Crypto asset investment products skilled one other no longer easy week as capital outflows persevered for a 2d consecutive duration. Per the latest portray from CoinShares, a whole of $584 million exited crypto-centered investment autos, pushing the two-week cumulative outflows to $1.2 billion.

This movement coincides with investor uncertainty surrounding the possibility of pastime price cuts by the US Federal Reserve this year, which James Butterfill, Head of Compare at CoinShares, believes is contributing to waning sentiment in the market.

Butterfill attributed the investor pullback to increasing skepticism about macroeconomic protection shifts, in particular price reductions. On the the same time, exchange-traded product (ETP) exercise hit a brand contemporary low, with global ETP volumes falling to correct $6.9 billion, marking the weakest weekly procuring and selling volume for the explanation that delivery of jam Bitcoin ETFs in the US earlier this year.

Bitcoin and Ethereum Web the Brunt of The Crypto Outflows

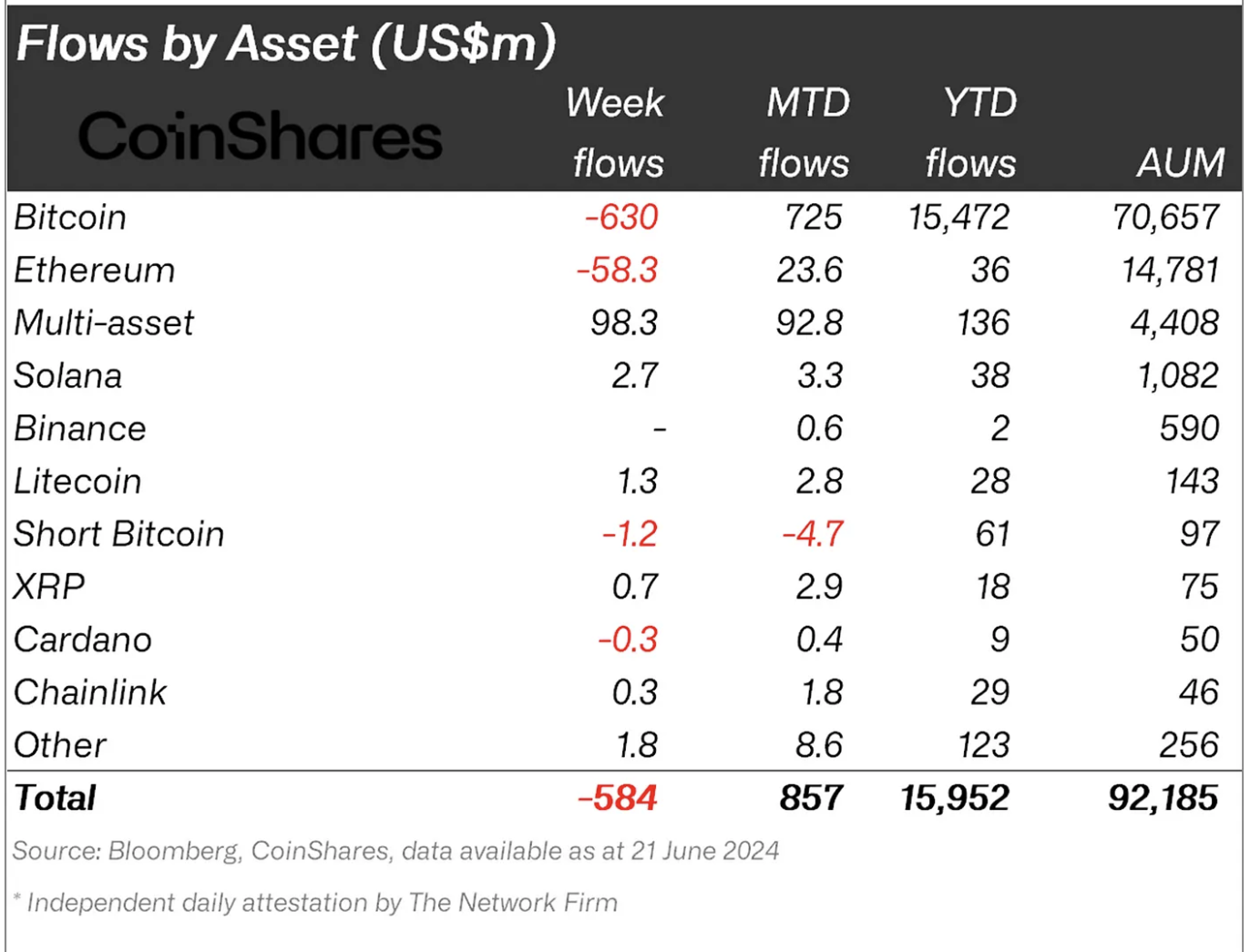

Bitcoin accounted for almost all of this week’s outflows, with $630 million leaving BTC investment products. Despite the indispensable movement of funds out of long Bitcoin positions, quick Bitcoin products moreover recorded outflows totaling $1.2 million.

This implies that investors are no longer presently making a wager heavily on downside exposure, opting as an different to follow it the sidelines amid unsafe market stipulations. Ethereum in the same procedure saw unfavourable movement exercise, with $58 million in outflows, persevering with the model of cautious investor habits all over main resources.

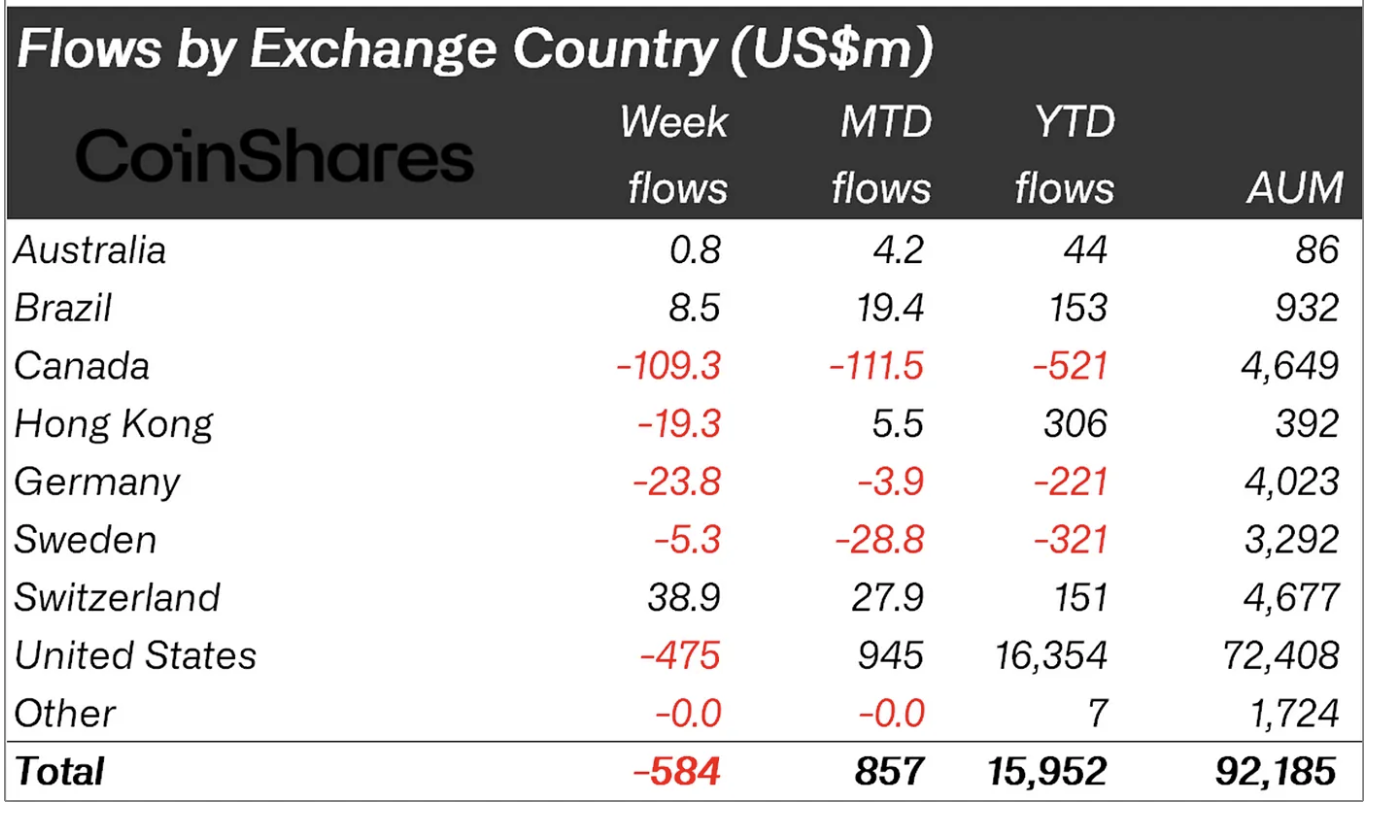

The portray moreover highlighted geographical breakdowns, noting that the US led all regions with $475 million in outflows, followed by Canada at $109 million. Germany and Hong Kong recorded smaller outflows at $24 million and $19 million, respectively.

In distinction, Switzerland and Brazil stood out as exceptions to the broader model, bringing in rep inflows of $39 million and $forty eight.5 million, respectively. This divergence suggests that native factors or institutional suggestions in those regions might per chance possibly be riding assorted investment behaviors.

Altcoins Intention Selective Make stronger

Whereas sentiment remained bearish for astronomical-cap resources, some altcoins managed to blueprint capital inflows. Solana, Litecoin, and Polygon saw modest however indispensable beneficial properties of $2.7 million, $1.3 million, and $1 million, respectively.

These inflows can also specialize in opportunistic positioning by investors seeking exposure to resources which relish underperformed no longer too long ago. Furthermore, multi-asset investment products, which unfold exposure all over diverse cryptocurrencies, recorded $98 million in inflows.

This indicators that some investors are the consume of latest brand weaknesses to create diverse glean true of entry to to the market as a replace of concentrating bets on single tokens.

The persevered divergence in fund flows highlights the advanced sentiment presently influencing crypto markets. With macroeconomic uncertainty mild dominating investor outlooks, digital asset markets dwell reactive to both global financial protection indicators and evolving regional investment traits.

Featured image created with DALL-E, Chart from TradingView