Right here’s a section from the 0xResearch newsletter. To learn fat editions, subscribe.

Banks take in deposits to make investments a share in riskier, illiquid assets — that’s how they build money.

This “borrow rapid, lend prolonged” replace model is in any other case identified as fractional reserve banking. As prolonged as no longer each and every depositor wants their money valid now, all individuals’s at ease!

When crisis mode hits and users slump for the exits, the risk devices of banks are establish to the take a look at.

At the guts of the narrate is non-transparency round a bank’s liabilities and available in the market assets. It’s doubtless you’ll per chance theoretically steer definite of this narrate if that records was as soon as considered, as you are going to curate your personal risk devices.

Enter infiniFi, a brand fresh DeFi protocol on Ethereum that targets to repeat the total stack of fractional reserve banking onchain.

How it in fact works:

- Users deposit stablecoins for iUSD receipt stablecoin.

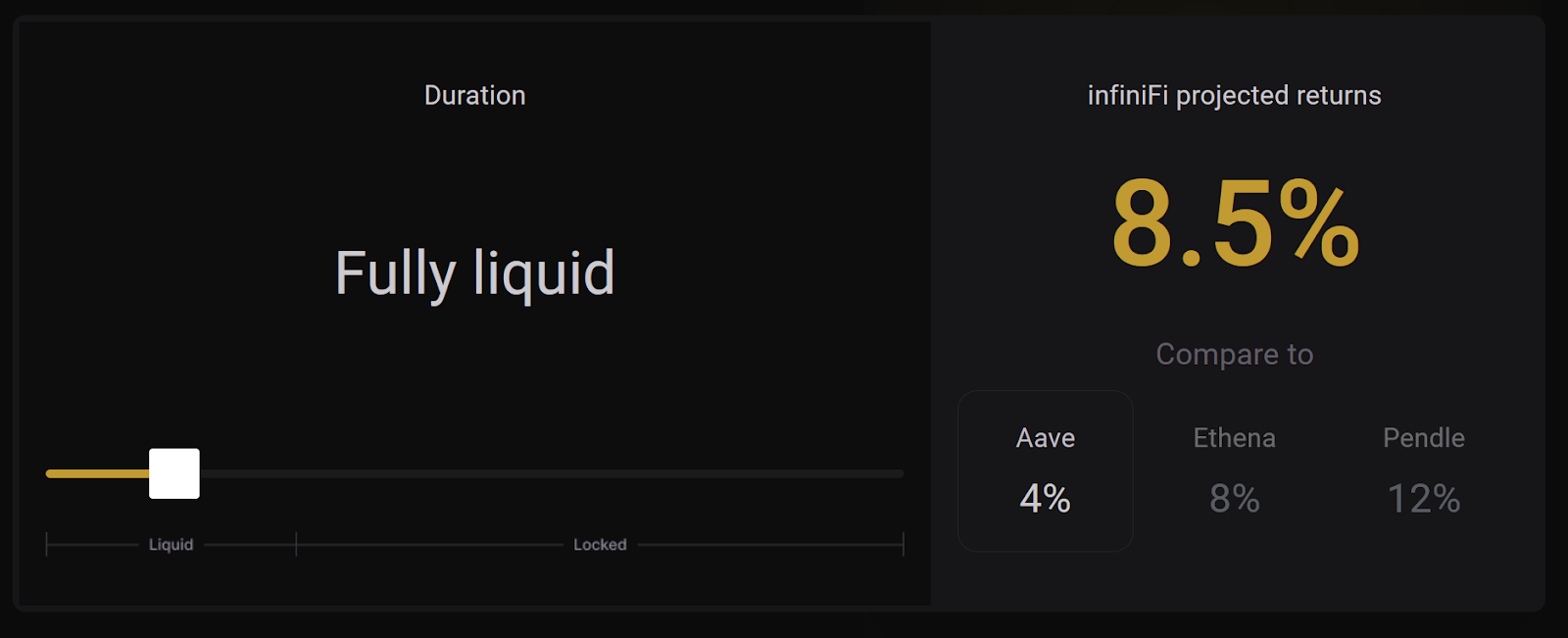

- For lower risk yield, stake iUSD for siUSD. Right here is liquid.

- For better risk yield, lock up iUSD for liUSD. Right here is illiquid.

Now the “fractional reserve banking” narrate is available in the market in.

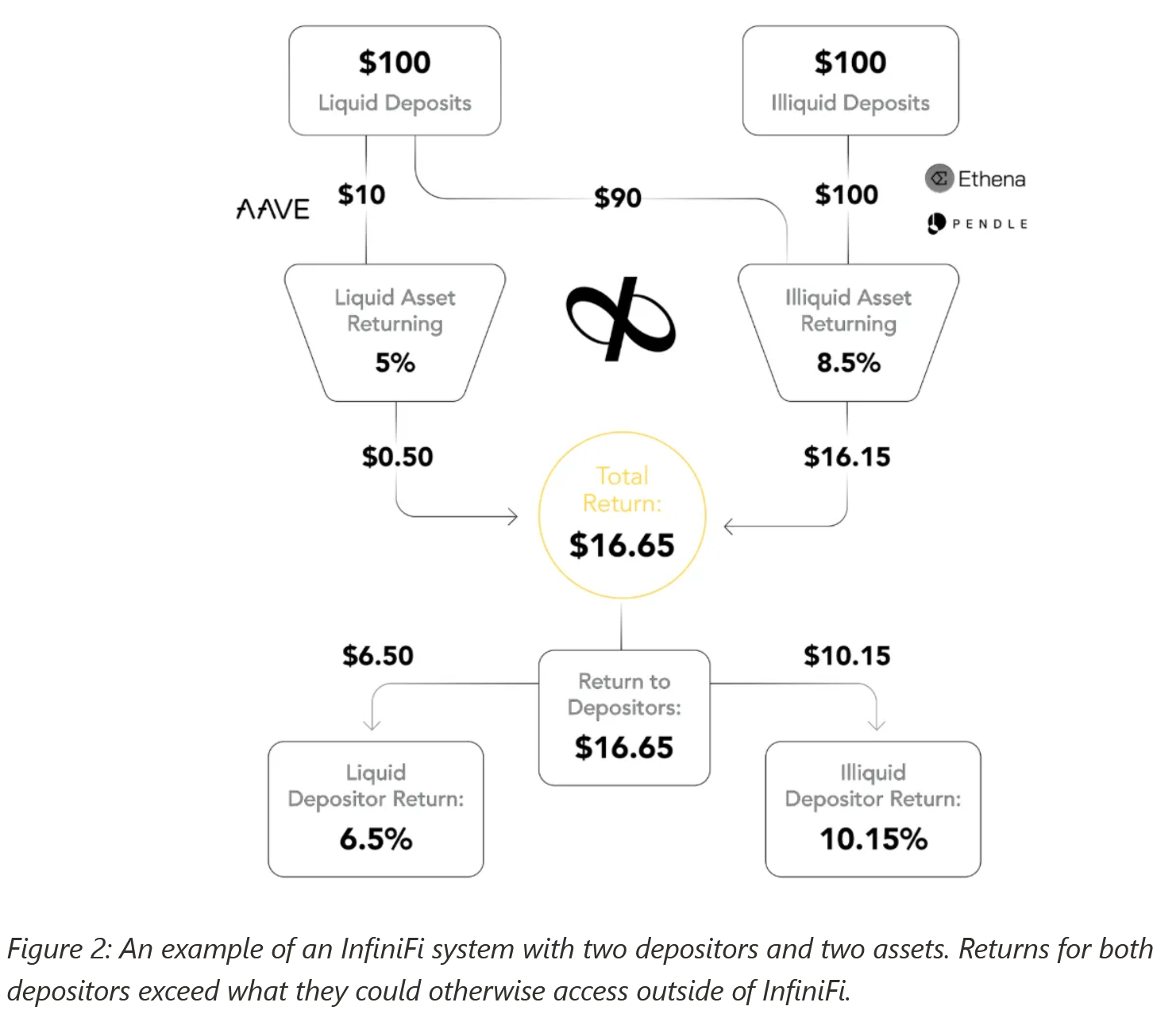

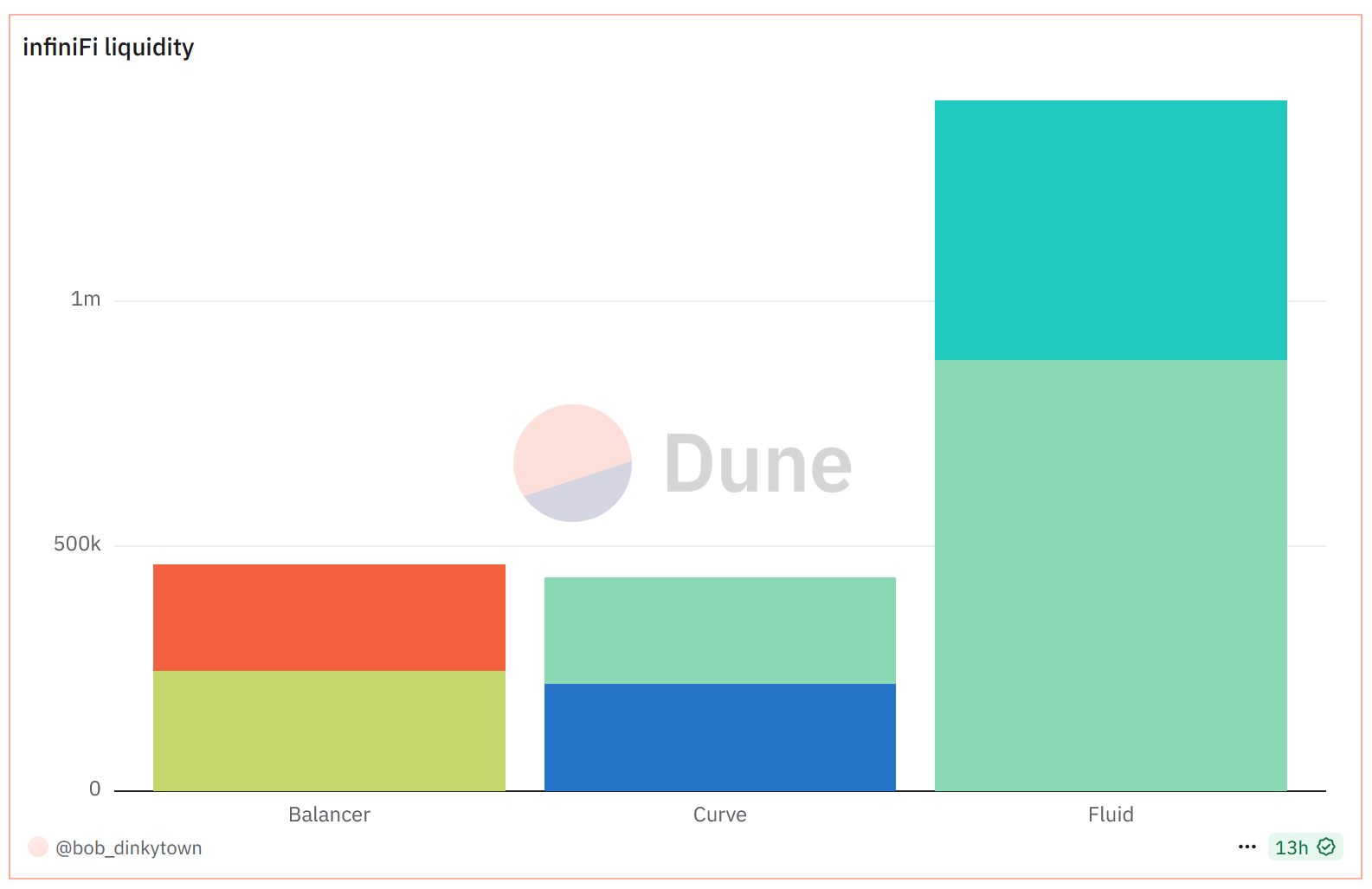

InfiniFi deploys the liUSD liquid tranche capital into lower risk return money markets luxuriate in Aave or Fluid, while optionally deploying the siUSD illiquid tranche into better risk return options. (Governance will sooner or later decide these decisions.)

That individual ratio is knowledgeable by the demonstrated preferences of depositors and which yield alternate options they decide out (siUSD vs liUSD).

The grisly-sum end result? InfiniFi will get to distribute amplified yields for both teams of depositors than in the occasion that they’d pursued their options for my share.

Offer: infiniFi

In step with infiniFi’s internet situation, whether you’re choosing a liquid (siUSD) or locked (liUSD) yield, you rep a relatively superior yield than the underlying protocol.

It’s a excellent replace model.

Nonetheless what infiniFi is doing in itself — borrowing rapid and lending prolonged — isn’t all that various from what banks on the total enact.

The innovation comes from the truth that the total stack is on the blockchain.

That’s how you, as a consumer, can sleep with out problems at evening — you admire your bank isn’t pulling a Sam Bankman-Fried and pursuing unchecked leverage in opposition to basically the most illiquid assets.

InfiniFi’s reserve composition is entirely transparent onchain, so you don’t have to depend on a quarterly name represent.

It’s doubtless you’ll per chance with out problems behold up USDC deposits and iUSD tokens minted in opposition to it to discover its actual asset-liability mismatch, if any.

It’s doubtless you’ll per chance moreover search for a breakdown of the protocol’s yield options, or whether the protocol is abiding by its liquidity buffers — down to the quantity and grace of assets they’re made up of.

In the tournament of a hack or “bank slump,” an explicitly coded loss waterfall will decide who will get paid in uncover.

Essentially the most tasty-yield and locked liUSD token holders are first in the firing line, intriguing losses first.