Crypto attorney John E. Deaton has reignited hypothesis just a few doable Ripple Preliminary Public Offering (IPO), arguing that the profitable public debut of digital asset firm Circle has supplied a obvious benchmark for what Ripple shall be value. His prognosis suggests that if Circle can account for its excessive valuation, a $100 billion valuation for a Ripple IPO shouldn’t be any longer “far-fetched.”

Deaton’s commentary companies on an prompt comparability of the two companies’ monetary strengths, emphasizing that Ripple’s big XRP holdings give it a foremost support.

I know @bgarlinghouse said @Ripple is NOT in a speed to head public. They completely don’t must boost capital, which is in overall, a foremost motive to head public. However TIMING an IPO is truly a mountainous consideration. If @circle can hit a 62B-75B market cap then @Ripple, with almost about 40B XRP,… https://t.co/MSFNMy6i8E

— John E Deaton (@JohnEDeaton1) June 23, 2025

The Circle IPO as a Valuation Benchmark

The core of the argument hinges on a straightforward comparability of market value. Circle, the issuer of the USDC stablecoin, has carried out a landmark public valuation, environment a brand unusual precedent for a system digital asset companies are valued in public markets.

Deaton’s seize is that if the market values Circle at its present diploma, then Ripple, which possesses a essentially elevated and extra treasured balance sheet thru its tall token holdings, would possibly possibly perchance well also logically account for an very excellent greater valuation if it win been to head public.

Ripple’s Financial Firepower

To present a steal to this case, the prognosis points to Ripple’s believe treasury. Ripple currently holds almost about 40 billion XRP, which, at a trading value of $2.15, interprets to a valuation of spherical $80 billion. This estimate is in response to this day’s value and XRP’s circulating provide of 59 billion tokens. Notably, XRP’s market cap has now reached over $116 billion, underlining its situation as a dominant force within the crypto sector.

This tall balance sheet plan Ripple shouldn’t be any longer in urgent want of elevating capital, allowing it to time any doable IPO strategically. Nonetheless, the success of alternative crypto-related IPOs has made the prospect of a public checklist extra wonderful.

XRP Market and Technical Context

This excessive-diploma valuation dialogue is taking position in opposition to the backdrop of a cautious XRP market. The value of XRP is currently trading at $2.15, up 5.90% within the leisure 24 hours nonetheless aloof down 4.5% over the past seven days.

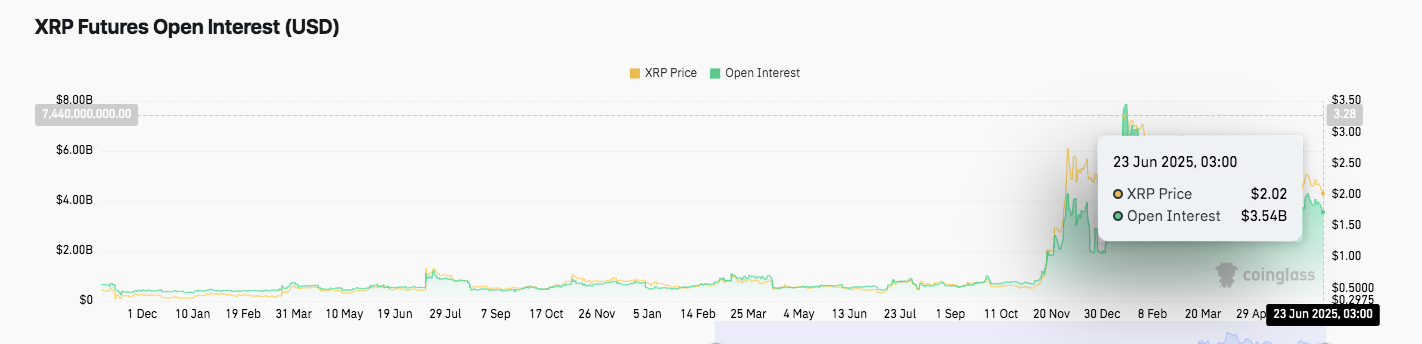

The XRP Futures Open Hobby files provides deeper insights into market habits. Open Hobby remained below $2 billion for a total lot of of 2024.

However in gradual November, it surged all of a sudden, reaching $7.44 billion by early 2025. This amplify mirrored XRP’s bullish value rally. As of June 23, Open Hobby stands at $3.54 billion properly above pre-rally ranges indicating sturdy trader involvement.

Nonetheless, whereas trader hobby remains excessive, technical indicators counsel warning. The Relative Energy Index (RSI) at 32.68 signals that XRP is coming near near oversold territory. Historically, such ranges win induced vital rebounds in value.

Whereas the MACD indicator currently suggests detrimental momentum, with every traces below zero, weakening bearish stress hints at that you just would possibly possibly also own shifts. Additionally, the fixed engagement in futures trading shows traders are aloof positioning for extra volatility, or presumably a recovery.

Disclaimer: The solutions presented listed right here is for informational and tutorial capabilities most attention-grabbing. The article does no longer constitute monetary advice or advice of any form. Coin Version shouldn’t be any longer to blame for any losses incurred as a results of the utilization of affirm, merchandise, or companies mentioned. Readers are suggested to exercise warning forward of taking any action related to the firm.