Bitcoin traded inner a slim intraday fluctuate between $103,832 and $105,218 on June 19, 2025, hovering at $104,929 per unit. With a market capitalization of $2.086 trillion and a 24-hour trading volume of $28.79 billion, the digital asset exhibited indicators of indecision across key technical indicators and loads of chart timeframes.

Bitcoin

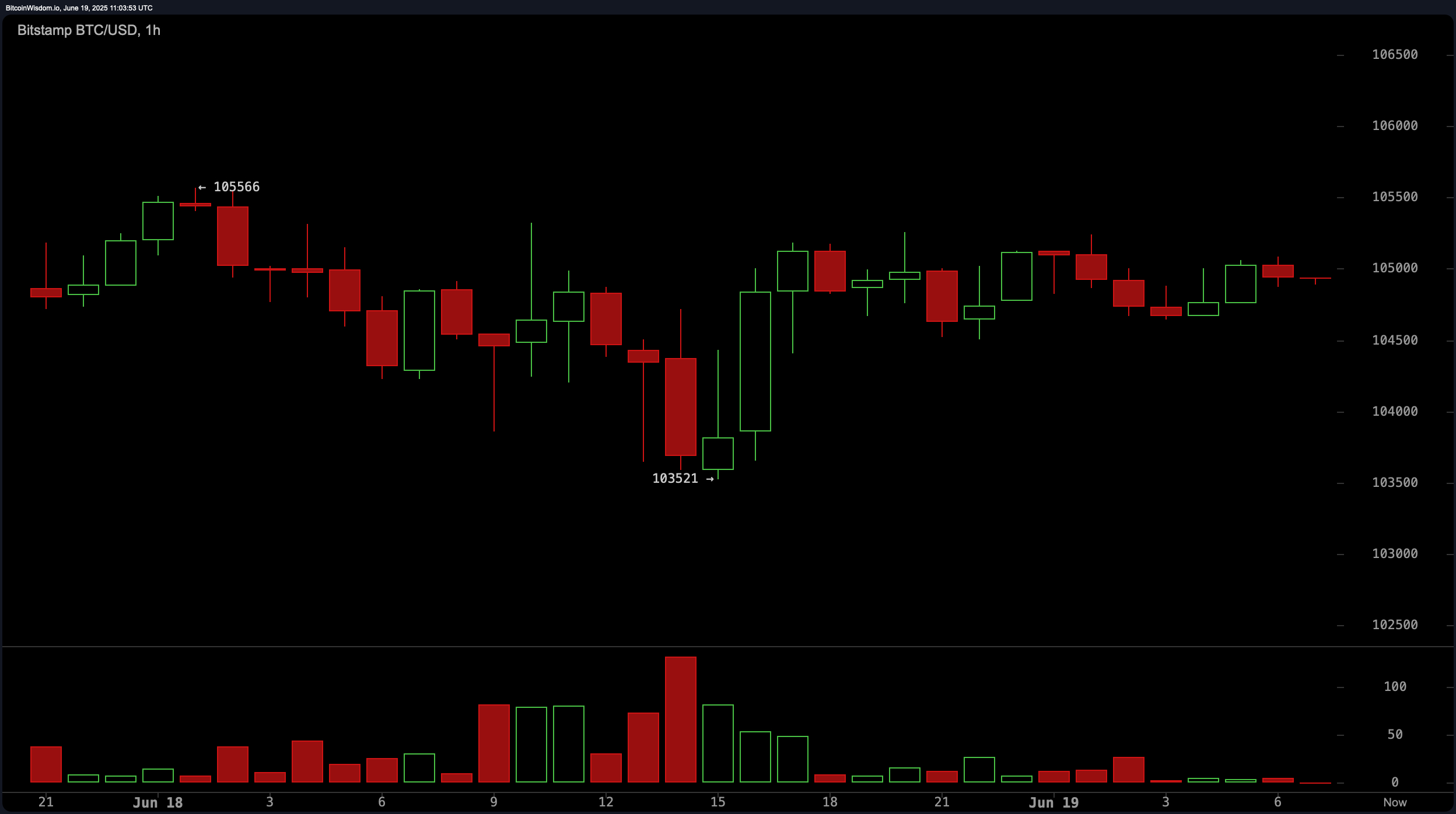

On the 1-hour chart, bitcoin showed a flat-to-bearish posture, forming an moral channel between $103,500 and $105,500. Impress motion displayed a bearish flag pattern, in general a continuation signal for downward motion unless invalidated by bullish volume. Thinning volume underscores market hesitancy, with an intraday scalp opportunity presenting approach $103,500 focused on $104,800 to $105,000. A decisive breakout above $105,500, supported by volume, also can home off a non eternal rally, while a breach below $103,000 would seemingly set off sell-aspect momentum with targets approach the $100,000 stamp.

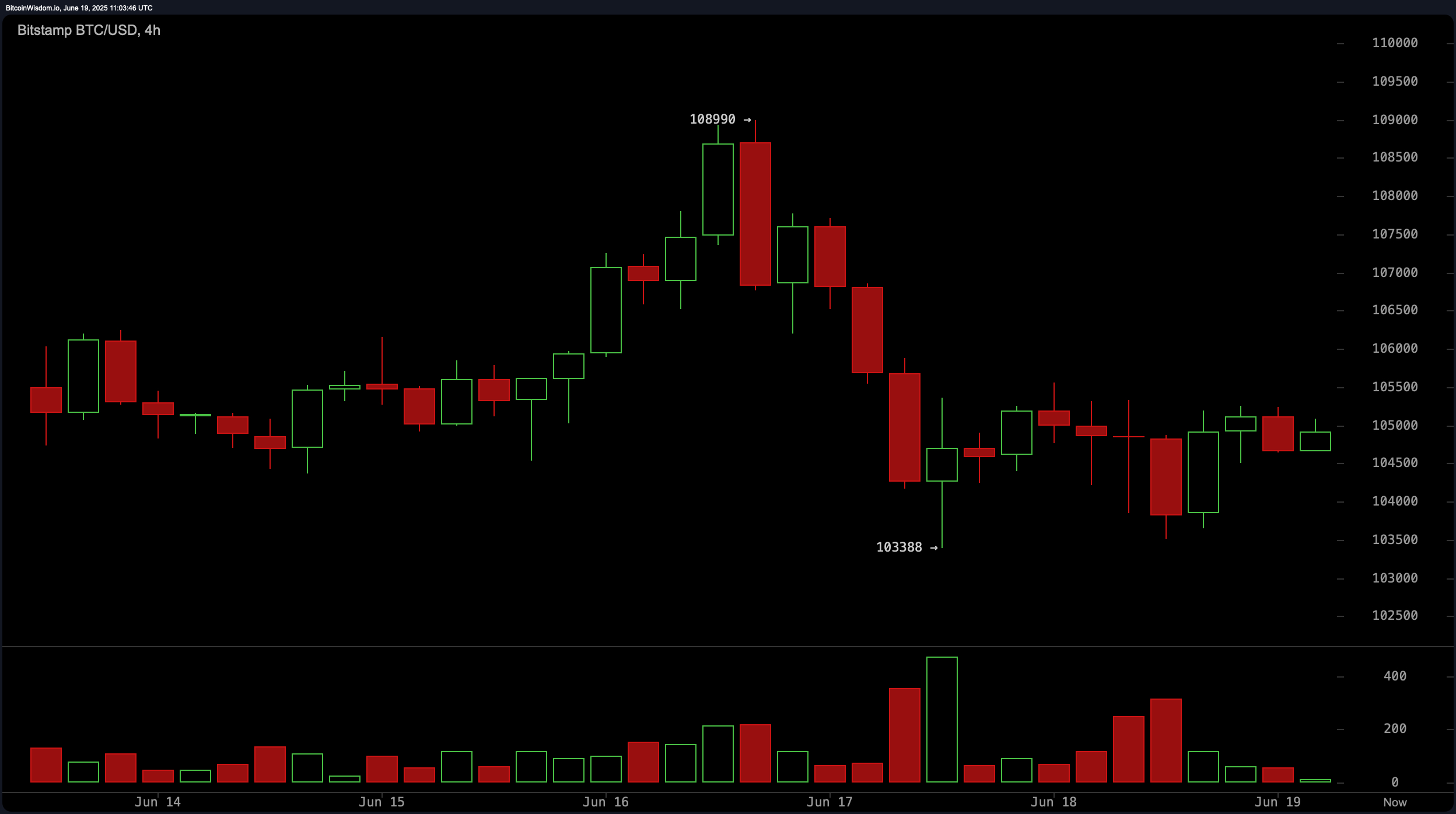

The 4-hour bitcoin chart illustrated a prevailing downtrend from a local excessive of $108,990 to a latest low of $103,388, followed by listless sideways trading. Decrease highs and lower lows emphasize the bearish construction, and elevated sell-off volumes hint at institutional exit affirm. Ability lengthy trades require a breakout above $105,500 with elevated volume, whereas failure to place $103,000 enhance also can delivery a path to test lower levels at $101,000 and $100,000, aligning with fast-entry triggers.

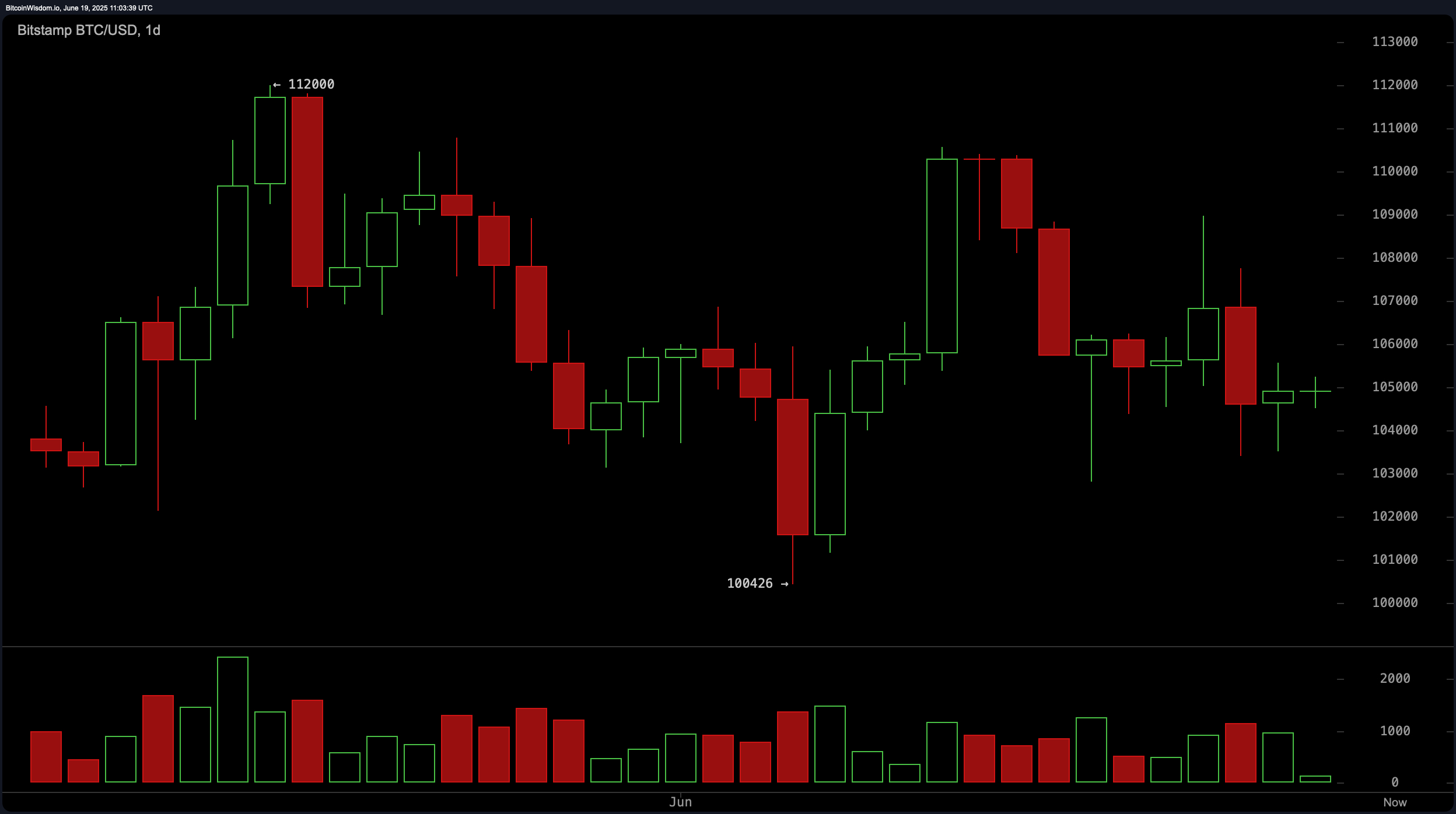

On the day-to-day chart, a great take into fable of bitcoin finds a peak approach $112,000 followed by a tantalizing pullback to $100,426, culminating in the sizzling consolidation round $105,000. This pattern aligns with a setting up Head and Shoulders high, a classical bearish formation. Impress rejection at bigger levels and elevated volume on red candles imply distribution. Conservative longs also can safe worth round $100,500 to $101,000, contingent upon distinct bullish affirmation, while a breakdown below $100,000 would substantiate additional downside dangers.

Oscillators delivered a mostly neutral signal, reflecting market ambiguity. The relative energy index (RSI) stood at 48, the Stochastic oscillator at 42, and the commodity channel index (CCI) at -44—all indicating neutrality. The in model directional index (ADX) at 15 additional signaled a outdated vogue. Then again, momentum showed a bearish divergence at -5,399, and the transferring moderate convergence divergence (MACD) stood at 283 with a negative indication, adding a runt bearish skew.

A maintain a study transferring averages (MAs) printed a divided outlook. Non eternal averages just like the exponential transferring moderate (EMA) and simple transferring moderate (SMA) for the ten, 20, and 30 intervals all signaled bearish indicators. Conversely, longer-time interval metrics reminiscent of the EMA and SMA for the 50, 100, and 200 intervals supplied bullish indicators. This divergence illustrates a market in transition—doubtlessly staging for a reversal or additional capitulation, reckoning on upcoming label conduct approach serious levels.

Bull Verdict:

If bitcoin decisively breaks above the $105,500 resistance level with solid accompanying volume—particularly on the 4-hour or day-to-day chart—this can also signal the open of a restoration toward the $108,000 zone and doubtlessly bigger. Strengthen from longer-time interval transferring averages suggests foundational energy stays, and a bullish reversal candle or divergence would pork up the upside scenario.

Have Verdict:

If bitcoin breaks below the $103,000 enhance level with heightened volume, the market is liable to re-test $101,000 and presumably the psychological enhance at $100,000. Bearish momentum from oscillators and non eternal transferring averages indicators prevailing promoting rigidity, and a confirmed breakdown also can home off an accelerated downside toward the mid-$90,000 fluctuate.