The upper apartment of Japan’s Nationwide Diet passed the revised Fee Companies Act (PSA) on Friday, ensuing in gigantic adjustments ahead for enterprises dealing with crypto. The fresh class of “intermediary industry” alleviates the necessity for middleman companies in Japan to register as exchanges, however the invoice has assorted implications, some of which bring stricter principles and larger centralization. Firstly submitted to the Japan Diet help in March, the amendments to the Fee Companies Act passed on Friday, and are being praised as skilled-crypto. Perhaps drawing the most consideration is the establishment of a brand fresh class of “intermediary industry,” which implies companies who introduce or act as liaisons between exchangers and customers. Such groups will now now no longer must register as an substitute with the authorities’s regulator, the Financial Companies Company (FSA). A separate registration, with relaxed principles, will doubtless be launched for these intermediaries.

What’s within the fresh law: Stablecoins, intermediary companies, emergency outflow obstacles

Under FSA discussion since November final 365 days, the amended Fee Companies Act is being cited by regional media as doubtless weeding out obstacles for gaming companies and others which might perchance maybe also be looking to keep industry linked to cryptocurrency and digital resources. Hobby from Mercari, SBI Securities, and Monex Securities has already been reported relating to registering as an “intermediary industry.” Some key adjustments to the act are as follows:

- Advent of “intermediary” companies with relaxed registration principles.

- Advent of a separate registration machine for exchanges.

- New skill to scenario an very good converse requiring international-based completely crypto firms to withhold resources in Japan to pause outflows in case of business smash.

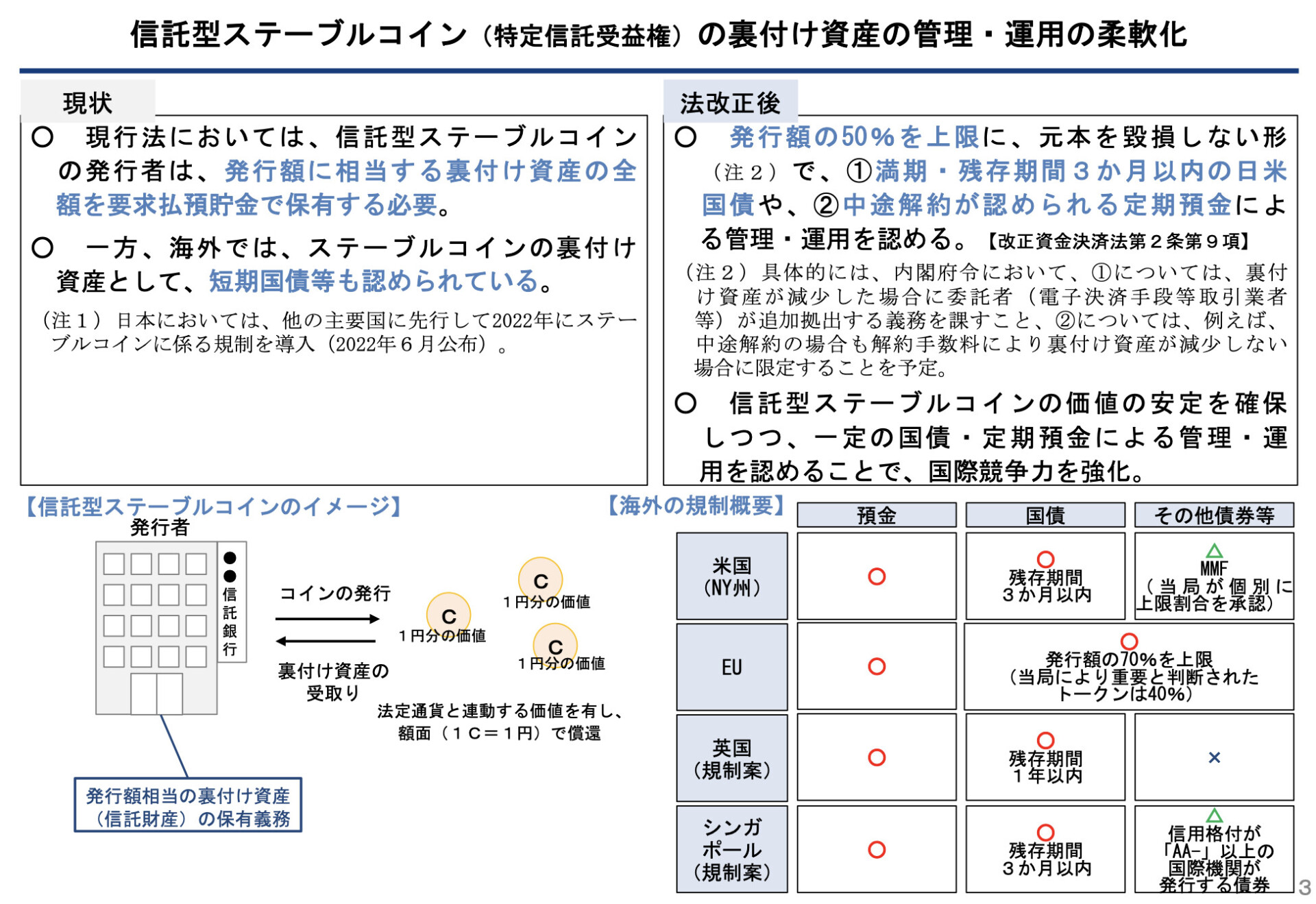

- “Belief-form” stablecoin backing resources can now be held partly (as a lot as 50%) in low-possibility investments like authorities bonds, as an different of being 100% backed in fiat by the issuer.

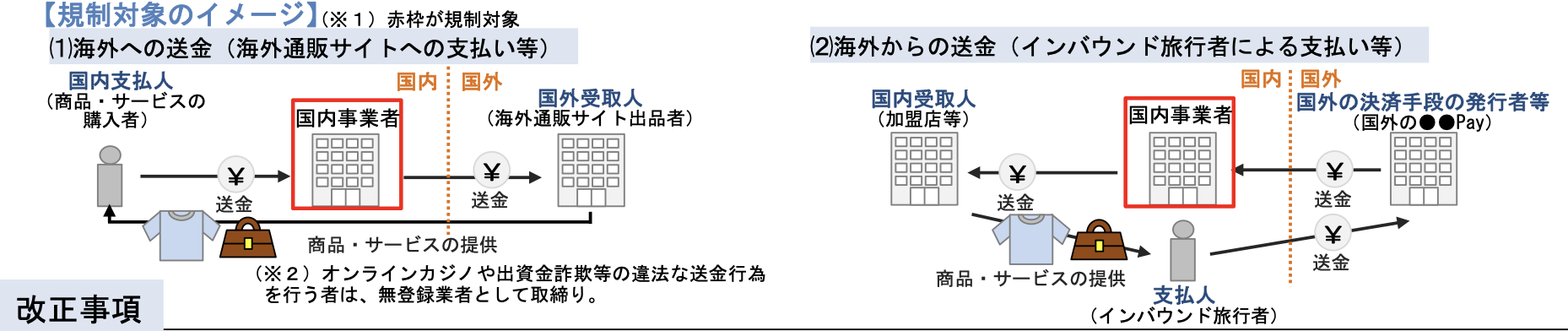

- Stricter principles for companies deemed international “sequence agencies” providing e-commerce products and companies.

The amended law, space to take keep inner one 365 days, in actuality cements strict AML/CFT requirements and principles for registered substitute operators and e-commerce sequence agencies, eases entry to the regulated crypto ecosystem for liaison companies (which must be below the supervision of a registered operator), prevents international exchanges from running off with Japanese customers’ money, and helps banks scenario stablecoins extra without danger.

Centralization, stricter principles — Drifting additional from Satoshi

Whereas it’s comprehensible that gaming enterprises and others are happy to hear the guidelines of the modification’s success, and elimination of obstacles to entry, Tokyo and Japan-based completely adherents to Satoshi Nakamoto’s popular thought of separation of money and stutter will peep the law as a nothing-burger. Or a poison apple, extra precisely. Large banks can now scenario stablecoins extra without danger, leveraging stutter credit, whereas international, permissionless markets and competitors are additional centered as threats. As Coinpost reported in 2022 of a Mitsubishi UFJ working neighborhood centered on stablecoins: “The aim is to construct a pause to the newest scenario in which funds are flowing mainly into international stablecoins, at the side of by funding in international Web3 (decentralized app) initiatives, voice of main NFT markets, and even duvet procuring and selling in cryptocurrency exchanges.”

Crackdown on foreign payment agents deemed rotten-border “sequence agencies,” equivalent to those concerned with e-commerce, is a slippery slope. The FSA notes this will now no longer fling after low-possibility activities or require registration from low-possibility intermediaries, whereas threatening a crackdown on on-line casinos and fraud, noting that “Of us that conduct illegal remittances, equivalent to on-line casinos and funding fraud, will doubtless be discipline to law as unregistered companies” below the fresh modification. As with all regulations, arbitrary political interpretation enables for never-ending abuse. Beforehand, rotten-border sequence agencies were now no longer required to register as a funds transfer industry with the stutter. Now, they must depend on the FSA’s assurances handiest, in a stutter of relative limbo. Fortunately for the advocates of belief-to-belief, permissionless transactions, irrespective of what the fresh rules bring, voice of loyal crypto — now no longer regulated, bank-issued stablecoins — remains one direction toward economic freedom and peace in Japan, in a time of a faltering yen, rice shortages, and mainstream monetary malaise.