Right here is a section from The Breakdown e-newsletter. To read more editions, subscribe.

“The importation of gold and silver is no longer the vital, powerful less the only real revenue which a nation derives from its distant places replace.”

— Adam Smith

Capitalism, it’s miles continuously stated, is how we care for participants we don’t know.

Folks you don’t know develop the meals you enjoy, produce the house you reside in and sew the dresses you wear.

For American citizens, a type of these other folks reside in Vietnam, though we don’t seem very grateful for them — this week, the chair of the White Home Council of Economic Advisors, Stephen Miran, stated a brand new replace take care of Vietnam is “improbable” due to it’s “extraordinarily one-sided.”

Right here is a Hunger Games worldview that I favor I could per chance perchance well focus on him out of.

Dear Mr. Miran: Vietnam doesn’t have to suffer for American citizens to prosper!

Apt the opposite, in spite of all the pieces.

The whole point of free-market capitalism is that exchanging goods and services and products is a positive-sum activity.

We learned this from Adam Smith, who outlined that every voluntary swap makes both parties — or it wouldn’t occur.

Folks have an innate “propensity to truck, barter and swap one thing for yet one more,” he wrote, and the more we produce it, the wealthier we all are.

Extracting “extraordinarily one-sided” replace deals, by disagreement, makes either facet poorer.

The deal Miran touted is so one-sided that it literally has one facet; Vietnam hasn’t even agreed to it, Bloomberg reports.

The president imposed in an analogous plan one-sided deals on Japan and Brazil this week, in letters that revive the 18th-century observe of capitalizing random nouns: “We invite you to take half within the unheard of Economy of the US, the Quantity One Market within the World, by a long way.”

The letter to Japan complained that the connection between the 2 international locations has been “removed from Reciprocal” (again with the capitalization!), since the US sends more money to Japan than it receives.

But Smith would repeat that the principle fair of replace is no longer “the importation of gold and silver,” nonetheless the elevated availability of products and services and products for all.

To think replace relationships fully by the circulation of cash is to think that replace is a nil-sum activity.

Sadly, this Hunger Games outlook appears to be like to be one amongst the few areas of bipartisan agreement.

“Zero-sum pondering doesn’t tumble neatly along ranking together traces and is no longer a clearly left-wing or glorious-wing mindset,” Stefanie Stantcheva wrote for The Economist.

As a replace, a watch she co-authored chanced on that urban dwellers, PhDs and young other folks are per chance to have a nil-sum watch of the realm.

Even PhDs don’t read Adam Smith anymore, I negate.

The stock market doesn’t seem very afraid by this troubling vogue. It’s up nearly 7% year thus a long way, as if nothing powerful has took put of living.

But I’m positive Adam Smith would repeat you that if we exclaim on making world replace a contest, we’re all going to lose.

Hunger Games had a contented ending, in spite of all the pieces, nonetheless perfect due to they stopped taking half within the sport.

Let’s compare the charts.

One thing is occurring:

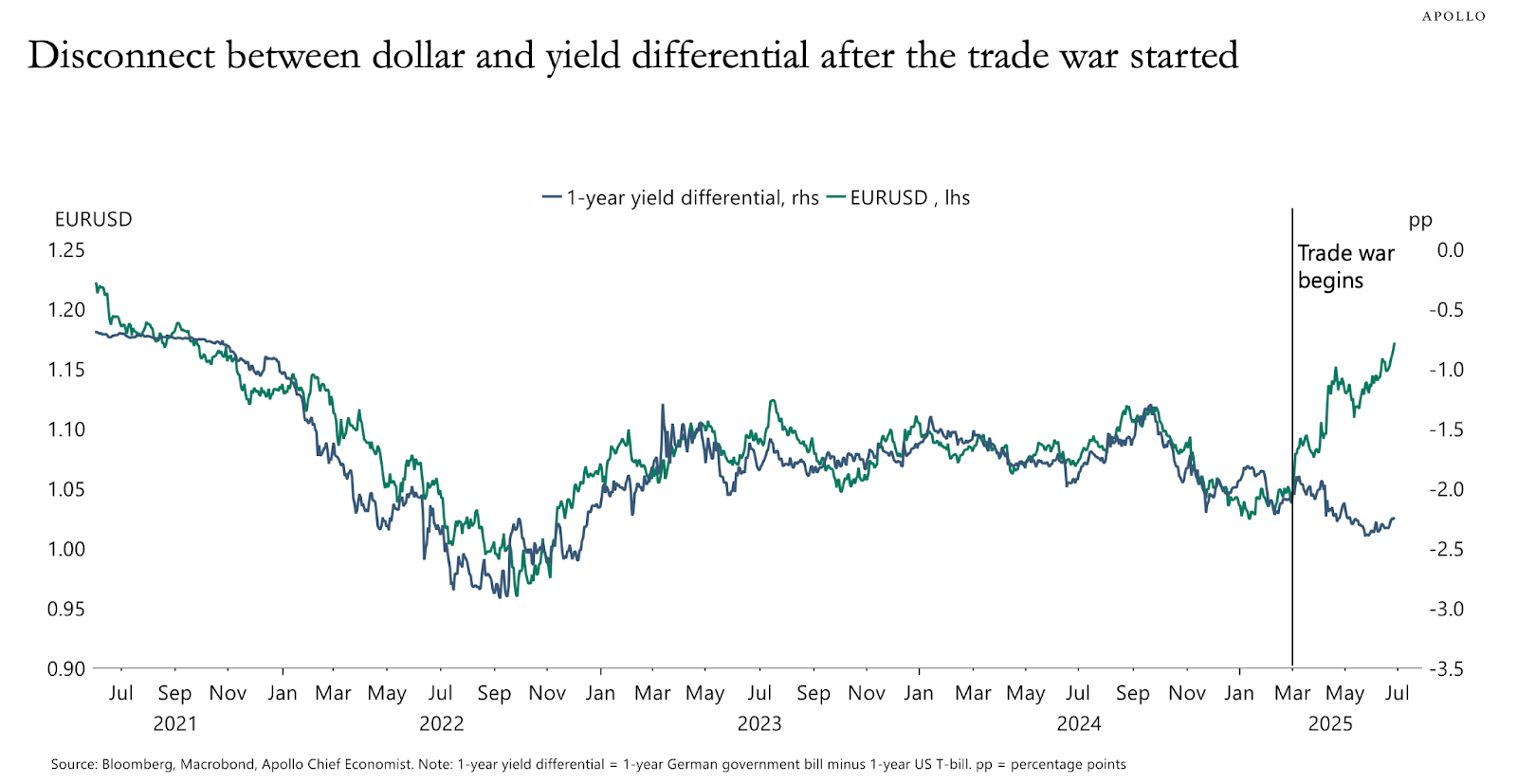

The euro-greenback swap rate would possibly per chance perchance well furthermore be a feature of the distinction in passion charges between the US and EU. These two things have decoupled since the launch of the replace struggle, which means that currency markets (in disagreement to stock markets) deem that tariffs produce topic.

Are trying to preserve up:

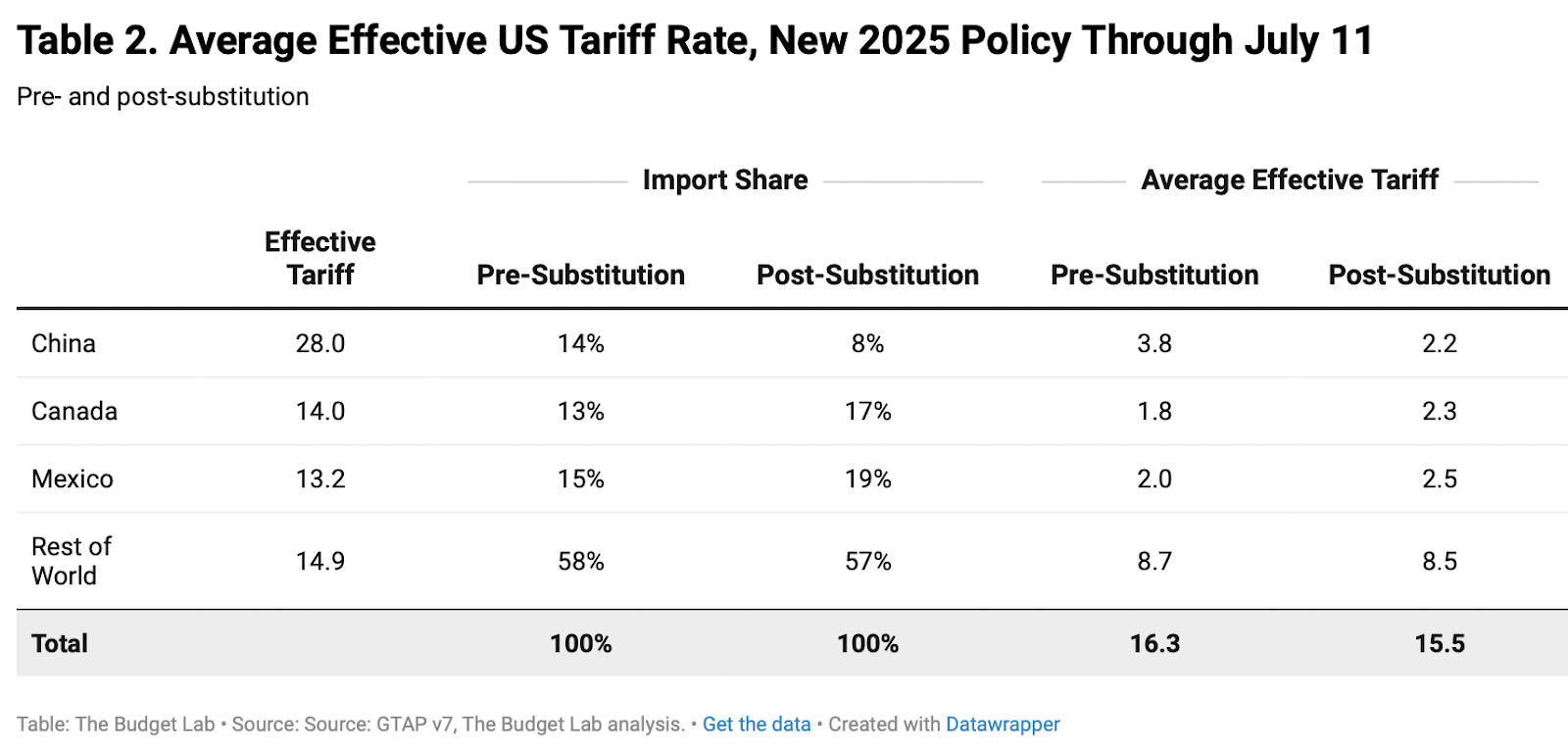

Economists at Yale’s Price range Lab calculate that the announced tariffs — as of right this moment! — quantity to an effective rate of 16.3% (pre-substitution). It’ll doubtlessly be diverse the following day. And doubtlessly better.

Tariff cheat sheet:

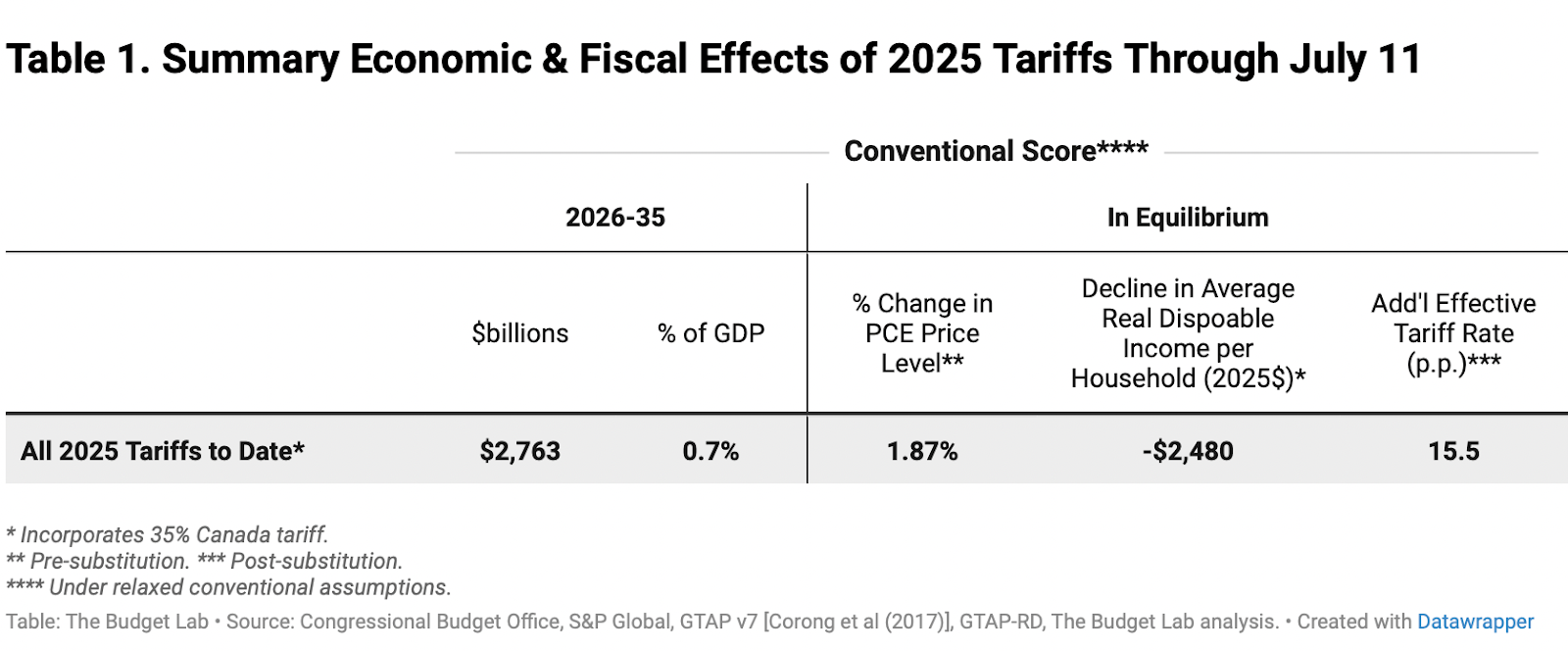

Yale also keeps a operating calculation of how tariffs will impact GDP, inflation and our purchasing vitality. It within the mean time estimates that the annual disposable revenue of American households will tumble by a median of $2,480. (It appears to be like to have read its Adam Smith.)

Is inflation due for a vogue swap?

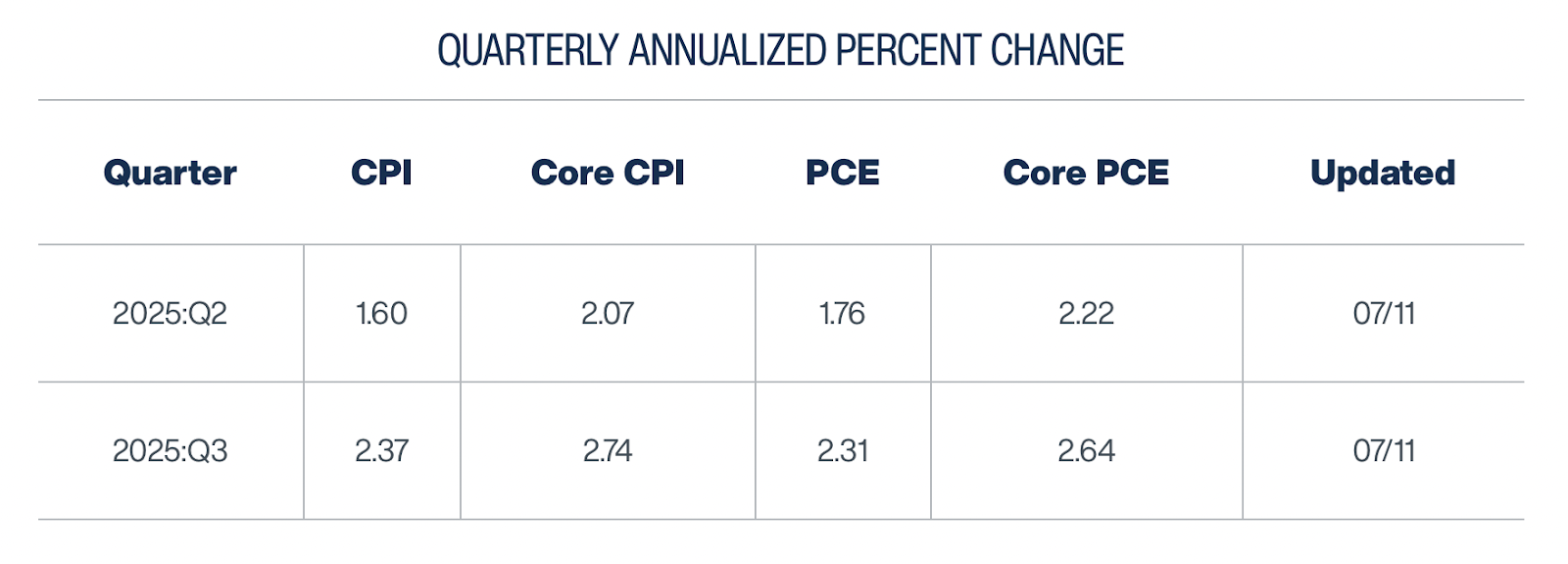

CPI has an excellent deal surprised to the downside four months in a row, nonetheless the Cleveland Fed sees inflation nearly 0.8% better in Q3 vs. Q2. Subsequent week’s CPI file shall be scrutinized for a swap within the hot vogue.

Skittish the economy:

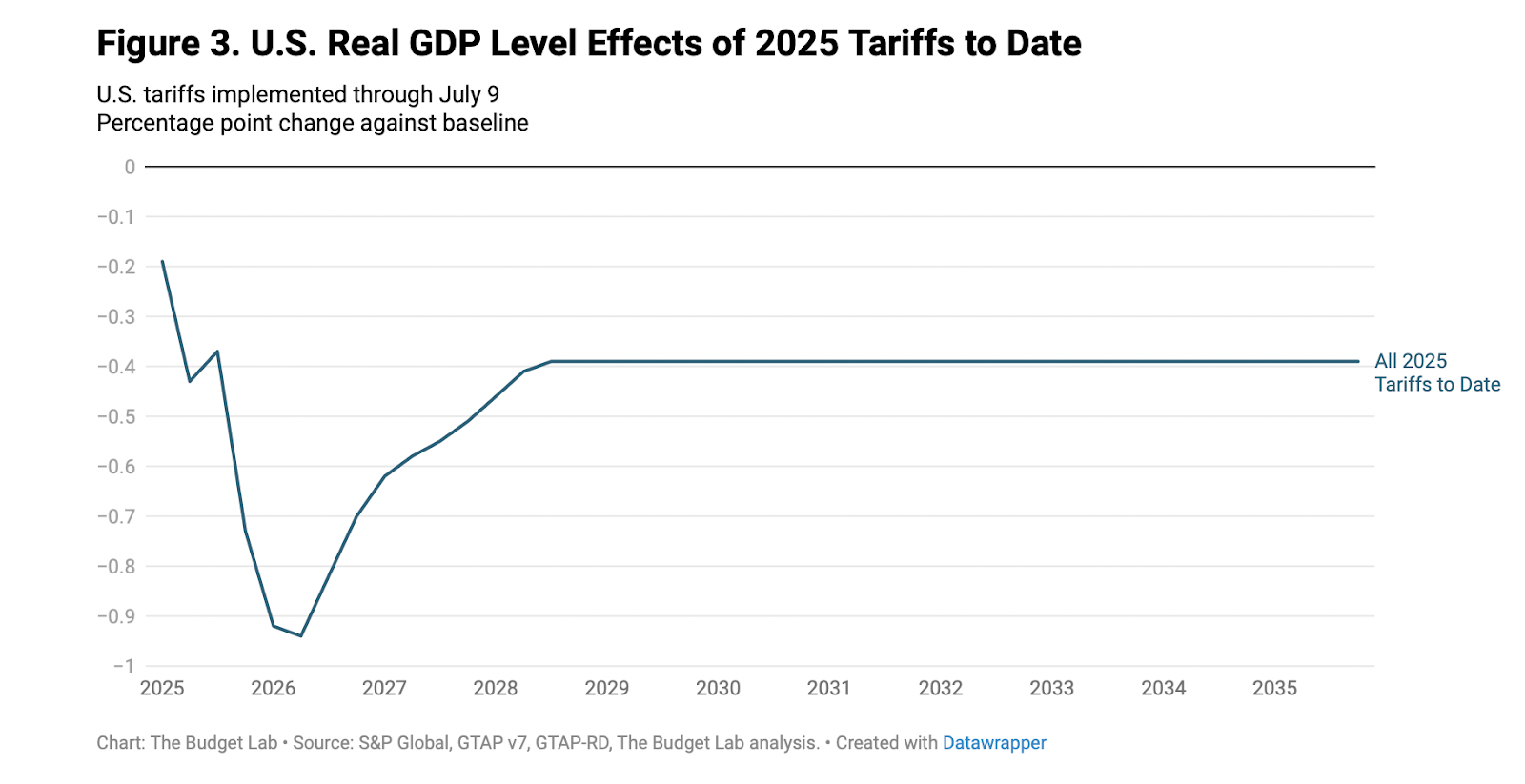

The Price range Lab estimates that tariffs will take about 0.8% off GDP in 2026 and that the US economy, rising from a smaller snide, will stay 0.4% smaller than it in every other case would have been, in perpetuity.

Skittish the economy, phase two:

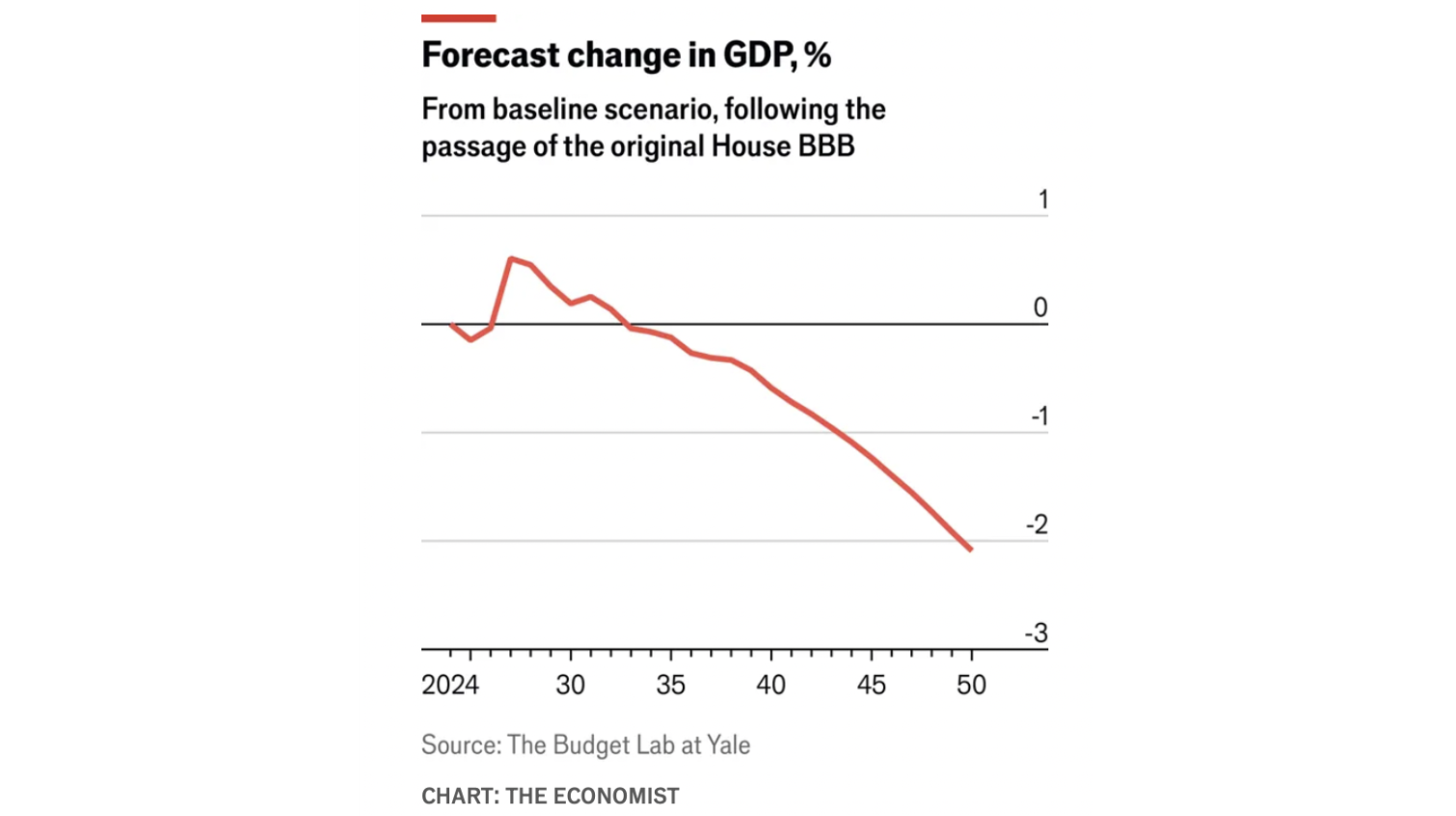

The Economist (using Yale info again) charts the produce of the substantial beautiful invoice, which is expected to have made the US economy 2% smaller in 2050 than it in every other case would have been. Two share aspects in 2050 would possibly per chance perchance well not sound esteem powerful, nonetheless it absolutely will occur faster than you per chance would possibly per chance perchance well deem. I did the arithmetic and chanced on out 2050 is lower than 15 years away. (Weird and wonderful, nonetheless real.)

Must you missed it:

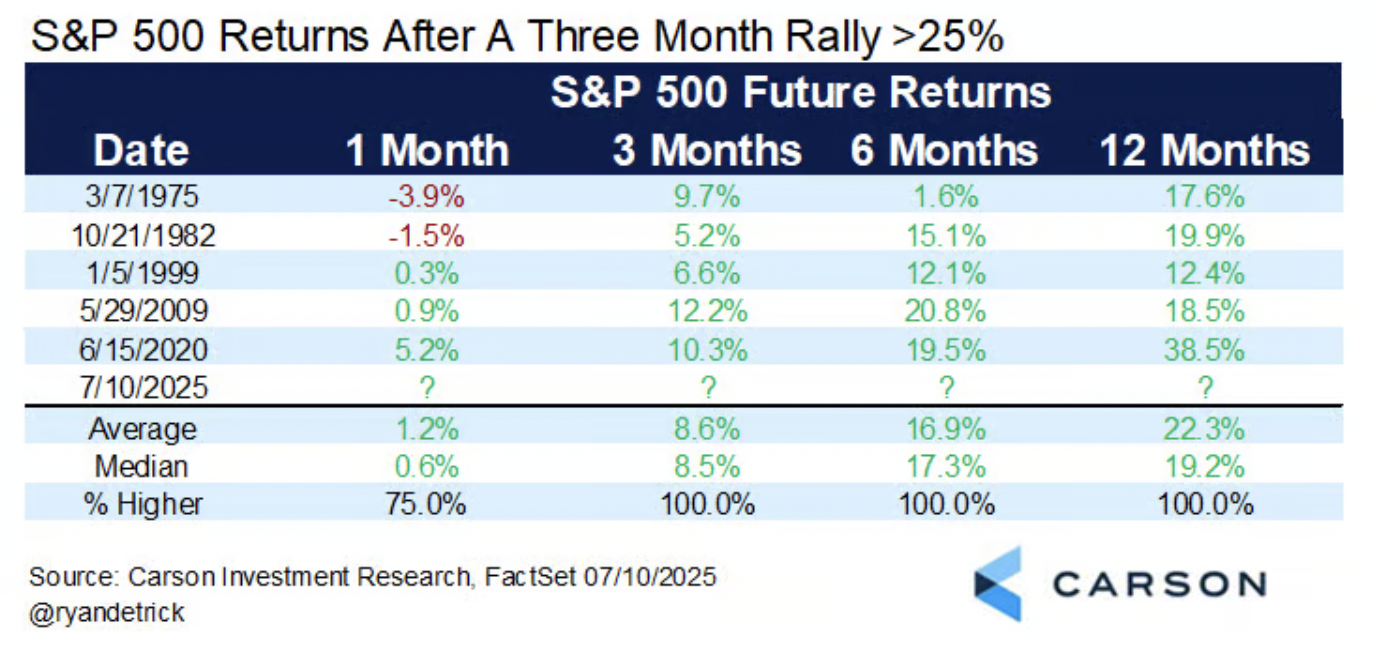

“It” being the stock market. Data from @ryandetrick displays that as soon as stocks are up as powerful as they are in spite of all the pieces, they are consistently better three, six and 365 days later. That is a mathematical reality…nonetheless with a pattern dimension of glorious four, sadly, so per chance don’t bet the house on it.

My popular chart:

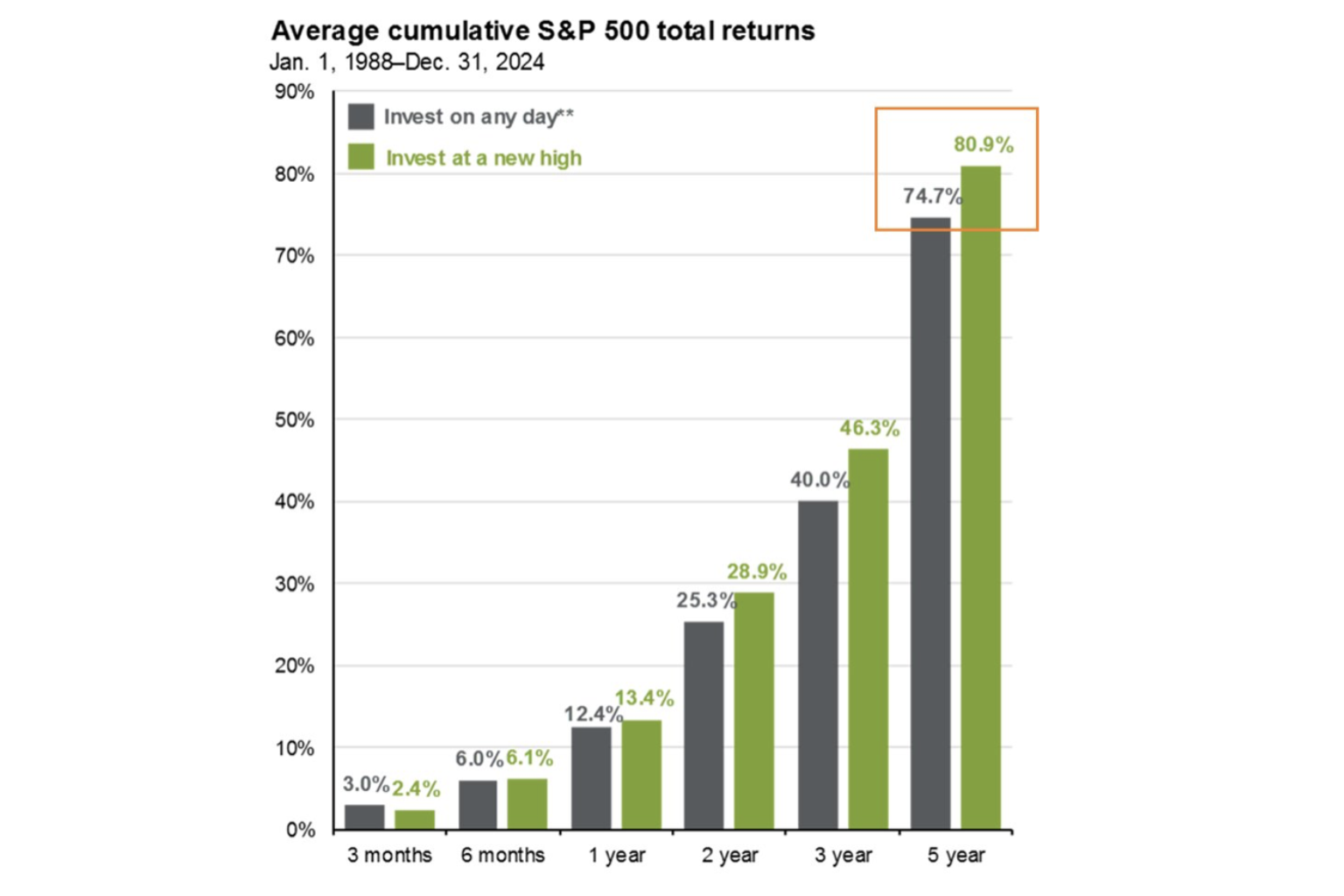

I’m good at purchasing for high, so I consistently ranking pleasure from seeing the counterintuitive info Mike Zaccardi reprises above. By some capacity, purchasing for the S&P 500 perfect at its all-time highs is more healthy than purchasing for randomly. There’s hope for us all.

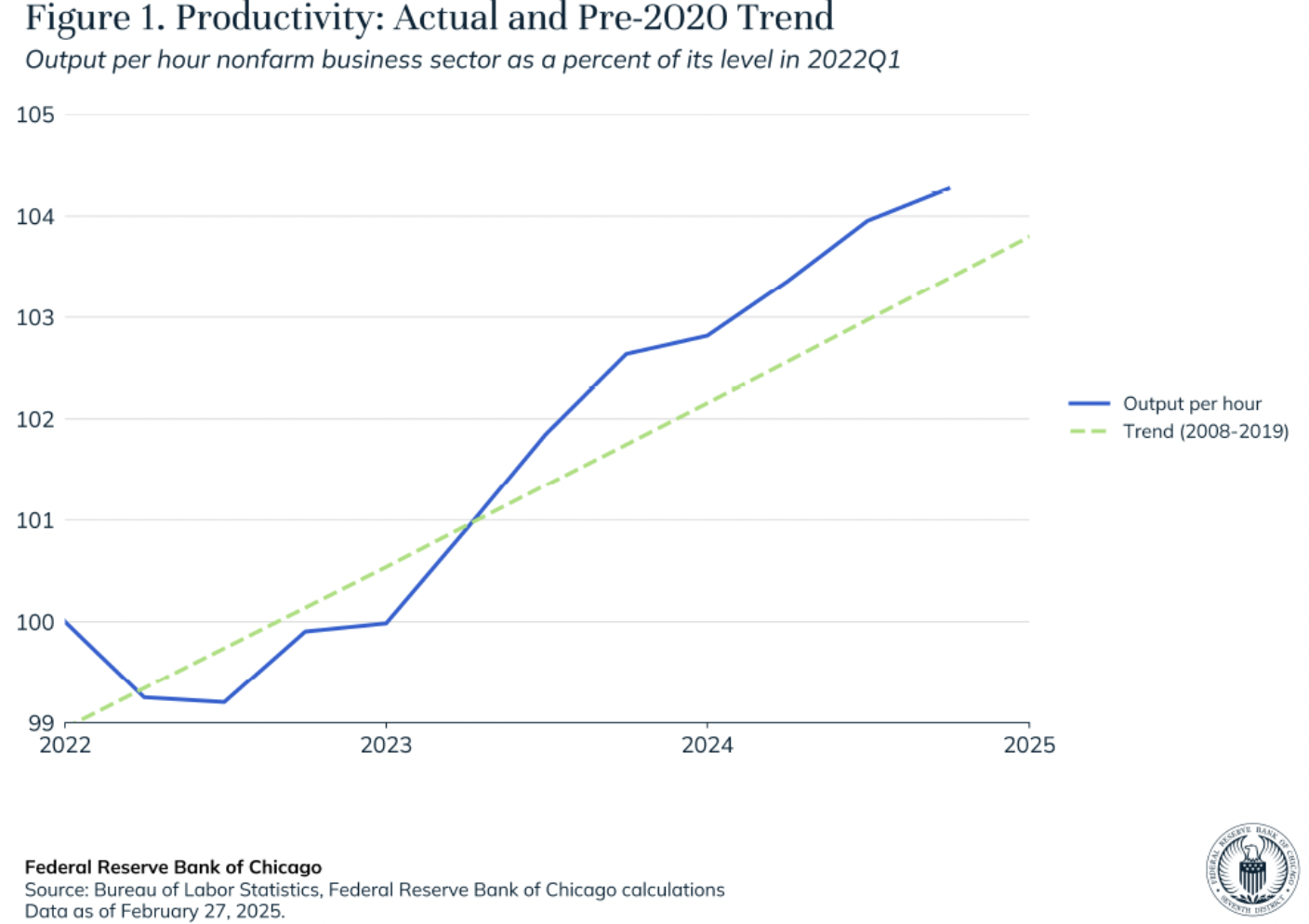

Doing more with more: