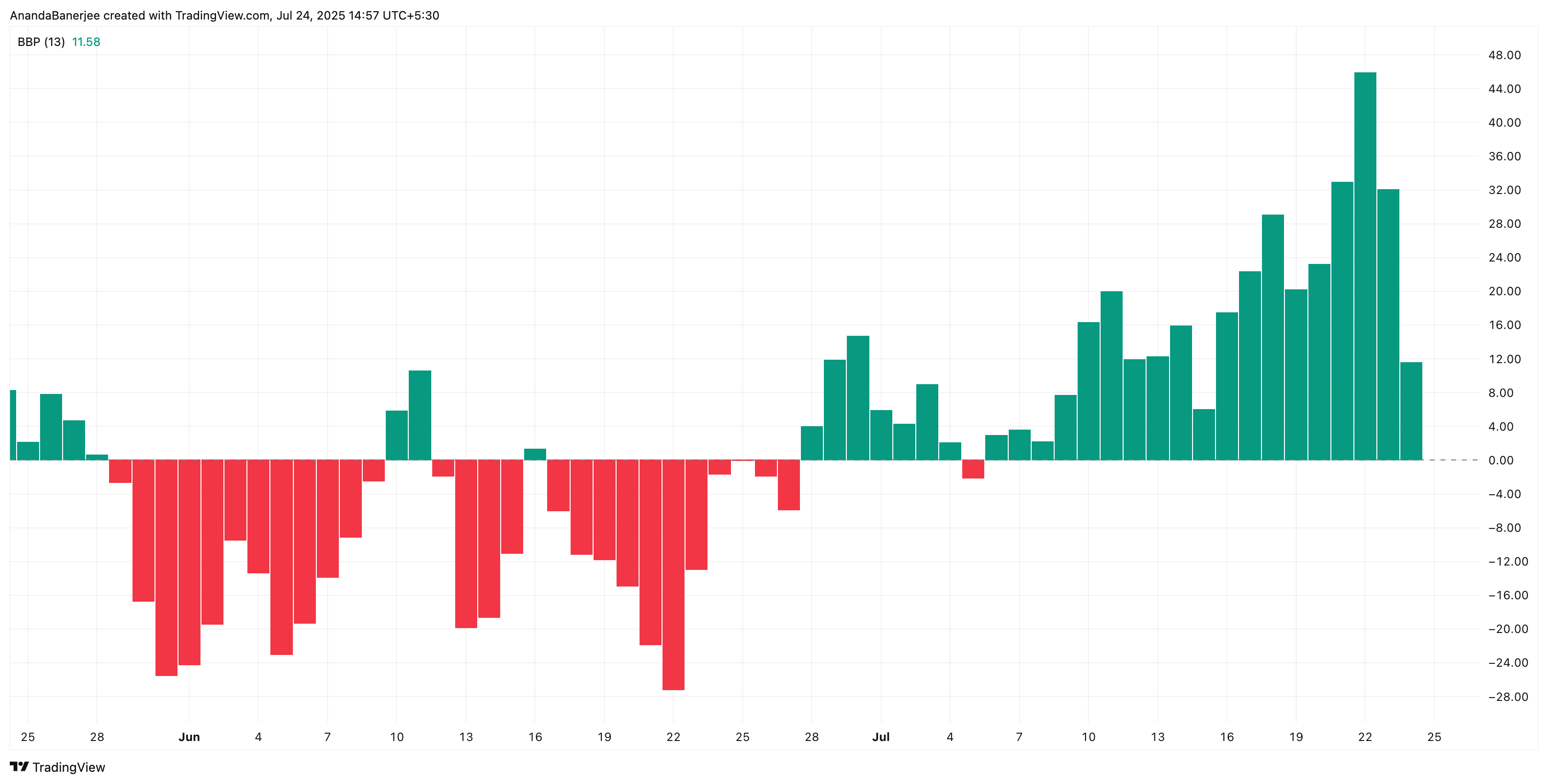

At the an identical time, the Bull Endure Vitality Index unexcited favors the bulls. While the indicator has cooled moderately, patrons are unexcited outpacing sellers. That’s a key clue that the dip hasn’t flipped sentiment but. And that the bulls would possibly perchance correct be ready to make stronger the value differ on the heatmap.

This combination: strong make stronger within the value foundation zone and bulls retaining non-public an eye on, parts to a probably leap around $175, even though the value dips that low. A fall to that level would handiest be a 5.4% ride from recent prices. Unless this differ breaks down laborious, a brief reversal can even very successfully be on the playing cards.

The Payment Foundation Heatmap visualizes where the huge majority of tokens were got. Bull-Endure Vitality gauges who has more non-public an eye on within the recent fashion: patrons or sellers. And the Bull Endure Vitality Index measures the strength difference between patrons (bulls) and sellers (bears) to instruct who’s within the intervening time up to the ticket of tag momentum.

Solana Impress Breaks Enhance But Doesn’t Look Frail, But!

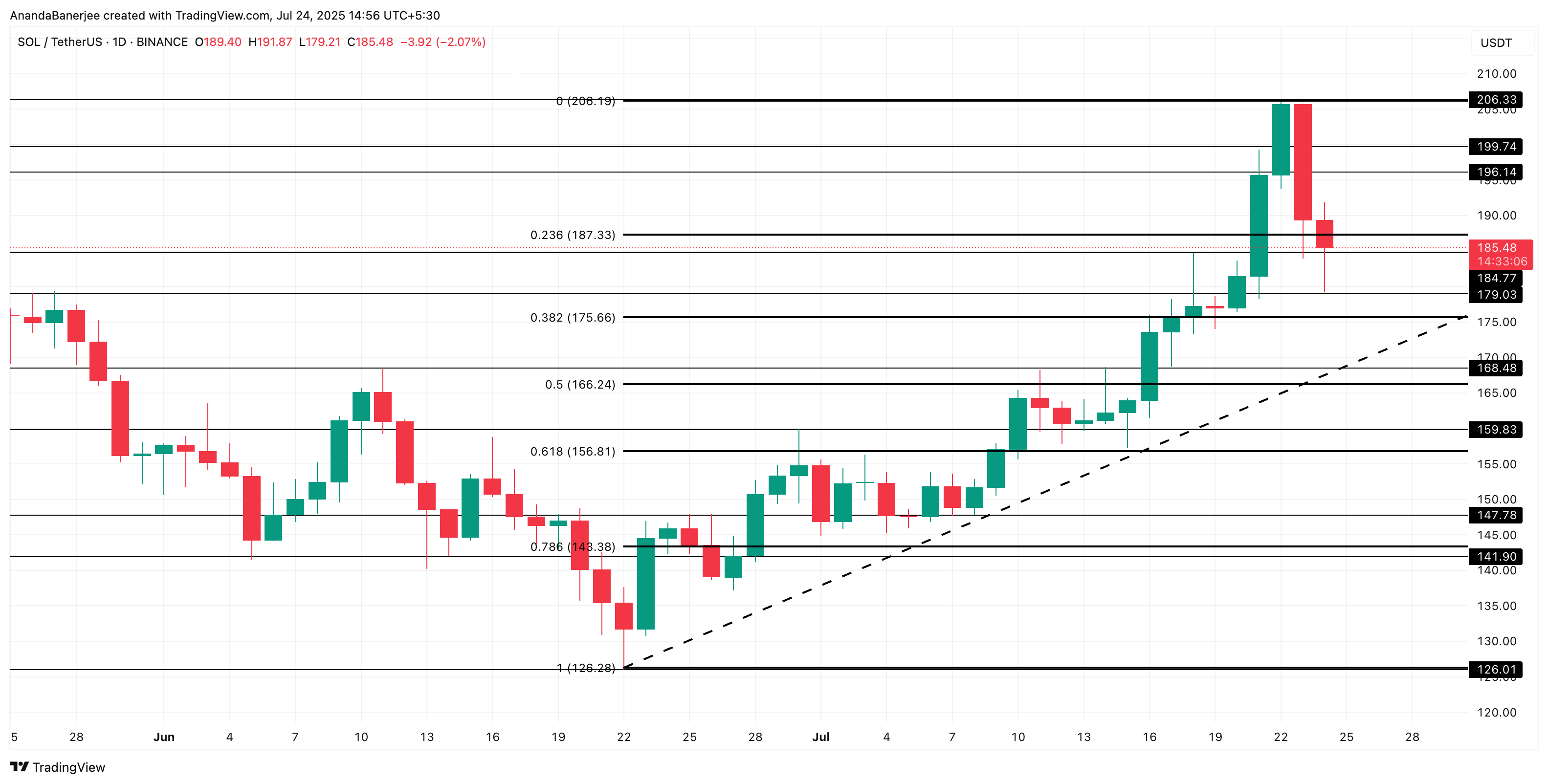

From a technical standpoint, the Solana tag is within the intervening time attempting out the 0.236 Fibonacci retracement level at $187, per its June low of $126 and July high of $206. While the level changed into once breached on the time of writing, the SOL tag looks to be to be attempting laborious to reclaim the an identical.

The next technical make stronger lies at $184. If it fails to non-public here, the subsequent strong make stronger sits at $175, which aligns with the put to originate of the value foundation cluster.

This creates a confluence zone between $175 and $180, making it the major level to witness. A leap here can even non-public the bullish building alive. But a breakdown beneath $175 would possibly perchance house off sharper losses toward $166 and beneath.