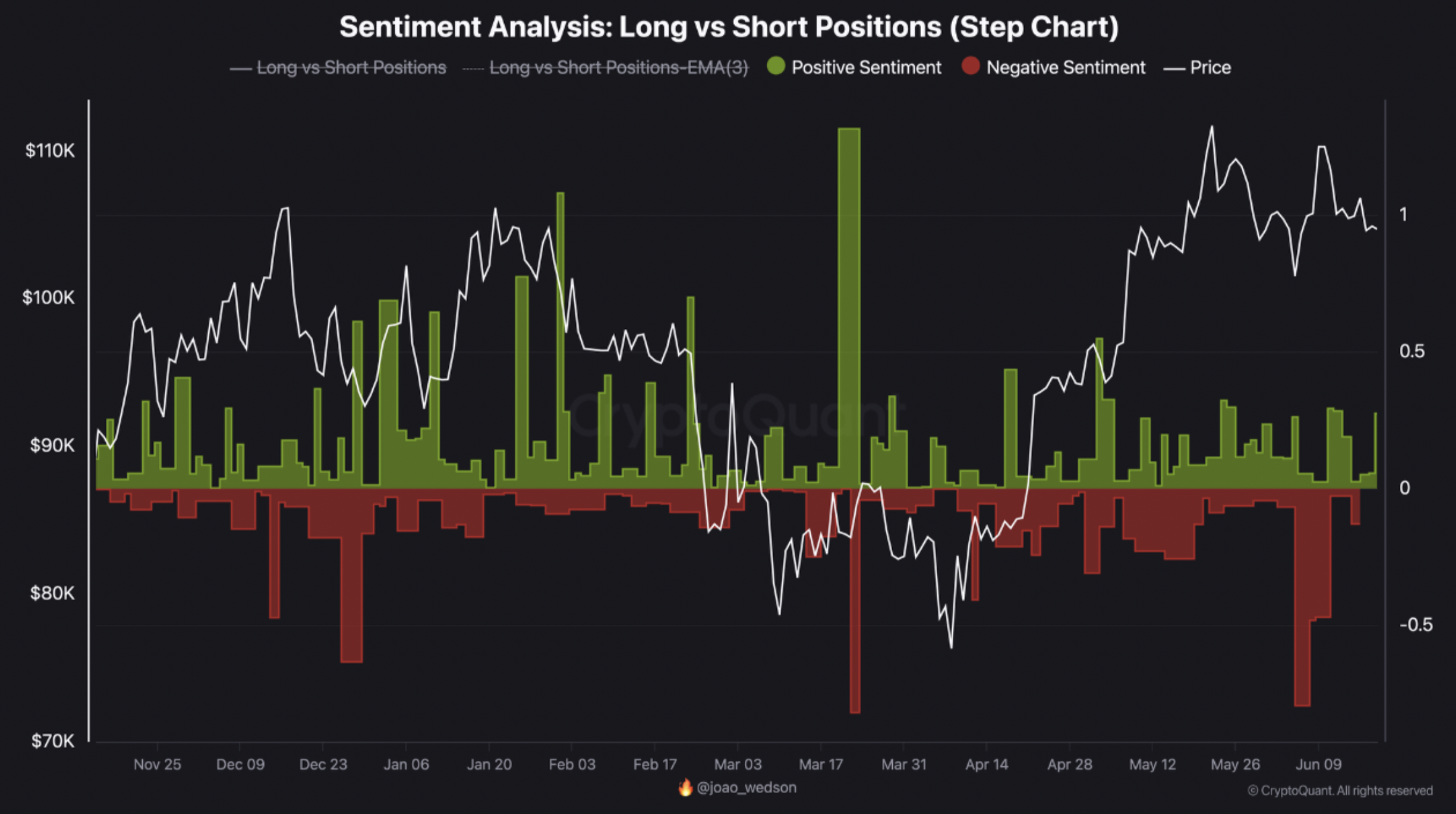

Whereas Bitcoin (BTC) has remained vary-poke – trading between $100,000 and $110,000 for roughly a month – both short and lengthy positions had been constructing inner this vary, with short positions rising at a faster inch.

Bitcoin Long Positions A bit of Forward But Shorts Catching Up

After reaching a brand new all-time high (ATH) of $111,814 closing month, BTC has consolidated within the future of the $100,000–$110,000 vary for nearly a month, providing minute clarity on its next directional switch.

Based entirely mostly on a brand new CryptoQuant Quicktake put up by contributor BorisVest, fresh details from Binance crypto alternate means that lengthy positions currently enjoy a minute edge in this vary.

Historical details finds a pattern – when short positions upward push, short squeezes are inclined to exhaust. Similarly, a buildup in lengthy positions has most regularly led to lengthy squeezes. A decisive breakout from both stop of the most up-to-date vary will seemingly resolve Bitcoin’s next main switch.

That mentioned, Binance details implies that whereas lengthy positions are marginally ahead, the ratio of longs to shorts remains fairly balanced. The funding charge hovering approach objective stages helps this stare, reflecting a intently contested standoff between bulls and bears.

Nonetheless, such steadiness most regularly indicators uncertainty within the market. Whereas lengthy hobby has stabilized, short positions continue to climb – seemingly driven by expectations of additional plan back amid escalating geopolitical tensions within the Middle East. BorisVest illustrious:

This reveals that the majority market contributors mediate the rally might perhaps well honest no longer continue. When Bitcoin’s charge begins to fall, and funding charges turn detrimental, it approach shorts are piling in fleet. All of this choices to this vary being a highly sensitive zone.

He additional illustrious that with most traders leaning in direction of short positions, the setup shall be ripe for a surprise switch within the opposite route – presumably fuelled by serene accumulation from elevated market contributors.

Is BTC Making ready For A Sizable Pass?

Despite BTC trading within the future of the $100,000 – $110,000 vary for the greater fragment of the old month, several analysts posit that the flagship cryptocurrency is making ready for a main switch within the arrival weeks.

Most analysts are leaning in direction of a switch to the upside. For instance, crypto trader Josh Olszewics remarked that if liquidity holds, then BTC might perhaps well honest survey a switch in direction of the $150,000 stage.

From a technical standpoint, the outlook is encouraging. Crypto analyst Mister Crypto at present identified that BTC is forming a bullish inverse head & shoulders pattern on the 3-day chart.

Nonetheless, most up-to-date on-chain details reveals that Bitcoin Community Build to Transactions (NVT) Golden Corrupt at present moved into an overpriced zone, warranting warning. At press time, BTC trades at $105,940, up 1.1% within the previous 24 hours.