Bitcoin (BTC) has slipped 2% as of late, because the broader crypto market continues to face downward stress. The decline comes amid weakening buying and selling volumes, indicating cautious sentiment among investors.

On the opposite hand, on-chain records suggests that this pullback will likely be temporary.

BTC Bulls Withhold the Line

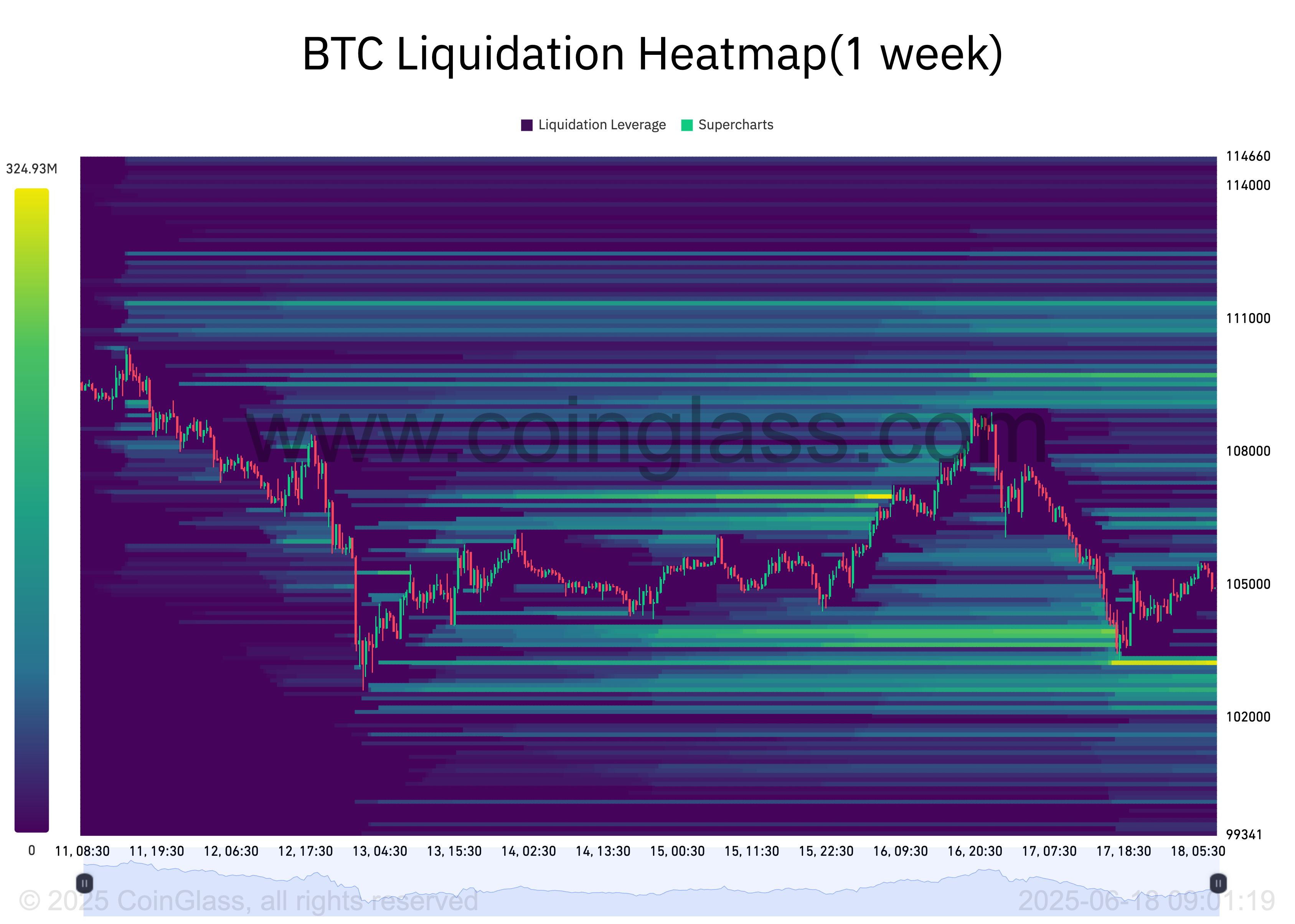

One of the distinguished extra distinguished indicators comes from a concentrated liquidity cluster forming all the design by the $103,000 zone. Readings from BTC’s liquidation heatmap monitor a concentration of liquidity under its model at the $103,221 zone.

This suggests famous market toughen ready to be activated if the price dumps toward this stage. Liquidation heatmaps are passe to call model ranges the set huge clusters of leveraged positions are inclined to be liquidated. These maps spotlight areas of high liquidity, veritably colour-coded to monitor intensity.

BTC’s liquidation heatmap suggests that get toughen is ready to lift in promoting stress if the coin witnesses a correction toward the cluster zone. Merchants dangle positioned many purchase orders at the $103,221 condominium, indicating self perception that BTC is no longer going to spoil under this threshold.

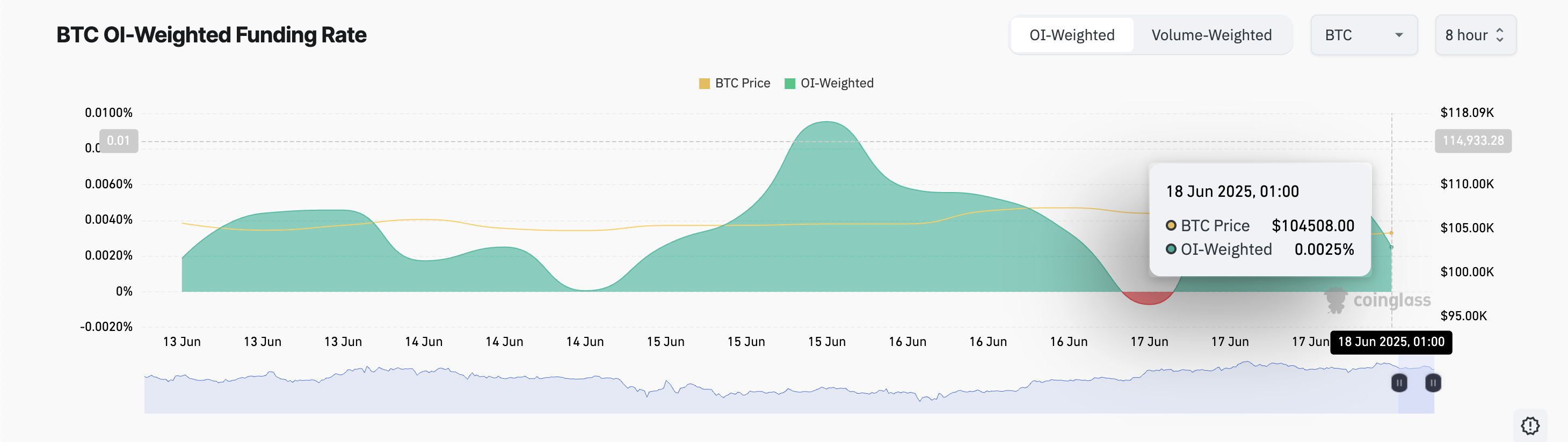

Moreover, BTC’s certain funding rate, at 0.0025% at press time, provides to the cautiously optimistic outlook. It shows traders’ willingness to pay a top rate for long positions.

The funding rate is a routine fee exchanged between long and short traders in perpetual futures markets to dangle prices aligned with the location market. When its model is certain, it signifies bullish market sentiment, as extra traders are watching for the asset’s model to upward thrust.

$106,000 or Bust? Bitcoin’s Next Pass Hinges on Global Tensions

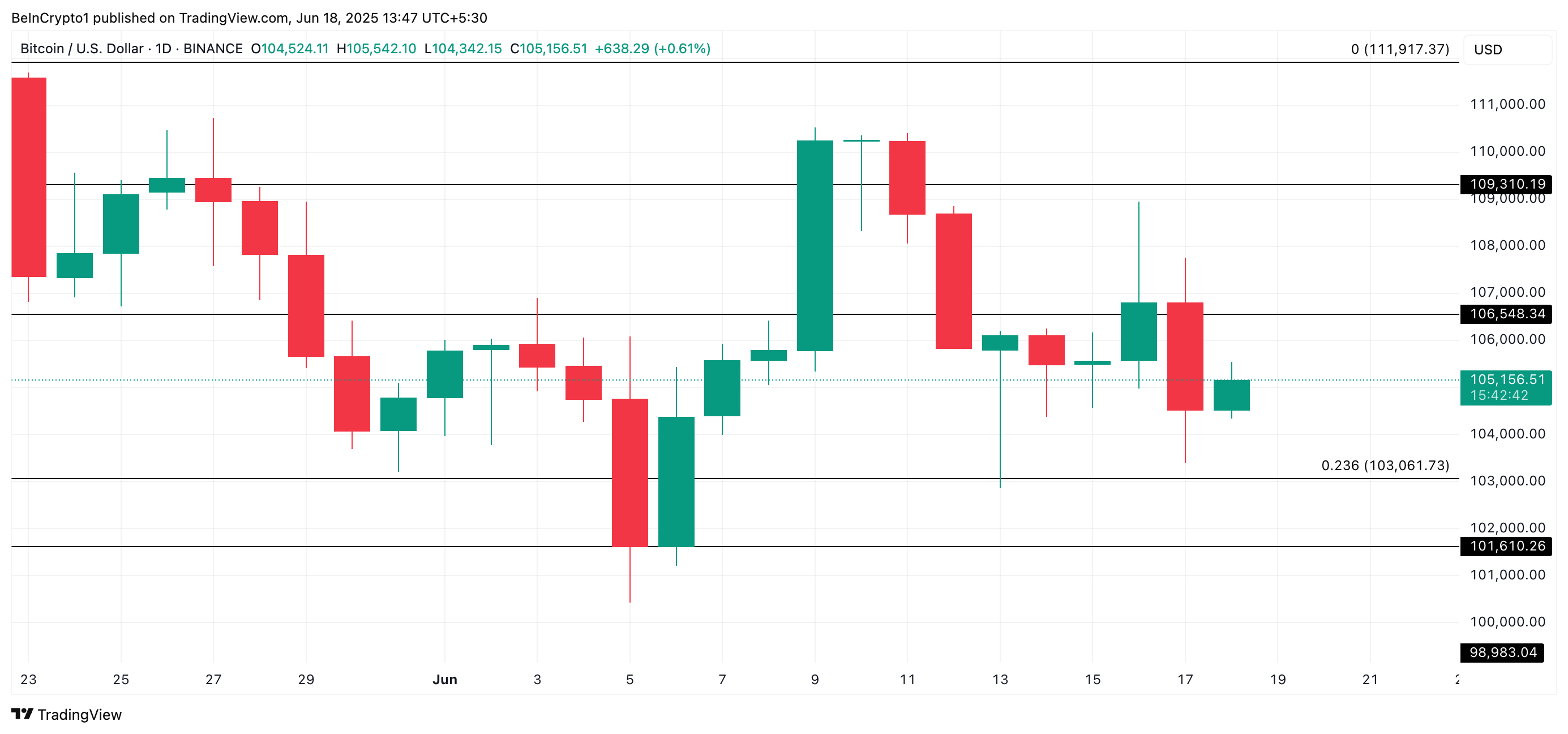

Despite the bullish on-chain indicators, BTC remains carefully influenced by broader market sentiment, which has been weakening amid escalating tensions between Israel and Iran.

Bitcoin’s model rally would possibly maybe stall if the geopolitical speak deteriorates extra, likely sliding toward $103,061. Can also simply serene the liquidity cluster near $103,000 fail to plan toughen, a deeper tumble to $101,610 would possibly maybe be aware.

Conversely, if bullish momentum returns and market sentiment improves, the coin would possibly maybe rebound from unusual lows and scamper toward the $106,548 stage.