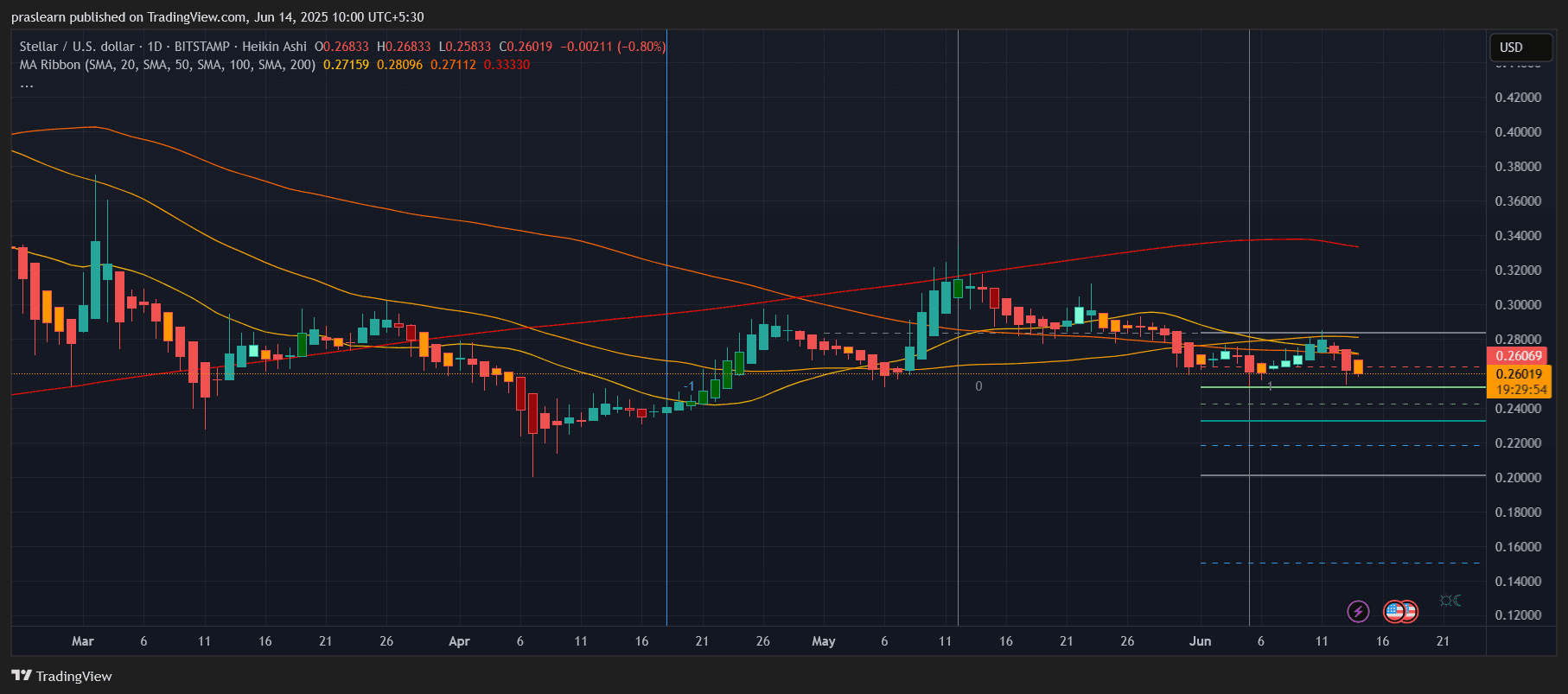

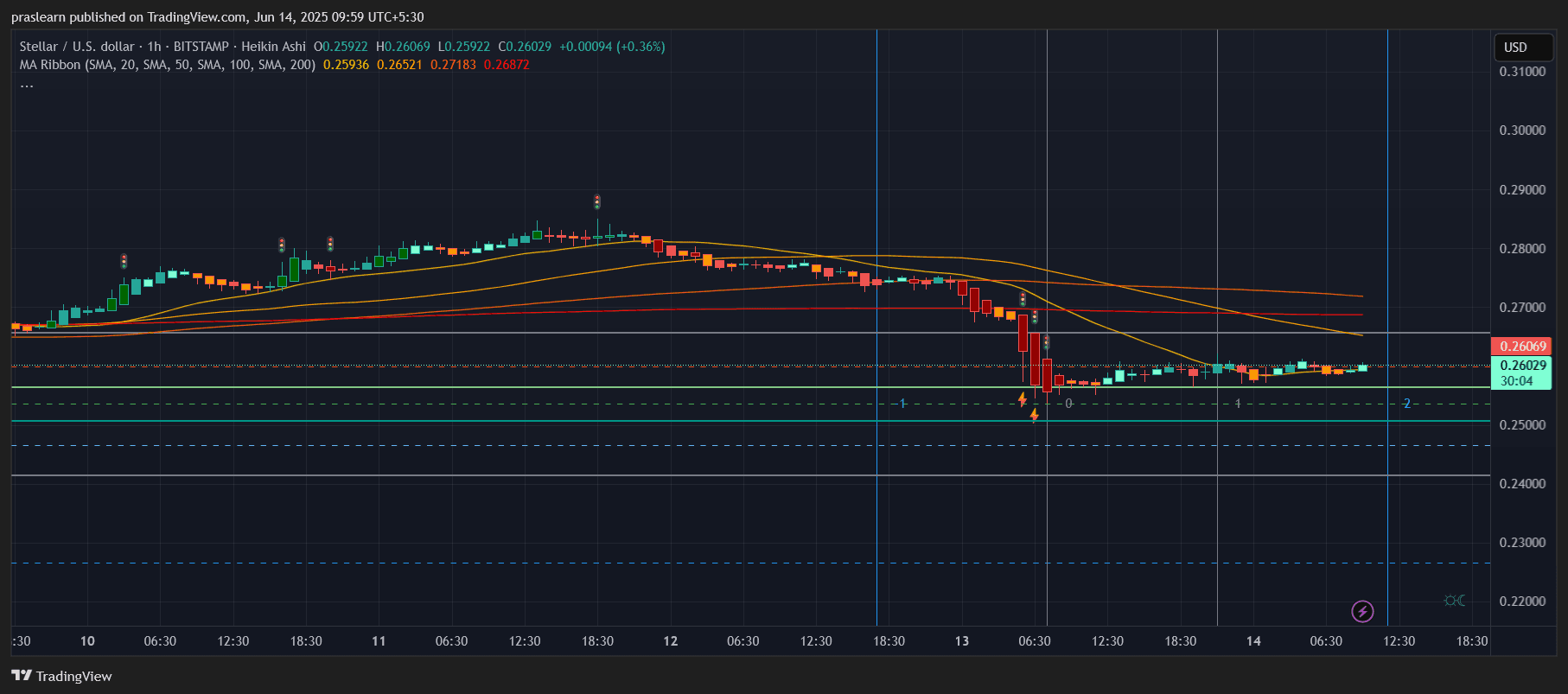

Stellar (XLM) designate is currently buying and selling around $0.260, hovering factual above a key toughen zone after going by contrivance of a earn rejection from the 50-day transferring moderate. The recent designate circulate on the day-to-day chart presentations a gradual bleed over the closing few weeks, with XLM designate now sitting dangerously shut to multiple key demand levels. Temporary sentiment has weakened, as confirmed by the hourly chart, where we no longer too prolonged in the past noticed a pointy intraday sell-off that pushed XLM designate down nearly 6% in a pair of hours.

Stellar Ticket Prediction: How Unhealthy Is the Downtrend on the Each day Chart?

The day-to-day Heikin Ashi chart finds a consistent sequence of crimson candles since mid-May maybe perhaps. Stellar designate has failed to take care of above its 20-day and 50-day SMAs—currently at $0.27112 and $0.28096 respectively. This rejection implies bearish abet a watch on is aloof dominant. Moreover, the price has dropped below the 200-day SMA at $0.333, confirming the prolonged-term bearish structure.

We also peep Fibonacci extension levels placed below the recent designate. Assuming the swing excessive used to be shut to $0.30 and swing low shut to $0.25, the 1.618 extension projects a probable topple to $0.22, which aligns with an oldschool consolidation toughen level from March.

Calculation:

Let’s mediate the swing excessive used to be $0.30 and low used to be $0.25.

1.618 extension = 0.25 – (0.05 × 1.618) ≈ $0.169

Nonetheless, more conservative Fibonacci supports are considered shut to $0.24 and $0.22, that are visible as dotted horizontal traces on the chart. This offers us a doable 15%–20% downside possibility from recent levels.

What Does the Hourly Chart Point out About Instant-Term Sentiment?

On the hourly chart, XLM suffered a steep tumble on June 13, forming a chain of colossal crimson candles. This worn out a earlier 3-day accumulation fluctuate between $0.27 and $0.28. Put up-topple, we search a sideways consolidation around $0.259–$0.260, this capacity that designate is now trying for toughen.

Despite the short rebound attempts, the 20, 50, 100, and 200 SMAs are all stacked in bearish picture, with the 20-SMA acting as intraday resistance around $0.265. Except this flips, XLM designate could revisit the recent low at $0.254.

The hourly chart also presentations attempted accumulation candles, however with out increasing quantity or bullish divergence, restoration looks oldschool.

Is There Any Hope for a Reversal?

Reversal probabilities depend fully on a decisive break above $0.271—the 50-day SMA. If Stellar designate closes a day-to-day candle above this level with quantity, we could target $0.30 one more time. This could perhaps be a 15% upside from the recent designate. Nonetheless, failure to reclaim this level will seemingly location off extra promoting in direction of $0.24 and perhaps $0.22, where bulls could are attempting a stronger protection.

A straightforward possibility-reward diagnosis:

Aquire at $0.260, discontinuance loss at $0.24 (−7.7%), target $0.30 (+15.4%)

Possibility/Reward = 2:1, however simplest if momentum shifts bullish, which isn’t yet confirmed.

Stellar Ticket Prediction for June 2025: What’s Subsequent?

If bears defend abet a watch on and Bitcoin remains below stress, XLM designate could dawdle in direction of the $0.22 zone by the tip of June. That can impress a shut to 15% topple from the recent level. On the opposite hand, any sure macro sentiment or altcoin momentum could push Stellar designate to reclaim $0.27 and intention for $0.30, especially if a breakout candle emerges on the day-to-day chart with earn apply-by contrivance of quantity. Accurate now, the vogue is bearish each technically and momentum-lustrous, with no fundamental bullish reversal signals yet confirmed.

$XLM, $Stellar