Worldcoin (WLD) tag is exhibiting signs of a stable technical recovery after weeks of bearish stress. With the day-to-day chart flashing a bullish setup and RSI momentum building gradually, merchants are now eyeing larger resistance zones — particularly the $1.50 designate. But can WLD tag wreck previous the present resistance and rally in the short time length? Let’s dive into the records and gape what the chart says.

WLD Designate Prediction: Is Worldcoin Building Up for a Bigger Breakout?

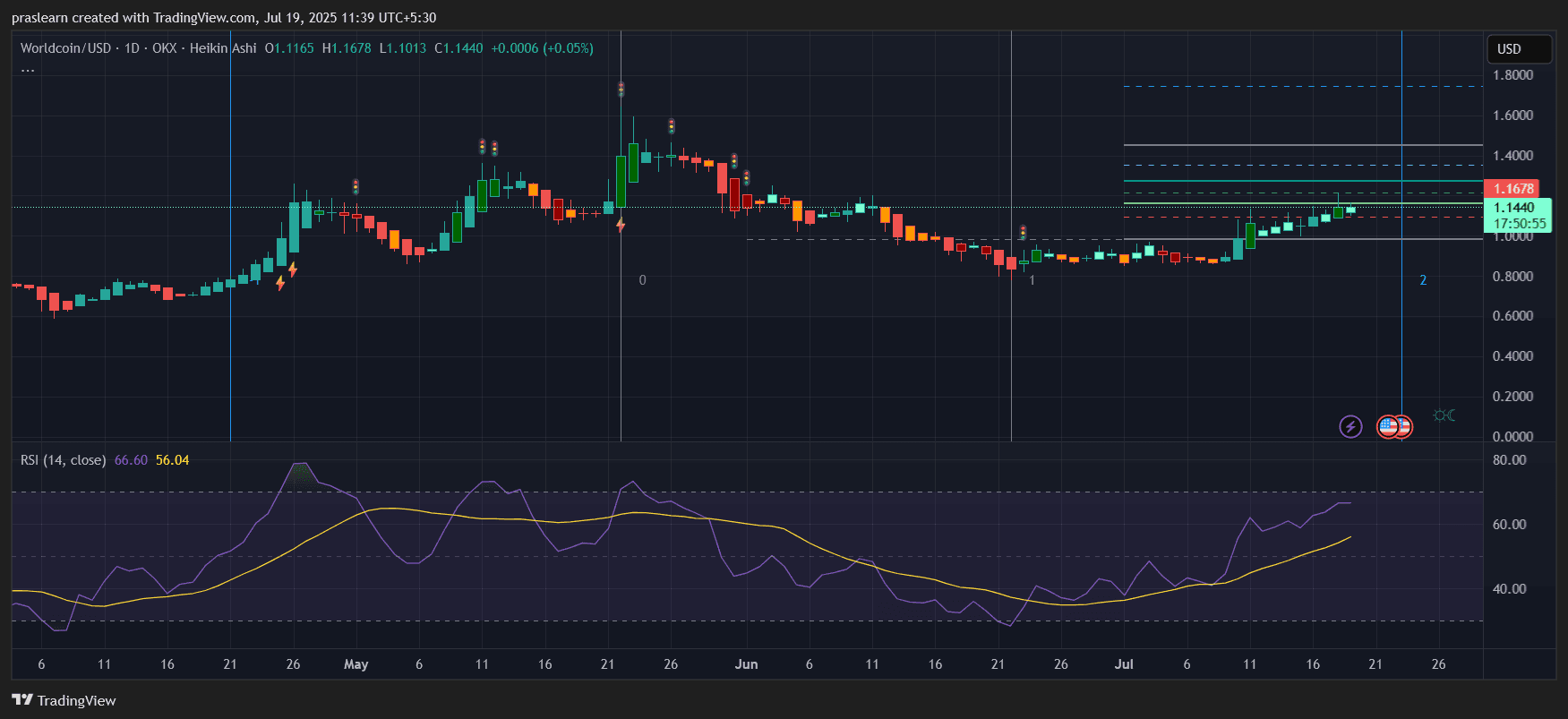

WLD tag is currently shopping and selling at $1.1440, with a recent intraday high of $1.1678. The chart exhibits a assortment of stable Heikin Ashi inexperienced candles with nearly no decrease wicks — a classic signal of pattern energy and bullish momentum. This uptrend began in early July, bouncing from around $0.90, surroundings up a swing manufacture of practically 27.11% in precisely two weeks.

Calculation:

Share Fetch=(1.144−0.90/0.90)×100≈27.11%

This momentum aligns with a rising RSI tag of 66.60, imminent the overbought zone (above 70), but no longer rather there but — indicating there is soundless room for upward motion.

Key Resistance Stages to Survey

The chart has Fibonacci retracement-vogue resistance stages drawn, suggesting targets at:

- $1.20 (minor psychological barrier)

- $1.33 – $1.38 (prior resistance cluster)

- $1.50 – $1.60 (critical fib confluence and previous swing high)

The present bullish building means that if Worldcoin tag closes above $1.17 decisively with volume affirmation, it’s going to also place of residing off a breakout rally toward $1.33 – $1.38. After that, $1.50 becomes a viable target.

Can RSI Push Bigger or Signal Reversal?

RSI (Relative Energy Index) is currently 66.60, rising gradually alongside the tag. This means momentum is supporting the uptrend, but merchants can even fair soundless withhold an gape on any RSI divergence or unexpected reversals stop to 70–75 zones.

Importantly, the RSI broke above its dynamic resistance trendline (visible from early June), extra validating the shift from bearish to bullish sentiment.

Quantity and Pattern Construction: Are Bulls in Defend watch over?

Quantity is step by step rising (although no longer visible on this chart), and the enchancment of the candles displays stable shopping stress. Notably, this rally differs from the April and Also can rallies the place prices spiked after which dumped swiftly — this present pattern is extra measured and consistent.

This signifies conceivable institutional accumulation or affected person shopping, especially as Worldcoin fundamentals (appreciate rising biometric identity integrations) continue to fabricate global attention.

WLD Designate Prediction: Will $1.50 Defend or Break?

If bullish momentum sustains and no critical rejection occurs at $1.20 or $1.33, then Worldcoin tag can even reach $1.50–$1.60 within the next 10–14 days.

Here’s a projection route per Fibonacci extension and historical behavior:

- Non everlasting target (next 3–5 days): $1.20

- Mid-time length target (next 7–10 days): $1.33 – $1.38

- Aggressive breakout target (next 2 weeks): $1.50 – $1.60

Alternatively, if bulls fail to withhold the day-to-day stop above $1.17, and RSI rolls over, then WLD tag can even fair revisit give a take to at $1.00 and even $0.95 earlier than attempting all once more.

Is It Time to Aquire WLD?

Worldcoin tag is exhibiting a technically dapper bullish setup after weeks of consolidation and decline. The ongoing pattern is backed by a rising RSI, Heikin Ashi energy, and breakout building. While possibility soundless exists stop to key resistance zones, the upside capability toward $1.50 looks to be stable if momentum sustains.

Merchants can even fair take into yarn entries on pullbacks to $1.10 – $1.12 with discontinue-loss below $1.00 and targets around $1.33 – $1.50. This rally would perhaps be Worldcoin tag comeback second — if it clears $1.33, we would possibly presumably well be watching a complete recent portion of upside.