Bitcoin’s provide on exchanges has fallen to its lowest stage, raising expectations for a probably spike in volatility.

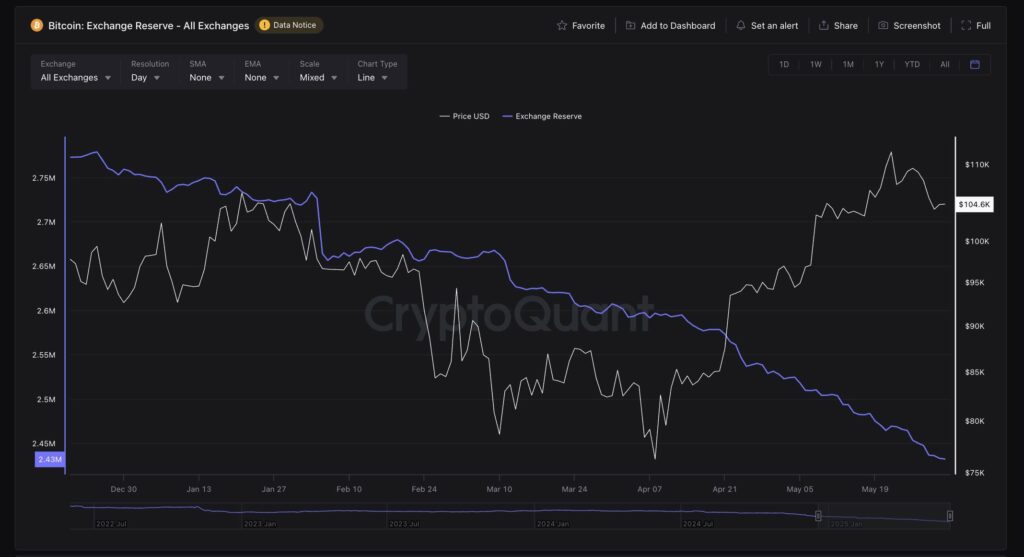

Based totally on records from CryptoQuant, the total quantity of Bitcoin (BTC) held throughout all centralized exchanges diminished to factual below 2.5 million BTC as of late Can also 2025. This true plunge has been accompanied by a solid mark rally, with Bitcoin most unbiased lately reaching a new all-time high above $111,500.

The records indicates a most important divergence between exchange reserves and costs. While the amount of Bitcoin held on exchanges has been declining, its cost has elevated. On the CryptoQuant chart, that is illustrated by a white line bright upward for mark, and a blue line sloping downward for reserves.

Historically, a declining provide of Bitcoin on exchanges has pushed up costs, namely when quiz is high. Right here is viewed by many analysts as a signal that the market would maybe well presumably very well be about to enter a new portion, the attach sharper moves in either direction are fueled by diminutive provide.

Institutional accumulation appears to be playing a most most important feature in the new market construction. Tall holders, including wallets with between 1,000 and 10,000 BTC, were regularly accumulating, with considerable of the BTC being despatched to frosty storage.

Approach added 7,390 BTC in Can also, bringing its entire holdings to 576,230 BTC, roughly 2.75% of entire provide, bought at an common mark of $69,726. Other public firms, including GameStop and Japan-based totally Metaplanet, salvage also been actively including to their holdings.

Within the intervening time, plot Bitcoin exchange-traded funds introduced in $5.23 billion in inflows all over the last month, per SoSoValue records. Lots of governments are following swimsuit. The UAE and Pakistan salvage stepped up their accumulation efforts, while U.S. lawmakers are discussing the introduction of a national Bitcoin reserve.

From a technical perspective, Bitcoin appears to be in a wait-and-discover portion. Momentum indicators are blended. The relative energy index stands at 52, showing neutral momentum, while the bright common convergence divergenc has turned moderately of bearish. Temporary bright averages present some downward stress however the longer-term outlook remains intact.

Bitcoin is trading well above the 200-day EMA and SMA, that are both on an upward model. The rally would maybe well presumably proceed toward $110,000 or elevated if Bitcoin is in a neighborhood to improve its instant bright common of around $106,000. Nonetheless, a decline toward $98,000 or even $94,000 is imaginable whether it is far unable to construct beef up.