Litecoin carried out a historic milestone in January 2025 by processing its 300 millionth transaction. The amount cements its convey as essentially the most-used cryptocurrency for accurate-world payments outside of stablecoins. While Bitcoin maximalists debate store-of-cost narratives and Ethereum developers race scaling solutions, Litecoin quietly constructed one thing assorted: a fee community that if truth be told works.

More than correct a statistic, this milestone shows how the community developed from Bitcoin’s checking out floor into a standalone fee powerhouse. Since launching in 2011, Litecoin has operated without interruption. The yr 2025 introduced plenty of records—from achieving an all-time excessive hashrate of two.7 petahashes per 2d to expanding into main platforms love Telegram Pockets.

What Makes Litecoin Hundreds of from Bitcoin?

Litecoin differs from Bitcoin essentially via sooner transaction speeds, decrease prices, and enhanced accessibility. Charlie Lee, a delicate Google engineer, created Litecoin in October 2011 to address Bitcoin’s barriers. Constructed as a Bitcoin fork, it tackles velocity and accessibility concerns that made Bitcoin less good for day to day exhaust.

Blocks project each and every 2.5 minutes when put next to Bitcoin’s 10-minute intervals. This permits sooner transaction confirmations. The Scrypt hashing algorithm modified into first and fundamental designed to democratize mining. This day, it has developed into a sturdy proof-of-work community secured by specialised hardware. This consensus mechanism connects Litecoin to Bitcoin’s security mannequin while declaring clear traits for assorted exhaust cases.

A mounted offer of 84 million coins—four instances Bitcoin’s 21 million—mirrors the historical relationship between silver and gold. This tokenomics affect creates shortage while allowing increased circulation for day to day transactions. Transaction prices on occasion cost below $0.01. Together, these fundamentals convey Litecoin beautiful powerful as good digital cash in wish to purely a store of cost.

Reliability stands as the community’s finest success. Since 2011, Litecoin has operated continuously without downtime or security breaches. A entire bunch of millions of transactions possess processed while declaring finest uptime. Financial institutions an increasing number of cost this tune document as they be taught about battle-tested blockchain infrastructure for mission-excessive capabilities.

Litecoin’s ecosystem extends beyond total payments. Key ingredients encompass:

- Mining swimming pools that find the community via dispensed hashpower

- Pockets tool that manages non-public keys and transaction signing

- Layer-two solutions love Lightning Community that enable quick micropayments

All these ingredients accumulate a entire monetary infrastructure that reaches a long way beyond easy conception-to-conception transfers.

How Acquire is Litecoin’s Community in 2025?

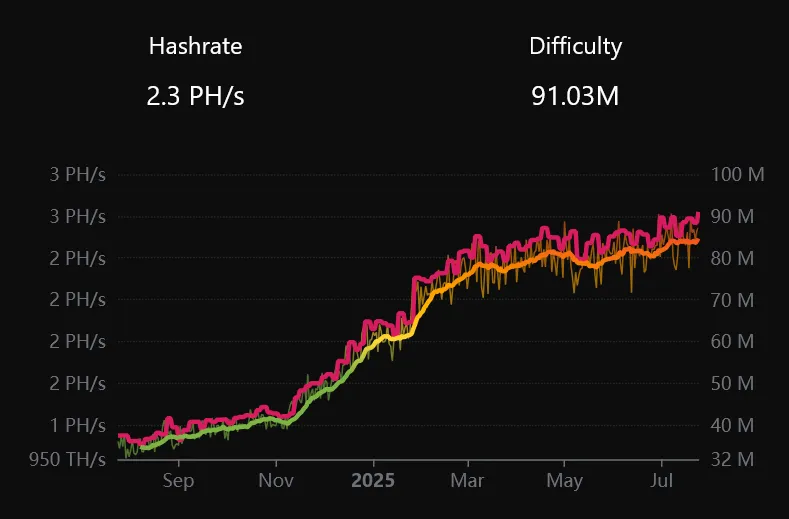

In March 2025, Litecoin’s security metrics hit unheard of levels as the community’s hashrate climbed dramatically exact via the yr. From roughly 1 petahash per 2d first and fundamental of 2025, the hashrate has surged to 2.4 petahashes per 2d as of July 2025, representing a huge amplify in computational vitality conserving the blockchain from attacks. This sustained growth reflects rising miner self belief and demonstrates the community’s evolution into enterprise-grade infrastructure.

The hashrate surge coincided with processing over 15 million transactions in the first quarter on my own. Unlike many proof-of-work networks facing environmental criticism, Litecoin’s Scrypt algorithm enables merge-mining with other cryptocurrencies. This maximizes security effectivity without proportional vitality will enhance.

Security milestones raise significance beyond technical metrics. Regulators evaluating cryptocurrency ETF capabilities prioritize networks with confirmed security and decentralization. Litecoin’s commodity situation from the U.S. Commodity Futures Trading Commission strengthens its institutional adoption potentialities when mixed with this security document.

Mining Economics Increase Remark

Mining economics additionally enhance long-time period community health. The combo of transaction prices and block rewards creates sustainable incentives for miners, while the community’s effectivity when put next to Bitcoin mining makes it pleasing for operators hunting for winning strategies.

Essential Platform Integrations Power Adoption

Litecoin’s enlargement into mainstream platforms accelerated exact via 2025, with integrations eradicating friction boundaries that beforehand tiny cryptocurrency adoption.

Telegram Pockets Integration Expands Worldwide Reach

March 24, 2025, marked a necessary enlargement. Litecoin integrated into Telegram’s inner wallet system. This pass gave millions of users across Asia and Europe seamless accumulate entry to to aquire, sell, and switch LTC in the present day exact via the messaging platform.

The integration tackles a key adoption barrier. It eliminates the need for separate wallet capabilities or complex setup processes. Users can now ship Litecoin as without problems as sharing a message. This opens fresh exhaust cases for micro-transactions and deem about-to-conception payments in regions where Telegram dominates social communication.

Early adoption metrics show veil rising day to day active users leveraging Litecoin for minute-cost transactions, in particular in markets where former banking infrastructure stays tiny. The integration’s success demonstrates how cryptocurrency adoption quickens when friction boundaries recede.

Price Platform Leadership

Litecoin maintains its dominant convey amongst cryptocurrency fee processors with solid efficiency across main platforms:

- Top-ranked cryptocurrency for provider provider payments on BitPay

- Third convey score on CoinGate, surpassing many bigger-market-cap competitors

- Regular growth in transaction volumes on Venmo and PayPal platforms

Dilapidated fintech platforms portray constructing on the bigger than 201,000 transactions processed via one main provider in 2024. This momentum extends into 2025 as users perceive Litecoin’s Layer 1 blockchain advantages for remittances and immoral-border transfers.

The frequent adoption of payments reflects Litecoin’s good advantages over strategies. Faster affirmation instances than Bitcoin, decrease prices than Ethereum, and increased stability than most altcoins accumulate an optimum combination for commerce capabilities.

Does Litecoin Provide Privateness Aspects?

Sure, Litecoin affords privateness ingredients via Mimblewimble Extension Blocks (MWEB), which skilled explosive growth exact via 2025. By July 24, 2025, over 164,000 LTC were locked in MWEB addresses—a fresh document representing roughly $18.5 million in cost at new prices of $113.04—demonstrating document adoption of Litecoin’s non-major privateness ingredients.

MWEB enables confidential transactions that veil amounts and balances while preserving community auditability. Unlike privateness coins that imprecise all transaction recordsdata, MWEB affords opt-in fungibility that maintains compliance with regulatory requirements while providing enhanced monetary privateness.

Growing User Adoption

This privateness layer addresses a foremost limitation of clear blockchains. Dilapidated cryptocurrencies relate all transaction historical past, creating surveillance concerns that limit adoption for reputable exhaust cases. MWEB’s growth indicates an rising question for monetary privateness without compromising the advantages of blockchain transparency.

The feature’s adoption additionally demonstrates Litecoin’s characteristic as a checking out floor for Bitcoin improvements. MWEB’s success could well affect Bitcoin’s future privateness implementations, persevering with Litecoin’s custom of pioneering ingredients later adopted by its predecessor.

Which Companies Are Adding Litecoin to Their Treasury?

The corporate treasury trend represents a necessary shift in how agencies deem about Litecoin’s twin nature as each and every store of cost and fee medium.

Luxxfolio Holdings Pioneers LTC Treasury Intention

In January 2025, Canadian agency Luxxfolio Holdings modified into the first publicly traded firm to adopt Litecoin as a treasury asset. The firm cited Litecoin’s accurate-world utility and decrease volatility when put next to other altcoins as main elements in their resolution.

By July, Luxxfolio expanded their intention, holding 20,084 LTC in treasury as of their July 17 change, valued at roughly $2.27 million at new prices of $113.04 per LTC. This means positions LTC as each and every an inflation hedge and fee enabler, differentiating it from pure store-of-cost suggestions on occasion connected to Bitcoin treasury adoption.

The pass reflects rising institutional recognition of Litecoin’s hybrid traits. Unlike Bitcoin, which serves essentially as digital gold, Litecoin combines store-of-cost properties with good fee efficiency, making it pleasing for corporations requiring each and every treasury management and operational fee capabilities.

MEI Pharma Leads U.S. Market

July introduced a prime milestone when U.S. biopharmaceutical agency MEI Pharma (Nasdaq: MEIP) announced a $100 million non-public placement dedicated to constructing a Litecoin treasury. The deal closed on July 22, 2025, making MEI Pharma the first Nasdaq-listed public firm to adopt this form of technique. The announcement sparked a necessary stock surge and contributed to LTC’s imprint appreciation, with Litecoin trading at $113.04 as of July 24, 2025.

These early company adoptions set up precedent for other corporations pondering cryptocurrency treasury suggestions. Litecoin’s commodity regulatory situation affords clearer compliance pathways than securities-categorized cryptocurrencies, reducing correct uncertainties that quit institutional adoption.

Will Litecoin Gain an ETF in 2025?

Three dedicated Litecoin ETF capabilities stay pending with the Securities and Commerce Commission from Canary Funds, CoinShares US, and Grayscale. The SEC’s July 2025 steering on cryptocurrency ETF regulations equipped clearer framework expectations, potentially smoothing the approval project. Prediction markets love Polymarket now show veil 87-95% odds for approval by December 2025, buoyed by Litecoin’s rising institutional traction and new company treasury adoptions.

Hashdex plans to encompass LTC in their plenty of cryptocurrency ETF alongside LINK and AVAX later in 2025. This basket potential could offer substitute publicity for investors hunting for cryptocurrency diversification beyond Bitcoin and Ethereum.

Litecoin’s regulatory advantages enhance ETF approval potentialities. The Commodity Futures Trading Commission’s commodity classification removes securities law concerns which possess an notice on many other cryptocurrencies. This clear regulatory situation, mixed with its in depth operational historical past, addresses key concerns regulators on occasion develop about cryptocurrency ETF capabilities.

Discussions about a doubtless U.S. strategic cryptocurrency reserve possess included Litecoin alongside Bitcoin, recognizing the historical gold-silver monetary relationship. Such legit recognition could well unencumber institutional capital flows measured in trillions of bucks.

Litecoin Summit 2025 Showcases Group Strength

The fifth annual Litecoin Summit, held Could perchance 29-30 at Harrah’s in Las Vegas, introduced together alternate leaders, developers, and community members for intensive discussions about Litecoin’s future construction.

Key presentations enthusiastic in MWEB adoption growth and upcoming interoperability initiatives love LitVM, a zero-recordsdata omnichain initiative designed to enhance Litecoin’s compatibility with Ethereum and other blockchain ecosystems. These technical developments address criticisms about Litecoin’s innovation slip while declaring its core reliability strategies.

Technical Roadmap Highlights

The summit highlighted Litecoin’s exceptional convey as a checking out floor for Bitcoin improvements. Ancient examples encompass Segregated Gape (SegWit) and Lightning Community compatibility, each and every utilized on Litecoin earlier than Bitcoin adoption. This relationship continues to produce cost for each and every networks while organising Litecoin’s technical contributions to the broader cryptocurrency ecosystem.

Group engagement metrics show veil real growth, with Litecoin’s X following exceeding 1.2 million by July 2025. Developer activity continues to extend, with active GitHub repositories, and fresh wallet implementations adding MWEB enhance, while core protocol improvements defend community effectivity.

Technical Achievements Define 2025 Performance

Beyond headline metrics, Litecoin’s technical efficiency exact via 2025 demonstrates the community’s maturation into enterprise-grade infrastructure.

Transaction Volume Breaks Files

The fundamental ten weeks of 2025 saw Litecoin project 14 million transactions, organising a slip that could well fracture outdated annual records. This volume reflects right utility in wish to speculative trading, as transaction patterns show veil customary exhaust for payments, remittances, and commerce capabilities. Amid July’s company treasury bulletins, LTC skilled necessary imprint appreciation, reaching $113.04 on July 24, 2025.

Day-to-day transaction counts continuously reach hundreds, while 24-hour trading volumes steadily exceed billions in cost. These metrics verbalize sustained community activity that helps long-time period cost propositions beyond speculative imprint actions.

Zero Downtime Narrative Continues

Litecoin’s flawless operational document has been maintained exact via 2025, making certain continuous provider exact via its entire existence. This reliability becomes an increasing number of precious as monetary institutions overview blockchain infrastructure for excessive capabilities.

The success becomes extra impressive pondering the complex technical challenges blockchain networks face. Protocol upgrades, mining pool changes, and external attacks possess disrupted many competitors, while Litecoin’s conservative construction potential has preserved operational continuity.

Can Litecoin Compete with More moderen Cryptocurrencies?

Sure, Litecoin can compete effectively with more moderen blockchain platforms, despite the indisputable reality that it faces ongoing criticism about innovation slip and competition from initiatives providing sooner transaction speeds or extra advanced ingredients. Solana, Polygon, and other networks market superior technical specifications, questioning Litecoin’s relevance in a mercurial evolving panorama.

However, Litecoin’s defenders emphasize organic growth over mission capital-driven construction. The absence of token dumping by early investors and paid promotional campaigns creates extra sustainable adoption patterns. Charlie Lee’s 2017 resolution to sell his deepest holdings, on occasion mischaracterized as abandonment, modified into explicitly designed to defend a long way off from conflicts of interest while he persisted promoting the project.

The community’s proof-of-work consensus mechanism, while vitality-intensive, affords security guarantees that more moderen consensus mechanisms possess yet to sign over extended classes. For institutions prioritizing battle-tested infrastructure over reducing-edge ingredients, Litecoin’s conservative potential affords advantages.

Market positioning additionally advantages from realistic expectations. Unlike initiatives promising modern changes or limitless scalability, Litecoin specializes in incremental improvements to established efficiency. This means could well appear less thrilling but creates extra predictable construction outcomes.

Having a gaze Ahead: Second Half of 2025 Possibilities

The remainder of 2025 holds necessary doubtless for Litecoin across plenty of construction areas.

Key Construction Areas

Lots of main initiatives could well reshape Litecoin’s panorama:

- Pending ETF approvals that could well dramatically extend institutional accessibility

- Persisted MWEB adoption acceleration as users perceive privateness advantages

- Technical developments love LitVM expanding its utility into decentralized finance capabilities

Dilapidated investors for the time being face necessary boundaries accessing cryptocurrency markets, and regulated investment merchandise could well unencumber huge capital flows. The non-major nature of privateness ingredients enables compliance with varying global regulations while providing enhanced fungibility for users who require it.

Company treasury adoption stays in its early stages, with additional corporations at possibility of deem Litecoin’s possibility-return profile. The combo of store-of-cost properties and fee efficiency affords exceptional advantages for agencies requiring each and every treasury management and operational fee solutions.

Progressively Asked Questions

What makes Litecoin assorted from other cryptocurrencies in 2025? Litecoin combines flawless operational historical past with good ingredients love 2.5-minute block instances and sub-penny transaction prices. Its non-major privateness via MWEB and regulatory clarity as a commodity accumulate exceptional advantages for each and every particular person users and institutions.

How necessary is Litecoin reaching 300 million transactions? This milestone demonstrates right utility beyond speculative trading. The volume represents accurate-world utilization for payments, remittances, and commerce, organising Litecoin as essentially the most-used cryptocurrency for good capabilities outside of stablecoins.

What are Litecoin’s potentialities for ETF approval in 2025? Three dedicated Litecoin ETFs expect SEC approval with solid market self belief for approval by December. The community’s commodity situation and operational tune document address key regulatory concerns that on occasion complicate cryptocurrency ETF capabilities.

Conclusion

Litecoin’s 2025 efficiency demonstrates that utility and reliability stay precious in a market on occasion dominated by hypothesis and hype. The community’s 300 million transaction milestone, document hashrate achievements, and expanding institutional adoption think organic growth constructed on confirmed infrastructure in wish to promotional campaigns.

As digital silver to Bitcoin’s digital gold, Litecoin has found its area of interest serving good fee needs while declaring store-of-cost traits. The community’s conservative construction potential delivers predictable improvements to established efficiency in wish to modern promises.

For a cryptocurrency that has survived plenty of undergo markets, regulatory uncertainty, and technological competition, 2025 represents validation of a clear potential to blockchain construction—one which prioritizes utility over hypothesis and reliability over innovation theater.

Consult with the legit Litecoin internet region for additional recordsdata and follow @litecoin on X to discontinuance updated on essentially the latest developments.

Sources:

- Litecoin Official Bulletins and Month-to-month Updates (2025)

- Reuters US SEC’s steering is first step toward principles governing crypto ETFs

- U.S. Commodity Futures Trading Commission Regulatory Classifications and Updates

- Luxxfolio Data – Litecoin holdings