Bitcoin has yet all over again hit a brand fresh all-time excessive, briefly nice looking above $121,000 before stabilizing advance $120,500. The price is up 2.54% this day, persevering with a solid vogue that began earlier this month. But is this rally sustainable, or nearing a slowdown?

Key indicators imply the vogue might perhaps perhaps perhaps now now not be performed supreme yet.

Holders Aren’t Taking Profits But

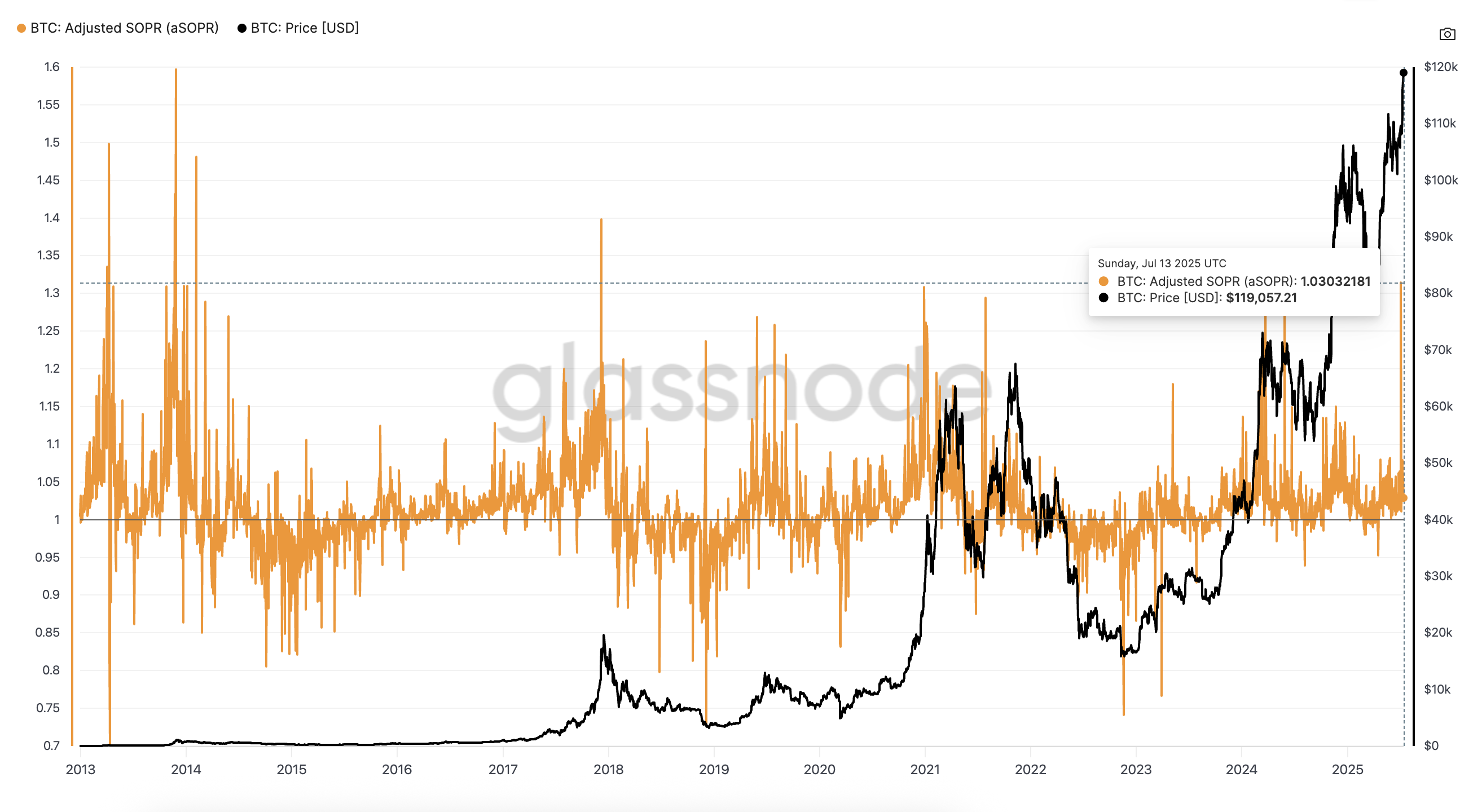

The adjusted Spent Output Profit Ratio (aSOPR) currently sits at 1.03, properly below the early July 2025 ranges, where aggressive profit-taking pushed the ratio great better. This time, despite Bitcoin making fresh highs, merchants seem to be keeping as a alternative of promoting.

This system most cash being moved on-chain are now now not being sold for giant beneficial properties, this implies that the rally is now now not overheated.

SOPR presentations whether BTC moved on-chain is being sold at a profit (>1) or at a loss (<1). Adjusted SOPR shapely-tunes the metric and filters out short-term inner transactions to repeat whether BTC moved on-chain is being sold at a profit or loss.

Quantity is Supporting the Rally

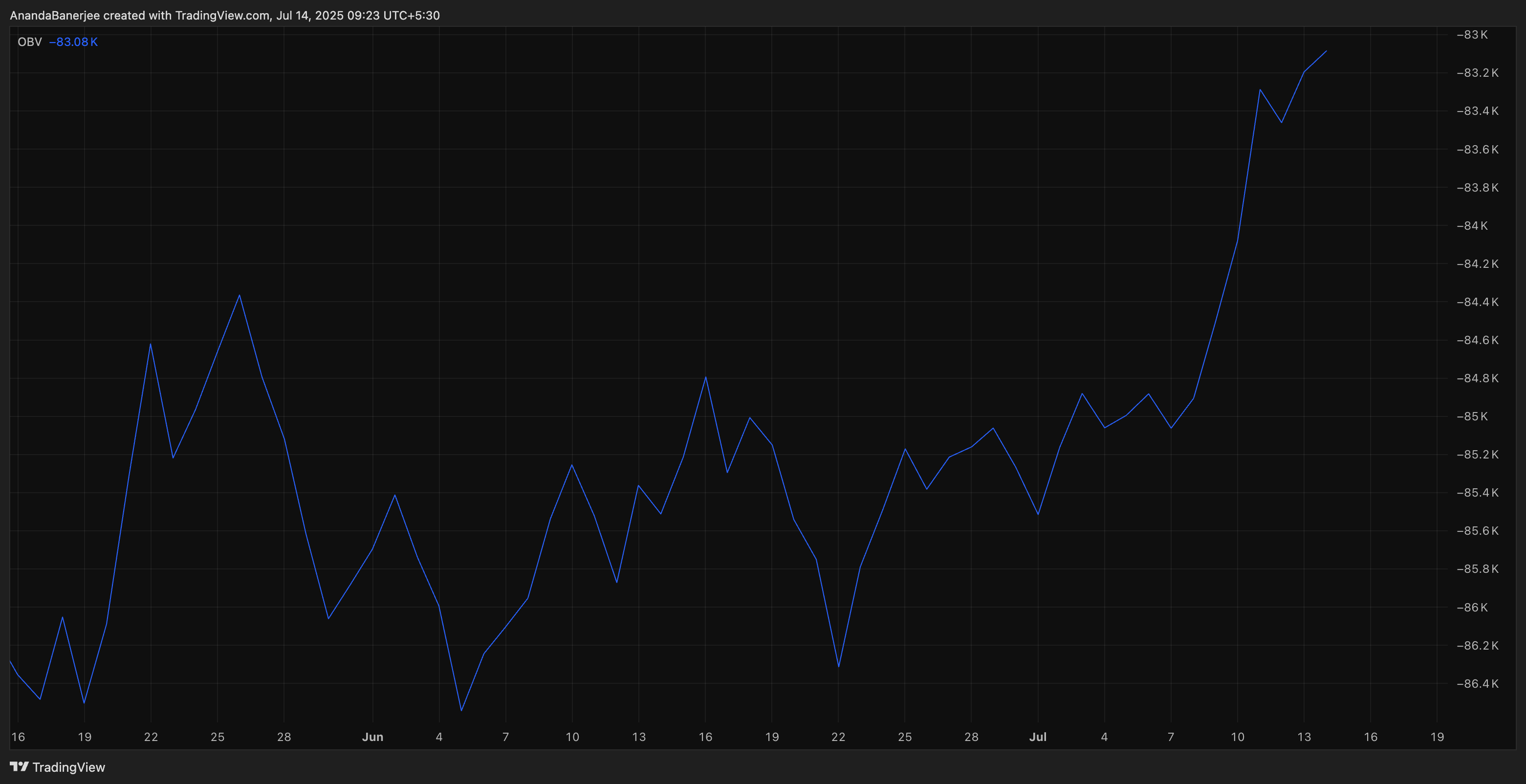

On-Balance Quantity (OBV) is nice looking up in tandem with Bitcoin’s mark, a key signal that procuring for volume is conserving tempo with the rally. There’s no visible divergence, no breakdown in momentum.

In extra shiny terms: BTC goes up, and the volume goes with it, now now not in opposition to it.

OBV measures cumulative aquire/promote stress in accordance to day-to-day volume route. It is a bullish signal when it follows a obvious mark vogue.

BTC Model Structure and Subsequent Stages

BTC is currently keeping supreme below $121,519, a key resistance level from the Pattern-Essentially based Fibonacci Extension. If Bitcoin closes above this level, the next extension target is $127,798, adopted by $135,425. These are long-vary projections in accordance to outdated vogue conduct.

Pattern-Essentially based Fibonacci Extension is a tool that uses three key mark factors: a low, a excessive, and a retracement, to venture future resistance ranges in a trending market.

If BTC consolidates, advance-term pork up sits at; $117,109, which is a prior breakout home. The bullish vogue would weaken if BTC falls below $112,699, a key pork up level advance the first all-time excessive, in particular if trade inflows spike or SOPR starts to upward thrust sharply. That might perhaps perhaps imply holders are initiating to clutch earnings aggressively, which might perhaps perhaps perhaps lead to a pullback or vogue reversal.