Solana (SOL) and Avalanche (AVAX) were top performers in 2021 and 2023, offering a more scalable answer to Ethereum (ETH). Each ecosystems grew from a couple of million to billions of greenbacks in capitalization, rewarding crypto investors who embraced the alternative.

Now, as know-how evolves, new funding alternatives surge in the cryptocurrency landscape via yet low-capitalized improved technologies.

Namely, Radix (XRD) looks as a promising contender amongst layer-1 cryptocurrencies taking a peep at decentralized finance (DeFi) and Web3 solutions. Radix is portion of a neighborhood of chains the utilization of sharding to scale their ability whereas maintaining decentralization and security.

Numerous ‘sharded’ chains are MultiversX (EGLD), Discontinuance to (NEAR), Sui Network (SUI), and Toncoin (TON), to reveal a couple of. Particularly, XRD at the moment has the lowest capitalization amongst these opponents, with lower than $1 billion in market cap.

Radix (XRD) elementary prognosis

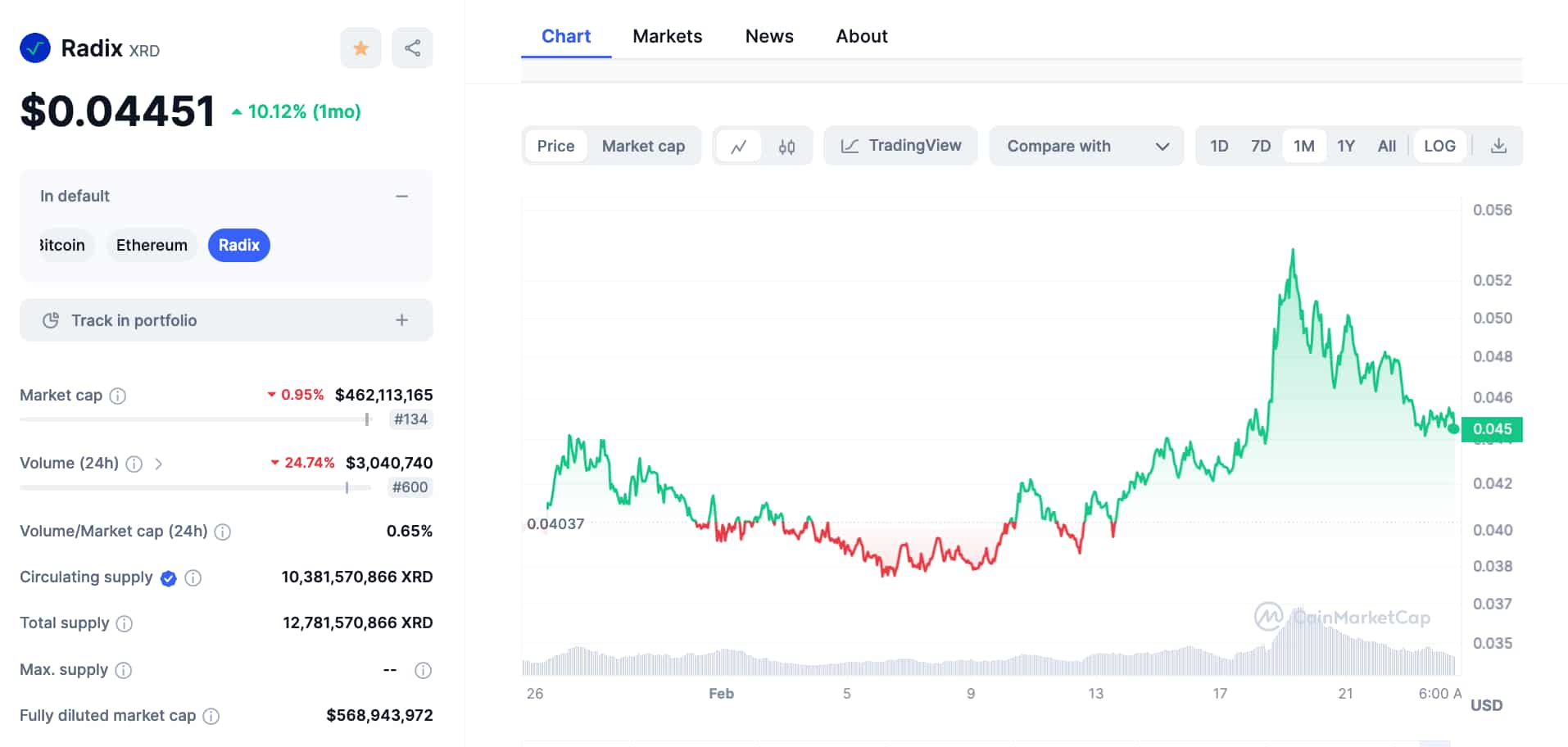

From a elementary prognosis point of view, Radix is a $462 million cryptocurrency, trading at $0.044. The DeFi-focused project has 10.38 billion XRD circulating out of the 12.78 billion total present. This makes XRD a low-inflation token, at spherical 2.5% yearly, issued via the proof-of-stake mechanism with native delegation.

In the past, we’ve considered memecoins enjoy PEPE surpassing the $1 billion market cap zone in a couple of days. Almost definitely positioning Radix at a discount appealing on its explain-fixing talents with lower than half of of this ticket.

On that prove, Radix thrives as one among the most revolutionary technological stacks in DeFi. Its asset-oriented model prevents pockets-draining hacks, total in tasks corresponding to or effectively suited with the Ethereum Digital Machine (EVM).

Moreover, Radix’s pattern language, Scrypto, and its consensus algorithm, Cerberus, guarantee easy onboarding for developers, plus atomic-composability for the sharded transactions the network processes.

Radix (XRD) technical prognosis

In the intervening time, the weekly chart suggests XRD as a attention-grabbing crypto funding alternative for traders who skipped over SOL, AVAX, and others.

Here’s attributable to a present breakout from a yearly downtrend, coinciding with a breakout from the 20-week exponential transferring moderate (EMA). Curiously, Radix went from $0.05 to above $0.15 per token the closing time it came about.

A ticket action mirroring this old exercise would put XRD at $0.1 per token for a nearly 125% in discovering. Additionally, this would comprise Radix overcome the $1 billion capitalization tag. Unruffled, l lower than 10 times what Solana and Avalanche get whereas fixing linked concerns from both networks.

It is price pointing out both SOL and AVAX went via main network outages in 2024.

In conclusion, Radix might maybe very effectively be a promising crypto alternative for investors pondering about DeFi. It has a rising ecosystem with decentralized exchanges, lending protocols, having a wager, and even a preferred memecoin known as HUG.

Alternatively, XRD is a low-cap and low-liquidity cryptocurrency, which exposes investors to risks. On account of this reality, caution is a truly great when investing and speculating in these experimental tasks.

Disclaimer: The whine on this option ought to no longer be regarded as funding recommendation. Investing is speculative. When investing, your capital is at threat.