- Bitcoin ticket edges lower on Wednesday after trying out the upper band of a consolidation vary advance $120,000.

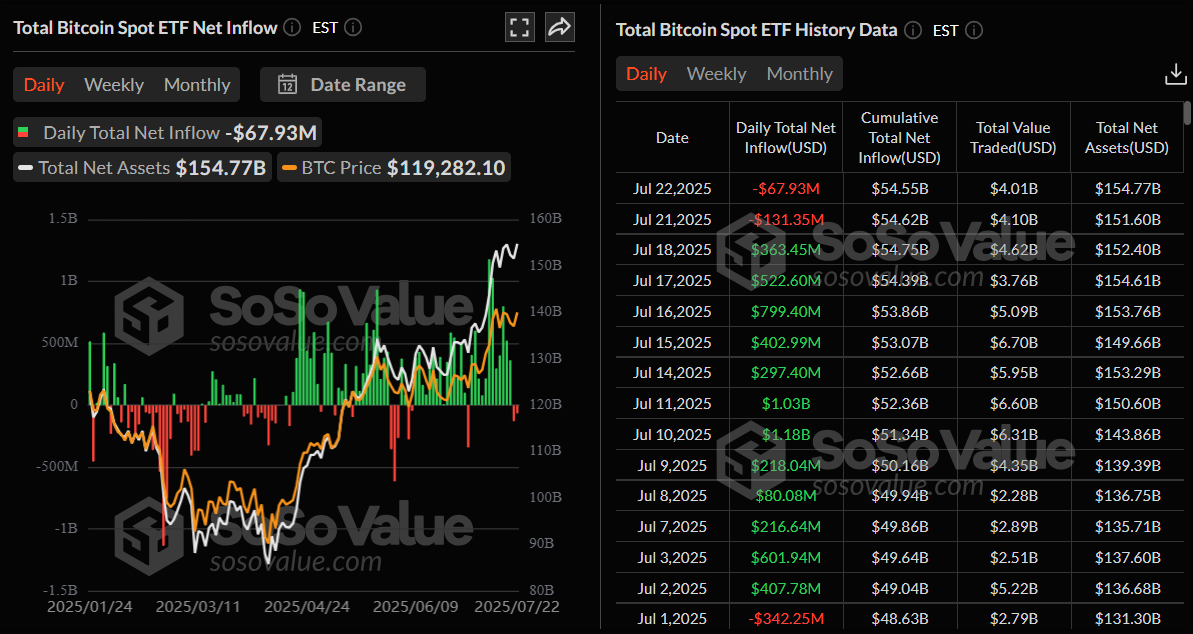

- US-listed put Bitcoin ETFs file a 2d straight day of outflows, with $67.93 million exiting on Tuesday.

- Technical indicators signal a weakening of bullish momentum, suggesting a seemingly momentary correction ahead.

Bitcoin (BTC) trades a runt the total contrivance down to advance $118,000 when writing on Wednesday after trying out the upper boundary of a consolidation vary advance $120,000 earlier in the day. The decline comes amid a 2d consecutive day of outflows this week from US-listed put Bitcoin Change Traded Funds (ETFs), signaling cautious sentiment amongst institutional investors. The technical outlook moreover suggests a momentary correction, as momentum indicators display cover indicators of exhaustion.

Bitcoin put ETFs display cover early indicators of weak spot

SoSoValue data exhibits that US put Bitcoin ETFs recorded a 2d consecutive day of outflows this week, with $67.93 million exiting on Tuesday. If this building continues and intensifies, Bitcoin ticket might perchance well well face a correction.

Total Bitcoin Feature ETFs daily chart. Supply: SoSoValue

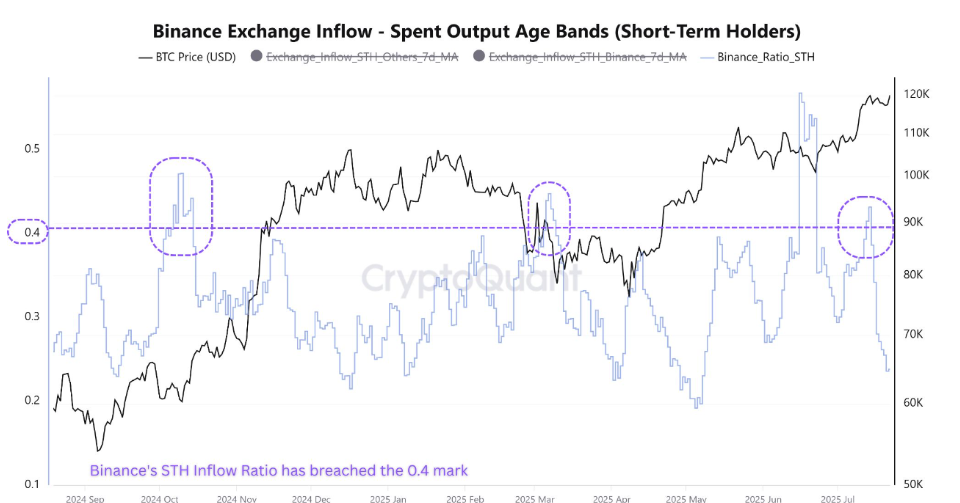

CryptoQuant data moreover confirmed a surge in Brief-Interval of time Holder (STH) process on Binance, signaling capacity revenue-taking by retail investors.

The graph below exhibits that the metric had no longer too lengthy in the past crossed the 0.4 threshold this week. This stage, previously linked with retail-pushed sale process, in general coincides with local bottoms after a large surge in BTC, which can perhaps well well reason a momentary correction in BTC ticket.

BTC STH process chart. Supply: CryptoQuant

Some indicators of optimism

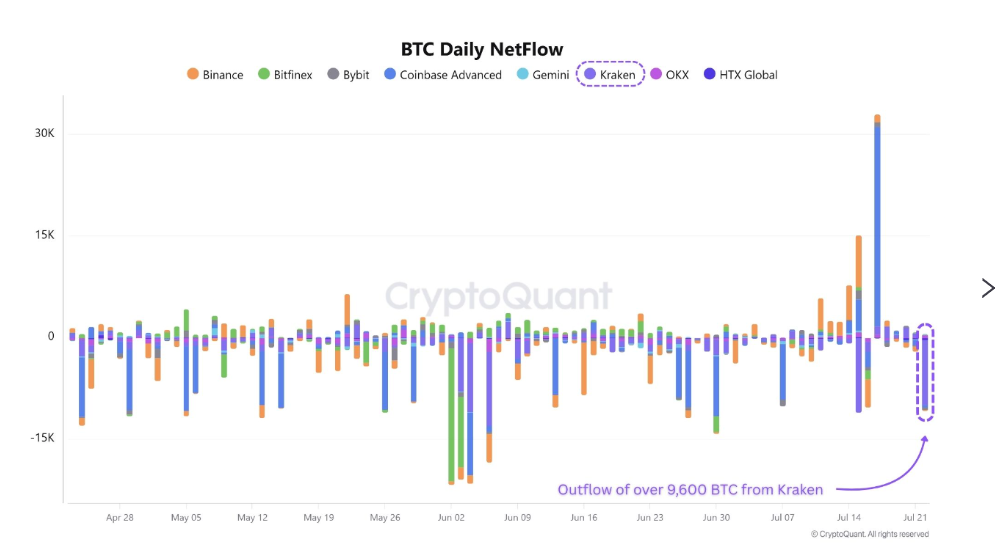

Despite light outflow in institutional ask and selling process from retail investors, some whales are unruffled collecting BTC.

CryptoQuant data below exhibits that over 9,600 BTC have been withdrawn from the Kraken alternate on Tuesday, marking one of the necessary valuable single day withdrawals from the alternate in most novel months. Such building minimize instant sell-side liquidity, which can perhaps well well soak up the selling stress from the retail side.

BTC daily netflow Kraken alternate chart. Supply: CryptoQuant

Historically, retail investors have in general exited their positions upfront all the contrivance by contrivance of bull markets, while desirable investors — often usually known as desirable money — have a tendency to capitalize on these moments by collecting and keeping by contrivance of volatility for increased features.

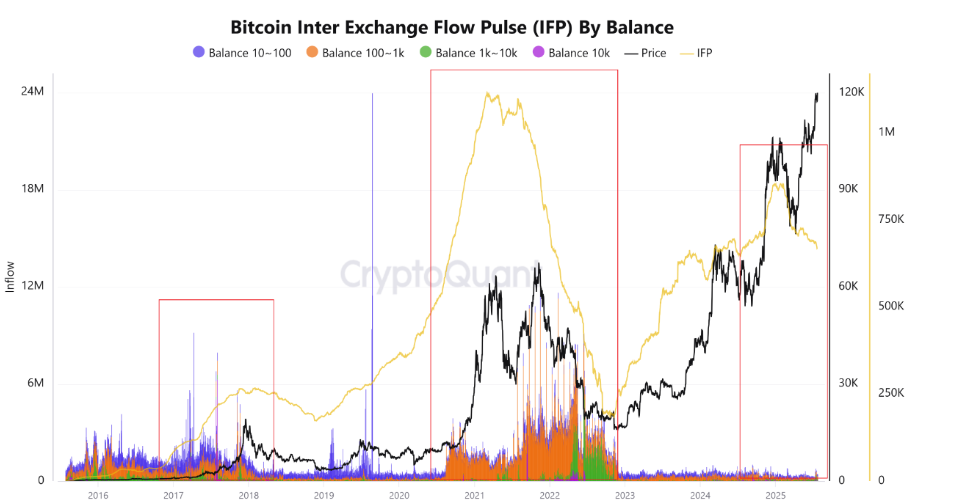

The Bitcoin Inter Change Waft Pulse (IFP) by balance indicator exhibits a protracted and clearer image. Despite Bitcoin’s reaching its file high of $123,218 remaining week, the IFP exhibits a decline in Bitcoin flows to exchanges. This habits suggests that investors, in particular desirable ones, are no longer intending to sell at this stage.

When inspecting 2017 and 2021 bull runs, the metric confirmed a spike indicating selling process from desirable wallets, which resulted in a smash in the BTC ticket. On the other hand, as of now, the metric is consolidating, suggesting that desirable investors are keeping onto the market and that flows to exchanges are restricted.

Bitcoin Inter Change Waft Pulse (IFP) by balance chart. Supply: CryptoQuant

Bitcoin Stamp Forecast: BTC consolidates between $116,000 and $120,000

Bitcoin ticket has been buying and selling broadly sideways between $116,000 and $120,000 after reaching a brand new all-time high of $123,218 on July 14. At the time of writing on Wednesday, it faces rejection from its upper consolidation band at $120,000.

If BTC falls below the lower consolidation boundary at $116,000 on a daily foundation, it will most likely perhaps well well prolong the decline to retest the 50-day Exponential Shifting Realistic (EMA) at $110,948.

The Relative Energy Index (RSI) on the daily chart reads 62, after rejecting its overbought stipulations on Tuesday, indicating fading bullish momentum. The Shifting Realistic Convergence Divergence (MACD) traces coil against every other, indicating indecisiveness amongst traders.

BTC/USDT daily chart

On the different, if BTC closes above the upper boundary of the consolidation vary at $120,000 on a daily foundation, it will most likely perhaps well well prolong the restoration against the unique all-time high at $123,218.