A highly leveraged trader on Hyperliquid, Qwatio, came upon himself facing 8 consecutive liquidations after making a bet against the market rally.

This took pickle as the cryptocurrency market surged by 1.78% over the past 24 hours, fueled by a US-Vietnam trade deal. As Bitcoin (BTC) and Ethereum (ETH) rallied, Qwatio’s shorts took a success, marking a rough day for his approach.

Hyperliquid Trader Hit with Liquidations Amid Market Surge

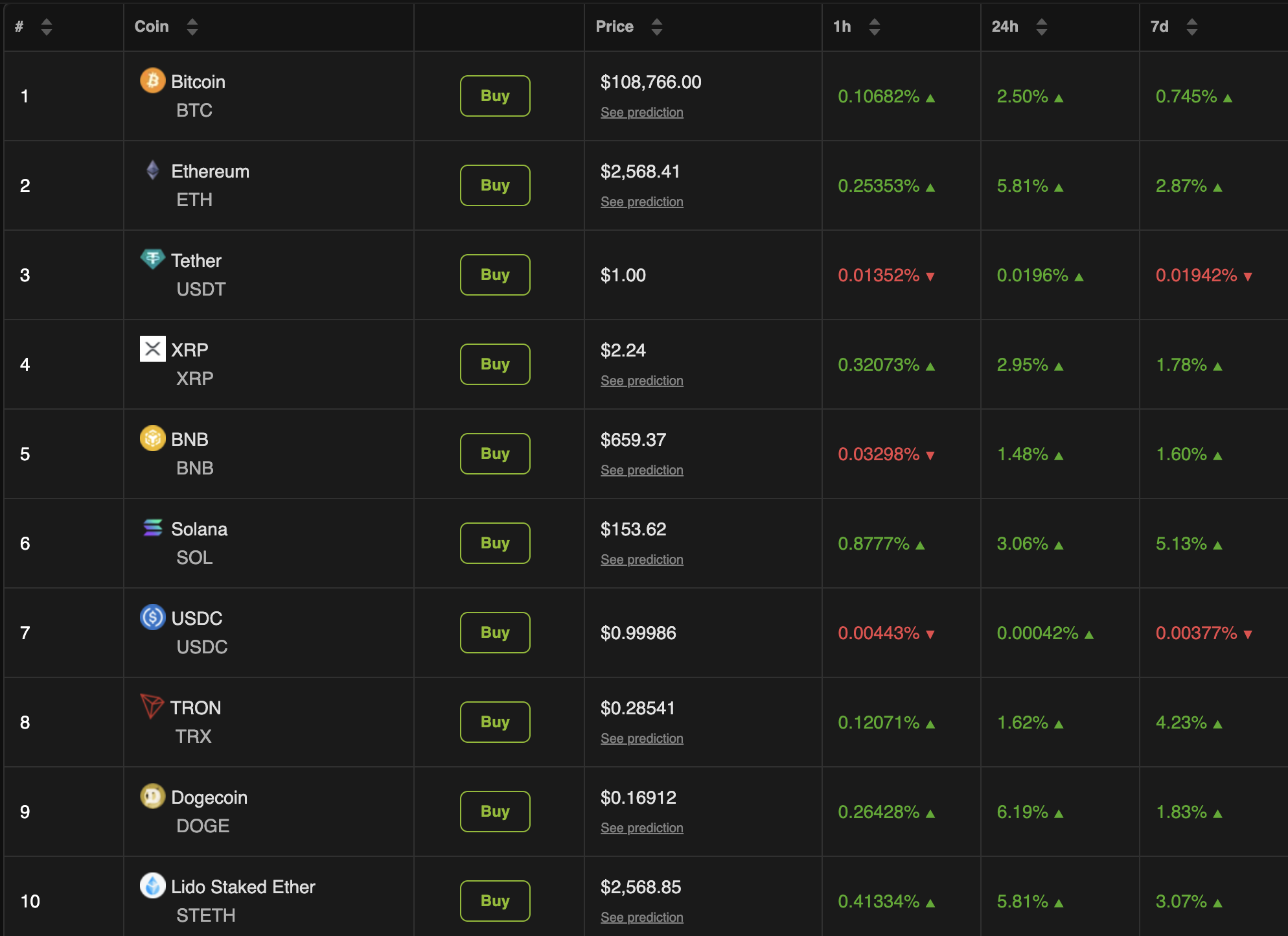

Essentially primarily based on the most contemporary knowledge from BeInCrypto, the market turned green following a rally sparked by eased tariffs on Vietnamese exports. Bitcoin rose 2.5%, reaching $108,766 at press time. Ethereum saw a honest bigger soar, climbing 5.8% to trade at $2,568.

On the opposite hand, this market surge didn’t bode nicely for transient sellers. Qwatio failed to private up for the rebound amid his high-leverage bets. This led to cascading liquidations that wiped out indispensable holdings.

Lookonchain knowledge printed that the trader’s leveraged positions had been liquidated 8 separate cases within a 5-hour period. Over the past 10 days, Qwatio’s total losses beget reached over $15 million.

“Gambler Qwatio caught in a savage liquidation storm! He was liquidated 8 cases in 5 hours, with a total of 1,177 BTC($128.3 million) and 34,466 ETH($86.82 million) liquidated,” Lookonchain posted.

The blockchain analytics agency added that the trader uses a high-leverage formulation to bet against the market (shorts) when costs tumble. On the opposite hand, when the market rises, his positions ranking liquidated.

This isn’t the foremost time the trader has confronted big losses. BeInCrypto has previously reported on his recurring struggles on Hyperliquid. General, Qwatio has confronted 15 liquidations with Bitcoin and eight with Ethereum.

In the meantime, Qwatio wasn’t the correct one facing setbacks. Lookonchain reported that one other trader, 0xFa5D, skilled a indispensable blow, dropping over $6.8 million. The day long gone by, he took a protracted design on ETH, which impress him $3.55 million.

“But he wasn’t ready to wander away with a loss — particular to compose it motivate. Splendid 2 hours later, he got here motivate with the 15.66 million USDC and flipped rapid on ETH with 10x leverage,” Lookonchain added.

On the opposite hand, this approach backfired. Barely than recuperating his losses, the trader ended up dropping a further $3.28 million.

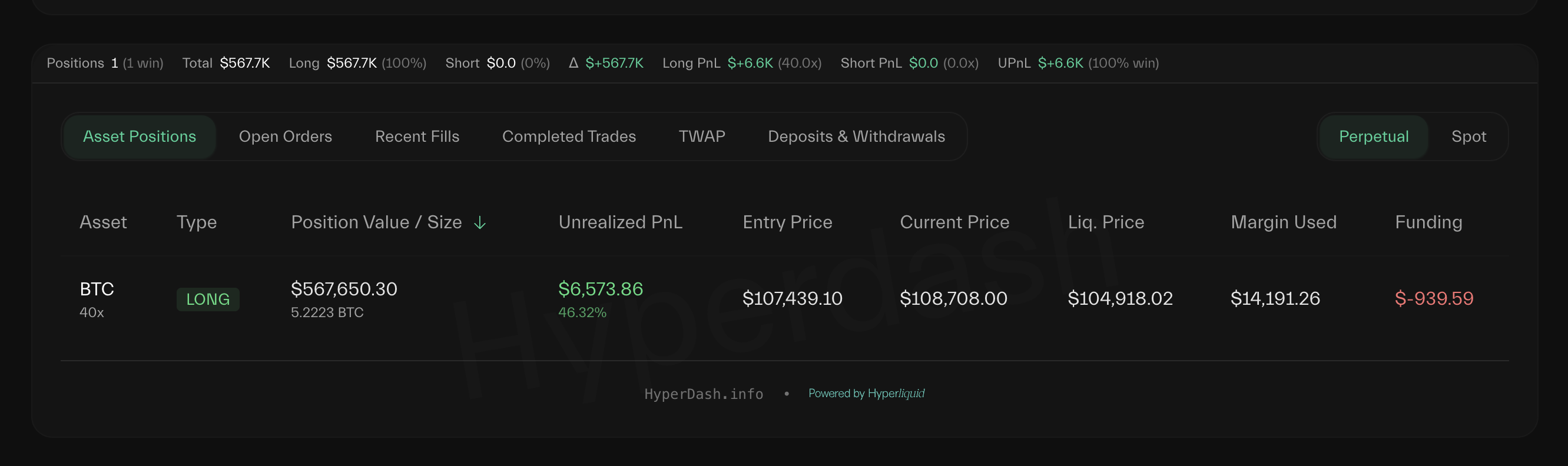

These incidents highlight the dangers linked to high-leverage buying and selling, a distress that one other Hyperliquid whale, James Wynn, knows all too nicely. Wynn has suffered losses exceeding $100 million. No topic this, Hyperdash knowledge unearths that he continues to open unusual positions.

His most up-to-date long BTC design reveals a modest unrealized earnings of $6,573.8, a moving dissimilarity to his earlier $87 million earnings, which he misplaced exclusively.

Nonetheless, some merchants beget capitalized available on the market alternatives. BeInCrypto highlighted a trader who turned $6,800 into $1.5 million, all while avoiding directional bets.