Amid persevered discussions around the utility XRP boasts in payments, what could its tag develop to if each most important financial institution makes utilize of it globally for injurious-border payments?

XRP’s Charm in Global Payments

Namely, they present its rising role in world payments, especially via Ripple’s On-Ask Liquidity (ODL) platform, now rebranded into Ripple Payments.

For context, ODL permits banks to utilize XRP as a bridge forex. It permits them to settle injurious-border payments with out pre-funding accounts in destination currencies. This setup lowers transaction costs, speeds up settlements, and improves transparency.

On the opposite hand, it remains unclear how this could affect the XRP tag. This skill that, based on the rising curiosity, we asked OpenAI’s ChatGPT to highlight what XRP’s tag could peruse adore in essentially the most optimistic subject, translating to paunchy adoption by most important banks worldwide.

Designate of 1 XRP if Every Financial institution Adopts It for Pass-Border Payments

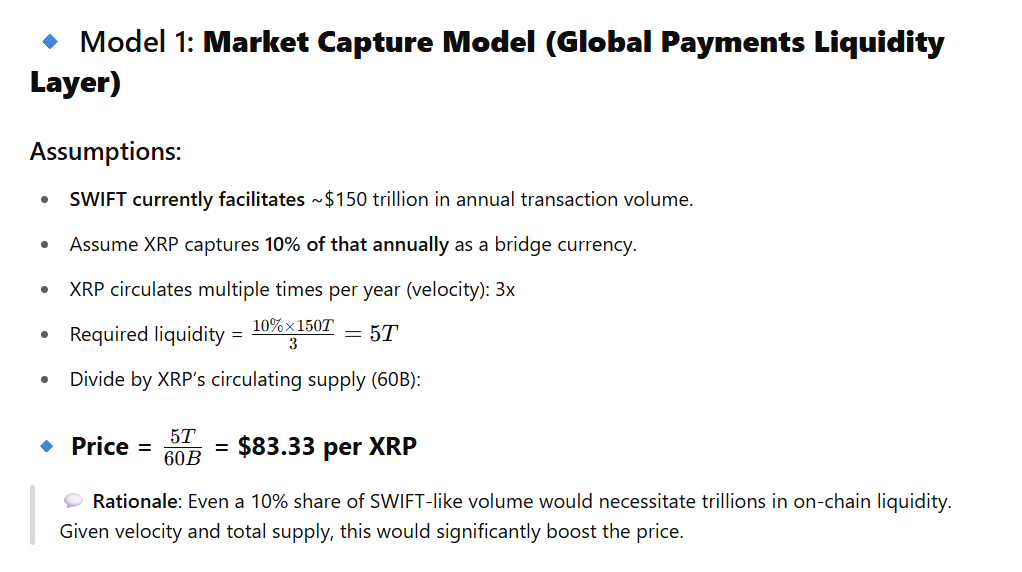

ChatGPT discussed several very bullish models, each based on a particular manner to fee. In a single of essentially the most aggressive estimates, it imagined XRP capturing 10% of the $150 trillion that SWIFT processes each year.

Utilizing a bustle of three, meaning each XRP will get historic thrice yearly, it calculated that the plan would want $5 trillion fee of XRP to operate. Now, with a circulating provide of 60 billion tokens, that will push XRP’s tag to roughly $83.33.

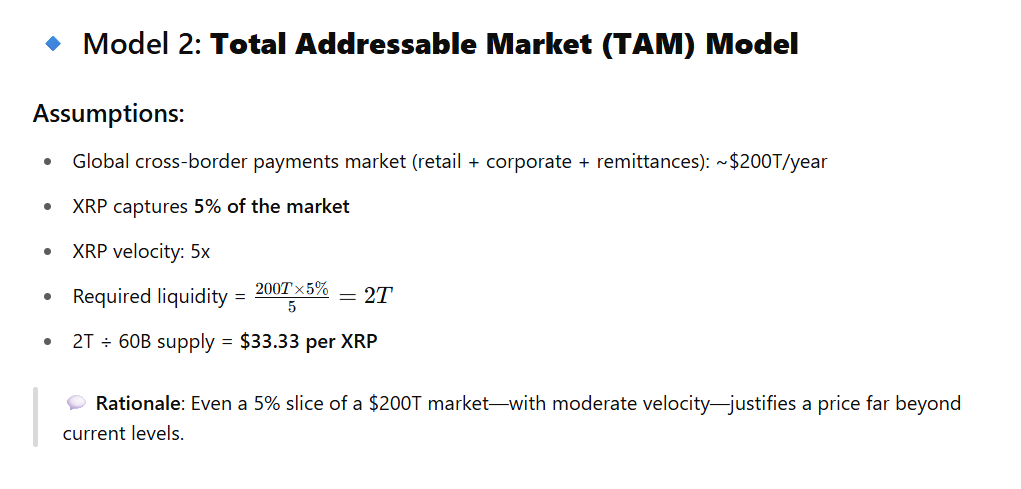

Meanwhile, but another mannequin regarded at the entire injurious-border payments market, which contains corporate payments, retail flows, and remittances. The market adds up to about $200 trillion each year. If XRP handles correct kind 5% of that quantity and turns over 5 times yearly, it would want $2 trillion in energetic provide. This kind of setup would enhance a tag of $33.33 per XRP.

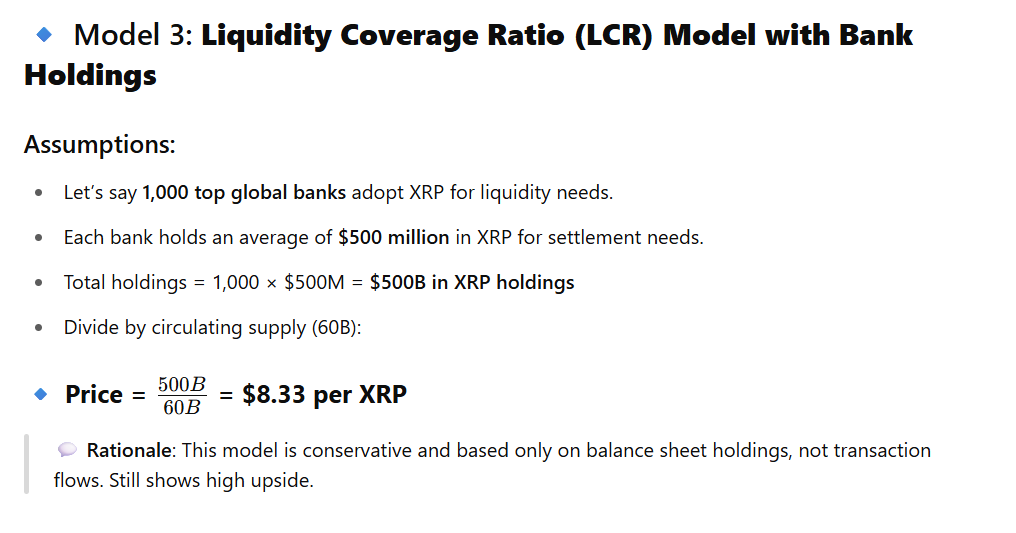

On the opposite hand, ChatGPT presented a more conservative estimate, focusing on financial institution reserves in its attach of transaction flows. Particularly, it assumed that 1,000 top world banks each held $500 million fee of XRP to meet their liquidity wants.

This stage of adoption would add up to $500 billion in holdings. Pondering the circulating provide of 60 billion tokens, XRP’s tag on this case would land at around $8.33.

General, ChatGPT burdened out that XRP’s bustle is a most important ingredient to possess in mind regarding its pricing. Particularly, the sooner it strikes between palms, the much less provide the plan wishes to find at any given time, which reduces upward strain on tag.

Aloof, if banks adopt XRP on a extensive scale, tag projections all the plot via all models negate meaningful upside. If XRP becomes the poke-to instrument for world settlements, its tag could soar anyplace from $8 to over $80.