Flare Community quietly turned three on July 14, 2025, exactly three years after its mainnet went are living support on July 14, 2022. What began as a brave experiment to layer trim contracts and exact‑time records feeds onto blockchains take care of XRP has since blossomed into a filled with life, mercurial‑evolving ecosystem. It’s now bustling with applications, protocols, and a passionate crew.

In these three years, Flare has handled over 240 million transactions across bigger than 40 million blocks. On the present time, nearly about four million uncommon wallets call the network home, and on a median day, the network processes about 445,000 transactions at a brisk 1.8‑2d block time. Far more putting: nearly about three‑quarters of all FLR tokens are staked or delegated, underscoring the faith—and the skin within the sport—that holders private in Flare’s promise.

That scuttle hasn’t been with out its stepping stones. Assist in September 2021, long ahead of the mainnet start, Flare launched Songbird, its “canary” network—a sandbox for making an strive out original aspects in are living instances. When the mainnet at final arrived in July 2022, it opened in “commentary mode,” giving builders and customers time to shake out any kinks ahead of the elephantine rollout. Then, in January 2023, FLR tokens found their system into millions of pockets through an airdrop to XRP holders—a snapshot taken support in December 2020.

Underpinning all of this are Flare’s oracles: the Flare Time Series Oracle (FTSO) for high‑frequency imprint records and the Flare Recordsdata Connector (FDC) for every thing else. Earlier this year, FTSO v2 launched, bringing in actuality decentralized imprint feeds straight on‑chain. Meanwhile, FDC has recruited 86 records suppliers overlaying 18 clear records forms—from Bitcoin to DOGE to XRPL—and has already answered over 234,000 on‑chain queries.

Turning into a DeFi Powerhouse

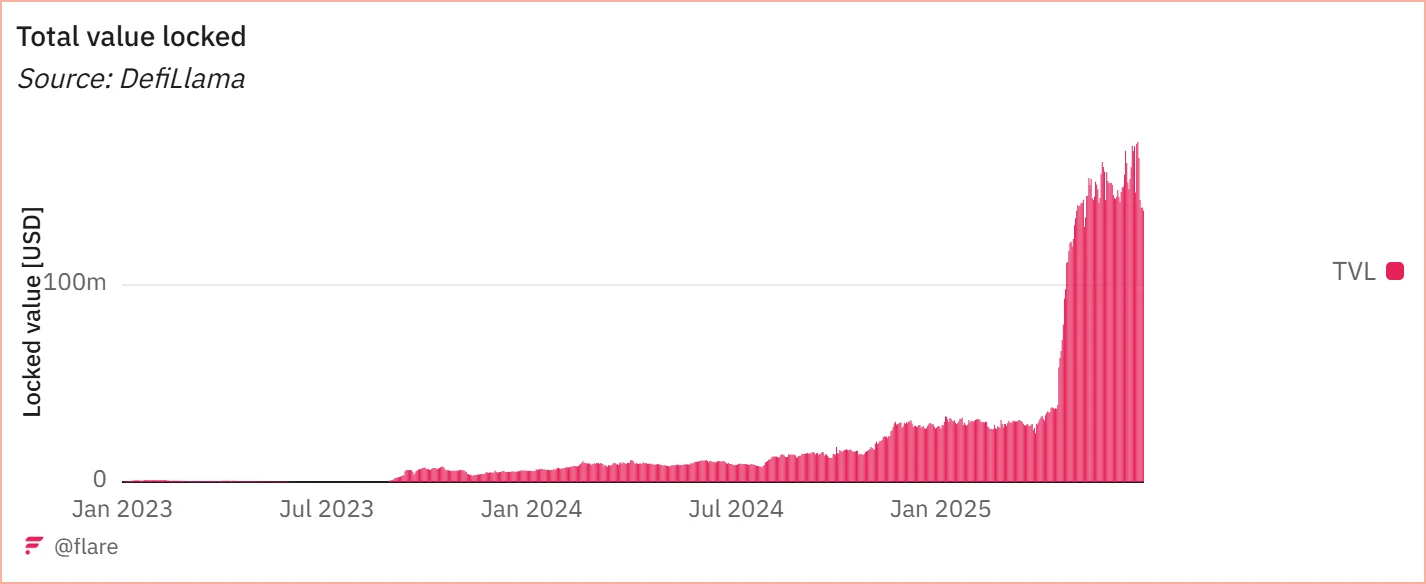

DeFi exercise on the Flare Community has exploded. Total Designate Locked sits around $170 million, with stablecoins accounting for roughly $150 million of that. And the network’s April 2025 integration of USD₮0 became a sport‑changer: TVL leapt from about $37 million to over $120 million in correct below two weeks, fueled by rFLR rewards and a $2.2 billion FAssets Incentive Program launched July 1.

Huge names private joined the event, too. Google Cloud signed on as both a validator and an information provider in January 2024. Kraken started checklist USDT0 in April 2025. And in June, BitGo rolled out regulated custody companies for FLR and SGB. Partnerships with VivoPower, EasyA, TrustSwap, and Crew Finance private moreover opened doorways for institutions and builders alike.

However what the truth is models Flare apart is its other folks. Early this year, the network launched a stammer bounty program and a gamified “Flare Beautiful” on Songbird, plus a $100,000 Community Yelp Grant. These initiatives private sparked original on‑chain exercise and drawn in contributors from all corners of the globe.

Taking a stare forward, Flare’s roadmap is packed. Subsequent up is stXRP staking through Firelight, letting XRP holders stake FXRP with out sacrificing liquidity, and more FAssets releases are correct around the nook. Experts imagine that Flare is aloof at the starting line of what’s that that probabilities are you’ll imagine whereas you fuse decentralized records with programmable blockchain good judgment. If the first three years are any indication, the next chapter guarantees to be scheme more intriguing.