A Supreme Political Storm for Crypto

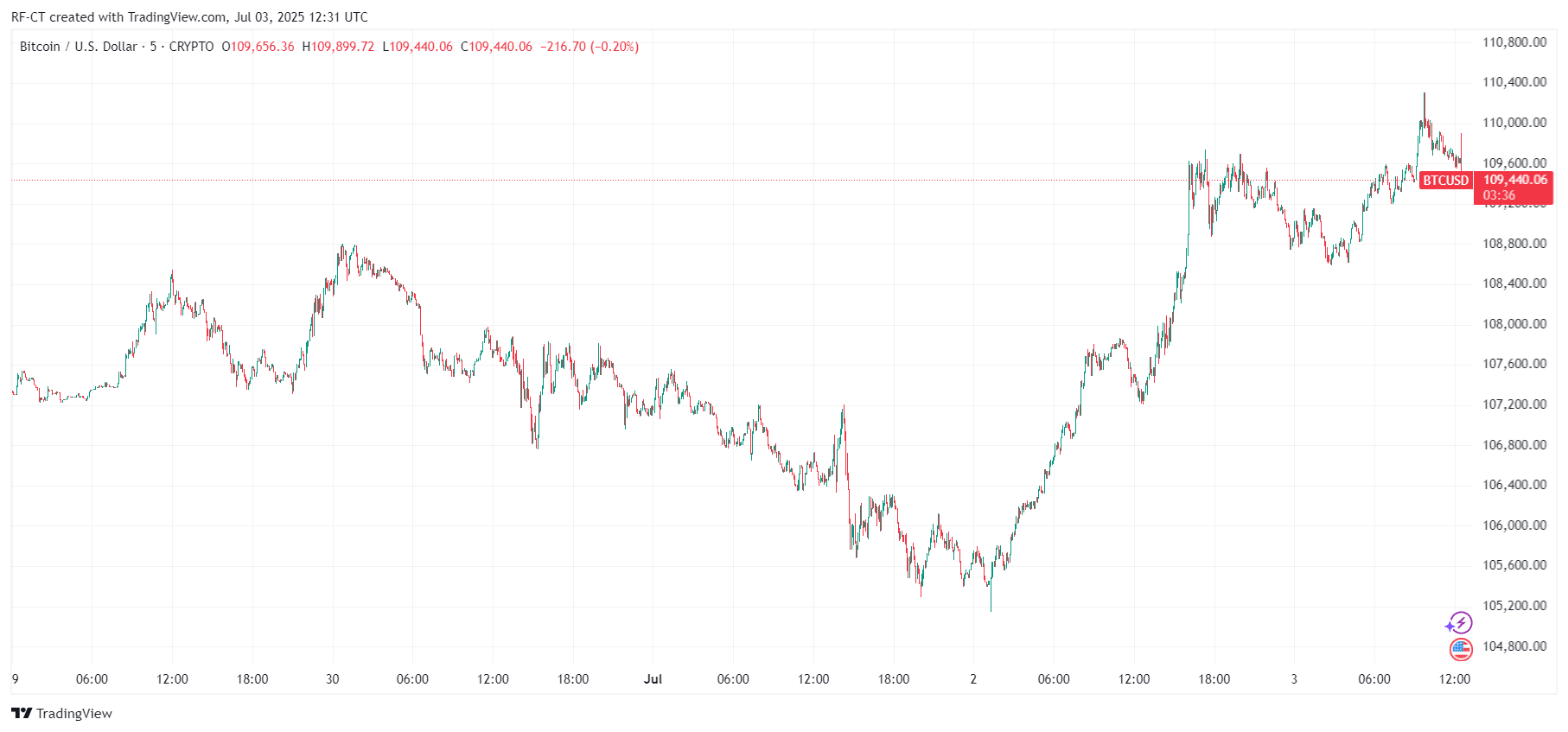

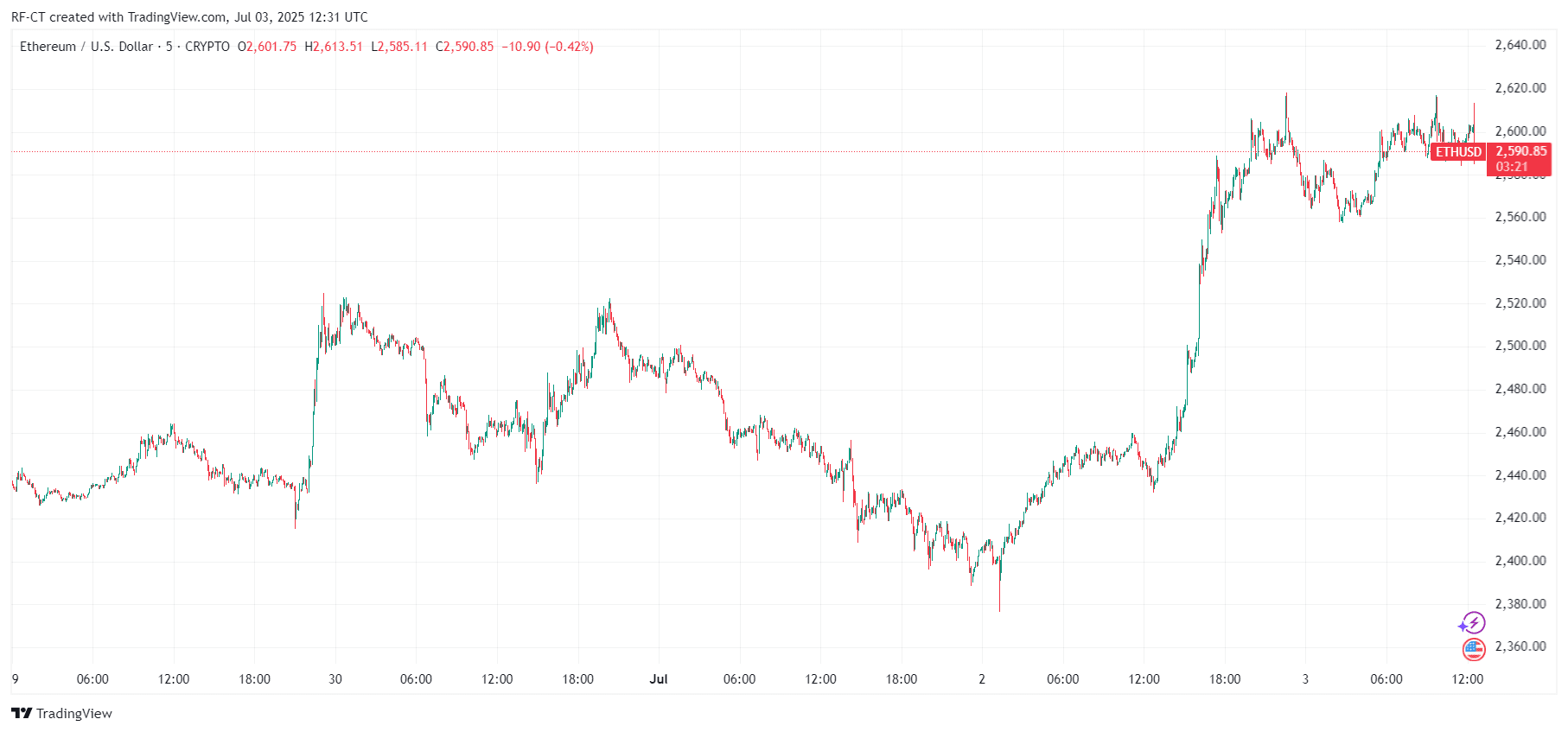

Early July opened with BTC punching above $110K amid the 2d-greatest rapid wipe-out of 2025. Within the intervening time, ETH can’t appear to sure $2,600. The backdrop isn’t valid chart-pattern hype—it’s an out of the ordinary combine of:

- Enormous U.S. legislation (the “One Broad Pretty Bill”) barreling toward Trump’s desk

- Elon Musk’s very public stand up in opposition to that bill

- A recent U.S.–China détente after Washington scrapped chip-application export curbs

- Trump’s put a question to that Jerome Powell “resign straight away,” dangling the possibility of a radically various Fed

- A twin Bitcoin-Ether ETF filing (75% BTC / 25% ETH) from Trump Media & Skills Community now shifting via NYSE Arca

Place together, the macro-political story could maybe matter as grand as hash-fee or shifting averages.

1 | $110 Million in BTC Shorts Vaporised

Bigger than $110 million in bearish positions were liquidated within an hour as BTC broke $109K. Liquidations in general snowball into “compelled buys,” converting bearish leverage into site put a question to—one reason bulls peep $112K–$116K as the next purpose.

2 | All the most practical seemingly device via the “One Broad Pretty Bill” (OBBBA)

Size & Scope: Roughly $3.3 trillion in tax cuts, armed forces spending, and border-security outlays, offset by deep cuts to healthcare and inexperienced-energy programs

Crypto Attitude: Sections within the bill declare the Treasury to modernise fee approved guidelines and fabricate a U.S. Strategic Bitcoin Reserve

Situation: The bill has handed the Senate, with the Rental anticipated to finalise and send it to President Trump by July 4

Musk’s Insurrection

Elon Musk calls the bill “completely insane and unfavorable,” warning it would abolish millions of future-tech jobs and balloon the deficit. He’s even threatened to inspire necessary challengers in opposition to Republican supporters of the bill.

Market Impact: If the bill is signed, bulls put a question to a “money printer toddle BRR” story to push Bitcoin increased. Musk’s lobbying could maybe prolong or soften the bill’s local climate rollback sections—crucial for ETH-linked sustainability tokens.

3 | China Chip-Tax Rollback – Why Crypto Cares

The U.S. has officially lifted restrictions on exporting evolved chip-fabricate application to China. This stream is a necessary score for global tech collaboration and particularly benefits companies on the inspire of Bitcoin mining infrastructure.

The rollback lowers the concern of provide-chain disruptions and helps retain mining charges real, which is bullish for Bitcoin’s lengthy-term trace sustainability.

4 | Powell on the Hot Seat

Trump has straight away known as on Federal Reserve Chair Jerome Powell to resign, calling him “too unhurried” to act on inflation and accusing him of hurting the economic system.

A doubtless Powell resignation could maybe signal a shift toward lower interest rates and looser monetary policy—each bullish for crypto markets.

Scenario Impacts:

- If Powell stays → slower fee cuts → neutral to a exiguous bit bearish

- If Powell exits and a respectable-crypto or dovish replace is named → spirited upside for BTC and ETH

5 | ETH – Tranquil Lagging, Nonetheless ETF Tailwind Ahead

Despite Bitcoin’s dominance, Ethereum is procuring and selling flat spherical $2,600. Alternatively, momentum could maybe fabricate as Trump Media’s twin Bitcoin-Ethereum ETF filing progresses.

The proposed constructing allocates 75% to BTC and 25% to ETH, maybe using institutional capital flows into Ethereum as soon as approved.

If Powell exits or if the ETF will get greenlit, ETH could maybe creep a 2d wave that narrows the BTC/ETH efficiency gap.

Bitcoin Tag Prediction – Can BTC Print $120K in July?

| Timeframe | Target | Rationale |

|---|---|---|

| Rapid-Time frame | $112K–$116K | Momentum plus lingering rapid interest |

| Mid-July | $120K | Laws passage + institutional flows |

| End of July | $128K | That you just can judge Powell resignation, ETF hype |

BTC toughen lies spherical $107K, with $103K as a deeper stage. Invalidation below $101K indicators a false breakout.

Ethereum Tag Prediction – Will It Ultimately Slump Shotgun?

| Timeframe | Target | Catalyst |

|---|---|---|

| Rapid-Time frame | $2,650–$2,850 | Follows BTC energy |

| Mid-July | $3,200 | ETF possibility window opens |

| End of July | $3,500 | Powell exit + ETF approval + recent inflows |

Breaking above $2,950 could maybe ignite lickety-split motion as much as the $3,200 discipline.

Conclusion: Politics Is the New Hash-Rate

Bitcoin’s breakout above $110K isn’t valid a technical memoir—it’s a geopolitical change on legislation, central banking, and global cooperation. If Trump’s bill is signed and Powell steps apart, the market could maybe enter a “worry-on” mode, using BTC toward $120K this July.

Ethereum lags recently but is wisely-positioned to apply, particularly with a twin-asset ETF and shifting monetary policy on the horizon. In brief, July might be the month politics propels crypto to its next milestone.

$BTC, $ETH, $Bitcoin, $Ethereum