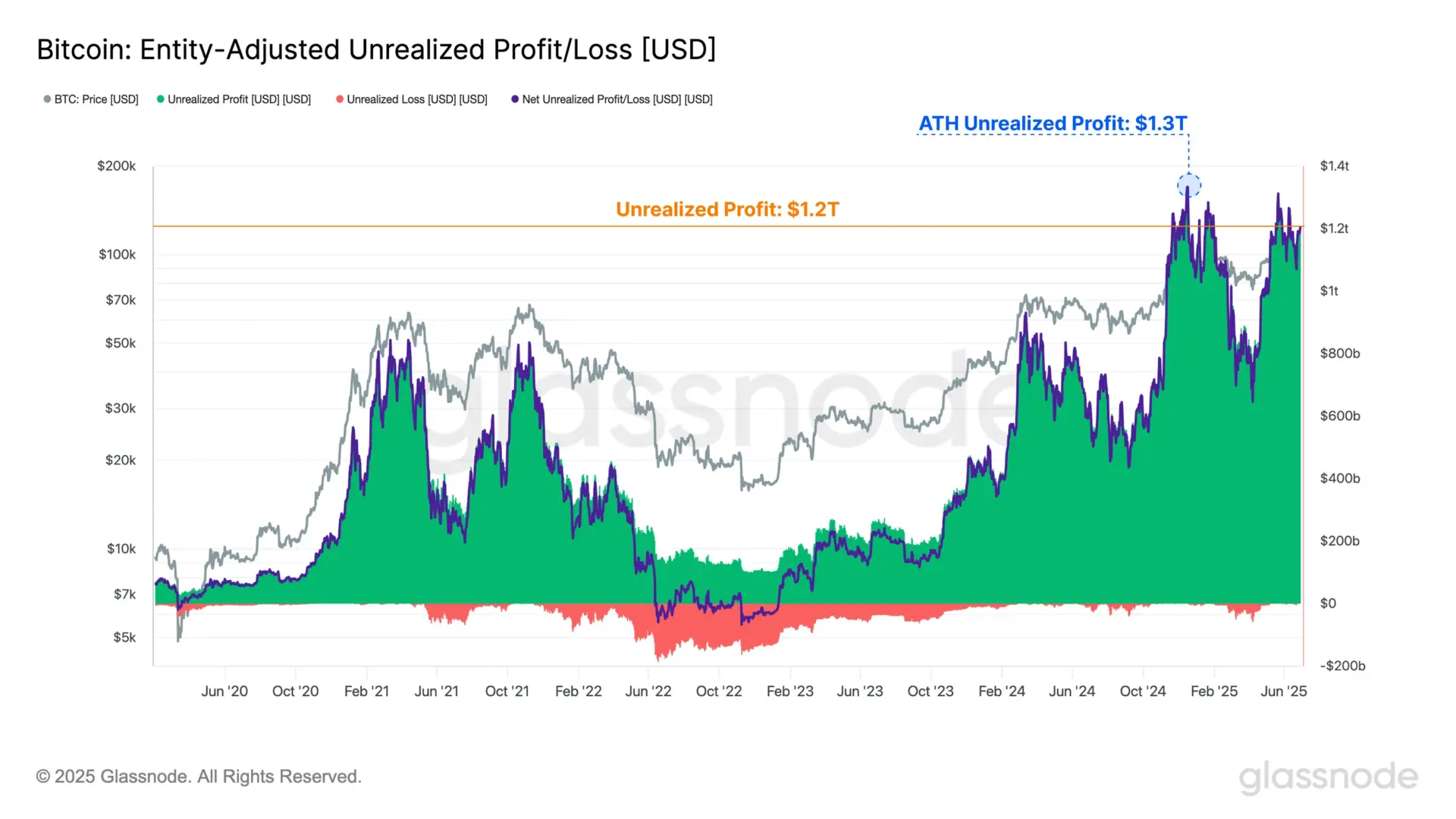

Bitcoin’s rally above $107,000 has delivered a spectacular windfall for merchants, an estimated $1.2 trillion in unrealized earnings, in accordance with Glassnode’s latest on-chain recordsdata.

But this huge pool of paper good points cuts each and each ways, signaling each and each stable bullish sentiment and a latent menace of peculiar sell stress.

Traders are HODLing on to their Bitcoins

Despite the theoretical windfall, BTC merchants have demonstrated important restraint. Knowledge exhibits that realized earnings are declining, lengthy-term holder provide has reached unique highs, and selling stress from temporary holders has eased.

This mix of huge unrealized good points and cautious habits is representative of the market’s present dynamics.

Bitcoin no longer too lengthy in the past saw a sell-off to about $ninety 9,000 precipitated by geopolitical tension between Israel and Iran. But, prices rebounded to $107,000 after a stop-fireplace, with toughen emerging reach the $98,300 cost basis of temporary holders—a stage that analysts remark consolidates the bullish epic.

Off-chain capital inflows from institutional sources, equivalent to U.S. effect BTC ETFs, averaging $298 million per week, also bolster quiz even as present merchants assist valid. The mix of patient holders and unique institutional liquidity paints a image of a deepening, passe market.

On the opposite hand, the sector is precarious. While conserving remains dominant, a shift in sentiment might perchance well maybe well unleash critical selling stress. Analysts warn that present mark ranges are “insufficient to trigger critical earnings-taking,” and demonstrate that the market might perchance well maybe well must disappear increased (or decrease) to unlock further provide.

Historical past says stress to sell is due

Historical precedent amplifies the sector of wholesale earnings-taking. CryptoQuant’s network unrealized earnings/loss (NUPL) indicator has beforehand flashed sell indicators when unrealized earnings spiked, on the complete sooner than market pullbacks.

In the same blueprint, old experiences demonstrate that lengthy-term holders historically originate spending and rising sell-aspect stress when their practical unrealized good points reach around 350%, which reportedly happens reach the $100,000 mark zone. This implies that rising prices might perchance well maybe well shift sentiment even among staunch holders, making a solutions loop of earnings-taking and price corrections.

Despite these dangers, the institutional cohort continues to enhance Bitcoin’s market foundation. The Gemini‑Glassnode Q2 document exhibits over 30% of circulating BTC now resides in centralized entities, in conjunction with ETFs, exchanges, custodians, and sovereign treasuries.

Furthermore, off-chain venues now story for over 75% of trading quantity, signaling that mark discovery is migrating in direction of regulated, institutional platforms. That’s a structural evolution that, whereas supporting liquidity, might perchance well maybe well also point out more organized and potentially surprising sell stress from huge stakeholders.

Analysts proceed to computer screen the market

Several analysts demonstrate that a meaningful mark disappear, either surpassing the $110,000–$112,000 resistance or slipping under the present $98,000–$ninety 9,000 toughen band, shall be required to dislodge the market’s present equilibrium.

Because the market stands, Bitcoin’s $1.2 trillion in unrealized good points indicators each and each its maturity and vulnerability. The large paper earnings remember investor self perception and institutional backing.

On the same time, it indicators a latent pool of doable selling fuel, person that might perchance well maybe well ignite if sentiment cracks or technical ranges fail.

For now, HODLing remains the dominant habits, institutional inflows vitality momentum, and averages of realized earnings and liveliness proceed to remark no.