The crypto market cap has recorded a keen uptick this day led by spacious-cap altcoins corresponding to Ethereum (ETH) and Ripple Labs-backed XRP, thus reaching a brand fresh all-time excessive of about $4.03 trillion. In step with market details from Coingecko, Ether observe has surged over 8% within the closing 24 hours to substitute above $3,640 for the most main time for the reason that main week of January, this year.

XRP has obtained over 16% within the previous 24 hours to substitute at about $3.60, above its prior all-time excessive of about $3.4 space in January 2018. In step with market details from Binance-backed CoinMarketCap, XRP recorded a 122% surge in its day-to-day common traded volume to about $22.4 billion.

Connected: XRP Breakout: Label Rally to $4.35 Begins

Ethereum’s day-to-day common traded volume soared by 12% to about $54 billion on the time of this writing. Due to this, the combined ETH and XRP day-to-day common traded volume surpassed that of Bitcoin (BTC), thus signaling the onset of the much-awaited 2025 altseason.

Factors Showing Altseason 2025 Has Begun

The cryptocurrency market has recorded a gigantic spike in cash influx from retail and institutional investors within the fresh previous. In step with market details analysis from Coinglass, the salvage crypto Open Hobby (OI) has surged exponentially to a brand fresh all-time excessive of about $200 billion.

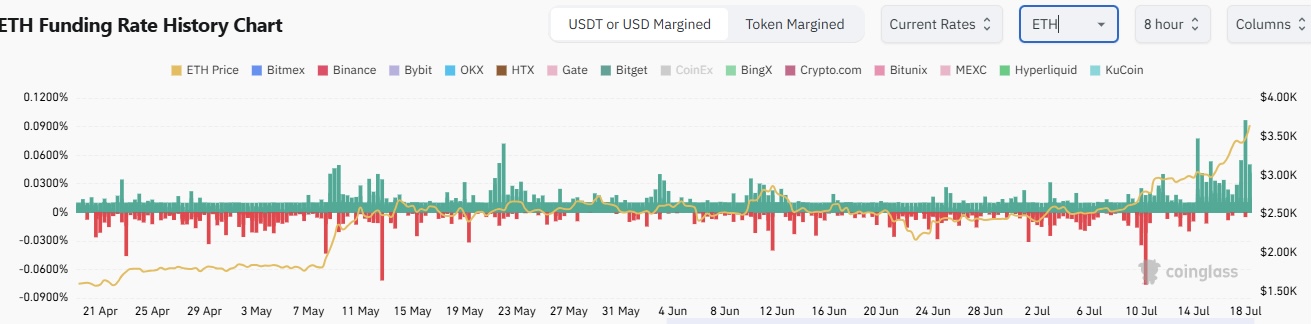

As a outcomes of the heightened crypto speculation, the ETH OI-weighted funding rate has surged to 0.0129%, signaling bullish sentiment. Traditionally, a sustained recede funding rate is an illustration of bullish sentiment and vice versa.

The assign a matter to of for altcoins by institutional investors used to be evident on Thursday after the U.S. dwelling Ether ETFs surpassed Bitcoin’s counterpart in salvage cash inflows. In step with market details from Sosovalue, the U.S. dwelling Ether ETFs recorded a salvage cash influx of $602 million while Bitcoin’s reported about $522 million.

Connected: The “Genius Act” Is on a Snappily Song, and Tether Is in Its Crosshairs

Due to this, the BTC dominance has dropped over 5% for the reason that initiating of this week to fly spherical 61%. Traditionally, a sustained tumble in BTC dominance has resulted in main altcoin summers, as recorded in 2021 and 2017.

#Bitcoin Dominance [2W] is breaking down from a 3-year Rising Wedge — a chief structural shift.

Very a comparable to the 2020–2021 Altseason playbook:

🔵 Initial wedge breakdown

✅ Exact top confirmed with bearish divergence

🚀 Altseason ignition pic.twitter.com/qiX2FTtJaY— Gert van Lagen (@GertvanLagen) July 17, 2025

The altcoin summer has been kicked off by the passage of the three crypto funds, the GENIUS Act, the Clarity Act, and the Anti-CBDC Act, within the US. Furthermore, definite crypto laws will birth floodgates of institutional capital to the broader cryptocurrency market within the reach future.

Disclaimer: The guidelines presented listed right here is for informational and tutorial choices greatest. The article doesn’t explain monetary recommendation or recommendation of any kind. Coin Version is now to no longer blame for any losses incurred as a outcomes of the utilization of assert material, products, or companies talked about. Readers are informed to converse warning sooner than taking any action linked to the firm.