Fashioned Chartered has also raised an optimistic outlook for BTC. As infamous in our earlier put up, the realm bank targeted BTC at $135,000 in Q3. This projection aligns with an earlier forecast from Berstein Analysis, as detailed in our final files allotment.

- Bitcoin futures funding rates flipped adversarial, suggesting a attainable designate rebound ahead.

- Momentum for Bitcoin is bettering with BTC eyeing the ATH.

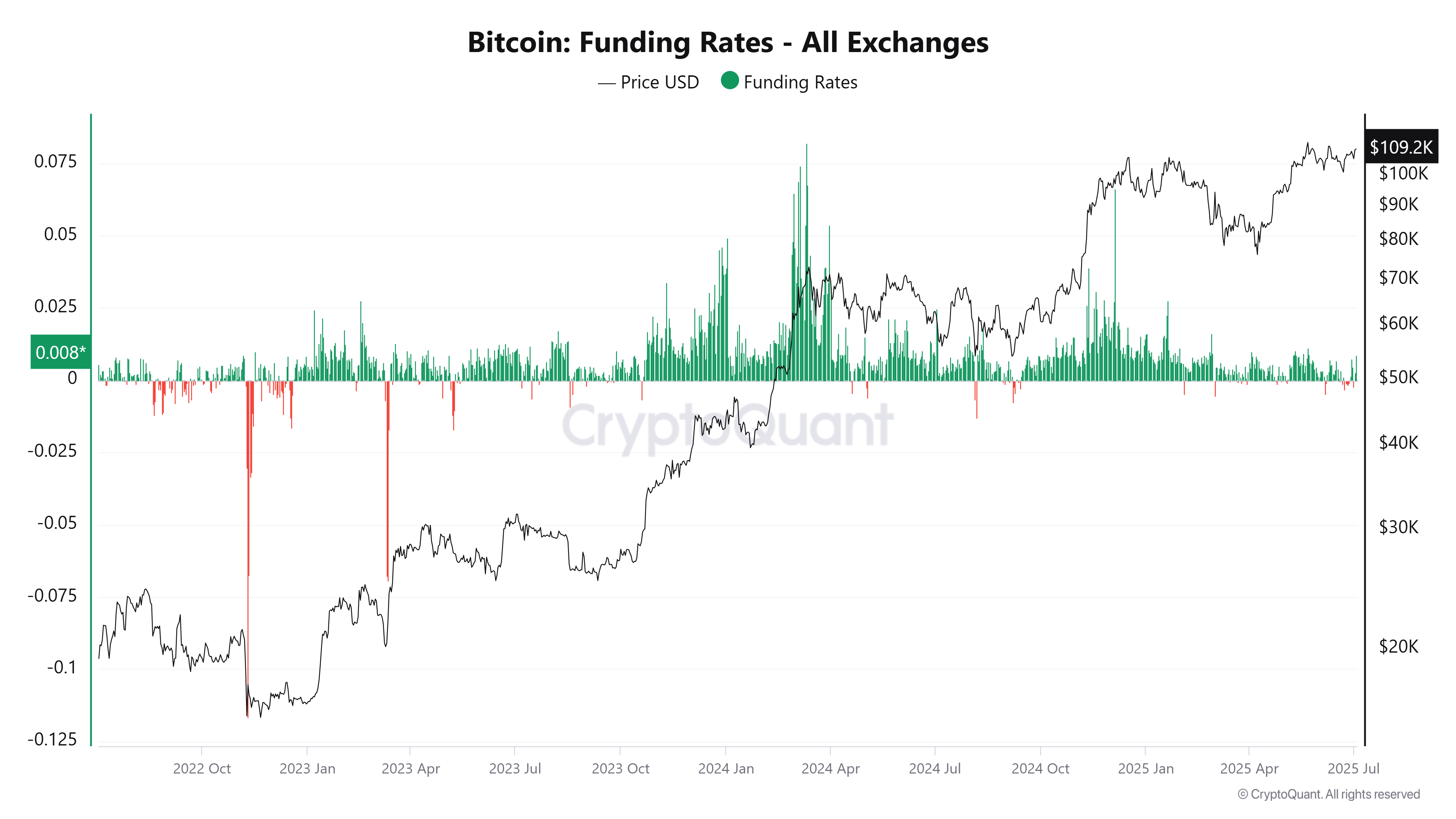

The Bitcoin (BTC) futures funding rates respect brought optimism for bulls. Notably, this metric flipped adversarial in leisurely June. Throughout this duration, the BTC mutter designate climbed from below $100,000 to $108,000.

Previously, this kind of divergence indicated a necessary designate enhance ahead for Bitcoin. In one cycle, the price of BTC surged 80%.

Will Bitcoin Designate Prepare Historical Traits

Onchain files analytics platform CryptoQuant published that the Bitcoin futures perpetual funding rates respect grew to change into adversarial. A adversarial funding rate design short-arena holders are paying prolonged traders to withhold their contracts. This is generally a signal of bearish market sentiment.

Nonetheless, a power adversarial rate also can merely counsel the market is oversaturated with bearish bets. This also can precede a designate rebound if shorts are forced to purchase aid their positions.

When futures funding rates slipped in September 2024 and July 2023, BTC soon experienced 80% and 150% beneficial properties, respectively. Pondering this performance, the leading coin also can presumably be gearing up for original rallies ahead. Analysts claimed the bearish reset also can merely respect already conducted out.

Constant with CoinGlass liquidation files, $111,320 on the BTC/USDT pair reveals the last be conscious focus of predicted liquidations previously three months. Internal this designate stage, the guidelines published an estimated $520.31 million in leveraged positions at effort.

This liquidity, if tapped, also can situation off a short squeeze. In this case, forced buybacks from short traders also can drive costs better.

Two predominant factors that influenced the latest BTC rally are ETF inflows and fading self belief in fiat strength. In a fresh change, we lined that the US greenback declined nearly 11% in 2025, reaching lows not viewed in decades.

Amid the weakened greenback, the US mutter Bitcoin ETFs recorded over $4.63 billion of gain inflows in precisely three weeks. Lengthy-term holders proceed to purchase Bitcoin. In H1 2025, Bitcoin minted over 26,000 millionaires, indicating its soaring adoption.

BTC Strikes Closer to ATH

Bitcoin, the leading cryptocurrency, is in the intervening time trading at $110,306. In the final 24 hours, the BTC designate has elevated by 2.3%.

The day to day trading volume also surged over 24% to $58.4 billion. The rally signifies that momentum has resumed as traders uncover renewed hobby in the coin.

Constant with the latest designate performance, BTC is engaging closer in opposition to its All-Time Excessive (ATH) of $111,924. Technical diagnosis also parts to a attainable rally on the horizon.

Examining the day to day chart published a breakout above the upper trendline of a bull flag pattern. The motion of this pattern parts to a attainable target come $117,500, per the prior flagpole. This designate closely aligns with $116,000 forecasted by 10x Analysis’s Markus Thielen for the cease of July.