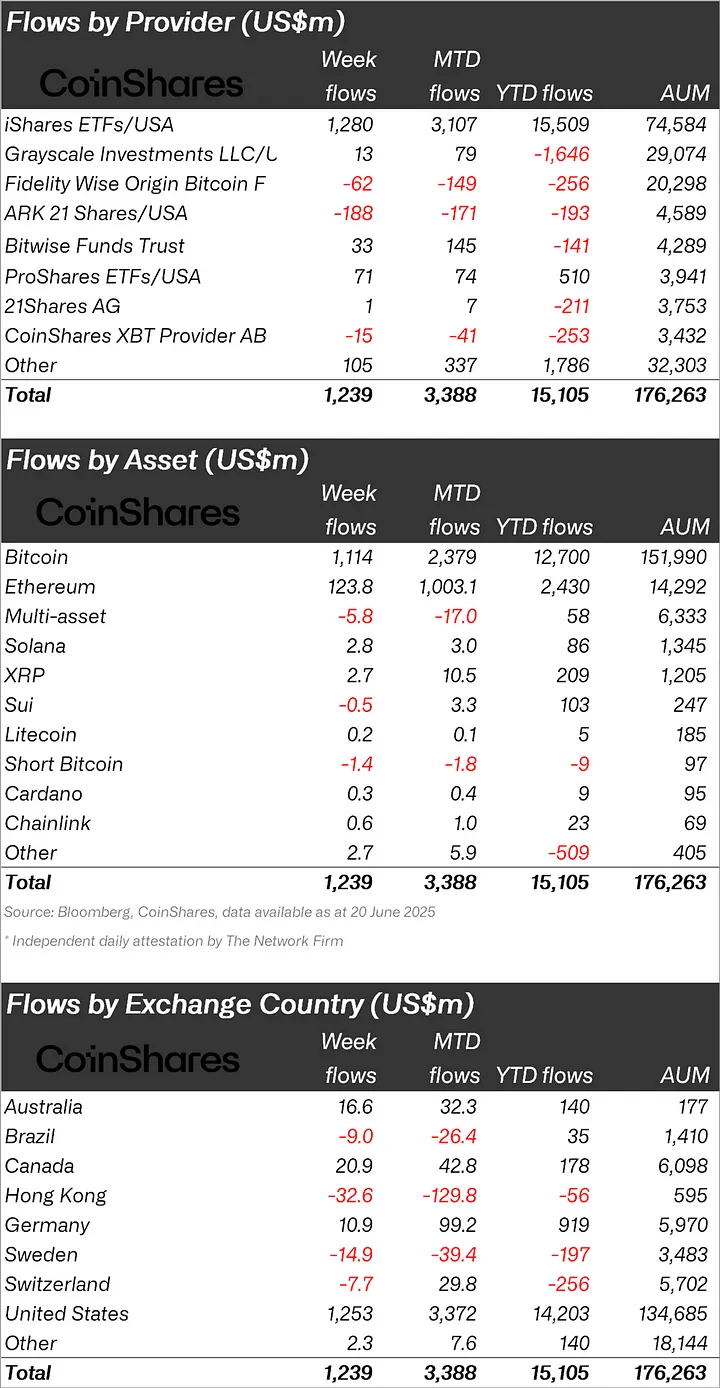

As Bitcoin and altcoins continue to be negatively struggling from tensions between the US, Israel and Iran, Coinshares launched its weekly cryptocurrency file and stated that $1.24 billion in inflows took place final week.

“While $1.24 billion price of inflows had been made to cryptocurrency funding products for the 10th consecutive week, inflows because the beginning of the twelve months reached a memoir stage of $15.1 billion.”

Bitcoin Becomes the Focal level All over again!

When taking a look at particular particular person crypto funds, it used to be considered that nearly all of inflows had been in Bitcoin.

While BTC experienced an inflow of $1.14 billion, certain sentiment also dominated Ethereum (ETH), with an inflow of $123.8 million.

When we glance at other altcoins, XRP experienced an inflow of $2.7 million, Solana (SOL) experienced an inflow of $2.8 million, and Sui (SUI) experienced an outflow of $0.5 million.

“Bitcoin noticed its second consecutive week of inflows totaling $1.1 billion despite the contemporary designate correction, suggesting investors are shopping for on weak point.

Ethereum has recorded its Ninth consecutive weekly inflow, totaling $124 million, bringing the cumulative total of this slump to $2.2 billion. This marks the longest inflow slump since mid-2021 and reflects continued tough investor sentiment in opposition to the asset.

Various essential inflows had been Solana ($2.78 million) and XRP ($2.69 million).

When taking a look at regional fund inflows and outflows, the USA ranked first with an inflow of 1.25 billion bucks.

After the USA, Canada had an inflow of $20.9 million and Germany had an inflow of $10.9 million.

Against these inflows, Hong Kong had an outflow of $32.6 million and Sweden had an outflow of $14.9 million.

*This is no longer funding advice.