After reclaiming the $105,000 level in early June, Bitcoin mark this day is exhibiting signs of transient hesitation. The broader market stays cautious, with Bitcoin mark hovering around the mid-$105,000s as merchants assess resistance perfect under $106,000. While bullish momentum stays intact on better timeframes, key indicators mark at consolidation risks heading into June 10.

What’s Going down With Bitcoin’s Impress?

The Bitcoin mark circulate has considered a decisive rebound from the $102,000 attach, making improvements to over 3% in precisely two lessons. This cross adopted a bounce from the confluence of dynamic give a rob to around the 100-EMA and horizontal demand of finish to $101,000. Nonetheless, the 4-hour chart shows that mark is all all over again stalling finish to a major resistance block between $105,800 and $106,900—an home that coincides with the upper Bollinger Band and earlier rejection zones from gradual May perchance perchance perchance also merely.

The fresh Bitcoin mark substitute highlights how tightly the asset is coiled within a transient symmetrical triangle, with breakout stress mounting as volatility compresses. This pattern is forming perfect under key resistance and usually precedes a directional cross, either confirming a breakout continuation or indicating a transient correction.

RSI, MACD Counsel Short-Term Caution

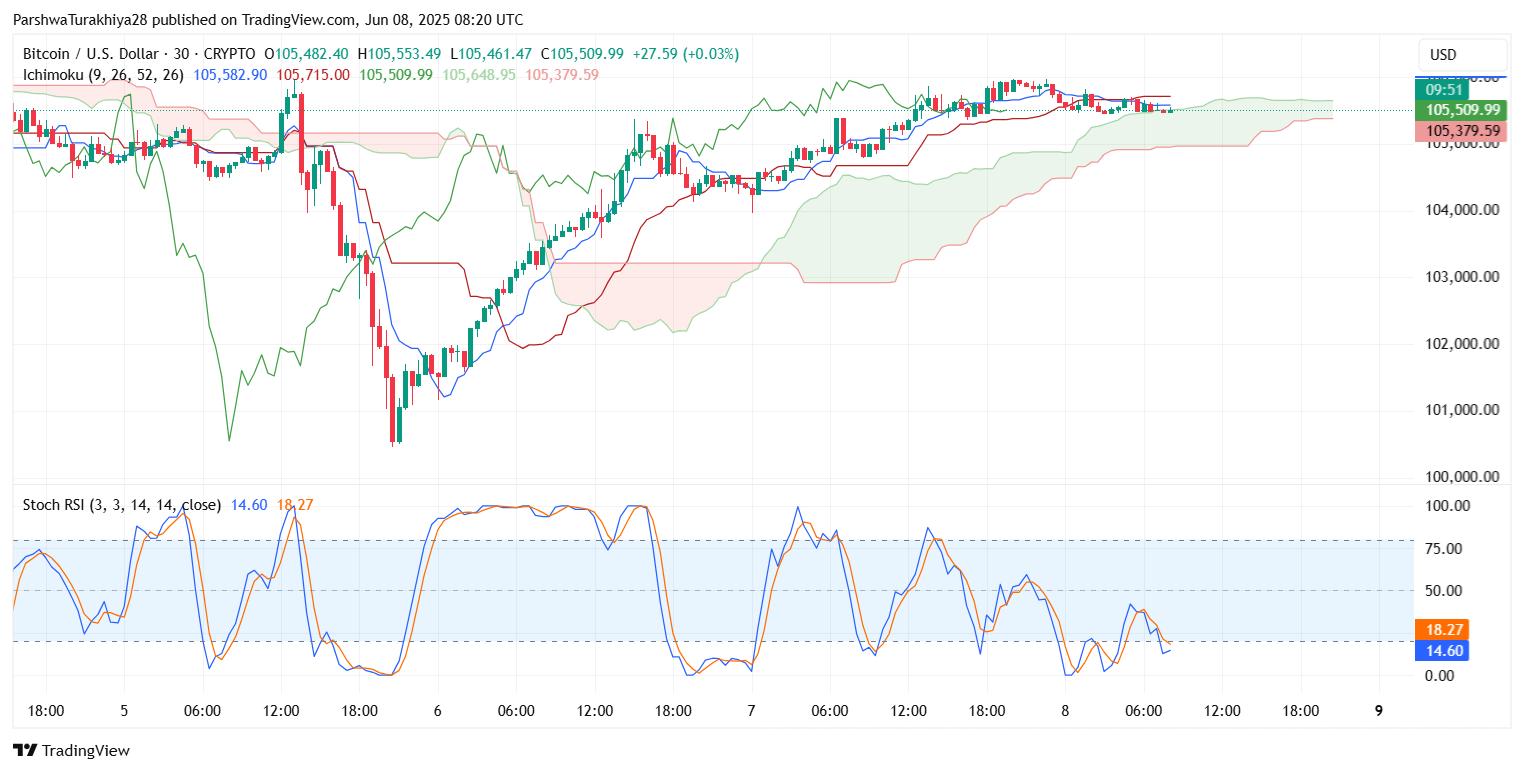

Momentum indicators on the 30-minute and 4-hour charts judge caution despite the rebound. The RSI on the 30-minute chart is currently fluctuating finish to the impartial 50 zone (47.65), failing to interrupt better despite extra than one intraday attempts. This divergence between mark strength and RSI momentum suggests waning bullish stress at present ranges.

The MACD histogram, whereas sure, is knocking down out after a fresh bullish crossover. This plateauing indicates that taking a glimpse for hobby will be weakening, and bulls desire a definite volume push to lend a hand additional gains. Without that, Bitcoin mark volatility might perchance well perchance enlarge in each and each instructions over the subsequent 24 to 48 hours.

Key EMA Clusters and Ichimoku Evaluation

On the 4-hour chart, Bitcoin mark is trading above the 20/50/100 EMA cluster, which currently sits between $104,900 and $105,300. This zone acts as intraday dynamic give a rob to, and a loss under $104,800 would invalidate the transient bullish structure.

The Ichimoku cloud on the 30-minute chart shows that BTC is looking to pause above the flat Kijun-Sen at $105,400, however the future cloud looks thin and bearish, suggesting vulnerability to minor pullbacks.

Meanwhile, the Bollinger Bands remain tight, reflecting declining Bitcoin mark volatility, which on the total precedes appealing directional moves. A day-to-day finish above $106,500 would heed a spruce breakout and perchance mumble the $108,300–$109,000 attach, final tested in gradual May perchance perchance perchance also merely.

Larger Timeframe Outlook Remains Optimistic

On the weekly timeframe, Bitcoin mark is forming a better low structure after reclaiming the 0.618 Fibonacci retracement level at $100,942. This level held firm one day of the May perchance perchance perchance also merely correction, and the 0.786 Fib finish to $104,900 is now performing as mid-time duration give a rob to. May perchance perchance perchance also merely serene BTC preserve above this Fib level via June 10, the subsequent major upside intention stays the $109,000 high, adopted by the extended 1.618 Fib projection at $130,900.

The 1D chart also reinforces this bias, as BTC trades effectively above the prior downtrend breakout zone. Nonetheless, there is serene a visible offer zone perfect above $106,800, and mark needs to sure this fluctuate with conviction to preserve bullish momentum.

Why Bitcoin Impress Going Up This day?

The query many merchants are asking is: Why Bitcoin mark going up this day? The reply lies in a aggregate of components. First, the sizzling bounce from EMA give a rob to lines and the bullish triangle breakout on the 1-hour chart sparked renewed transient hobby. Second, macro sentiment around inflation cooling within the U.S. and dovish central monetary institution signals has boosted risk urge for meals across major crypto sources.

Volume spikes around $104,000 also point out solid institutional expose hobby, perchance fueled by ETF-linked demand of and on-chain pockets accumulation. Composed, without confirmation from a breakout above $106,900, the value circulate stays technically rangebound within the rapid time duration.

BTC Forecast Table for June 10

| Indicator/Level | Impress (Approx.) | Signal |

| Immediate Resistance | $106,900 | Necessary Breakout Level |

| Toughen Zone | $104,800 – $105,000 | EMA Cluster, Fib 0.786 |

| MACD (30-min) | Feeble Bullish | Knocking down |

| RSI (30-min) | 47.65 | Honest-Bearish Divergence |

| Bollinger Band Bias | Tight Vary | Pre-Breakout Compression |

| Ichimoku Kijun (30-min) | $105,400 | Intraday Toughen |

| Weekly Key Resistance | $109,000 | Weekly Excessive |

| Long-Term Upside Aim | $130,900 | Fib 1.618 Extension |

In conclusion, Bitcoin mark this day shows resilience however also signs of exhaustion under $106,900. A breakout above this zone will likely be mandatory for bulls to retest prior highs, whereas a tumble under $104,800 might perchance well perchance trigger a transient correction in the direction of the $102,500 attach. Merchants should always rigorously video show the triangle structure and EMA supports as Bitcoin mark circulate moves real into a decision zone for the week forward.

Disclaimer: The recordsdata supplied listed right here is for informational and academic functions only. The article doesn’t constitute monetary advice or advice of any kind. Coin Model isn’t liable for any losses incurred as a outcomes of the utilization of express, products, or companies and products talked about. Readers are knowledgeable to exercise caution before taking any circulate linked to the corporate.