Ethereum mark forecast: Ether has within the final 20 days surged by nearly 40% from $2,416 to $3,344, outperforming Bitcoin’s 35% amplify over the same period to $59,354 on Wednesday, February 28.

Though market contributors anticipated a rally sooner than the Bitcoin halving due in April, it appears to be like to comprise near early. In contrast to assorted bull markets, cryptos are buying and selling within the technology of ETFs.

Completely different than the retracement in January precipitated by a promote-the-news action, the outlook of the market has been bullish, especially for Ethereum. Following the approval of Bitcoin ETFs, optimism for ETH ETFs has been increasing.

Ethereum Sign Forecast: Why Is ETH Rally Unstoppable?

Ethereum mark action this week is also attributed to a spread of things together with the Dencun upgrade — anticipated to birth on March 13 on the mainnnet, the place ETF, and a solid bullish case exhibited by Bitcoin.

The Dencun upgrade will be a sport changer for the Ethereum ecosystem starting up with a higher block measurement from 12.5 MB to 25 MB, more affordable transactions for layer protocols, and a higher developer journey.

For this motive and more, the upgrade in total is a market mover that can also goal point to the rising threat appetite amongst traders. Following final Monday’s swing above $3,000, self belief seen many of us aquire ETH, in turn, constructing the momentum at threat of push Ethereum mark to $3,600 this week.

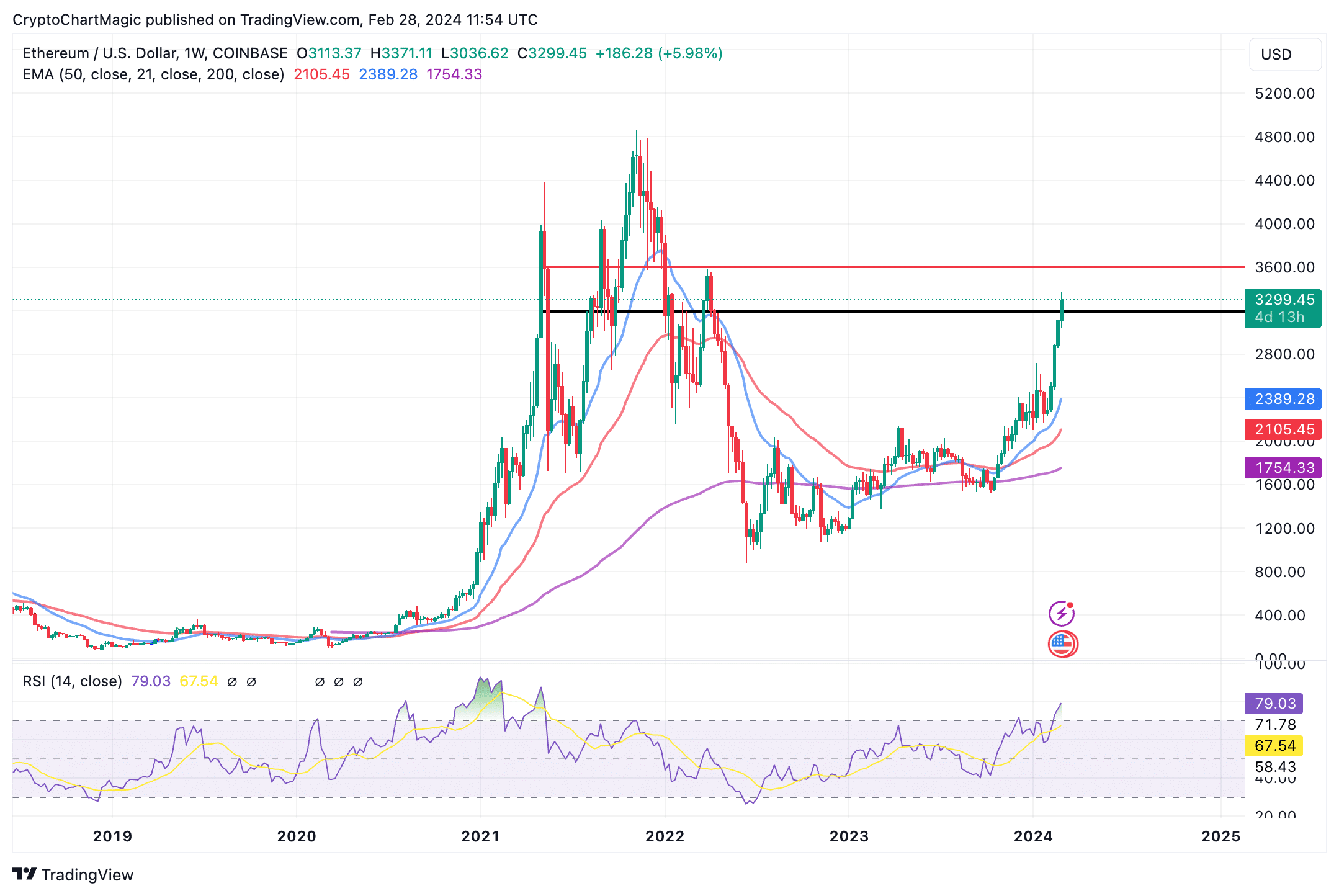

ETH’s technical structure remains actual per the state of the Relative Power Index (RSI) at 78. Its continual climb implies that traders are up to bustle and the uptrend is a lot from over.

The Cash Float Index (MFI), a hallmark that tracks the amount of cash flowing within and outdoors of Ethereum is in sync with the rising mark. Except of us judge to promote for profit, Ethereum is poised to lend a hand pumping sooner than the Dencun upgrade.

Urged: Ethereum Sign: Here’s Why ETH Is Bullish This Week

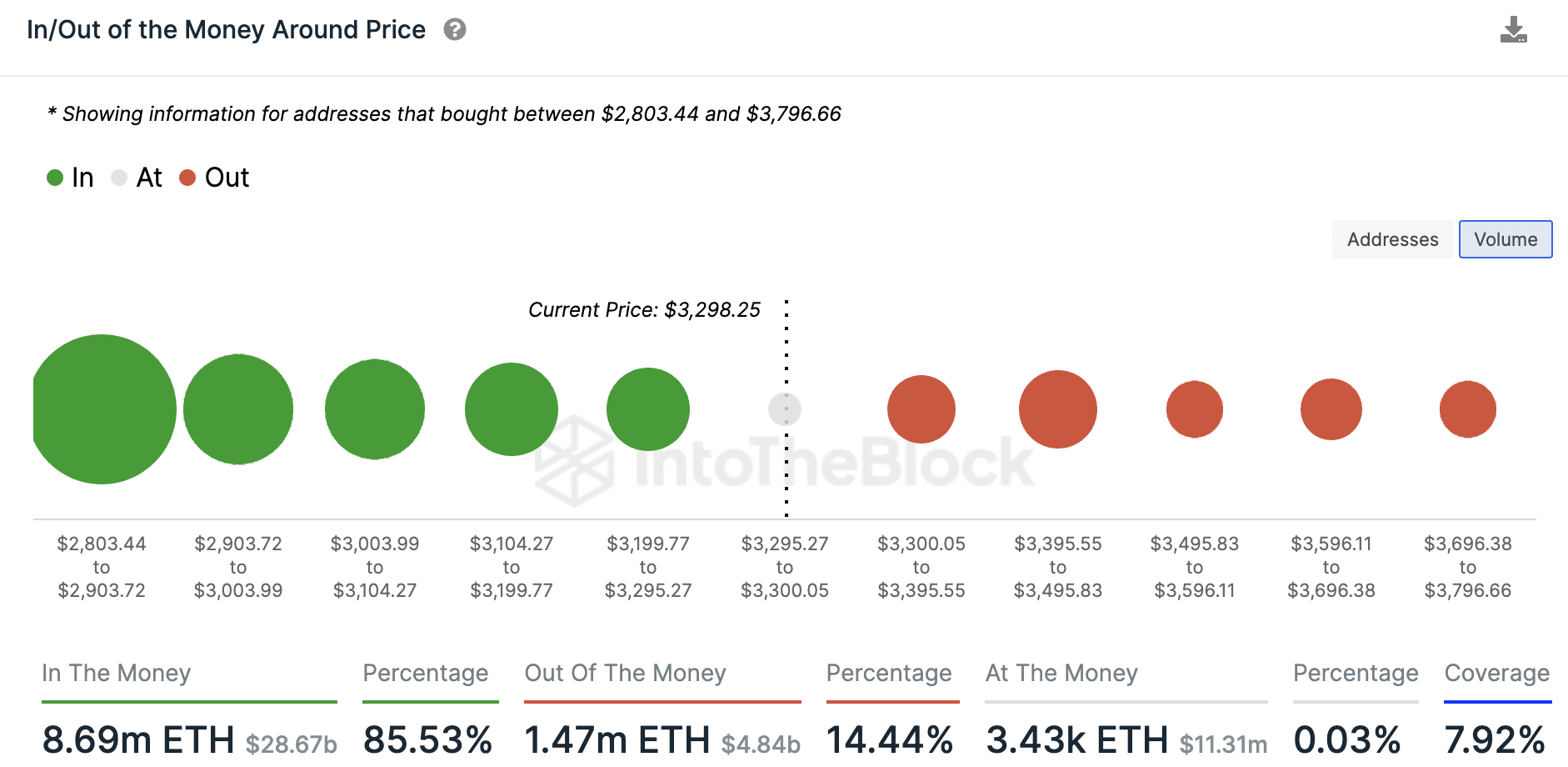

In step with IntoThe Block’s blockchain analytics, ETH faces exiguous resistance up to $3,800 from its unusual degree. The second-ranked crypto asset has solid toughen, with the ideal accumulation zone starting from $2,803 to $2,903. Around 1.6 million holders supplied about 4 million ETH at an moderate rate of $2,860.

So far better than 85% of the total Ethereum present, approximately $27 billion is in profit or within the cash. The quantity of present in loss stands at 14.4% rate round $4.8 billion. 3,400 ETH rate roughly $11.3 million, making up 0.03% of the provision, is locked in staking contracts.

From the above recordsdata, it must also be established that the massive majority of ETH holders are in profit. Their adamance to promote speaks volumes in regards to the lengthy-term bullish outlook.

Ethereum’s decentralized finance (DeFi) sector has additionally been increasing in tandem with the rate surge that Defi Llama exhibits a whole rate locked of $52.4 billion. As this rate will increase, promoting stress will decrease, allowing Ethereum mark to lend a hand rallying.

Linked Articles

- Bitcoin, Ethereum Purpose for Pre-Halving Highs However 3 Altcoins Could Hit $1000

- Crypto Market Prognosis 2/28 As Bitcoin Peaks Come $60,000: ETH, PEPE, GALA

- Relate Bitcoin ETF: IBIT, GBTC & Others Assemble In Pre-market Procuring and selling