The crypto financial system has dipped 1.08% in the previous 24 hours, pulling help to $3.16 trillion as bearish vibes rippled throughout the web site online and bitcoin touched an intraday low of $102,220. At the identical time, tensions between Israel and Iran stay escalated with extra strikes exchanged, marking the second week of ongoing war in the Center East.

Markets on Edge: Trump Weighs Moves, BTC Skids, and Liquidations Upward thrust

On Saturday, June 21, 2025, CNN reported original strikes in the continuing clash between Israel and Iran. The outlet also mentioned that U.S. President Donald Trump is brooding about his subsequent transfer, while a replacement of B-2 bombers devour departed from the Missouri Air Power Snide.

CNN printed that the Israel Defense Forces (IDF) reported the Israeli Air Power shot down three Iranian F-14 fighter jets on Saturday. IDF spokesperson Ephraim Defrin stated that the militia also focused radar detection programs and missile defense batteries in Iran’s western internet 22 situation.

The newsletter extra accepted that Defrin told reporters the action used to be allotment of a mighty wider push to place keep watch over of Iran’s skies. With a cloud of uncertainty hanging overhead, U.S. equities wrapped up the week with a mixed salvage of results.

At Friday’s closing bell on Wall Boulevard, the Nasdaq dropped 0.51% to 19,447.41, the NYSE ticked down 0.16% to 19,868.36, and the S&P 500 eased 0.22% to 5,967.84.

The Dow Jones (DJIA), on the replacement hand, nudged upward by a slim 0.08% to settle at 42,206.82. Despite essentially ice climbing all through geopolitical tensions, gold has stayed peaceable—slipping 0.08% in the final day and down correct over 2% for the week, now priced at $3,368 per ounce.

Silver will likely be in the crimson, falling 1.9% on Saturday and nil.82% over the week to land at $36.01 per ounce. The crypto market isn’t escaping the gloom either. Valued at $3.16 trillion, the web site online has shed extra than a elephantine percent.

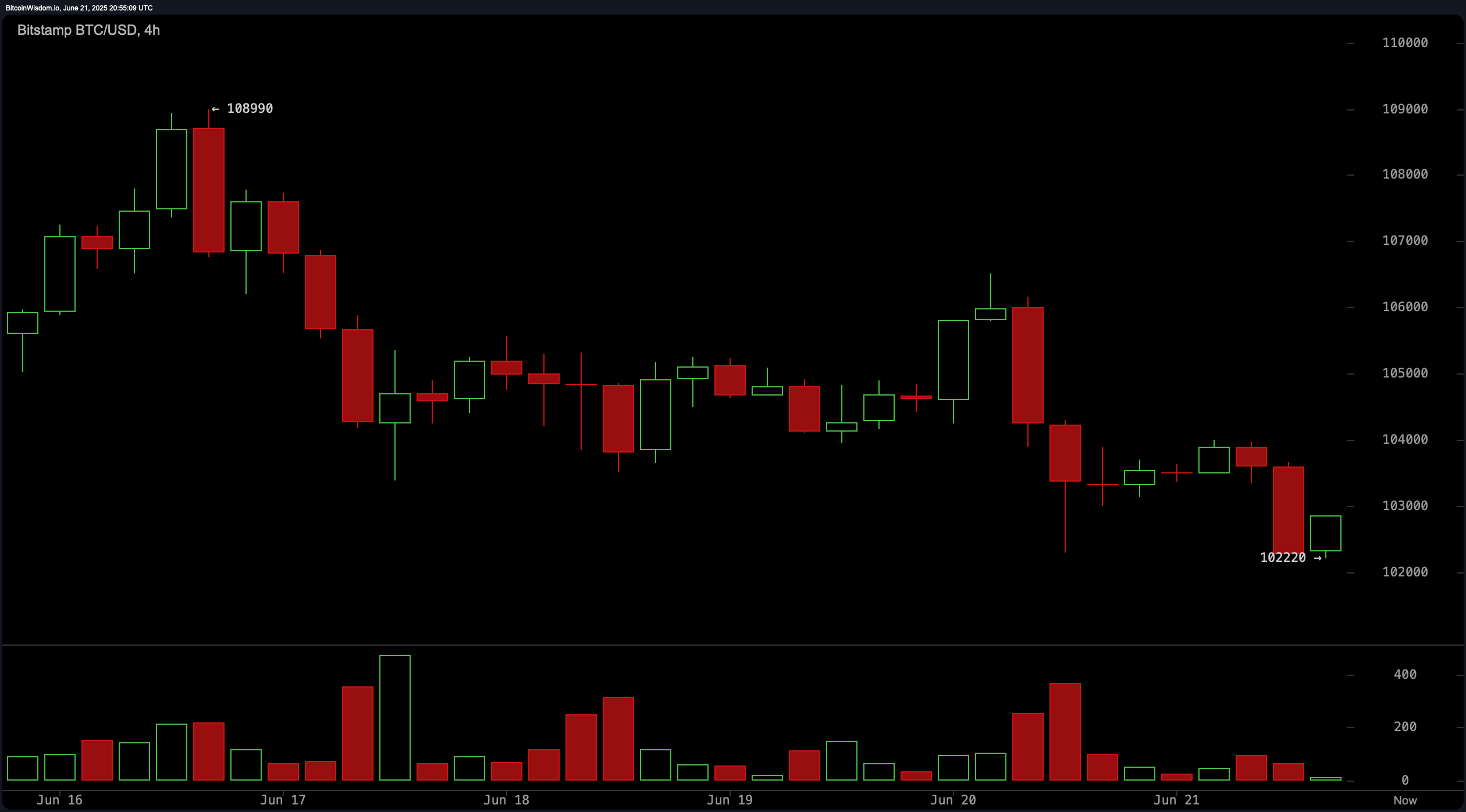

Bitcoin (BTC), the tip digital asset by market cap, slid to a Saturday low of $102,220 and has misplaced 1% in the previous 24 hours. Over the route of the week, BTC is down 2%. Ethereum ( ETH) took a extra great hit, losing 1.45% this day and down 4.5% for the seven-day stretch.

Roughly $190.13 million in crypto derivatives positions had been worn out correct throughout the last 24 hours, at the side of $27.23 million in lengthy bets. A heftier $42.57 million in ETH longs met the identical fate, while altcoins had been hit with predominant promote-offs all throughout the identical stretch.

An total of 92,899 traders had been liquidated, with the ideal single hit coming from HTX—a $4.74 million ETH- USDT website online. In the period in-between, after tumbling to $102,220 per unit, BTC is now cruising at $102,635 per coin correct ahead of 5 p.m. Jap time.

As worldwide markets battle through a mixture of geopolitical tension and investor jitters, traders appear to be treading cautiously all over all asset classes. The interaction of worldwide war and shifting sentiment has left crypto, treasured metals, and equities alike navigating uneven waters.

With uncertainty lingering, contributors will be staring at carefully for signals—political or financial—that could well perhaps shape the arrival week’s route.