Bitcoin declined 5.5% last week, falling from $110,000 to beneath $106,000 after escalating geopolitical tensions between Israel and Iran sparked a “threat-off” mood within the markets.

No topic the cost dip, on-chain data unearths a famous counter-story. Whereas headline prices dipped, institutional and company inquire for Bitcoin and altcoins remained exceptionally solid, signaling high conviction from the market’s largest avid gamers.

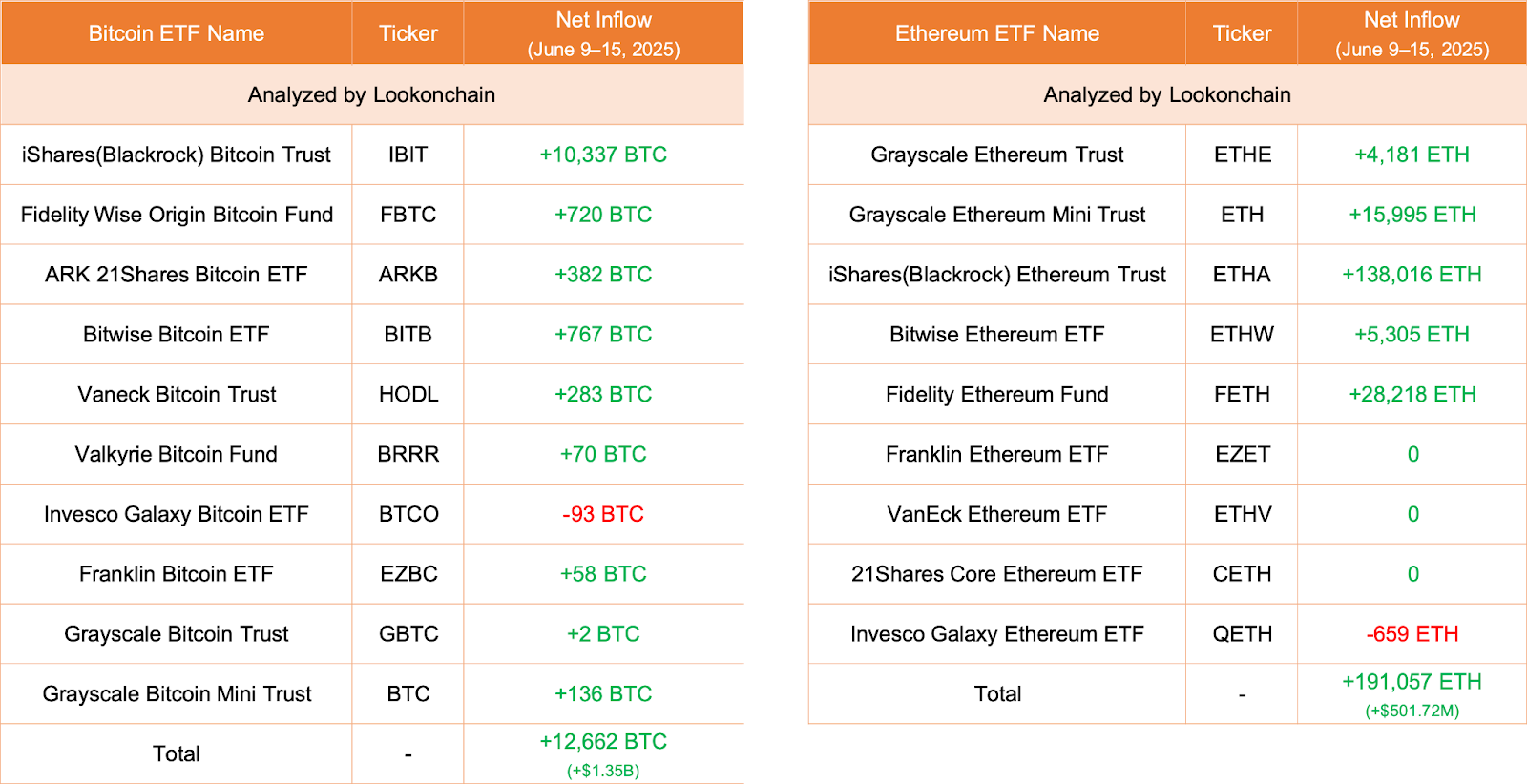

Institutional ETF Inflows Continue Unabated

Data from Lookonchain displays that build of dwelling Bitcoin ETFs noticed one other big week of inflows. Ten Bitcoin ETFs added a combined 12,662 BTC rate $1.35 billion. BlackRock’s iShares Bitcoin Belief led with 10,337 BTC ($1.1B) added. Ethereum ETFs additionally noticed inflows of 191,057 ETH ($501.72M). Again, iShares dominated with 138,016 ETH ($362.43M).

These tremendous allocations from main corporations signaled persisted inquire from institutional avid gamers, at the same time as crypto prices pulled aid.

Connected : Revenue-Takers Loom as Bitcoin Assessments $110K Ceiling

Whales Compile Bitcoin and Ethereum

Technique (MSTR) received 10,100 BTC ($1.05B), while Metaplanet added 1,112 BTC ($116.5M). On the Ethereum facet, SharpLink bought 176,271 ETH ($462.95M). A previously winning whale additionally sold 67,408 ETH rate $136 million.

On-chain transfer data confirmed ETH actions between Coinbase and Wintermute wallets, including a 26,000 ETH ($69M) transaction. These alerts display inspiring accumulation from tremendous holders despite most modern volatility.

Connected : Ethereum (ETH) Tag Prediction For June 18, 2025

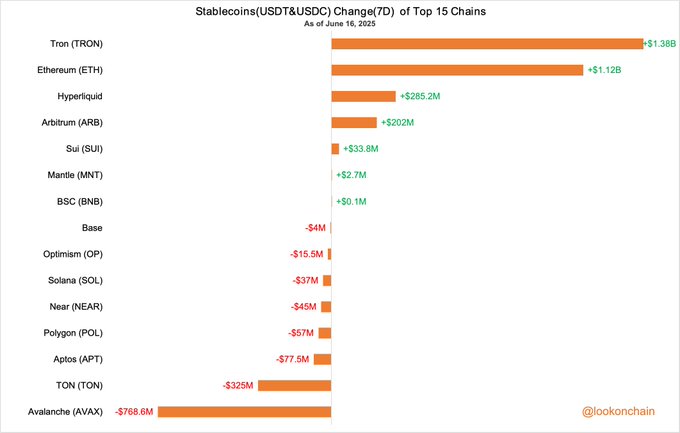

The total stablecoin market grew by $1.27 billion over the week. Tron led with a $1.38B magnify in USDT and USDC, while Ethereum added $1.12B.

Conversely, Avalanche noticed the greatest outflow, losing $768.6M. Assorted networks indulge in TON and Aptos adopted with $325M and $77.5M outflows, respectively.

A Mixed Image for On-Chain Individual Enlighten

An diagnosis of on-chain person issue displays a more combined image right via a amount of blockchain ecosystems. The Layer-2 network Rotten recorded a 77.35% magnify in every single day inspiring addresses and a 5.84% upward push in every single day transactions. Avalanche additionally noticed a 74.94% jump in transactions, though its inspiring addresses dropped 18.77%.

Hyperliquid’s TVL climbed 12.85%, the very wonderful among top chains. However, it faced a 30.14% plunge in inspiring addresses and a 53.89% decline in transaction volume.

Ethereum’s TVL remained neatly-liked at $61.4B, nonetheless it noticed a 3.32% lower in every single day inspiring addresses. Solana gained 1.44% in TVL and noticed a 9.62% upward push in customers, showing solid network engagement.

No topic the cost-driven wretchedness, institutional passion, stablecoin expansion, and selective network enhance persisted to help the broader crypto ecosystem.

Disclaimer: The details introduced listed right here is for informational and academic functions simplest. The article does no longer constitute financial advice or advice of any sort. Coin Model is rarely any longer accountable for any losses incurred as a outcomes of the utilization of squawk material, merchandise, or products and services talked about. Readers are told to issue warning earlier than taking any action associated to the firm.