Pi Community (PI) is down end to 6% correct by diagram of the final seven days, showing combined indicators at some point soon of key technical indicators. Whereas the DMI suggests fading bearish momentum and a that it’s good to presumably well mediate of shift in pattern, the CMF signifies light nonetheless light certain procuring for tension.

On the identical time, EMA traces uncover consolidation, with PI trading correct above a severe toughen stage at $0.601. Whether or now now not the price breaks down or rebounds from right here will seemingly rely on whether or now now not it must retain key toughen or push past end by resistance phases.

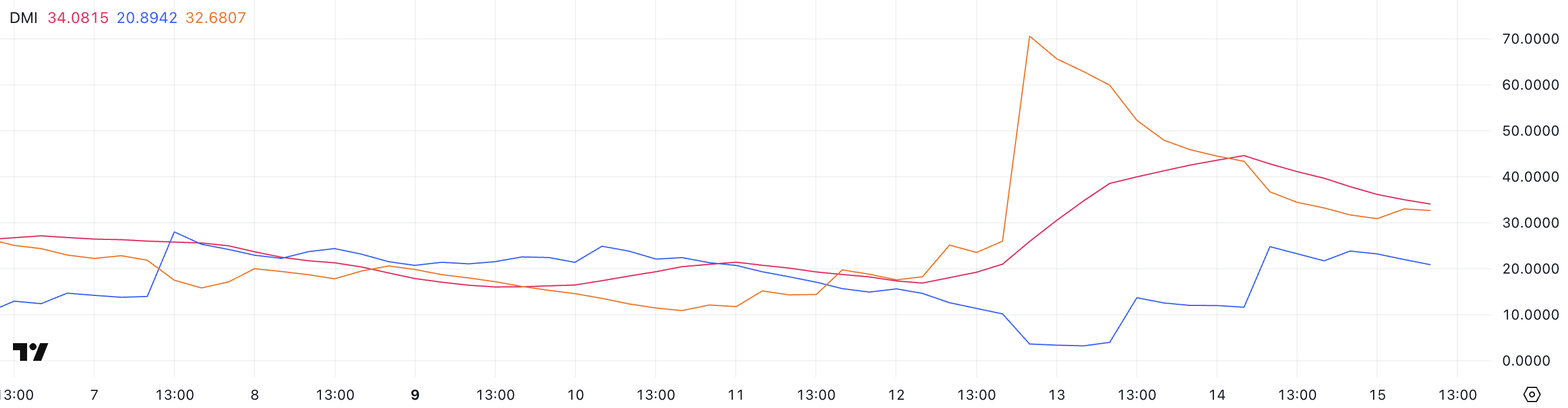

Pi Community DMI Signals Fading Bearish Momentum

Pi Community’s Directional Depart Index (DMI) reveals that its Common Directional Index (ADX) has dropped to 34, down from 44.59 correct a day within the past.

This decline follows a animated rise from 16.89 three days within the past, suggesting a most recent nonetheless now weakening pattern. The ADX measures the strength of a pattern, no topic direction.

Readings below 20 point out a ragged or no pattern, while values above 25 signal a exact pattern. With the ADX light above 30, Pi is seemingly in a trending allotment, nonetheless the momentum appears to be like to be to be cooling off.

Having a discover on the directional indicators, +DI has climbed to 20.89 from correct 4 two days within the past, signaling growing bullish tension.

Within the intervening time, -DI has dropped greatly to 32.68 after peaking at 70.57 three days within the past, showing that bearish momentum is fading.

This crossover in directional strength could presumably well presumably sign at a possible shift in sentiment. If +DI continues to rise while -DI declines, Pi’s sign could presumably well presumably start up improving or enter a more neutral allotment after a duration of intense promoting.

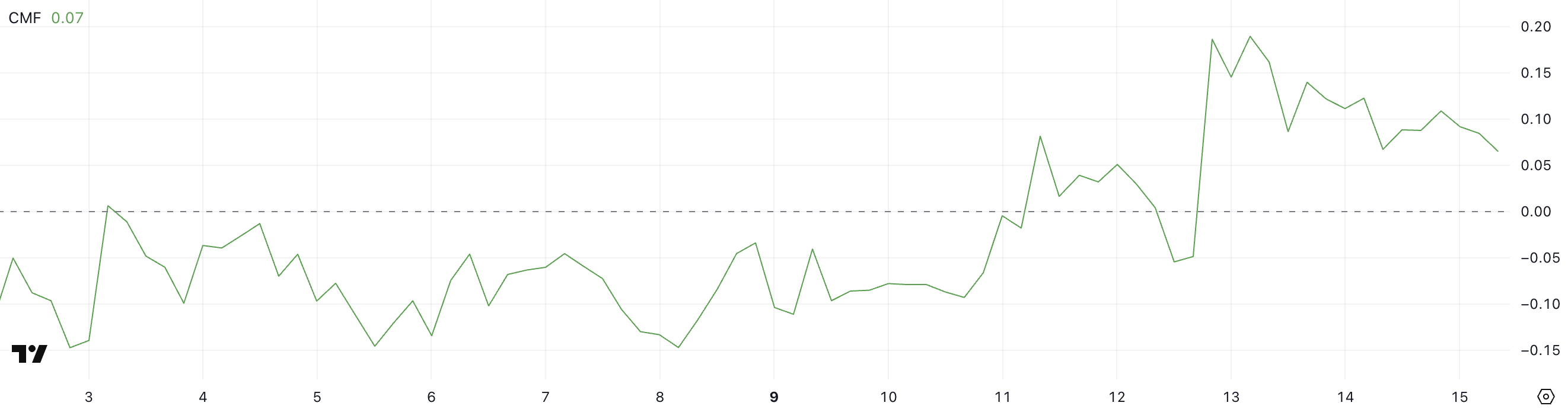

PI CMF Presentations Light Shopping for Pressure After Fresh Spike

Pi Community’s Chaikin Money Circulation (CMF) is currently at 0.07, down from 0.19 two days within the past nonetheless light increased than -0.05 three days within the past.

The CMF indicator measures the float of money into or out of an asset over time, the usage of sign and volume recordsdata. Values above 0 counsel procuring for tension, while values below 0 point out promoting tension.

Readings above 0.10 or below -0.10 are customarily seen as stronger indicators of accumulation or distribution.

PI’s most recent CMF stage at 0.07 suggests gentle nonetheless certain procuring for tension.

Whereas now now not exact sufficient to verify aggressive accumulation, it reveals that capital is light flowing into the asset, even supposing less intensely than two days within the past.

If CMF continues to retain above zero, it will probably probably presumably well toughen a stabilization or unhurried restoration in sign. On the opposite hand, if it dips support below zero, it will probably probably presumably well signal weakening inquire and ability shrink back risk.

Breakout or Breakdown? PI Trades Cease to Important Ranges

Pi Community’s EMA traces currently counsel a duration of consolidation, following a restoration from the animated drop precipitated by the Israel-Iran battle escalation.

Designate fling is hovering correct above a key toughen at $0.601. If this stage is broken, PI sign could presumably well presumably drop to $0.542, and if bearish momentum builds, it will probably probably presumably well descend extra against $0.40.

This structure shows uncertainty, with no clear bullish or bearish control for the time being.

On the upside, if PI manages to spoil by diagram of the resistance phases at $0.647 and $0.658, it will probably probably presumably well trigger a fresh uptrend.

A a hit breakout above these zones could presumably well presumably start the door for a transfer against $0.796.

The EMA setup supports a neutral stance for now, looking ahead to a decisive transfer in both direction.