In a lag that will per chance redefine crypto investment within the U.S., a sleek Solana ($SOL) space ETF from REX Shares and Osprey Funds is reportedly position to start trading on Wednesday, July 2, 2025.

The fund, expected to list beneath the ticker $SSK, brings a sleek and worthy twist to the ETF landscape. Unlike old digital asset funds, this one will contain on-chain staking, allowing traders to abet not true from Solana’s mark movement, but moreover from its staking yields.

Per a recent diagnosis from MartyParty on X, this sleek Solana ETF is structured beneath the Funding Company Act of 1940. Here’s a gigantic component, because it scheme the fund can steer certain of the lengthy 19b-4 approval course of that has been required for most other crypto ETFs. This different regulatory structure makes the commence timeline mighty sooner and extra seemingly, doubtlessly growing a sleek blueprint for future altcoin investment automobiles.

#Solana ETF Files: The @REXShares @OspreyFunds Solana ETF with staking, as announced by REX Shares, is reportedly position to start trading on Wednesday, July 2, 2025, consistent with a post on X citing the CEO. This ETF, expected to trade beneath the ticker $SSK, aims to be the first of…

— MartyParty (@martypartymusic) June 30, 2025

Why Is On-Chain Staking a Game-Changer?

The introduction of a staking component is a serious for an enviornment crypto ETF within the U.S. and would be a serious design for traders. It permits for passive revenue technology on high of any mark appreciation, a characteristic that changed into critically absent from the first wave of Ethereum ETFs.

Linked: The Bustle for a Situation Solana ETF Intensifies as European Enormous CoinShares Recordsdata within the US

The fund’s compliance with the 1940 Act moreover areas it inner a extra sleek and regulated framework, which would possibly per chance well attract extra conservative institutional traders. The timing of the commence, coming true after a serious altcoin rally, finest provides fuel to an already hot chronicle surrounding Solana.

ᴛʀᴀᴄᴇʀ, known for calling earlier rallies in tokens esteem $TRUMP and $POPCAT, had predicted a SOL ETF inner 30 days. The affirmation came in precisely one hour after he posted his diagnosis, boosting his credibility among retail and institutional traders alike.

I predicted $SOL ETF all by scheme of subsequent 30 days on this thread.

However it changed into confirmed in precisely AN HOUR after newsletter.

I gave you $TRUMP before 172x, #FARTCOIN before 195x, $POPCAT before 106x and loads extra BILLION alts.

Soon I will part my discover of 100x altcoin peaks.

Then I will… https://t.co/XB9LjI8Dy1 pic.twitter.com/VYEAPJHAGT

— ᴛʀᴀᴄᴇʀ (@DeFiTracer) June 30, 2025

SOL Label Holds Solid

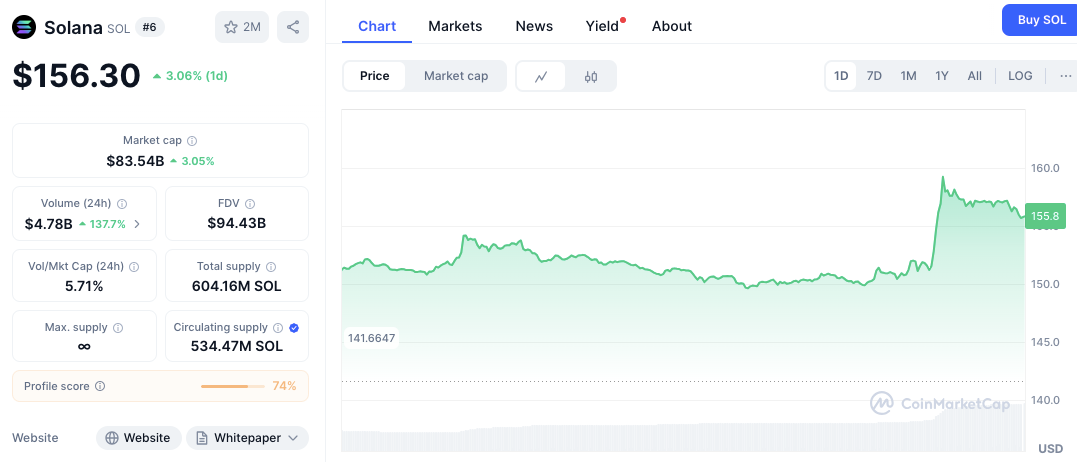

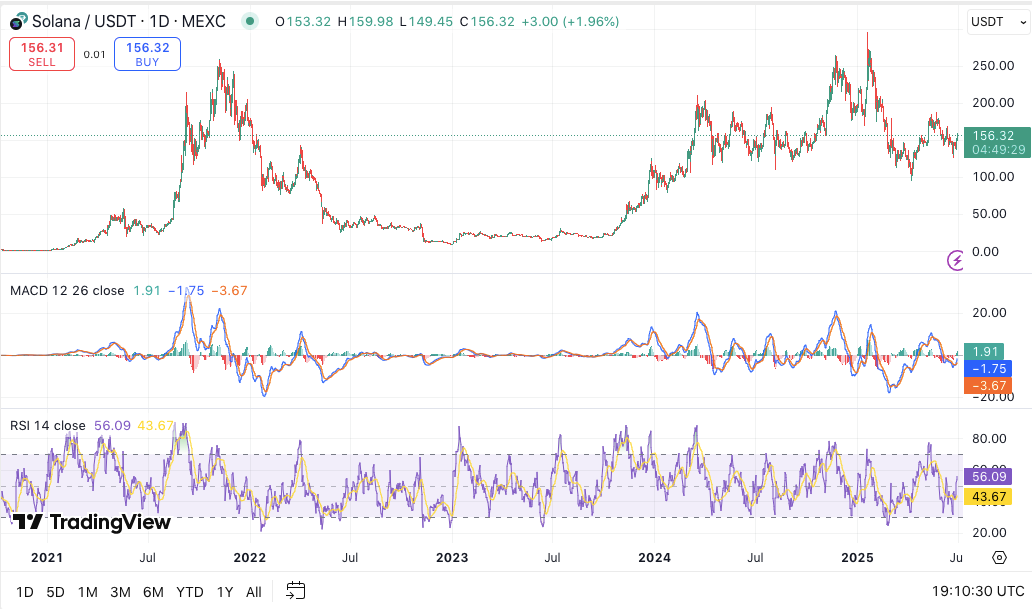

As of press time trading at $155.88, Solana is exhibiting non permanent bullish energy. Earlier within the day, the token hovered arrive $141.66 before pushing bigger. The important thing breakout came about above $160, though prices temporarily pulled abet afterward. Seriously, quantity surged 133.73% over the last 24 hours to attain $4.75 billion, confirming stable market participation.

Strengthen lies at $141.66 and $150.00, while resistance is clearly viewed at the $160.00 ticket. If SOL manages to interrupt above $160 with quantity, extra upside would possibly per chance well note fleet.

Linked: Solana (SOL) Label: Whale Moves, ETF Uncertainty, and Bearish Indicators

Additionally, the MACD true turned bullish. The MACD line rose above the signal line, while the RSI stands at a healthy 55.75, effectively beneath overbought territory. Because of the this truth, there’s room for extra gains if momentum continues.

Disclaimer: The recordsdata presented listed right here is for informational and academic functions finest. The article doesn’t explain financial advice or advice of any model. Coin Version will not be accountable for any losses incurred as a result of utilization of mutter, products, or products and companies talked about. Readers are told to declare warning before taking any action associated to the firm.