The Iran and Israel war came to a end because the United States intervened. Owing to this, protected haven resources like gold and silver saw a decline in costs.

The bias in gold has now changed to sell; alternatively, a retracement would possibly maybe well additionally be expected this week to fundamental key ranges from where merchants can undercover agent to enter extra sell positions. Let’s discuss the fundamental pivot ranges for gold searching for to secure and selling in this weekly forecast from June thirtieth to July 4th, 2025.

Desk of Contents

Key economic occasions of this week

Some fundamental U.S. economic experiences are scheduled for originate this week which shall be expected to affect XAUUSD.

Tue, Jul 1 – Fed Chair Powell Speaks, ISM Manufacturing PMI, JOLTS Job Openings

- Powell’s speech would possibly maybe well additionally amplify volatility because hawkishness would possibly maybe well additionally hurt gold whereas dovishness would possibly maybe well additionally weaken the USD and amplify gold.

- Despite being marginally higher than expected, the ISM Manufacturing PMI aloof signifies contraction, which affords some minor improve for gold.

- Gold upside would possibly maybe well additionally be constrained by labor market resiliency, as evidenced by stronger-than-expected JOLTS job postings.

Wed, Jul 2 – ADP Non-Farm Employment Replace

Labor market energy is indicated by a stable beat in ADP jobs statistics (105K vs. 37K). As rate hike expectations are renewed, this could perchance well additionally toughen the USD and effect stress on gold.

Thu, Jul 3 – Life like Hourly Earnings, Non-Farm Employment Replace, Unemployment Payment, ISM Providers and products PMI

- Gold is appreciated by weaker NFP (120K vs. 139K) and slower wage increase (0.3% vs. 0.4%), which issue cooling labor and inflation.

- Further evidence for this story comes from a elevated unemployment rate (4.3% vs. 4.2%).

- Gold would possibly maybe well additionally beget elevated upward momentum as concerns about an economic slowdown amplify if the ISM Providers and products PMI likewise displays weak point.

Read more: XAUUSD weekly forecast: $3600 subsequent target for gold?

Gold HTF Overview

On the present time is the final day of June, that diagram that the month-to-month shut would possibly maybe well additionally settle where July can rob the value of gold. Right here we are able to ogle that the value has already swept the excessive of Would possibly well perchance well 2025, and $3122 low is now pending. A red month-to-month candle shut can rob gold to $3122; alternatively, a honest true bullish shut can push it again to test $3441.

XAUUSD 1m chart – Source: Tradingview

Gold Forecast for June thirtieth to July 4th, 2025

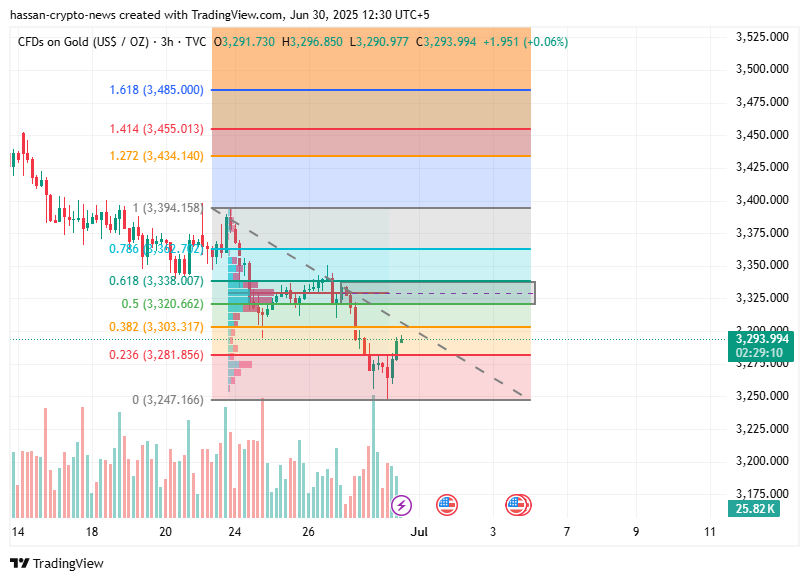

The with out a doubt zone to short gold is the $3320-3337 diploma, ensuing from the POC, breaker block, and the golden fib diploma on the 3h timeframe.

XAUUSD 3h chart – Source: Tradingview

Within the meantime, the closest diploma in the 30m chart of gold for selling is at $3301-3313. Right here we are able to ogle how the value has broken its improve and now it is performing as resistance.

XAUUSD 30m chart – Source: Tradingview

Famous searching for to secure in gold is now expected from the $3232-$3202 diploma, which is a 4h notify block and FVG in gold.

XAUUSD 4h chart – Source: Tradingview

Read more: Goldman Sachs scraps recession forecast as Trump pauses tariffs

Shopping and selling Recommendations & Funding Recommendation

To form, gold can give both buys and sells this week. Lower time frames are suggesting sells, whereas elevated time frames are aloof favoring a aquire remark in gold.

Resistance Levels

- $3301-3313 – improve grew to develop into resistance

- $3320-3337 – POC, breaker block, and golden fib diploma

Crimson meat up Levels

- $3232-$3202 – 4h notify block and FVG

Disclosure: This text does not signify funding recommendation. The bid and affords featured on this page are for tutorial purposes totally.