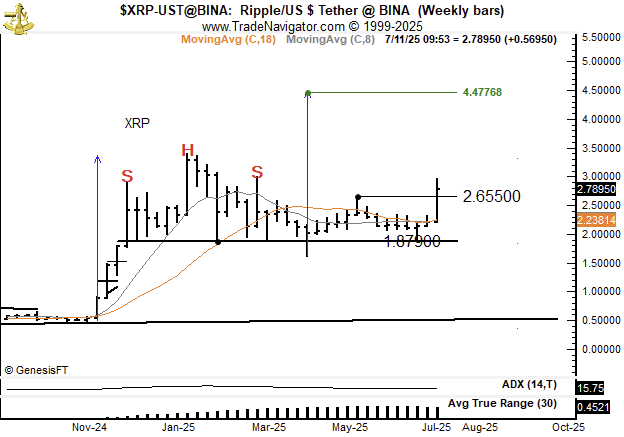

XRP has carved a “dramatic and highly uncommon continuation compound fulcrum,” a technical setup that would additionally catapult the worth to $4.40, basically basically basically based on legendary trader Peter Brandt.

In a most up-to-date tweet, Brandt acknowledged that following April’s false breakout, the XRP chart has fashioned a compound fulcrum that has implications for “XRP label to alternate at $4.4.”

As prolonged as XRP would no longer shut below this week’s low, Brandt maintains his bullish outlook, citing the pattern as a “compound fulcrum,” an especially uncommon pattern that step by step marks a bottom and happens when a market forms a complex Head & Shoulders top pattern after a prolonged and prolonged decline.

“Unless XRP closes encourage below this week’s low my interpretation will live that this pattern is most productive described as a compound fulcrum till proven in a different way,” Brandt acknowledged.

The worth aim of this pattern is $4.40, which represents a 58% amplify and a main breakout from contemporary trading levels.

In a tweet the day earlier than currently, Brandt highlighted XRP’s upward construction: “All the pieces I’ve reach to know know about charts informs me that the following construction on this mystery market will be Up Up Up.”

From bearish to bullish: Chart morphs

Brandt’s diagnosis marks a difficult flip from his old bearish outlook. In a tweet, Brandt explains his rationale, which is that charts are step by step morphing and that chart patterns would possibly maybe maybe well additionally infrequently fail.

Primarily basically basically based on Brandt, “Charts are step by step morphing—they would possibly maybe maybe well additionally morph from a imaginable chart formation with one implied end result into but some other chart pattern with diverse implications.”

Chart patterns infrequently fail, basically basically basically based on Brandt, referring to XRP’s false breakout in April, which on the starting up hinted at a bearish Head & Shoulders top. Then again, that formation used to be invalidated.

“There is mostly extra meaning in a failed pattern than in a carried out pattern. You pause no longer perceive that XRP in point of fact had a carried out intraday H&S top in early April. This motion used to be quick negated,” Brandt acknowledged.