Ethereum (ETH) is facing a mixture of reasonably low costs and elevated utilization. The network is carrying a near-report stage of transactions, while over 30% of the availability is locked.

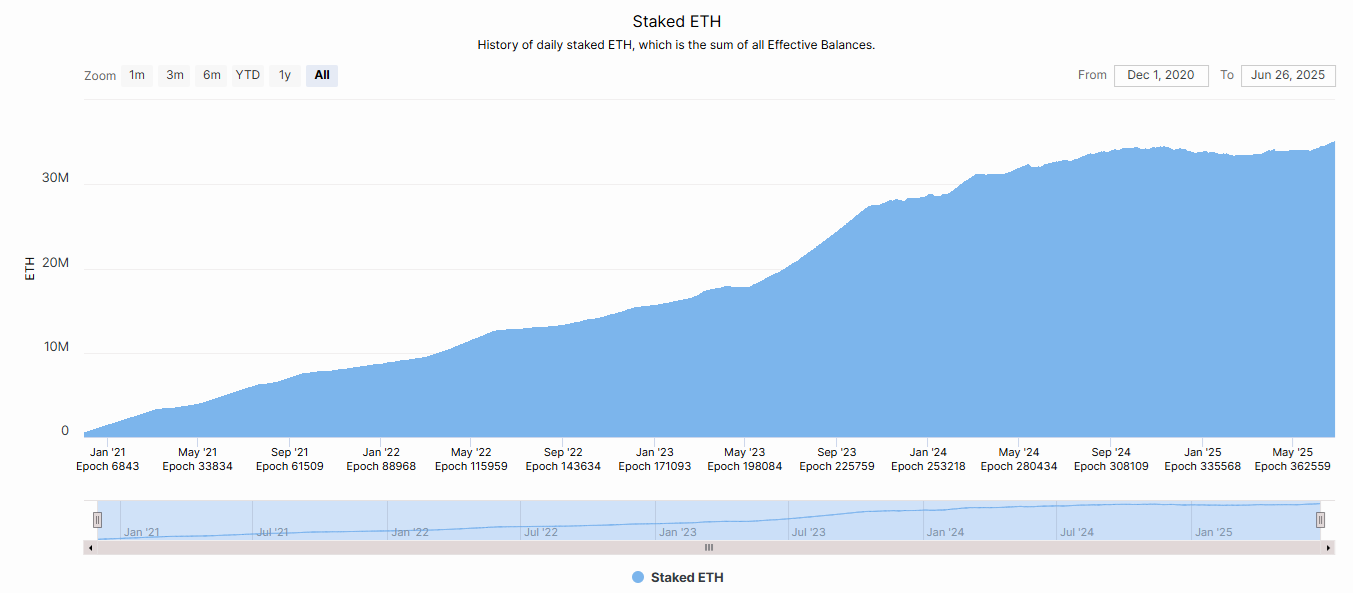

Ethereum (ETH) retains building up a provide crunch, essentially essentially based totally on whale holdings and elevated staking. Currently, round 30% of the availability is staked, with highly filled with life inflows in the past few months. Bigger than 35M ETH is staked on the Beacon chain, an all-time high. The vogue for staking would possibly per chance honest proceed, as ETFs are also allowed to consist of staking for passive profits.

After some outflows from the staking contract in some unspecified time in the future of the market alarm in March and April, Ethereum staking returned to height ranges, no longer viewed since September 2024. ETH staking grew to change into one among essentially the most legit markers for prolonged-timeframe self perception in the network’s tag.

Following the Pectra upgrade, staking also accelerated as trim-scale whales would possibly per chance deposit more ETH at a time to own their stake. Which skill that, the total tag staked on Ethereum is at an all-time high.

The Ethereum network carries over $61B locked in DeFi protocols, including lending, liquid staking, and DEX liquidity pools. ETH remains precious as collateral, and whales are in no speed to promote.

Extra ETH is wrapped in more than one protocols and is taken off the originate market. Whales own also shown elevated process, adding on life like 800K ETH per day for the previous week, while handiest 16K unusual ETH are produced each week. Whales are showing unheard of ranges of accumulation, boosting the story of a prolonged-awaited tag breakout.

ETH alternate reserves remain scarce, at round 19M tokens. ETFs are also actively taking a survey, with BlackRock honest honest lately titillating the stake sold by Grayscale. ETH is also changing into splendid to company merchants as a collateral asset.

The Ethereum network also awaits a unusual upgrade, which would possibly per chance further scale and speed up transactions. With out reference to the reasonably high tag when compared with other networks, Ethereum remains a key platform for DeFi. Based on natty contract process, the network’s valuable exhaust cases are ETH transfers, while USDT and USDC remain about a of the busiest natty contracts.

ETH remains undervalued with volatile trading

The contemporary intention of ETH is elevating expectations for a catch-up rally. Trading below $2,500, ETH is viewed as undervalued, regardless of the height on-chain process. Transactions were mountaineering for Ethereum right via 2025, reaching a better baseline, with the occasional day of anomalous report process.

With out reference to this, the ETH market tag remains end to its lows, aloof crashing after each breakout. In June, ETH failed to reclaim the $3,000 stage. The token is down round 5% in June, though Q2 would possibly per chance honest pause with critical gain features. ETH expanded by 31.8% in Q2, largely pushed by the height features in Can even.

The more than one bullish components for ETH are aloof no longer ample to spark a more decisive rally. In June, there would possibly be aloof an expectation for a breakout, where ETH can rally as high as $10,000. Even with out a rally, Ethereum has shown it is no longer a silly chain. Not too prolonged in the past, the network drew in over $334M in day-to-day gain inflows from bridges, as tag returned to the largest liquidity hub.