Trump’s ‘Out of the ordinary Stunning Invoice’ touts fiscal self-discipline, however the $2.4 trillion debt that this would perchance perchance add to the United States’ already alarming deficit has Wall Avenue on excessive alert. Within the duration in-between, bond yields proceed to cruise, and uncertainty over US treasuries as a haven looms.

Vincent Liu, Chief Funding Officer at Kronos Compare, counseled BeInCrypto that these elements would perchance perchance well further power assign a matter to for Bitcoin. Altcoins, on the different hand, would perchance perchance furthermore no longer fare as successfully.

Trump’s Economic Vision Meets Early Backlash

The Trump administration hails the One Out of the ordinary Stunning Invoice Act as a big laws that can dramatically reinforce the United States’ fiscal trajectory.

The bill handed the House in Also can fair and awaits Senate approval. It would perchance perchance well unleash trillions of greenbacks in tax cuts and gash spending on healthcare, meals stamps, and neat energy positive aspects.

While the White House affirmed that the bill will pave the system for an “period of out of the ordinary economic development,” others are less definite.

Besides Elon Musk’s references to the fragment of laws as a “disgusting abomination,” Wall Avenue confirmed instruct unease. Its apprehension reverberated a great deal, particularly on what the bill system for the nation’s ballooning fiscal deficit.

A $2.4 Trillion Allege

A document launched final week by the nonpartisan Congressional Budget Place of job (CBO) means that the bill’s tax breaks, which put collectively to pointers, overtime, and senior advantages, whole $3.7 trillion.

While this means taxpayers will preserve more of their money, it furthermore represents a big good deal in federal income. When the CBO analyzed whether the bill’s proposed spending cuts would offset this good deal, they concluded it would perchance perchance well topple short by $2.4 trillion over the next 10 years.

In essence, even despite the fact that the bill saves $1.3 trillion through program cuts, the final affect is a $2.4 trillion prolong in the national deficit.

That unaccounted hole is what’s being concerned monetary analysts and economists.

Will the Trump Budget Invoice Worsen the Deficit?

On condition that the tax cuts are no longer completely offset by its spending cuts, the authorities might want to borrow more money to quilt its costs. Borrowing more will furthermore prolong the final national debt.

“From there, it’s straightforward economics: more debt system more bonds, elevated yields, and tighter conditions,” Liu counseled BeInCrypto.

In line with the CBO, over the next 10 years, the additional borrowing precipitated by this bill is projected to consequence in an further $551 billion in pastime payments. This quantity is above what the authorities would already be paying on its existing debt.

This additional borrowing severely will enhance the bill’s whole worth, going beyond the inform affect of its tax and spending provisions. It furthermore creates a compounding carry out: more authorities borrowing ends in elevated pastime payments, which can then require even further borrowing.

This fiscal backdrop is already manifesting in key economic indicators.

Surging Bond Yields and Economic Tension

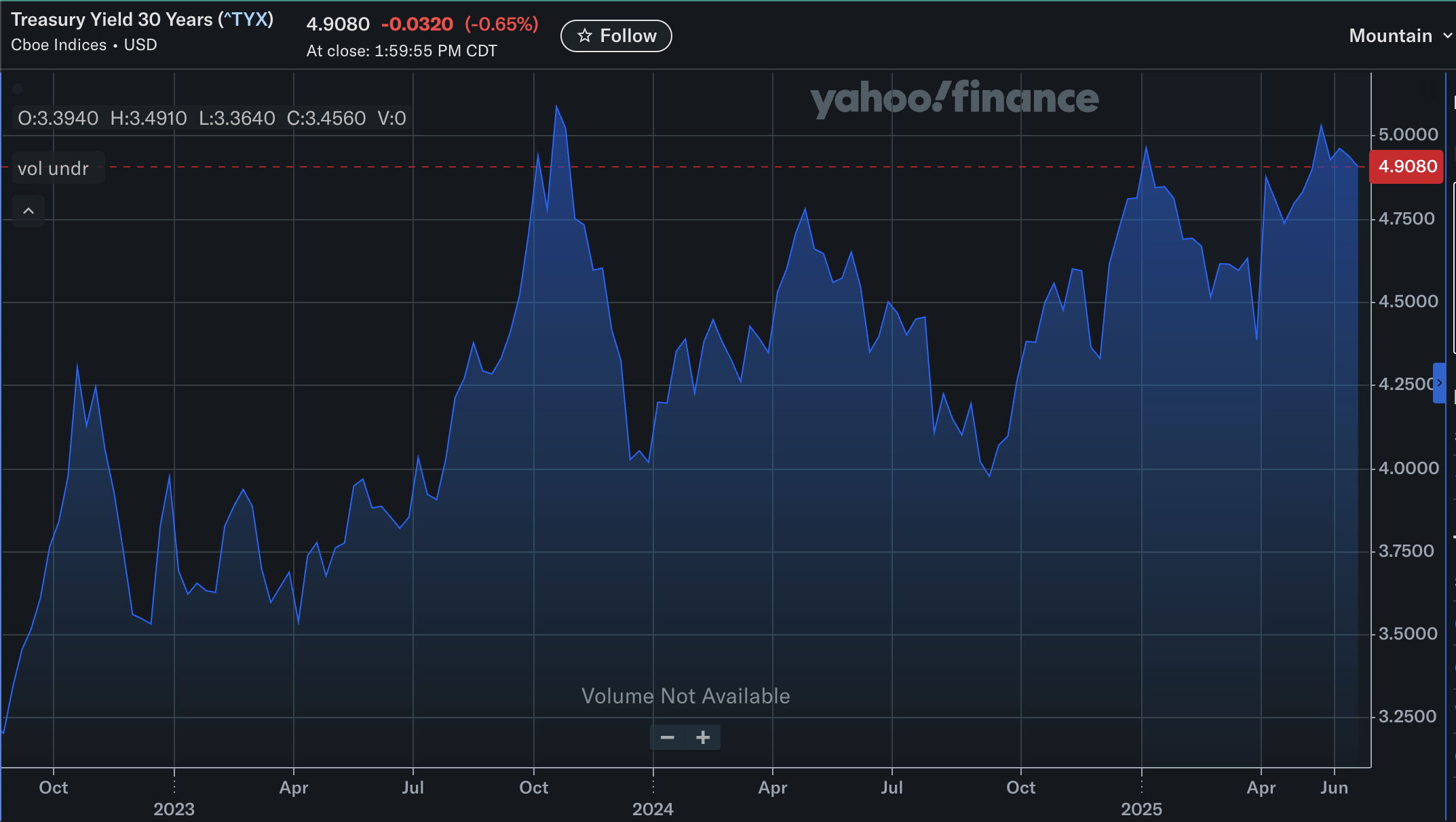

Now not up to three weeks ago, hovering bond yields spooked merchants because the 30-year bond yield surged past the 5% mark for the significant time since October 2023.

“When the 30-year yield breaks 5%, it’s no longer correct a market stat—it’s a warning gentle. Ardour payments are now one in every of the quickest-rising line objects in the federal worth range, and as a portion of GDP, they’re closing in on historic highs. Which system more taxpayer greenbacks are going to service debt, no longer make investments in the long flee,” Liu emphasised.

Enormously elevated bond charges have grand implications, making existence dearer for every day American citizens. Many frequent loans, equivalent to mortgages, credit score card charges, and auto loans, are straight tied to Treasury yields, rising as bond yields prolong.

This escalation in borrowing fees would perchance perchance well slack economic say, counteracting the stimulating effects of any tax chop laws. Conscious of this, merchants have already expressed their unease.

Are Markets Losing Endurance with US Debt?

Following the House’s approval of the Trump worth range bill on Also can fair 22, indexes across the stock market skilled a downturn.

Further illustrating Wall Avenue’s unease, final month’s 30-year bond auction was poorly bought, with merchants annoying a elevated-than-expected yield to aquire the bonds. Its ragged performance at the April auction echoed this lack of robust assign a matter to, signaling a public notion of The usa as a riskier investment.

This recent response from Wall Avenue to the national debt starkly contrasts with historic responses. Within the past, monetary markets ceaselessly confirmed more leniency, particularly when charges were low or crises demanded motion.

“Wall Avenue ragged to provide Washington more slack on deficit spending… Nonetheless at the present time, that cushion is long past. With excessive pastime charges, ballooning debt, and no speedy emergency to clarify it, markets are worthy less forgiving,” Liu said.

At the same time, these indispensable fiscal pressures would perchance perchance well furthermore trigger a global ripple carry out.

“US fiscal strain will enhance global borrowing fees, weakens rising markets, and puts rigidity on economies keeping orderly reserves of Treasuries. The outcomes aren’t restricted to the US they straight affect monetary steadiness in the end of the global economic system,” he added.

As self belief in outmoded actual havens wanes, merchants would perchance perchance furthermore an increasing number of be drawn to different resources equivalent to cryptocurrencies.

Bitcoin’s Stable Haven Enchantment, Altcoins Below Tension

The reconciliation bill’s fiscal strain would perchance perchance furthermore shift investor sentiment in direction of the cryptocurrency market. On the different hand, no longer all digital resources are created equal on this respect.

“Bitcoin would perchance perchance furthermore shine in that uncertainty, but altcoins would perchance perchance well face tougher headwinds as merchants develop more cautious,” Liu counseled BeInCrypto.

As authorities borrowing will enhance and concerns about inflation or the steadiness of outmoded resources develop, Bitcoin would perchance perchance furthermore abilities renewed allure.

An unsafe surroundings poses a say for altcoins, that are on the final riskier and more unstable than Bitcoin. Which ability that, merchants would perchance perchance furthermore prioritize capital preservation over speculative positive aspects, ensuing of their underperformance. This shift causes altcoin costs to claim no or stagnate, while Bitcoin would perchance perchance furthermore preserve its price and even upward push.

Also can fair peaceable the bill dash the Senate with minimal modification to its fiscal affect, these are likely some doable outcomes to are looking ahead to.