Bitcoin has come an effective procedure from merely being a financial experiment to changing steady into a in point of fact necessary store of imprint. Currently sitting at a six-resolve valuation, the flagship cryptocurrency has accrued a horde of merchants who actively earnings from its directional actions.

No topic all its boost, Bitcoin’s imprint action silent stands influenced by moments of frenzy, wretchedness, and additionally warning in merchants. On the 2nd, on-chain data aspects out that Bitcoin could per chance be at a portion the set warning is the articulate of issues. Here are the facts of this revelation.

90-Day CVD Shifts To Fair After Prolonged Traits

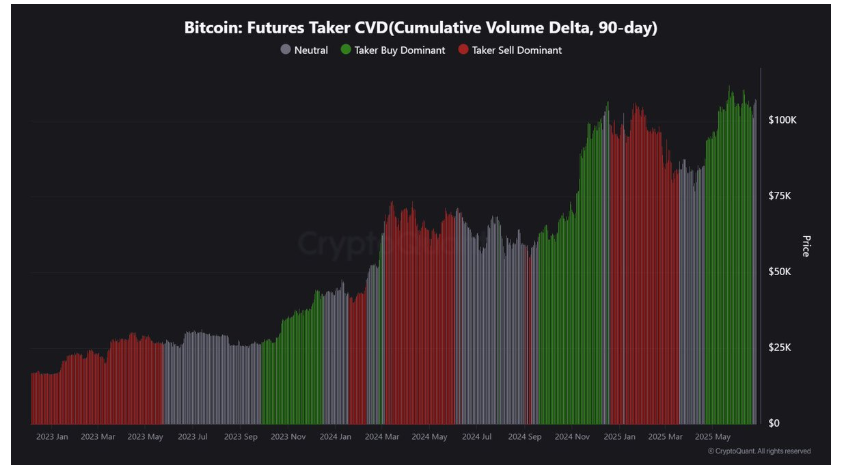

In a June 27 put up on X, the social media platform, crypto analyst Maartunn revealed that there has been a in point of fact necessary shift in a in point of fact necessary metric. The connected indicator right here is the 90-day Futures Taker Cumulative Volume Delta (CVD) metric, which tracks the fetch buying or selling stress in BTC’s futures market.

A sure and rising imprint of the metric usually come that the futures market is dominated by the shoppers (Taker Buy Dominant). On the assorted hand, when the indicator is negative, it come that the futures market is being dominated by the instant merchants (Taker Sell Dominant).

In the put up on X, Maartunn identified that the scorching 90-day CVD is flat, which signifies a balance between bullish and bearish forces available within the market. Whereas the Bitcoin imprint will possess confirmed right signs of recovery, this portion of on-chain data suggests that the market leader could per chance return to a consolidation fluctuate.

Bitcoin Fright And Greed Index At Fair Ranges

In a single other June 27th put up on X, crypto analytics firm Alphractal made an on-chain declare, which shares the same implications with Maartunn’s tell. Alphractal’s revelation turned into as soon as in retaining with the Bitcoin: Fright and Greed Index Heatmap metric, which tracks the market sentiment shift — from outrageous wretchedness to outrageous greed — over time.

The metric ranges with values from 0 to 100. The fluctuate 0-24 indicators outrageous wretchedness available within the market; 25-49 reads as wretchedness, while 50 is interpreted as a just level, the set there’s a balance between each market sentiments. On the assorted side of the spectrum, ranges 51-74 impress greed available within the market; 75-100 signifies outrageous greed available within the market, exhibiting current optimism that usually precedes market tops.

In retaining with data from Alphractal, the Fright and Greed Index is at 65, which is silent removed from the +90 ranges seen in November and December 2024. This balance between the shoppers and sellers could per chance imply that the market could per chance be expecting a catalyst, treasure macro data or on-chain traits, to fetch a breakout to both side of the market.

Resulting from the scorching uncertainty, merchants are informed to tread with warning available within the market. As of press time, Bitcoin is valued at about $107,143, with the cryptocurrency losing roughly 0.11% within the past 24 hours.

The associated charge of BTC on the on a typical foundation timeframe | Source: BTCUSDT chart on TradingView